Sunday Feb 15, 2026

Sunday Feb 15, 2026

Thursday, 31 January 2019 01:23 - - {{hitsCtrl.values.hits}}

The Sri Lanka-Singapore Free Trade agreement (SLSFTA)

Unlike the SLIFTA and the SLPFTA, SLSFTA is a modern FTA.It has a wider range of reform provisions going beyond liberalisationoftrade in goods to include other areassuch asservices, movement of professionals, telecommunications and electronic commerce, intellectual property rights, and government procurement. Overall, the subject coverage is similar to the other FTAs involving Singapore.

The SLSFTA was signed on 1 May 2018.However, whetheror when and in what form will the agreement come into force remain uncertain following the release in last November2018of the report of theCommittee of Experts (CoE)appointed by the President to evaluate it.

Singapore is one of the most opened trading nations in the world.Singapore’s average MFN applied duty rate is zero for all imports other than imports of beverages and tobacco for which the averagedrate varies from 1.6% to 85% (WTO 2018). Thus, the SLSFTA is unlike to have a direct impact on Sri Lanka’s exports to Singapore.

Some commentators have expressed concern that, under the agreement, Sri Lanka would be able to exports to other Southeast Asian countries with which Singapore has entered into Free Trade Agreements.It simply reflects the popularmedia practice of treating ‘trade within FTAs’ as ‘free trade’. This view ignores the fact that RoOs, which are an integral part of any FTA, preclude transhipment of goods to athird country though a FTA partner country.

Sri Lanka has little trade compatibility with Singapore on the import side (Table 2, part 2).This is because, over the past three decades, Singapore’s export structure has undergone a dramatic transformation. Commodity composition of exports is now dominated by petrochemicals, pharmaceuticals,high-tech parts and components of electronics, and surgical and scientific equipment.

Singapore is not a supplier of assembled (final) consumer electronics and electrical foods, automobiles, and low-end parts and comports of these products, which dominate Sri Lanka’s manufacturing imports.Therefore, the market penetration effect in Sri Lanka of Singapore products under the agreement is like to be negligible.

There is a fear that the agreement could open the door for industrial waste and other environmentally harmful products to enter Sri Lanka.This would entirely depend on theimplementationof the RoOs of the agreement by the Singapore authorities.Given the well-functioning instructions in Singapore with a proven record of adherence to the rule of law, one can hope that there would be little room for tweaking or lax implementation of the RoOs on Singapore’s part.

The Sri Lankan authorities anticipate that SLSFTA would help linking the Sri Lankan manufacturing sector to global production networks (global manufacturing value chain) (CBSL 2018).How this would happen is not clearly stated in the related government documents.One possibility could be Singapore-based firms operating within production networks relocating some sediments/tasks of the firms in Sri Lanka to exploit advantages from relative production cost differences.

Indeed, this process helped spreading production networks from Singapore to the neighbouring countries during the period from about the mid-1970s to the late 1990s (Athukorala and Kohpaiboon2014). However, because of the dramatic industrial transformation noted above, industries such as semiconductor and hard disk drive with potential to shift relatively low-end activities to low-cost locations have already disappeared from Singapore.

It is important to note that, the electronics firms currently in operating in Sri Lankan manufacturing export predominantly to countries like Japan, USA, Germany and some European countries. Their exports to Singapore and other ASEAN countriesare minuscule, notwithstanding duty free access to these markets under the WTO’s Information Technology Agreement.

Even if there were some opportunities for production relocation, whether the FTA would be an effective vehicle for facilitating the process is highly debatable, for two reasons. First, the very essence of global production sharing within global production networks is locating different segments of the production process globally, rather regionally or bilaterally. The relative cost advantage of producing/assembling a given part or components in the supply chain need not necessarily lie in a country within the jurisdictional boundaries of a specific FTA.

Second, there are formidable complications relating to the application of RoOs for trade within global production networks.Most of the task/segments produced/assembled within production networks have very thing value added margins in each location.In addition, most of imports and export of parts and components trained with production fall under the same HS 4-digit classifications. Therefore, the identification of the origin of trade within production network for granting tariff preferences becomes a major challenge (Athukorala&Kohpaiboon 2011).

Put simply, the rise of global production sharing strengthens the case for multilateral (WTO-based) or unilateral, rather than regional (FTA) approach, to trade liberalisation. To quote Victor Fung, the Honorary Chairman of Li & Fung, the world’s largest supply-chain intermediary based in Hong Kong: ‘Bilateralism distorts flows of goods ….In structuring the supply chain, every country of origin rule and every bilateral deal has to be tackled on as additional considerations, thus constraining companies in optimising production globally’ – Victor Fung, Financial Times, 3November2005.

These considerations suggest that more appropriate policy option for facilitating a country’s engagement in global production network is unilateral liberalisation or becoming a signatory to the ITA.Bothpolicy options assure unconditional duty-free access to the required inputs. The case for such broader liberalisation, rather than following the FTA route lies in that global production sharing is a global phenomenon, rather than a regional or bilateral phenomenon.

One of the main envisagedgainsto Sri Lanka from the SLSFTA is attracting FDI from Singapore.It is expected that the provisions in the investment chapter (Chapter 10) (safeguards against expropriation, most-favoured nation treatment, repatriation of capital and return from investment) would entice Singapore investors to come to Sri Lanka.Howeverthese provisions are exactly similar to those embodied in the Bilateral Investment Protection Treaty (BIPT) between the two countries that has been in force over three decades (since September 1980)(https://investmentpolicyhub.unctad.org).

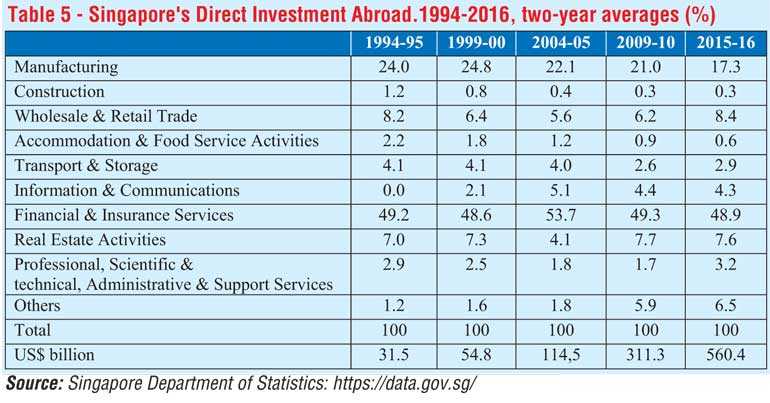

Notwithstanding this long-standing treaty, Sri Lanka has so far been able to attack only a tiny share of rapidly expensing oversees FDI from Singapore. The total stock of outward FDI from Singapore increased from $32 billion 1994-5 to over 560 billion in 2015-16 (Table 5). However, during this period Singaporean FDI in Sri Lanka amounted to a mere $ 1.2 billion (based on investment approval records of the Board of Investment).This compassion is much in line with the available multicounty evidence that a BIPT (or an FTA with an FDI chapter, for that matter) is unlikely to entice foreign investors unless they are appropriately embodied in a broader reform addenda to improve the overall investment climate of the country (Hallward-Driemeier 2003).

The data relating to the evolving patterns of outward FDI from Singapore seems to suggest that, even with required broader reforms, opportunities for Sri Lanka to attract Singaporean investors are not very promising (Table 5).This is because there is limited compatibility between the sectoralcomposition of Singaporean outward FDIand both Sri Lanka’s development priories and the current stage of economic development. Over a half of outward FDI from Singaporeis in the financial sector.These investments are primarily destined to high-income countries.

The manufacturingshare of FDI, which is relevant for Sri Lanka’s objective of joining global production networks, accounts for a smaller and declining share of total outward FDI (16% in 2015-16, compared to 25% in1994-95).MNEs accounts for the lion’s share of Singapore’s manufacturing industry (over 80% output).As noted, the SLSFTA is unlikely to be relevant for these MNEs because they make investment location decisions at their headquarters based of a wider inter-country assessment.

Report of the Presidential Committee

A fuller assessment of the report of the Presidential Committee of Experts (CoE) onSLSFTA is beyond the scope of this article.However, we would like to make some brief observations on the report’s key recommendation: ‘Priority need to be given to unilateral trade policy reforms instead of relying on FTAs’.

We fully agree with this recommendation.In fact, we have provided empirical evidence in support of this view, whereas CoE’srecommendation is based a priority reasoning. In addition, we have discussedinherent limitations of the FTA approach to trade opening compared to unilateral and multilateral reforms.We also endorse the recommendation that ‘national trade policy must align with a coherent national development policy framework’. However, we find that the recommendation made by the CoE is not consistent with the objective of addressing supply-side issuesto improve the country’s competitiveness in the context of the rapidly changing global economic order.The recommendations are simply ‘old [import-substitution] wine in new bottles’.

The CoE recommends‘to focus on targeted liberalisation so as to avoidinterference with the growing or infant industries; infants have to grow at home,they cannot start off as exporters,’following the examples of Japan, South Korea and Brazil during 1965-1985.

We were surprised to see Brazil listed here an example to follow.Brazil is certainly not a development success story (Thomas 2006).Yes, Brazil achieved rapid industrial growth during the import substitution era, but the Brazilian manufacturing industry has miserably failed to maintain this growth spurtduring the ensuing decades.In spite of country-specific advantages such as the ample domestic resource base, the vast domestic market and access to markets in neighbouring countries, only a handful of firms emerged during the import-substitution era have continued to remain internationally competitive.Give the lacklustre economic performance in a land of ample unexploded potential, Brazil is known in development policy circles as ‘the eternal land of the future’ (Edwards 2010).

Export-oriented industrialisation in Japan and South Korea (and, also Taiwan) was certainly guided and aided by the state.However, their development success was not based on blanket industrial protection as advocated by the CoE (Perkin 2013. Studwell, 2013, Li 1995, Park 1970, Tsai 1997). Trade protection and other government support to firms in these countries were strictly time bound and, more importantly, subject to stringent export performance requirement (export discipline).

FT Link

Exporting firms always enjoyed duty free status in procuring imported inputs for export production.Culling those firms, which did not measure up, was an integral part of their policy.More importantly, all those countries had strong, committed leadership that was vital for effective implementing these policies.President Park Chun He, who engineered the Korean export-oriented growth miracle, summed up his policy vision as follows:

‘The economic planning or long-range development programme must not be allowed to stifle creativity or spontaneity of private enterprises. We should utilise to the maximum extent the merit usually introduced by the price mechanism of free competition, thus avoiding the possible damages accompanying a monopoly system. There can be and will be no economic planning for the same of planning itself’ (Park 1970, p. 214).

The CoE has ignored dramatic changes in the global economy in making therecommendations that ‘infants have to grow at home’.This conventionalinfant industry argument is based on the standard trade theoretical assumption that ‘countries trade in goods produced from beginning to the end within its geographical boundaries’.

It is not consistent with global production sharing, which has been the prime mover of export-oriented industrialisation in this era of economic labialisation. To be successful in this form of specialisation, a firm has to have a global focus ‘at birth’.It is important to notethat most (if not all) of the successful exporting firms in Sri Lankan manufacturing emerged ‘de novo’ benefitting from the concurrent liberalisation of foreign trade and investment regimes (Athukorala 2019).

We do not agree with the CoE’s recommendation for postponing trade reforms until achieving the required supply side capabilities. Trade liberalisation should instead be an integral part of the overall reform package.It is not possible to achieve supply-side desiderata emphasised in the report such as factor efficiency and productivity growth, improving innovative capacity under a protectionist trade regime.

Contrary to the CoE’s claim, in East Asian countries trade reforms have gone hand in hand with supply-side reforms. By ‘trade liberalisation’ we mean here a move towards a relative more uniform tariff suture that hasa low average tariff, withprovisions for duty-free access to intermediate inputs for export production, not mindless dismantling of all trade barriers..

Relating to trade policy reforms, the CoE recommends combining para tariff (PT) with customs duties in order to provide protection to domestic manufacturers.The existing cocktail of PTs was introduced in an arbitrary fashion during 2005 – 2015 for revenue raising purposes, not for protecting industries. Thanks to tariff reforms introduced at successive stages during the preceding two decades, by the early 2000s Sri Lanka had been approaching an important policy phase marked by shifting the agenda away from protection and towards achieving a stable and predictable trade policy regime.

This process was interrupted by the arbitrary introduction PTs and upward adjustment the rates.PTs are an anomaly in the import duty structure that complicates customs administration.There is also evidence that PTs are now a major cause of anti-export bias in the incentive structure.Combining TPs and customs duties would help perpetuating the ant-export bias.

In making the recommendation for combining PTs with customs tariffs, the CoE has overlooked an important feature of the tariff structure: almost all intermediate imports to the country come under zero-duty tariff lines, but these imports are subject to PTs.So, removingPTs would directly help, rather than hinder, domestic producers.Ability to procure intermediate inputs at world-market prices is an important determinant of the competitiveness of manufacturing exports.

Concluding remarks

The role of FTAs in trade performance is vastly exaggerated in the Sri Lankan policy debate.

Most politicians, and much of the media, often do not seem understand the distinction between ‘free trade’ and ‘trade under FTAs’.In reality, FTAs areessentially preferential trade deals and actual trade effect is conditioned by the choice of commodity coverage, which is basically determined by political considerations and lobby group pressure, and rules of origin.

The actual coverage of FTAs in world trade much lower that portrayed in the Sri Lankan debate. Over 80% of world trade is taking place under the standard Most Favoured Nation (MFN) tariff system.

The failure to make progress with the process of multilateral liberation under the WTO does not make a valid case for giving priority to FTAs. The proliferation of FTAs over the past three decades has been drivenlargely by a number of non-economic factors, including the bandwagon effects.If the road to multilateral approach to trade reforms is closed, then the better and time-honouredalternative is unilateral liberalisation combined with appropriate supply-side reforms.

The outcome of FTAs or unilateral liberalisation depends crucially on supply-side reforms needed to improve firms’ capability to reap gains from market opening.However, even with effective supply-side reforms, FTAs would not promote trade in the absence of significant compatibility in trade patterns of the partner countries.Trade compatibility depends on the nature of economic structures and the stage of development of the countries. Location of the countries in the same region (the ‘neighbourhood’ factor) does not necessarily ensure trade compatibility. Our estimates of trade compatibilityand the analysis of the experience under the SLIFTA and SLPFTA cast doubt on potential trade gains from signing FTAs with countries in the region.

Giving priory to FTAsin the national trade and development strategy is not consistent with the Government’s objective of linking domestic manufacturing to global production networks(global manufacturing value chain).Global production sharing is a global, not necessarily a regional phenomenon.The relative cost advantage of producing/assembling a given part or components in the supply chain need not necessarily lie in a country within the jurisdictional boundaries of a specific FTA.

There is no evidence to support the view that Sri Lanka needs an ‘intermediary’ country (Singapore) to join production networks. The electronics films currently in operating in Sri Lankan manufacturing export predominantly to countries like Japan, USA, Germany and some European countries.Their exports to Singapore and other ASEAN countries minuscule, notwithstanding duty free access to these markets under the WTO’s Information Technology Agreement.

The available evidence on the role of FTAs in attracting FDI is mixed, at best. The only policy inference one can make from this evidence is that FTAs can play a role at the margin in enticing foreign investors provided the other preconditions on the supply side are met.

Proliferation of FTAs has the adverse side effect of complicating the tariff structure, giving rise to inefficiencies in resource allocation.Overlapping of the standard MFN tariffs with FTA tariff concessions and multiple RoOsattached FTAsweaken efficiency improvements in the custom system, and opens up opportunities for corruption

Concluded

(Athukorala is Professor of Economics, Australian National University, and can be reached via [email protected]. Silva is former Ambassador and Permanent Representative to WTO and former Deputy Head UN-ESCAP New Delhi Office and can be reached via [email protected]. Silva’s contribution to the article comprise his own views and do not reflect the organisation that he is currently affiliated with. The full article with references is available on request from: [email protected].)