Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Wednesday, 1 December 2021 00:00 - - {{hitsCtrl.values.hits}}

|

The stock market has been prominent on the headlines of the financial press in recent times. One can be forgiven for thinking it is the largest capital market in Sri Lanka.

The stock market has been prominent on the headlines of the financial press in recent times. One can be forgiven for thinking it is the largest capital market in Sri Lanka.

However, the Rs. 4,757bn (4.8 trillion) market capitalisation of the CSE is dwarfed by the Rs. 16,751 b market for Government Securities and Rs. 31,714 b held in deposits in the financial sector. Taken together, interest earning instruments in Sri Lanka represent nearly Rs. 25,000 b (25 trillion) in assets – more than five times the size of the stock market.

These assets are largely held by Sri Lankans and demonstrate the enduring attractiveness of relative certainty that one’s money will be returned at the end of the investment period.

However, the amount of advice available to investors on fixed income investing is very limited, and completely disproportionate to the value of assets held in fixed income. Dozens of pundits, hundreds of books, and apparently thousands of social media groups scream out advice on how to ‘win’ on the CSE.

In the absence of good advice, most fixed income investors in Sri Lanka simply place fixed deposits at their transaction bank, rolling these deposits over at maturity at whatever rate they are quoted. This is a sub-optimal investment strategy that helps large banks make larger profits at the expense of their clients.

Fixed income investments need to be viewed through two dimensions-risk/reward and duration. The relationship between risk and reward is somewhat well understood by many investors but often not acted upon. The result is that bank fixed deposits (which carry the default risk of the bank) often pay less interest than Treasury bonds issued by the Government of Sri Lanka (considered ‘risk free’ due to the Government’s ability to issue rupees to repay debt if required).

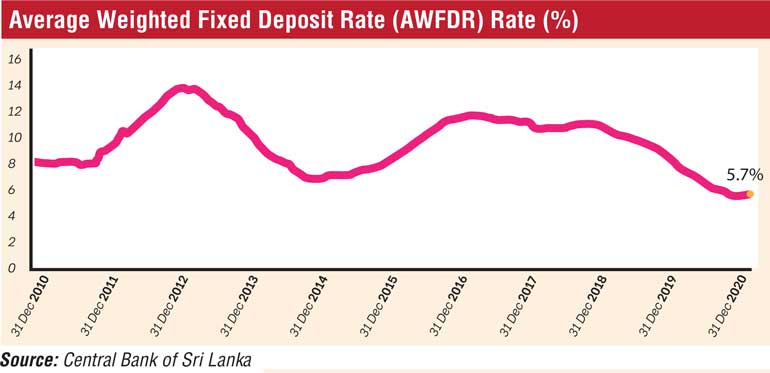

As per Central Bank Data, the average fixed deposit at a bank (represented by AWFDR on the graph) currently pays interest of 5.7%, compared to the one-year Treasury bill (risk free) which yielded 8.17% on 16 November (the time of writing). A better awareness of risk vs. reward in the investment community would help correct this imbalance.

Duration, the second dimension of fixed income, is not understood very well at all by most investors. Interest rates follow a cycle. The Average Weighted Fixed Deposit Rate (AWFDR) which is a proxy for how much the average investor can earn on a one-year fixed deposit has dipped to 5.70% today, from 10.91% in January 2019. As you can see from Figure 1, this current rate is the lowest we have seen in the past 11 years, but similar troughs were also witnessed in 2015 and 2011 when AWFDR dropped to lows of 6.87% and 8.11% respectively.

The trick to earning more interest based on duration is to place long-term deposits when rates are high, and short-term instruments when interest rates are low. The Central Bank, having reduced interest rates to historic lows in the aftermath of the COVID pandemic, started increasing interest rates once again in August 2021, and overall, policy rates have increased by approximately 1% since the ‘tightening’ cycle appears to have just begun and is likely to continue. As interest rates go up, the prudent investor is best placed keeping money in variable rate investments that allow quick withdrawal without penalties, allowing the investments to be rapidly ‘repriced’ upwards at higher interest rates in the future.

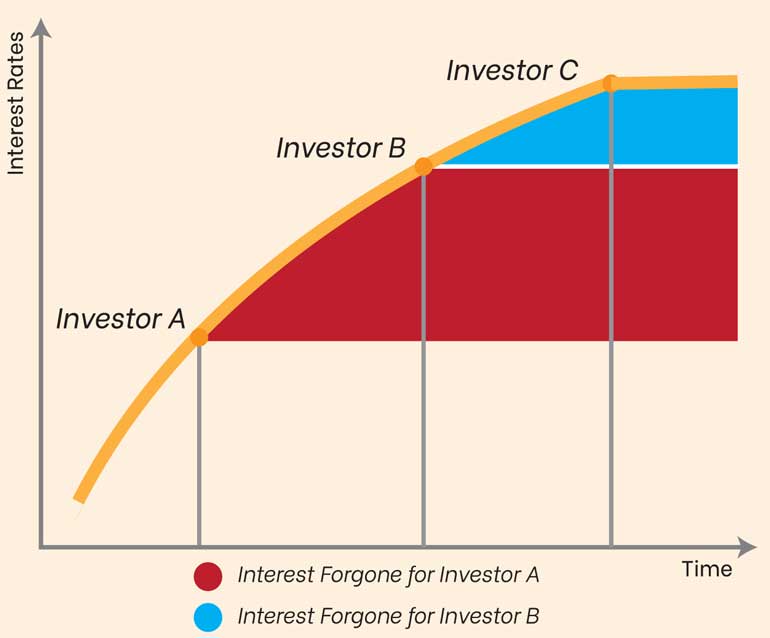

Deposit taking institutions, on seeing a potential future increase in interest rates, may even offer deposit rates that are slightly higher than the prevailing interest rate in an attempt to attract depositors. However, prudent investors need to resist the temptation of doing this too early. As you can see in Figure 2, the investor who is able to ‘ride’ the curve upwards can make a higher return at the same risk level compared to an investor who gets into a fixed deposit too early in the cycle.

Unit trust funds can offer an attractive alternate investment at times such as this. Unit trusts invest in a pool of fixed income investments and pay interest on a daily basis. Crucially, most unit trust funds allow investors to withdraw their investment anytime without a penalty. This allows investors the flexibility they need to ‘ride’ the interest curve on the way up, as in Figure 2.

Unit trusts are regulated by the Securities and Exchange Commission (SEC) and several competent and well reputed firms manage a number of unit trust funds investors can choose from. It is possible to identify the risk level of each fund by evaluating the fund credit rating or the ratings of the underlying investments of the unit trust fund. Unit trust returns are also quite attractive relative to bank deposits, with several highly rated funds yielding above 8% p.a. at present.

Investors can reap significant rewards by keeping their funds liquid and ‘short’ during this current low interest period, and then placing long term fixed deposits (three to five years) when interest rates are at, or close to, a peak in 2022. Such prudent investment calls will make a big difference to investor returns in the long run. Getting the right advice from qualified and capable investment advisors is something many investors who rely on interest for their monthly income can really benefit from.

The writer is the CEO of Capital Alliance Investments Ltd.

Footnotes:

Figure 01 Source: Central Bank of Sri Lanka (https://www.cbsl.gov.lk/sites/default/files/cbslweb_documents/press/pr/press_20211116_treasury_bill_auctions_held_on_16_november_2021_e.pdf)

Source: Central Bank of Sri Lanka (https://www.cbsl.gov.lk/en/statistics/statistical-tables/monetary-sector)