Monday Feb 23, 2026

Monday Feb 23, 2026

Monday, 15 October 2018 01:27 - - {{hitsCtrl.values.hits}}

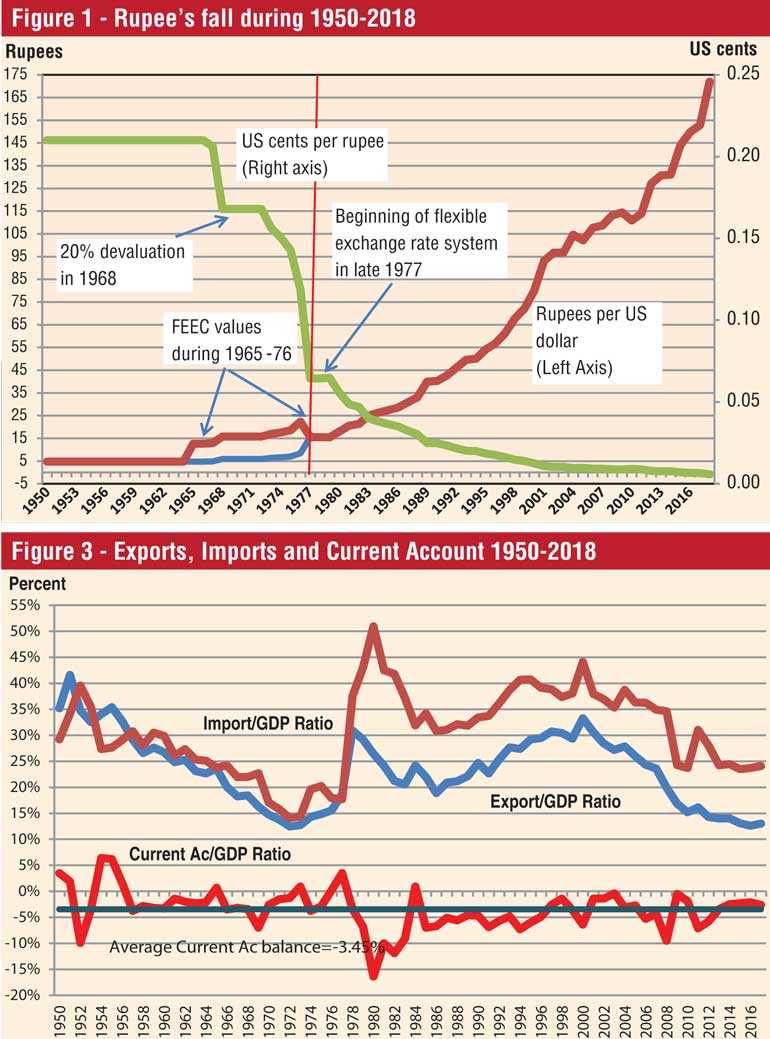

The rupee’s historical tragedy

As I have presented in a previous article titled ‘Rupee’s Sad Destiny of One-way Journey to Depreciation’ (available at: http://www.ft.lk/columns/Rupee-s-sad-destiny-of-one-way-journey-to-depreciation/4-654254), it has been a historical tragedy that the rupee has fallen in value ever since the country had gained independence in 1948. At that time, the rupee was exchanged for Rs 3.32 per US dollar. In terms of dollars, a rupee was worth 30 US cents. This was more or less equal to the exchange rate between the US dollar and the Singapore dollar that amounted to 33 US cents. Under the fixed exchange rate system that had been adopted by Sri Lanka till late 1977, this rate was devalued by the government from time to time based in the devalued Sterling Pound rate or the scarcity of foreign exchange reserves locally or both.

Accordingly, by 1977, the rupee/dollar rate had been devalued to Rs 8.41 per dollar or 12 US cents per rupee. When one adds the 65% Foreign Exchange Entitlement Certificate or FEEC rate to the official exchange rate, the rupee was effectively sold at Rs 13.88 per dollar or 7 US cents per rupee. In November 1977, this rate was adjusted to Rs 15.56 per dollar or 6 US cents per rupee before Sri Lanka chose to go for a flexible exchange rate system.

Since then, the rupee continued to fall in the market, eventually reaching a level of Rs 172 per dollar in early October 2018. This was, in dollar terms, equal to about a half of a US cent. Thus, the rupee which was traded for 30 US cents in 1948 has now descended to the status of a worthless currency. Figure 1 presents this one way journey of the rupee, both in rupees to dollar and dollars to rupee terms, during 1950-October 2018.

Singapore’s problem is how to prevent appreciation of currency

The Singapore dollar, which started almost at the same level with Ceylon rupee in 1948, has completed a journey in the opposite direction. Last week, its value was recorded at 73 US cents per Singapore dollar, up from 33 US cents in 1948.

But unlike Sri Lanka, Singapore has been blessed with a continuing increase in productivity, enabling it to allow the SGD to appreciate in the market without losing its global competitive  edge. However, its problem has been how to prevent the SGD from appreciating beyond what is permissible by improvements in productivity. Hence, to slow down the appreciation and allow only a ‘modest and gradual’ rise, the country’s Monetary Authority had in April 2018 slightly tightened the band within which the currency is allowed to float in the market (see: https://www.straitstimes.com/business/economy/mas-to-tighten-singdollar-policy-allowing-for-modest-and-gradual-appreciation ). Thus, the post-independence experience with respect to economic performance and achievement of Singapore and Sri Lanka has been a way apart from each other.

edge. However, its problem has been how to prevent the SGD from appreciating beyond what is permissible by improvements in productivity. Hence, to slow down the appreciation and allow only a ‘modest and gradual’ rise, the country’s Monetary Authority had in April 2018 slightly tightened the band within which the currency is allowed to float in the market (see: https://www.straitstimes.com/business/economy/mas-to-tighten-singdollar-policy-allowing-for-modest-and-gradual-appreciation ). Thus, the post-independence experience with respect to economic performance and achievement of Singapore and Sri Lanka has been a way apart from each other.

Governments’ deficit spending is the root cause

All past governments in Sri Lanka, irrespective of their political complexion, have to take responsibility for the country’s dismal economic performance that has led to the depreciation of the rupee in the market. Of course, Sri Lanka did not stay put where it started in 1948.

There have been achievements, but all of them had been small gains compared to what other successful nations had attained. Sri Lanka’s political leadership, like many other newly independent countries in Asia, Africa and Latin America, had harboured obsessive faith in the Government and Government financing for bringing quick prosperity to the people. Hence, in the whole of the post-independence period, except in 1954 and 1955, the Government was in the wont of spending more than what it earned – a budgetary practice known as deficit financing – by tapping a combination of different funding sources. They constituted borrowing from all sources – domestic private and banking sectors, on one side, and foreigners, on the other – to fill the budget gap. Thus, the country’s budget deficit in some years was as high as 19% of the total output, known as the Gross Domestic Product or GDP, but on average it stood at 7% of GDP, still an unmanageable level. But the average real economic growth that was recorded during the whole of the post-independence period amounted only to 4.4%, pretty much below the required rate of 8% to make Sri Lanka a rich nation within a generation.

According to the World Bank classifications, Sri Lanka was able to move from a poor country to a lower middle income country only in 1997, some 50 years after the independence. It is still continuing as a lower middle income country after 20 years, though it is now on the threshold of moving to the next higher category, an upper middle income country.

All the evidence today shows that it has been snared in what is known as ‘the middle income trap’, a situation in which it is unable to become a rich country soon, due to the absence of modern technology, and compete with its peers due to increased labour costs back at home. What has actually brought in is an undesired outcome. That is, Sri Lanka’s economy has bloated in rupee terms beyond its ability to maintain self-sustenance.

All Ministers of Finance in the past who have contributed to the bloating of the economy through deficit financing are entitled to shout only one desperate call. That is, ‘Honey, I Blew up the Kid’ like Wayne Szalinski in Randal Kleiser’s movie, by the same title. Szalinski’s work, leading to the creation of a monster out of an innocent kid in the movie, was not intentional but accidental. Similarly, the creation of a monster economy with a voracious appetite for filling a bloated belly by Ministers of Finance was also not intentional but consequential.

Getting into a blame game

The ex-Governor of the Central Bank, Ajith Nivard Cabraal, in an article titled ‘Govt, CB have abdicated the vital statutory duty by not being able to deal with rupee depreciation (available at: http://www.ft.lk/columns/Govt---CB-have-abdicated-vital-statutory-duty-by-not-being-able-to-deal-with-rupee-depreciation/4-664247) had presented a statistical table with data from 1977 to the latest with Central Bank intervention in the market to prevent depreciation of the rupee.

Despite this, the rupee has depreciated from Rs 8.83 per dollar in late 1976 to Rs 171 per dollar at end September 2018. In fact, as I have presented above, the rupee depreciation began much earlier, from the date on which Sri Lanka gained independence in 1948. His point has been that in the period from 2006 to 2014 during which he had been the Governor, the rupee depreciated by about Rs 29 per dollar or 3% on average a year with only sales from the Central Bank reserves amounting only to $ 2.3 billion on a net basis. Though in 2011-2, CB had sold $ 4 billion to protect the rupee, the net sales during that period have been reduced to $ 2.3 billion because of a mega net purchase of $ 2.3 billion in 2009, basically from the inflows to the government securities market after that market was open to foreigners. His point was that after he left the Bank in the period from 2015 to end September 2018, the Bank has sold in the market on a net basis $ 2.5 billion but the rupee had depreciated by Rs 40 per dollar or by 9% per annum on average. This net sale is made up of a mega sale done by the Central Bank in the period prior to the General Elections in August 2015, amounting to $ 3.4 billion, and a further sale of $ 1.9 billion in 2016. But just like Cabraal’s time, the present management of the Central Bank too has purchased from the market on a net basis $ 1.7 billion in 2017, augmenting the reserves.

Continuation of the blame game

Now, this is playing a blame game that, during his time, both the depreciation of the rupee and the net sale from the foreign exchange reserves were lower than the period since he had left the Central Bank. But still, the rupee depreciated and reserves were lost. However, the Central Bank, in a defensive mood, had replied to Cabraal (available at: http://www.ft.lk/opinion/Rupee-depreciation--Central-Bank-responds-on--misleading--article/14-664390), pointing out that the Bank had in the past done its best to stabilise the currency, given the constraints of unfavourable forces working against both the rupee and Bank’s attempt at providing stability to the exchange rate. Its main argument has been that in the current period, it cannot and should not repeat the mega interventions done in the past, namely, in 2011/12 and 2015, in view of the overwhelming debt repayment obligations which have fallen on the country due to its liberal past external borrowings. According to the Ministry of Finance, these obligations are too critical to be ignored, especially in 2019 and 2020. This has led to the continuation of the blame game, and Cabraal has in a later intervention has questioned the Central Bank’s wisdom of stabilising the rupee, whether it would fall to Rs 200 or Rs 250 or Rs 300 (available at: http://www.ft.lk/columns/At-what-value-of-the-rupee-will-Central-Bank-think-it-needs-to-stop-the-depreciation--200--250--300-/4-664555). These blame-excuse-blame games will not help the rupee or the economy and, therefore, should be stopped in order to find a permanent solution to rupee’s sad one way journey to depreciation, as I have argued in my previous article.

Permanent solution is the Government’s responsibility

A Central Bank can do very little to stabilise a currency, if the economy outside the bank is not supportive to its action. The currency depreciation is only a symptom of a graver malaise and not the root cause. Hence, a Central Bank could keep a currency at a stable level for a short period through its monetary, foreign exchange, and market intervention policies. Once a currency is stabilised at a certain level, it is up to the government in power to take long term permanent action to bring in a lasting stability. This was exactly what Singapore did, by increasing productivity through the introduction of new technology and promoting competitiveness at all levels in the economy.

Financial war fought by the Central Bank

Every Central Bank Governor is working under this constraint, and can only advise the political leadership what it should do. As the proverb says, he can take the horse to the water but he cannot make it drink it. In the severe foreign exchange crisis which the country faced during 2007 to 2009, when the country was at the height of the war with LTTE, there was a separate financial war fought by the Central Bank along with the war fought by soldiers in the battlefront. Sri Lanka lacked weapons, and China, its main weapon supplier, extended only 3 months’ credit to the country. The Bank of Ceylon had to honour the letters of credit on the due dates, and the Central Bank had to provide it with dollars. The country had to save its foreign exchange to meet this commitment on a priority basis, just like the present Governor, Indrajit Coomaraswamy, has to save the scarce foreign reserves for meeting debt repayment obligations.

Governor Cabraal’s creditable work

Cabraal should be given credit for managing that situation effectively, thereby facilitating a continuous flow of weapons to the country for soldiers in the field to move the war to a finish. I recall how he went around the world in 2007, canvassing for investments by foreign investors when the first sovereign bond issue of just $ 500 million was offered by the Government. That was peanuts in today’s context, but it was done against a very powerful force both within and outside the country. But that was not sufficient and foreign exchange requirements were alarmingly high. He dispatched himself to Libya to seek support from Mohammed Gaddafi, supposed to be a friend of President Mahinda Rajapaksa. But he returned empty-handed.

Then, he sent teams of senior Central Bank officers to major groups of countries to solicit support of the Sri Lankan diaspora, who were thought to be in readiness to give Sri Lanka much-needed dollars. I led the team to Australia and New Zealand, met Sri Lankans living in Melbourne, Sydney, Canberra and Wellington, and solicited support from them. They were sympathetic but demanded the pound of flesh from the Government in the form of a waiver of the fees charged for dual citizenships, admission to superior schools, and duty free vehicles for their relatives back at home. It was, thus, a failure.

Devoid of a source, Cabraal turned to IMF, which was sitting on the request due to the pressure from those who were sympathetic to the LTTE. The tables were turned only after the Indian Finance Minister, Pranab Mukherjee came forward, and issued a bold statement that if IMF did not approve of the loan sought by Sri Lanka, India would make available the needed funds to that country in need. Hence, it is not cricket for Cabraal to get into a blame game now, and find fault with the present management of the Central Bank.

Unreasonable past Governors

Central Bank Governors in the past have been unreasonable at times, but when sense was put to them, they came forward to support and protect that institution.

In 1996, immediately after the horrendous bomb blast in front of the Bank building, the late H N S Karunatilake began a blame game in public that the then-Governor A S Jayawardena had failed to protect the bank against a possible LTTE attack. In fact, he very correctly gave credit to himself that the Bank was saved from total destruction by the iron barrier he had constructed at the entrance, popularly nicknamed Karunatilake Barrier. When the late A S Jayawardena came on TV and said that at that instance of a national tragedy, all other Central Banks and previous Governors had come to the Bank’s support, Karunatilake did not mutter it again.

Then, after Cabraal became Governor in 2006, Karunatilake once again went into the blame game, criticising him even personally. That was put to a stop when Cabraal used his superior public relation skills to invite all previous Governors to a luncheon meeting at the Bank, and explained the true situation facing the country at that time.

High GDP and low exports are the cause of depreciation

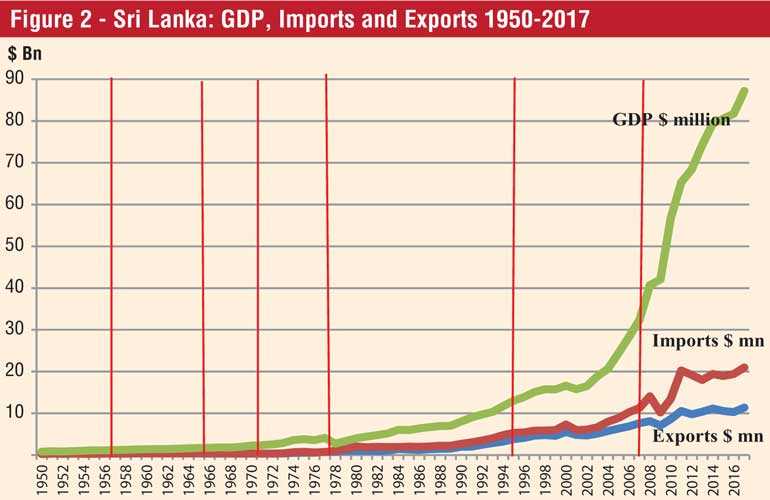

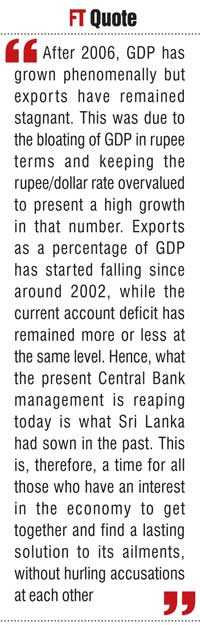

Cabraal has another reason to support the present management of the Central Bank. That is because the gravity of the rupee problem is rooted to the period from 2006 to 2014, when Sri Lanka had bloated its economy in rupee terms, and paid scanty attention to promoting exports or eliminating the deficit in the current account. As shown in Graph 2, after 2006, GDP has grown phenomenally but exports have remained stagnant.

This was due to the bloating of GDP in rupee terms and keeping the rupee/dollar rate overvalued to present a high growth in that number. This is shown by Graph 3, in which the exports as a percentage of GDP has started falling since around 2002, while the current account deficit has remained more or less at the same level.

Hence, what the present Central Bank management is reaping today is what Sri Lanka had sown in the past. This is, therefore, a time for all those who have an interest in the economy to get together and find a lasting solution to its ailments, without hurling accusations at each other.

Need is painful shrinking of spending by all

The solution involves getting the Government and the people to shrink their top spending on a priority basis. No country can think of stabilising its currency if it continues with a high deficit in the current account unabatedly. Perhaps, it is better if all the parties in the present blame game get together and shout, as in a previous Szalinski movie, ‘Honey, I have shrunk the kids’. It is painful but something that must necessarily be done.

(W A Wijewardena, a former Deputy Governor of the Central Bank of Sri Lanka, can be reached at [email protected])