Friday Feb 13, 2026

Friday Feb 13, 2026

Friday, 30 July 2021 00:03 - - {{hitsCtrl.values.hits}}

The Finance Ministry last week publicly refuted the rationale for and the timing of the warning given by Moody’s Investors Services that it may further downgrade the island’s sovereign rating, a full week before an ISB settlement on 27 July.

The Finance Ministry last week publicly refuted the rationale for and the timing of the warning given by Moody’s Investors Services that it may further downgrade the island’s sovereign rating, a full week before an ISB settlement on 27 July.

The Finance Ministry said it was ill-judged as funds were lined up to repay foreign debt including the sovereign bond maturing on 27 July. The Finance Ministry went further by saying the review for downgrade of Sri Lanka’s rating which was already at ‘Caa1’ was ill-judged and unacceptable.

The Finance Ministry was right, Moody’s statement by itself created uncertainty among investors who had invested in Sri Lankan ISBs, resulting in panic selling at a discount. At the same time several local analysts also speculated about Sri Lanka’s USD Reserve level post ISB settlements. But Sri Lanka has never defaulted historically and it was clear from the beginning it had no intention of doing so given that the country had diligently preserved $ 4 billion (borrowings and income) in reserves.

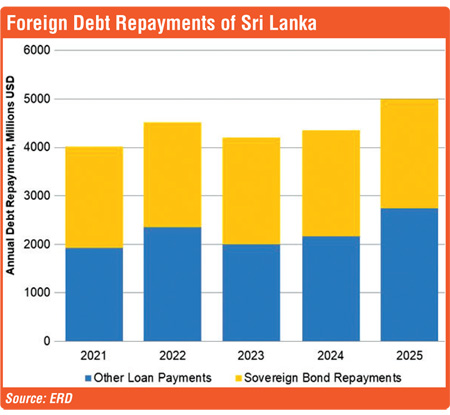

What analysts need to keep an eye from now on is the impact on the LKR and how the country plans to resource itself, post the $ 1 billion ISB settlement, given that most of the Government’s foreign debt service obligations for the 2021 financial year would have been repaid, giving Sri Lanka the space to borrow even at commercial rates to bump up the reserves, during the remainder of the year and given that a tourism recovery is still far away.

Strategy

According to the State Minister of Finance Sri Lanka Nivard Cabraal, “The country has worked out its external cash flows in a manner so that every forex loan repayment and interest payment will be made on time, through the careful management of its existing reserves as well as expected inflows and outflows.” According to the Minister the inflows over the next three months, as per the country’s forex pipeline amounts to nearly $ 2,650 m as follows:

Further he noted the Central Bank had also successfully negotiated a swap with the People’s Bank of China of a sum of $ 1,500 m, which too can be accessed and hence could be included as a part of its effective reserves.

In addition, arrangements are being made according to the Minister to roll-over almost the entirety of the SLDB and FCBU loans that are maturing over the balance part of the year, so that such maturities will not lead to a reduction in the foreign reserves.

Way forward

Post 27 July Sri Lanka’s foreign currency reserve balance will drop down to $ 3 billion, the country will need around $ 5-7 b minimum to manage the next five months at current levels of growth.

According to the Minister, the available reserves within the next few months would be over $ 7 billion, when considering the expected inflows and outflows. According to his statement this includes the SDR allocation of $ 800 million.

According to the Corporate Finance Institute (CFI), “SDRs are neither a currency nor a financial claim on the IMF. SDRs are a potential claim of IMF members on freely usable currencies. When a country trades SDRs for freely usable currencies, their holdings decrease and their foreign exchange reserves increase.”

Sri Lanka has several challenges confronting the economy in the next six months. This can get worse if there is another lockdown due to the spread of the Delta variant. So managing a weak currency, printing money to service local debt , credit ratings and debt-to-GDP levels of over 100% are just a few of them.

But these pain points can certainly be managed with good austerity measures, sound economic management, getting the key stakeholders together to fight the economic war and also revisiting its relationships with rating agencies and multilateral agencies.