Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 11 November 2021 00:19 - - {{hitsCtrl.values.hits}}

The monetary and fiscal policy for Sri Lanka should aim to attract investment, provide an environment that facilitates ease of doing business and support industries. The laws and regulations should be free of ambiguities and strive to harness the resources within the country to fulfil economic objectives – Pic by Shehan Gunasekara

If you have observed a spider’s web, you will see that even when it has been destroyed or damaged the spider diligently continues to repair the damage. I was amazed to find out that the material used to spin the web is five times stronger than steel which makes it so resilient to external forces. The design itself is very robust where localised stresses have very little impact on the overall structure. In a world hit by the pandemic, in a country struggling with economic pressures the story of a spider’s web gives food for thought.

If you have observed a spider’s web, you will see that even when it has been destroyed or damaged the spider diligently continues to repair the damage. I was amazed to find out that the material used to spin the web is five times stronger than steel which makes it so resilient to external forces. The design itself is very robust where localised stresses have very little impact on the overall structure. In a world hit by the pandemic, in a country struggling with economic pressures the story of a spider’s web gives food for thought.

In the wake of the upcoming Budget speech, we tend to wonder what can be done to revive the economy. It has been battered with COVID-related pressures, loss of foreign currency revenues, dollar shortage, loss of employment, high cost of living and the list goes on. We need to realise that each time the web is destroyed, the spider diligently continues to spin its web because it is only then that its next meal is provided for and its survival is ensured.

Likewise, Sri Lanka too needs to face these challenges with optimism as it is only then that we can all look ahead without fear. The recovery from the pandemic has been asymmetrical among the countries in the world, with certain governments trying to curtail the spread of COVID using different strategies. However, the central issue that all governments need to deal with is its economic recovery.

Economic growth

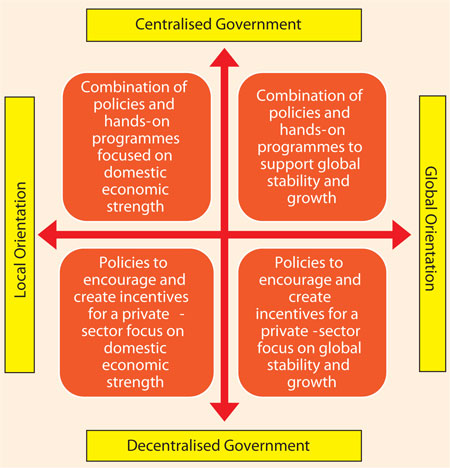

It is a given that without broad based economic expansion, it is difficult to address other issues such as healthcare and education. An article on ‘Creating economic recovery and growth after COVID-19’ argues that how Governments create and shape the environment for economic recovery depends on two decisions they make, namely (1) What will drive the country’s immediate recovery – an approach that is more locally oriented or globally oriented? and (2) What is the best option for stimulating national economic growth – active involvement and oversight of issues or enablement of the private sector and local institutions.

These two decisions are equally important in Sri Lanka in setting the tone for future economic growth and the policies that set this into action will be spelt out in the budget for the coming year. Pegging Sri Lanka at the correct spot on the graph is a tough call for the policymakers. Fiscal and tax policy in Sri Lanka is often the art of the possible rather than the pursuit of the optimal.

It has been predicted that the global economy is poised to see the most robust post-recession recovery in 80 years in 2021. The rebound however will be uneven across countries and major economies like US and China will contribute mainly towards this growth. The prospects for developing economies will be more bleak due to erosion of skills, sharp drop in investments, higher debt burdens and greater financial vulnerabilities. However, in countries where effective steps have been taken to curb COVID-19 with higher vaccination rates should enjoy higher growth from the spillovers from advanced economies. Data from the Spanish Flu in 1918 show that economies that had a stronger health response also enjoyed better economic recovery.

It is in this light that Sri Lanka should structure its future economic policies to attract these opportunities and enjoy the dividends from an effective vaccination drive compared to other countries in the region. The World Bank urges policymakers to nurture economic recovery with fiscal and monetary measures that take a long term view, reinvigorate human capital, expand access to digital connectivity and invest in green infrastructure to bolster growth along a resilient and inclusive path.

Attracting investments

One key aspect in boosting the economy is attracting investments. This is encouraged where the business environment facilitates ease of doing business and provide a stable, consistent policy framework.

At the time the changes to tax and economic policy was introduced in January 2020, it was emphasised that these policies will remain consistent in the longer run. It is the expectation of the people that the Budget for 2022 will maintain the same stance and will aim to create a stable policy framework within which the businesses can operate without any surprises.

However, it is also important to note that these changes were proposed at a time when COVID-19 was not rampant in the country. The outcome of how these measures would have stimulated the economy is now moot since factors not foreseen by the policymakers at the time have become the reality.

Tax issues

The present tax to GDP in Sri Lanka is below 10%. However, the Government funds free services to the citizens like healthcare and education which are generally afforded by governments that have at least 25% tax to GDP ratio. This disparity has contributed largely to the ever-increasing budget deficit and successive populace governments seek to reduce the tax burden on the people, without trying to reduce its spending as a welfare state. This approach exacerbates the pressure faced by governments which then naturally has to rely on debt funding.

The Budget proposals should try to not only increase tax to GDP, but also include proposals to reduce Government spending. It is only by adopting a strategy that is sustainable can Sri Lanka overcome its perennial issue of an increasing budget deficit. Proposals should also be devised to reduce corruption and improve administrative efficiency.

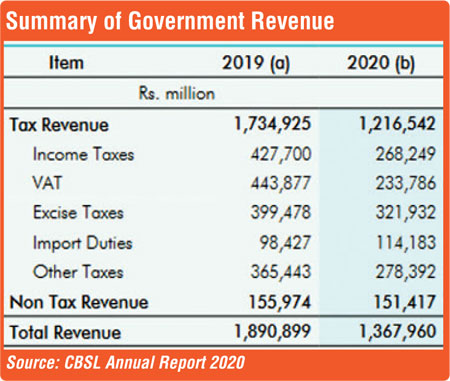

The tax to GDP has dropped from 11.6% in 2019 to 8.1% in 2020. The contribution to tax revenue from Value Added Tax (VAT) and other taxes for 2020 was 17% and 20% respectively. Income tax contributed 20% to the tax revenue of the country. (CBSL Annual Report 2020). In real terms, the tax revenue from income tax and VAT has reduced by half from 2019 to 2020.

The Central Bank Annual Report 2020 explains that the tax concessions introduced in 2020 minimised the adverse impact of the pandemic on businesses and individuals. However, it fails to explain how the policymakers seeks to bridge the shortfall in tax revenue. It is anticipated that the Budget proposals for 2022 will address this and provide measures on how the low tax regime is to be maintained into the future. It will be counterproductive at this juncture to impose any additional taxes on the citizens as most individuals and businesses are struggling to survive the pandemic.

It is however noted that because of the pandemic certain businesses have seen a boost in turnover. Certain industries are moving into more monopolistic/oligopolistic markets, as their competitors who are less agile have had to close down operations due to the downturn in economic activity and as more innovative supply channels have emerged. The tax administration must ensure that these businesses provide information transparently and pay their fair amount in taxes. In these cases, it is not evident that the percentage increase in tax paid is reflected in proportion to the increase in the revenue.

The lowering of the income tax rates and VAT rate in 2020 has not resulted in an improvement in the disposable income of the people as anticipated. The increase in prices of consumer products and services has eaten into any excess income that these proposals should have had. Policymakers should resist using subsidies and price controls to reduce the burden of food prices as this will add to the debt burden of the country and may not be sustainable.

Price is a function of demand and supply. This is best handled by the market forces in a self-regulating environment. Governments trying to intervene in pricing or trying to manage demand and supply can have disastrous consequences. It leads to shortages in the market and governments having to finally accept the prices demanded by businesses. What is required in a free market is for the policymakers to establish best practices and quality standards to ensure that market conditions are maintained to ensure fair play for all and facilitate ease of doing business. The objective here should not be to increase tax revenue by increasing the tax rate but rather increase tax revenue by broadening the tax base where more businesses make more profits.

Tax collected at source is the most cost-effective method of collecting taxes. Pinning the responsibility on a third party to pay the tax on behalf of the citizens and imposing penalties for non-compliance encourages greater compliance and less cost of collection. In the case of individuals, making such tax deducted as source a final tax will simplify the compliance obligations of the taxpayers and reduce administrative burden on the tax officials. The principle that income tax should be proportional to the income levels of the individuals can still be maintained even with a withholding system where the tax deducted at source will only be final tax for individuals having annual income below a certain threshold.

We have also seen that certain business sectors/industries have been isolated and specific taxes are imposed. For example, tourism industry, telecommunication industry, supermarkets etc. Having multiple taxes complicates the tax system and increases the administrative cost of collection. This also invariably increases the price of goods and services to the end consumer. It is suggested that rather than having multiple tax types, it is better to structure a specific tax rate for such industries within the income tax system. The benefits of this will however, be countered if certain players are given income tax exemptions/concessions under different statutory bodies like the BOI. Having a plethora of taxes is a deterrent to most foreign investors and it is a drawback in attracting FDIs to the country. Therefore, it is best to simplify the tax system by reducing the number of taxes and to aim for equitable distribution of income through direct taxes.

Foreign currency

Foreign currency

Businesses in Sri Lanka are also facing severe pressure due to the shortage of foreign currency. This has directly affected importers and resulted in shortages of goods in the domestic market as well as disruption to supply chains.

The Government through the Central Bank is regulating the exchange rate and implementing regulations on the conversion of dollars to rupees. The policymakers are adopting a protectionist approach towards the rupee and valiantly trying to regulate foreign currency movement in the country. However, in today’s context where Sri Lanka is a part of a global economy, it is difficult to manage the currency issue in a silo by trying to isolate the rupee from global pressures.

The Central Bank already has a lot on its plate. Managing the foreign currency issue, I feel is best managed with least intervention from the Central Bank. Since the Monetary policy is very restrictive in Sri Lanka and all foreign currency movement is regulated, we are trying to fight the dollar crisis with our arms behind our back.

Exporters and foreign income earners are mandated to convert their foreign currency into rupees. Their freedom to do business is impeded. Importers are knocking at the door asking for banks to release foreign currency. They are suffering from delays in bringing in their stocks. The protectionist approach is helping no one. The policymakers should relax the tight fist it has on the flow of foreign currency in Sri Lanka.

Exporters rather than being mandated to convert their dollars should be allowed to do business within the country in dollars. This would relieve them from the risk in the depreciating rupee. This will be a more effective strategy to encourage foreign currency income being brought into Sri Lanka. The money can then flow through the supply chain in foreign currency to the importer without the intervention of the Central Bank. The exchange rate will have no bearing on the transactions as the foreign exchange risk is eliminated.

Managing the exchange rate has always been recognised as a tool to help exporters compete in the global market on pricing. However, in my opinion the pricing of products in the global market should reflect the basic principles of demand and supply. Businesses which have survived the pandemic and are still competing in the global stage would be happier to compete with their products on the shelf than having to combat government regulations mandating the conversion of their foreign currency income.

Global inflation

Global inflation

Economic recovery post the pandemic has seen global inflation rise and increase in food prices. There is significantly higher spending on health in fighting the virus. These circumstances all lead to economic upheaval.

In an ideal situation, the legislatures and central banks should use the power of the purse to help mitigate the economic crisis. Even in Sri Lanka we saw legislation being passed as a stimulus for the economy. However, with the reserves of the country dwindling, the Government alone cannot halt the adverse impact on the economy.

We cannot salvage our economy by building walls around it. It is rather through policies with long-term vision, a political will to build better administrative structures and the commitment to reduce the debt burden, through constructive engagement with larger economies and promoting a business-friendly environment that we can overcome these difficult times. This is a global issue and we need to see it as such.

The monetary and fiscal policy for Sri Lanka should aim to attract investment, provide an environment that facilitates ease of doing business and support industries. The laws and regulations should be free of ambiguities and strive to harness the resources within the country to fulfil economic objectives. The policies should be more robust where localised pressure in one segment would have little impact on the overall structure.

Just like the spider weaves its web each time it is damaged, the policymakers too need to weave in the policies that strengthen the economy with commitment and diligence. It is only then that we can journey ahead with resilience.

[The writer is Associate Director, Tax Services at BDO Partners and is a Chartered Accountant, LLB (Hons.)(Colombo), Attorney-at-Law and Chartered Tax Advisor.]