Thursday Feb 19, 2026

Thursday Feb 19, 2026

Saturday, 15 October 2022 00:10 - - {{hitsCtrl.values.hits}}

The Sri Lankan Government adopted a relaxed monetary policy coupled with lower taxes to stimulate economic growth since 2020 (beginning) till end of 2021. The objective was to provide relief to people and businesses in order to overcome negative effects due to COVID-19 and the Easter Sunday attack in April 2019. However, whether the economy really produced goods and services to the extent that is required is questionable.

The Sri Lankan Government adopted a relaxed monetary policy coupled with lower taxes to stimulate economic growth since 2020 (beginning) till end of 2021. The objective was to provide relief to people and businesses in order to overcome negative effects due to COVID-19 and the Easter Sunday attack in April 2019. However, whether the economy really produced goods and services to the extent that is required is questionable.

It is true that during the year 2021 they have been able to convert the negative growth rate of 3.6% in 2020 into a positive growth rate of 3.7% in 2021. Commencing 2022, Central Bank (CBSL) has adopted a policy of tightening the monetary policy by increasing the interest rates and increase income tax and indirect taxes such as VAT and social security contribution levy in order to reduce inflation and inflationary expectations. One can argue that all these contrasting policy measures are in accordance with the accepted macro-economic theories put forward by eminent economists.

This year Nobel Prize goes to Economist, Bernanke, ex-Chief of Central Bank, US

Eminent economist, Ex-Fed reserve, Chief, US, Ben Bernanke, together with two other eminent economists, won the Economics Nobel Prize this October on the role of banks, particularly during financial crises and how to regulate financial markets. “In his role as Chief of the Central Bank, US, Bernanke was able to put knowledge from research into policy during the financial crisis of 2008-2009,” the Nobel Committee said.

Bernanke has been previously credited and hailed for the Fed’s unorthodox response of slashing interest rates and flooding the financial system with liquidity and thus successfully handling the recovery after the 2008 recession, but at the same time, criticised for doing little to avert it, allowing investment bank Lehman Brothers to collapse. The award winners also showed how the financial institutions were vulnerable to so called banks runs.

“If a large number of customers (savers) simultaneously run to the bank to withdraw their money, the rumour may become a self-fulfilling prophecy – a bank run occurs and the bank collapses,” the Nobel Committee said. The Committee added this dangerous dynamic can be avoided by governments providing credit and giving banks a life-line by becoming a lender of last resort. “In a nutshell, the theory says that banks can be tremendously useful but they are only guaranteed to be stable if they are properly regulated,” the Nobel Committee Chairman added.

Solutions to Great Depression in the 1930s

This reminds me of ‘Keynesian’ economics, which involves government expenditures while monetarist economics believe that government spending causes inflation and therefore need to control the supply of money that flows into the economy. In contrast, Keynesian economists believe that a troubled economy continues in a downward spiral unless a government intervention drives consumers to buy more goods and services. They believe in consumption, government expenditure and net exports to change the state of the economy. In short, governments should balance out the cyclical movement of the economy by spending more in downturns and less in prosperous times (thereby preventing inflation).

In fact, Keynes begins his general theory by attacking Say’s law, the view that ‘supply creates its own demand’. Keynes proceeded to turn Say’s law on his head, arguing that aggregate demand determines the supply of output and level of employment. (Post-Keynesian Economics (PKE) is a school of economic thought which builds upon John Maynard Keynes’s argument that effective demand is the key determinant of economic performance.) In the field of monetary theory, ‘post-Keynesian’ economists were among the first to emphasise that money supply responds to the demand for bank credit, so that Central Banks cannot control the quantity of money, but only manage the interest rate by managing the quantity of monetary reserves.

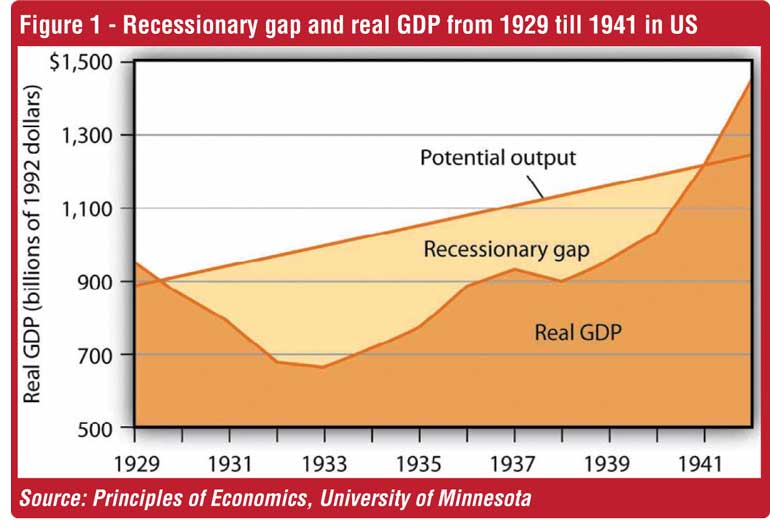

By the way, Bernanke previously received awards for his analysis, conducted in the early 1980s, of the ‘Great Depression’ in the 1930s, the worst economic crisis. For Keynesian economists, the experience of the Great Depression provided impressive confirmation of Keynes’s idea which is consistent with Keynes’s argument. A sharp reduction in aggregate demand had gotten the trouble started. A reduction in aggregate demand took the economy from above its potential output to below its potential output, and, as we see in the given Figure, the Depression and the recessionary gap created by the change in aggregate demand had persisted for more than a decade, but expansionary fiscal policy had put an end to the worst macroeconomic nightmare.

The dark-shaded area shows real GDP from 1929 to 1942, the upper line shows potential output, and the light-shaded area shows the difference between the two—the recessionary gap. The gap nearly closed in 1941. The chart suggests that the recessionary gap remained very large throughout the 1930s.

Inflation, money printing and unemployment

Under the Monetary Law Act 1949 as amended, the economic and price stability and financial system stability were made the core objectives of the CBSL. Therefore, it should focus on maintaining stable price levels, means containing inflation and inflationary expectations. In order to attain ‘price stability’, CBSL is required to keep liquidity and money supply of the country at appropriate levels so that the total demand for goods and services known as the ‘aggregate demand’ is more or less equal to the total supply of goods and services called ‘aggregate supply’.

In 1958, economist A.W. Phillips published an article in the British journal of economics that would make him famous covering a relationship between unemployment and inflation. Phillips curve showed negative correlation between rate of unemployment and the inflation. When inflation is high, the rate of unemployment is low and vice versa. Practically policy makers use this by altering monetary and fiscal policies in influencing ‘aggregate demand’ in the short run and achieve trade-off between employment and rate of inflation. The ‘Nobel Prize’ winner in 2001, Economist George Akerlof once said, “Probably the single most important macroeconomic relationship is the Phillips curve.”

New Keynesian approach has emerged as the preferred approach

Steeply rising prices is a bigger threat to businesses than high interest rates which will have to be maintained for a time until inflation start to ease, Central Bank Governor Dr. Nandalal Weerasinghe said recently. He was quoted by the local media as saying. “Sri Lanka was now experiencing the result of past money printing and if rates are cut now, runaway inflation could be the result. Higher interest rates are cost to business, but inflation drives up all costs,” Governor Weerasinghe explained addressing concerns of businesses on high interest rates and raising taxes. However, the Columbia University professor, author of “The Price of Inequality” and “Globalization and Its Discontents,” Joseph Stiglitz argued that the overwhelming source of inflation is supply-side disruptions leading to higher prices in oil and food. “Will raising interest rates lead to more oil, lower prices of oil, more food, lower prices of food? Answer is clearly not”.

This is in response to recent announcements by Federal Reserve officials in the US indicating that interest rate hikes will continue in order to bring down rising prices — but this may intensify inflationary pressures, according to the Nobel Prize-winning economist. “The real worry in my mind is, will they increase interest rates too high, too fast, too far?” Joseph Stiglitz told CNBC recently at a forum in Italy. In fact, the real risk is it will make it worse. “Why? Because what we need to do is to make investments to relieve some of these supply-side bottlenecks that are causing such havoc on our economy. It’s going to make it more difficult.” Unquote. According to Joseph Stiglitz, raising interest rates in non-competitive markets may lead to even more inflation.

While there is less consensus on macroeconomic policy issues than on issues in the microeconomic and international areas, surveys of economists generally show that the new Keynesian approach has emerged as the preferred approach to macroeconomic analysis. The finding that about 80% of economists agree that governments’ expansionary fiscal measures can deal with recessionary gaps certainly suggests that most economists can be counted in the new Keynesian camp. Neither monetarist nor new classical analysis would support such measures. At the same time, there is considerable discomfort about actually using discretionary fiscal policy, as the same survey shows that about 70% of economists feel that discretionary fiscal policy should be avoided and that the business cycle should be managed by the Fed (Fuller & Geide-Stevenson, 2003). Just as the new Keynesian approach appears to have won support among most economists, it has become dominant in terms of macroeconomic policy.

Conflicting theories on macro-economic policies put into practice

As can be seen, Sri Lankan policymakers tend to adopt economic policies going into two extreme ends; namely, relaxed monetary policy, coupled with government expenditure through excessive money printing and lower taxes on the one hand, and tight monetary policies coupled with high income tax and indirect taxes on the other hand. When interest rates are raised, availability of bank credit reduces and consequently overall economic activities tend to slow down. If they continue to adopt tight monetary policy framework and fiscal (high taxation) policies, it’s likely the aggregate supply will contract and may lead to lower production, which in turn end up in ‘stagflation’ or it could even end up in a recession.

The economy is expected to contract this year around 8-9% of gross domestic product (GDP) as investment and consumption falls. Nevertheless, at the IMF and World Bank annual sessions in Washington this October, the State Finance Minister Shehan Semasinghe was quoted as saying, “Sri Lanka’s ongoing IMF-prescribed reforms to come out of an unprecedented economic crisis will not be reversed in future unlike in the past as there is somewhat consensus among the current lawmakers for such reforms”; Unquote. Already the micro and small and medium enterprises have serious issues, where they cannot afford to borrow any more or repay the debts already taken. As a result, household indebtedness may gradually increase to unprecedented levels. This may in turn, increase the instability of the financial and banking system. How the present government is going to address those serious socio/economic issues is yet to be seen.

We need to reiterate the fact that the Sri Lankan economy can only be re-built in the medium term by successfully addressing the structural weaknesses, increase exports as a % of GDP and thus eliminating the twin deficits, namely government budget deficit and balance of payments with the rest of the world. Simultaneously, the above stated vulnerabilities; household indebtedness, banking system stability, etc. must be arrested in order to make a sustainable economic recovery possible. However, the challenge is the time it can take for the economy to adjust to these changes and how to manage the cash flows and social unrest during the interim period.

USA President Harry S. Truman (33rd President serving from 1945 to 1953) hated what he termed two-armed economists, those who would advise him first “on the one hand” and then “on the other hand.” Give me a one-armed economist, he demanded, an adviser who wouldn’t waffle.