Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Thursday, 9 February 2023 00:40 - - {{hitsCtrl.values.hits}}

|

“The other point…is the integration with India. Greater integration with India and this is not just for the Northern Province, it’s for the whole of Sri Lanka.”

(Dr. Indrajit Coomaraswamy, Sangarapillai Memorial address, January 21, 2023)

President Ranil Wickremesinghe’s ‘Throne Speech’ rolled-out a bold neoliberal vision for the next 25 years when it’s a safe bet he won’t be in that seat in 25 months and even the next 25 weeks are going to be a choppy ride. But that’s Ranil.

President Ranil Wickremesinghe’s ‘Throne Speech’ rolled-out a bold neoliberal vision for the next 25 years when it’s a safe bet he won’t be in that seat in 25 months and even the next 25 weeks are going to be a choppy ride. But that’s Ranil.

Under this unelected President, democracy is up against the wall. Before our 75th Independence Day dawned, and in defiance of a magisterial order permitting a non-violent satyagraha (a ‘sit-down’), jets of Police water cannon, black-uniformed riot squads and pro-Government thugs slammed into a group of protestors (hardly rioters) seated backing the wall of the Elphinstone theatre in Maradana.

Armed Forces

Ranil Wickremesinghe proceeded with the 4 February military parade for at least two reasons. Firstly, to solidify his equation with the military, which is vital to him because for the first time in 75 years Sri Lanka does not have an elected leader with a popular base and a mass party of his/her own.

Secondly to signal the regrouping resistance which this time around involves the wage-earners from Port workers to professors and medical doctors, that he has the military with him and will not hesitate to deploy them, ordering use of lethal force if there is another Aragalaya.

Paradoxically though, by his policies and his conduct he has done the armed forces a great disservice, cutting them off from their all-important secure rear-area, the supportive citizenry.

The Wickremesinghe presidency is dangerous to the military also because the Sri Lankan armed forces always operated for 75 years under the umbrella of an elected and therefore legitimate (not just constitutionally legal) leadership. This is the first time our military is devoid of such cover and therefore of the strategic asset of “soft power” which has at its very core, popular consent.

The armed forces are further jeopardised by a problem which has been created recklessly by President Ranil Wickremesinghe, with his pledge to ‘fully implement’ the 13th Amendment at breakneck speed, commencing 8 February. This will further de-stabilise society and stir debate within the armed forces from top to bottom. Gen. Jagath Dias emerged from retirement to join a ‘NO’ picket.

As the protests of 4 February and 8 February prove, President Wickremesinghe has managed to mobilise absolutely diverse, absolutely disparate forces against him. The military may find it even more difficult to defend him than it was to defend Gotabaya.

Winning the economic war

Winning the economic war

At the annual global seminar on South Asia hosted by the Institute of South Asian Studies of the National University of Singapore (ISAS/NUS) in November 2009, an event at which I was a speaker, the then Deputy Prime Minister and Defence Minister of Singapore told the audience that “postwar Sri Lanka has the highest growth-rate outside of China which has the highest growth-rate in Asia which has the high growth-rate in the world.”

Addressing the same audience, Law Minister K. Shanmugam (later Foreign Minister) pointedly added that the test before Sri Lanka is whether “having won the war it could also win the peace”. It could have, but didn’t.

How did we win the war? First, we arrived after decades at the realisation that contrary to the Norwegians and the Co-Chairs, a negotiated peace was impossible with Prabhakaran and we had to step outside their paradigmatic parameters.

Second, we (narrowly) made the correct choice in December 2005 as between Ranil and Mahinda, after the shock of Lakshman Kadirgamar’s assassination during Ranil’s paralysing, porous CFA and MR’s determined speech at Kadirgamar’s funeral (August 2005).

Third came the correct team for that historical moment and challenge: MR-Sarath Fonseka-Gotabaya.

If Sri Lanka is to recover from the economic crisis as it did from civil wars in 1989 and 2009, it must use the same tested pathway and elect a new political leadership and facilitate a new team. But who, and which party? The answer is accessible through another question: “what policy do we need to exit the economic crisis or at least not plunge more painfully into it?”

Diagnosing the debt crisis

We must reject diagnoses and prescriptions which seem scientific but are actually subjective, normative, ideological ‘constructs’ based on ideological policy preferences and social priorities. We should eschew the ‘expertise’ proffered by those guilty of leading us into the debt trap. We should be guided by the views of the most credentialed, knowledgeable and respected.

The recent statement by 182 academics including at least 10 internationally renowned economists (far more respected than BR Shenoy or Ricardo Hausmann), namely Thomas Picketty, Dani Rodrik, Robert Wade, Yanis Varoufakis, Ha-Joon Chang, Jayati Ghosh, Jean Dreze, Utsa Patnaik, Prabhat Patnaik and Ben Fine, give us a diagnosis which includes the causation of the debt crisis.

I would much rather trust their analysis than that of followers of obscure Indian free-market fundamentalists and outlandish right-wing philosophers beloved only by the American economic-libertarian fringe.

The 182 scholars’ statement highlights, inter alia:

“…specifically, the deregulation and openness that encouraged irresponsible borrowing, enabled illicit financial flows out of the country and assisted political corruption—have intensified external debt and balance of payments crises.”

“…specifically, the deregulation and openness that encouraged irresponsible borrowing, enabled illicit financial flows out of the country and assisted political corruption—have intensified external debt and balance of payments crises.”

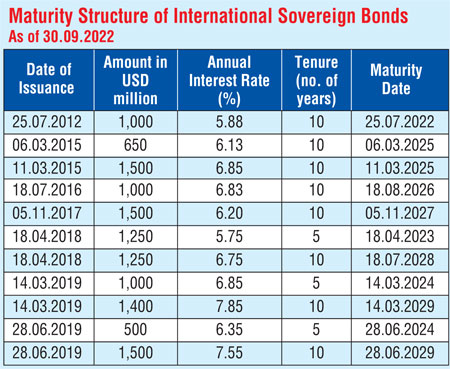

“…Private creditors own almost 40% of Sri Lanka’s external debt stock, mostly in the form of International Sovereign Bonds (ISBs), but higher interest rates mean that they receive over 50% of external debt payments. Such lenders charged a premium to lend to Sri Lanka to cover their risks, which accrued them massive profits and contributed to Sri Lanka’s first ever default in April 2022. Lenders who benefited from higher returns because of the “risk premium” must be willing to take the consequences of that risk.”

“…Private creditors own almost 40% of Sri Lanka’s external debt stock, mostly in the form of International Sovereign Bonds (ISBs), but higher interest rates mean that they receive over 50% of external debt payments. Such lenders charged a premium to lend to Sri Lanka to cover their risks, which accrued them massive profits and contributed to Sri Lanka’s first ever default in April 2022. Lenders who benefited from higher returns because of the “risk premium” must be willing to take the consequences of that risk.”

“…In this context, giving private bondholders an upper hand relative to sovereign debtors in the Paris Club and the IMF’s required debt negotiations violates the basic principles of natural justice.”

“…In this context, giving private bondholders an upper hand relative to sovereign debtors in the Paris Club and the IMF’s required debt negotiations violates the basic principles of natural justice.”

“…Apart from revealing the identity of ISB holders, it is also important to disclose how ISBs were deployed, and the use of those funds.”

“…Apart from revealing the identity of ISB holders, it is also important to disclose how ISBs were deployed, and the use of those funds.”

“…The IFIs are not currently living up to these responsibilities, at a time when they are most urgently required. In Sri Lanka they encouraged the very policies of more open capital accounts and deregulation that have led to the current crisis.”

“…The IFIs are not currently living up to these responsibilities, at a time when they are most urgently required. In Sri Lanka they encouraged the very policies of more open capital accounts and deregulation that have led to the current crisis.”

“…Instead, the focus should be on legal and regulatory changes to stem the illicit outflow of capital through transfer pricing and trade mis-invoicing over the past 15 years, which is estimated to be far more than the aggregate foreign debt of Sri Lanka, and on taxation of wealth and consumption of the super-rich…” (Sri-Lanka-debt-statement.pdf (debtjustice.org.uk)

“…Instead, the focus should be on legal and regulatory changes to stem the illicit outflow of capital through transfer pricing and trade mis-invoicing over the past 15 years, which is estimated to be far more than the aggregate foreign debt of Sri Lanka, and on taxation of wealth and consumption of the super-rich…” (Sri-Lanka-debt-statement.pdf (debtjustice.org.uk)

This clarifies the anatomy of the debt crisis and indicates contours of a possible solution. We are reminded that the debt crisis dates back 15 years, not 75, nor from 1977 as the JVP-JJB schizophrenically claims.

We are also reminded that it wasn’t limited to the Rajapaksa years. The 15 years include two Rajapaksa terms and one (Yahapalanaya) in which finance was firmly in the hands of the UNP headed by Ranil Wickremesinghe as PM and Ravi Karunanayake and Mangala Samaraweera as Finance Ministers. The “deregulation and openness that encouraged irresponsible borrowing, enabled illicit financial flows out of the country and assisted political corruption” took place during the UNP Yahapalana dispensation at the hands of UNP Finance Ministers and their ‘Segundos’.

As the statement of the 182 academics underscores, 40% of the debt is held by and 50% of external debt payments go to private foreign creditors.

It is far easier to deal with states and international institutions than with the high-interest, short-gestation private money markets.

Bilateral debt is 31% of the total debt while commercial debt is 42%, of which 36% are ISBs. (https://www.treasury.gov.lk/news/article/180)

The Yahapalanaya UNP economic team (2015-2019) is squarely responsible for the largest single slice of the foreign debt i.e., most of the borrowing from the private foreign creditors.

The private bondholders have just written a letter to the IMF hinting that there should be greater scrutiny and stringency in Sri Lanka’s restructuring plan and stating clearly—and intrusively—that a restructuring of the domestic debt would be a condition for the Bondholder group’s agreement:

“…We would note that the finalization of an agreement will also be subject to the satisfaction of the following conditions: The central government’s domestic debt – defined as debt governed by local law – is reorganized in a manner that both ensures debt sustainability and safeguards financial stability…” (Sri Lanka Bondholder Group Letter to the IMF (prnewswire.com)

The Bondholder Group obviously envisions either veto-power for itself over the IMF agreement or the right not to comply with any agreement the IMF may arrive at which is not consonant with the Group’s views:

“… it is nevertheless important that the Bondholder Group has the opportunity to express its views on both the economic assumptions underpinning these IMF Programme Targets and the adequacy and feasibility of the adjustment efforts contemplated under the IMF Programme. When considering any restructuring proposal that is made to the Bondholder Group, it is the Bondholder Group’s intention to take into consideration the extent to which the economic assumptions and the adjustment efforts are consistent with these views…” (ibid)

Ranil Wickremesinghe and the 2015-2019 UNP economic policy team got this country into this particular trap, making us hostages of the private bondholders.

Logically, Ranil Wickremesinghe and all members of his economic team responsible for this economic crime must be ruled out as having the solution or the credibility to propose one.

Sirikotha Consensus

In 2015 Nobel prizewinner for Economics Joe Stiglitz shared a panel with Prime Minister Wickremesinghe and gave him the recipe for post-conflict prosperity: lead with equity. Ranil and his economic team ignored him and opted instead to consult the rightwing Venezuelan Ricardo Haussmann, indubitably an infinitely less distinguished economist.

Under the UNP the growth-rate dropped from the wartime 5% average to half that figure—despite a drop in petroleum prices. With the UNP shut-down of Chinese projects causing growth to slow, there were no earnings to keep pace with debt repayment, hence the excessive recourse to private borrowing and the virtual sell-off (long lease) of the Hambantota Port leaving a larger Chinese footprint in Hambantota, triggering Indian apprehensions and counter-moves.

Does anyone really know where the funds from the Hambantota lease went, at a time bills were relatively low because oil prices were down?

What about the open-ended (according to the then Auditor-General) economic damage caused by the Central Bank bond scam?

Call it the Sirikotha Consensus. Ranil and his proteges of 2001-2004 and 2015-2019 converge on current economic policy from different political directions. They want to return to where they were stopped by the voters. Those in the post-UNP opposition space who are part of the neoliberal Sirikotha Consensus on economics want a popular mandate not to implement an alternative to Ranil’s program but precisely to implement Ranil’s program itself, since he cannot do so as he himself has no mandate. They seek to be a supplement, substitute, partner or proxy for Ranil; not a progressive-centrist alternative to him and his economic strategy.

|

Economic blueprint

The citizens DID NOT ask our governments to go to the private money markets nor did the governments ask the citizens whether or not to do so. The citizens didn’t even know about it. By what moral or ethical logic are they being asked to bear the brunt of debt repayment? That insistence violates natural justice. Why should we live by “the laws of the State of New York” behind which most of the private bondholders shelter and operate, and which prominent economists keep invoking shrilly as if they were Moses’ Ten Commandments?

The 182 academics including the constellation of top economists urge that any solution must imperatively contain two components, namely (a) regulatory tightening and (b) tax on the ‘super-rich’—not, I might add, on wage-workers and middle-class professionals:

“…the focus should be on legal and regulatory changes to stem the illicit outflow of capital through transfer pricing and trade mis-invoicing over the past 15 years, which is estimated to be far more than the aggregate foreign debt of Sri Lanka, and on taxation of wealth and consumption of the super-rich…” (Sri-Lanka-debt-statement.pdf (debtjustice.org.uk)

“…the focus should be on legal and regulatory changes to stem the illicit outflow of capital through transfer pricing and trade mis-invoicing over the past 15 years, which is estimated to be far more than the aggregate foreign debt of Sri Lanka, and on taxation of wealth and consumption of the super-rich…” (Sri-Lanka-debt-statement.pdf (debtjustice.org.uk)

A progressive economic blueprint would pledge to tighten the regulatory framework which was unconscionably loosened by a UNP Finance Minister’s 2017 scrapping of a Foreign Exchange Act which had been in place since the 1950s including the decades of the Open Economy.

OXFAM GB recently issued a call for a ‘windfall tax’ on corporate profits. Any economic blueprint should pledge a heavy tax on corporates which urged drastic tax cuts and raked in windfall profits during the Gotabaya years.

Neoliberal economists who give tuition classes on public platforms insisting there is only ONE solution, basically that of the current IMF agreement, cover up the problem—the logical contradiction-- within that ‘solution’. The Bondholders letter to the IMF recapitulates the strategy agreed upon by the IMF with the Wickremesinghe administration:

“…to design and implement restructuring terms that would…allow the country to re-gain access to the international capital markets during the IMF Programme period.” (Sri Lanka Bondholder Group Letter to the IMF (prnewswire.com)

This strategy of restructuring designed to “allow the country to re-gain access to the international capital markets” is exactly like allowing a drug addict in painful rehabilitation for heavy addiction, to regain his access to drugs and drug dealers.

We need an economic blueprint to free itself of reliance on the predatory international money markets and the compulsion to access them, while reviving, rebalancing and smartly regulating the Open Economy, not rejecting it as the JVP-JJB does.

We do not need a (Ranil-Ravi-Mangala) neoliberal ‘greenprint’ that keeps our country a hamster on the wheel of foreign debt dependency, gutting public healthcare and education, and crushing the wage-earning and fixed income/savings classes. The logical endgame of that strategy has been unveiled by a member of Ranil’s 2015-2019 economic team greatly responsible for the huge borrowing from the private international money markets and therefore getting us deeper into the debt trap:

“…The other point…is the integration with India. Greater integration with India and this is not just for the Northern Province, it’s for the whole of Sri Lanka.” (Dr. Indrajit Coomaraswamy)

This would translate into the ineluctably subaltern integration of Sri Lanka into India.

Political and policy conclusion

Sri Lanka imperatively needs a social democratic economic blueprint for breakout of the debt trap. Opposition Leader and SJB leader Sajith Premadasa is on a blistering campaign invoking Social Democracy, a Middle Path, a mixed economy, Roosevelt’s New Deal, the need for rapid industrialisation-driven economic expansion not contraction, and President Premadasa’s equation with the IMF and other IFIs which did not burden the masses but secured assistance for social entitlement/upliftment programs.

Sajith’s then, is the economic blueprint we need: a Premadasa Mk II developmental paradigm.