Sunday Feb 22, 2026

Sunday Feb 22, 2026

Saturday, 21 September 2019 00:05 - - {{hitsCtrl.values.hits}}

I am not an economist nor do I profess to be an economic analyst. The views expressed in this presentation are those of a layman who has always been interested in the economic progress of Sri Lanka.

I am not an economist nor do I profess to be an economic analyst. The views expressed in this presentation are those of a layman who has always been interested in the economic progress of Sri Lanka.

Some of the statistics quoted are from newspaper articles and other information is mainly from the Annual Report 2018 of the Central Bank. Further I have expressed my personal views which are not based on original research and as such my views may be subject to criticism and may be challenged.

Overview of the economy

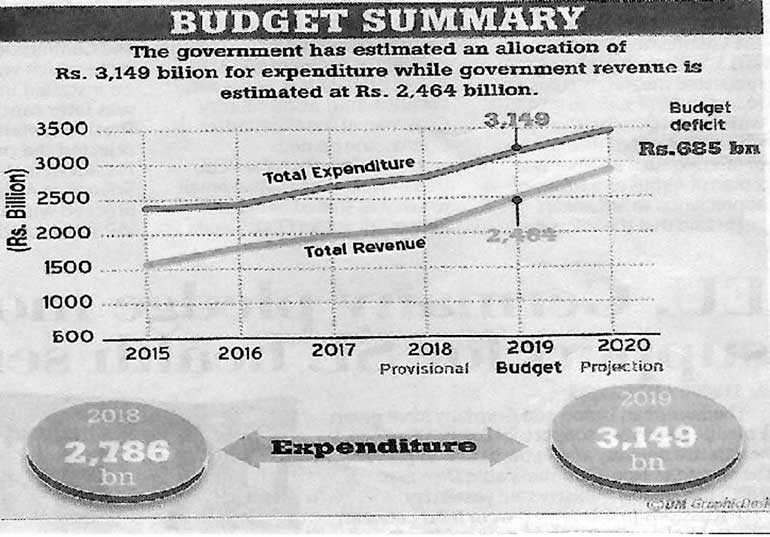

The present state of the economy can be best illustrated by chart 1 which appeared in the Daily Mirror on 6 March, showing the budget summary which indicates a total expenditure for 2019 at Rs. 3.149 billion and the total revenue to be Rs. 2.464 billion thus indicating a budget deficit of Rs. 685 billion.

As you can see from this chart, the budget deficit had been of the same order from 2015 onwards. It should be noted that the budget deficit indicated in this chart does not include the payments provided for redemption of overall government debt which makes the situation far worse.

As indicated in chart 2, from the budget proposal giving gross borrowing requirements for 2019, total gross borrowing requirement’s amounts to Rs. 2,079 billion which is only Rs. 324 million less than the total revenue receipts and grants to the country at Rs. 2,403 billion. This indicates that almost the entire revenue of the country is been utilised to meet the debt redemption which reflects the present serious situation of Sri Lanka’s economy.

Despite the parlous state of the economy, the Government in its last budget gave numerous handouts as it was expected to be an election-oriented budget.

More recently, it was announced that the Government had appointed 300 or more sports instructors to schools presumably all supporters of the Government as many of them were reported to be unqualified. Samurdhi benefits were extended to 600,000 new beneficiaries claiming that they had been discriminated as earlier that they were UNP supporters. Even more recently there was a move to recruit unemployed graduates to monitor so-called Development Programs.

In order to carry out these projects considerable additional funds will be needed and such funds have to be obtained from additional borrowings making the debt situation even worse than what it is now. Continuous budget deficits and borrowing money to achieve the budgeted targets has been the order of the day for many years in our country. A famous quotation by the late Lee Kwan Yew that ‘Sri Lanka Politicians are always in the habit of auctioning non-available resources especially before elections’, is most appropriate.

GDP growth trends

In a critical article by C.A. Chandraprema, a strong critic of the Government, in the Sunday Island on 10 March titled ‘Governments Elections Strategy through the Budget’, it is stated: “For example the growth rate declined precipitously after the Yahapalana Government took over. In the first four years of the Rajapaksa era, from 2006 to 2009 the average growth rate was 6%.

“In the five post-war years from 2010 to 2014, the average growth rate was 7.4%. Sri Lanka per Capita income was $ 1,242 at the end of 2005 and that had increased three-fold to $ 3,821 by the end of 2014. That was quite a remarkable performance considering the fact that no government before or since has managed to maintain an average growth rate of 6% during his tenure much less one of 7.4%.

“In contrast the growth rate, after the Yahapalana Government came in to power dwindled to 5% in 2015, 4.5% in 2016, 3.1% in 2017 and 3.2% in 2018. All predictions made after the events of 21 April indicates that it may be between 2.5% to 3% in 2019.

“The Finance Minister gave no explanation for this poor performance when he presented the last budget. Another matter the Finance Minister failed to explain was why and how the indebtedness of the country had increased by 58% in less than four years. At the end of 2014, the total outstanding Government debt was Rs. 7, 391 billion.

“By the end of October 2018, this had increased to Rs. 11,667 billion – an increase of Rs. 4,276 billion. That works out to a 58% increase in total outstanding government debt during this period. How could things come to such a pass in less than four years? Even as the Budget for 2019 was presented to Parliament the other bit of news that we heard was that the Government was making a sovereign bond issue of another $ 2.4 billion.

“The all share price index of the Colombo Stock Exchange was Rs. 7,299 in 2014 and this declined to Rs. 6,894 in 2015 and further to Rs. 6, 228 in 2016. The ASPI recovered marginally to 6,369 in 2017 but then declined further but there has been a recent resurgence in the stock market, perhaps due to the possibility of a Presidential Election this year.

“The market capitalisation of CSE was Rs. 3,105 billion at the end of 2014, but has since decline to Rs. 2,688 billion. This means that 417 billion in value has disappeared into thin air. When expressed in dollar terms, the decline is even more precipitous. At the end of 2014 the market capitalisation of CSE was $ 23.7. Today at the exchange rate of around Rs. 178 to the dollar, the market capitalisation of CSE has dwindled to $ 14.9 billion.”

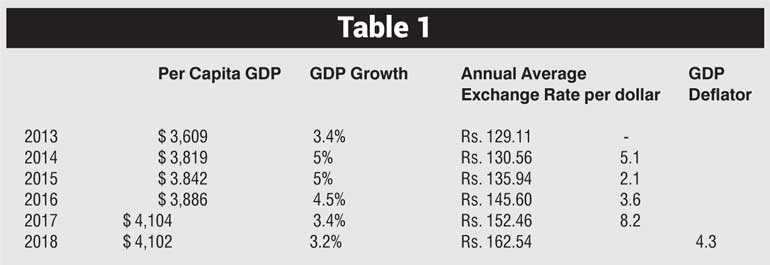

Table 1 shows Per Capita GDP income and the GDP Growth for the last five years.

It should also be noted that the Per Capita GDP has decreased from $ 4,104 in 2017 to $ 4,102 in 2018.

So as indicated by Chandraprema in the above mentioned article during the Yahapalana regime there has been a continuous decline in the GDP growth rate of Sri Lanka.

Foreign Direct Investment (FDI)

According to the Central Bank report 2018, FDI recorded the highest inflow in history in 2018 as indicated below. The major inflows of FDI included receipts for the Hambantota Port Project and Colombo Port City Project, both are which expected to attract significant amounts of FDI in 2018 and beyond. See table 2.

Thus FDI in 2018 recorded the significant growth of 38.4% from 2017. There is an urgent need to increase FDIs as it is one of the major ways in which the economic imbalance of the country can be corrected. Until there is political stability and a proper long term vision established for the economy it will not be possible to attract substantial FDIs comparable to those attracted by Burma, Vietnam, Cambodia and Laos whose economies can be comparable.

Balance of payments

According to the Central Bank Report the deficit in the primary income account widened to $ 2.3 billion in 2017 from $ 2.2 billion in 2016.

Workers’ remittances

Workers’ remittances continued to be moderate in 2018, resulting in a subdued performance of the secondary income account during the year.

Workers’ remittances which account for the majority of inflows to the secondary income account declined by 1.1% to $ 7.2 billion in 2018 as opposed to the growth of 3.7% in 2017. This can be mainly attributable due to the prevailing geo-political uncertainties due to fluctuation in oil prices and sluggish growth.

As we all know the Sri Lankan ladies who literally kill themselves by working in the Middle East to the detriment of their families and dependents are vital to a FDI receipts in Sri Lanka.

However I believe the Government is not paying special attention to providing them proper orientation and training facilities and also sufficiently safeguarding them in many foreign countries where they are employed and where there are no acceptable labour laws. A better training before departure will not only enable them to earn a higher income comparable with Philippine House Maids but also increase their FDIs remittances to the home country and improve their future quality of life.

Restructure of the economy

Although the Government has initiated steps in an attempt to restructure the economy, political constraints have stifled this process. The SOEs continue to be a huge burden on the economy with some 230 billion total losses in 2017.

Finance Secretary Dr. Samaratunga had stated at a conference by the Public Enterprise Department of the Finance and Mass Media Ministry that successive governments have pumped in a colossal amount of Rs. 1,150 billion for the upkeep of the strategically State-Owned Enterprises (SOEs) up to 2017.

He revealed that Sri Lanka has about 400 SOEs of which 55 are considered strategically important and generally referred to as State-Owned Business Enterprises (SOBE). In 2017 alone the Treasury had to inject Rs. 41 billion to the SOBs, which recorded a turnover of Rs. 1,755 billion (about 13% of Sri Lanka GPD), while their total asset base grew by 13.6% over the previous year. Only 39 of these SOBEs made profits which amounted to 136 billion while the remaining 16 made a cumulative net loss of 87 billion. The return on assets of these 55 SOBEs was merely 0.64%.

Sri Lankan Airlines is one of the biggest problems with a continuing debt burden and no partner being identified despite numerous efforts globally. The 21 April turbulence resulting in tourist arrivals declining dramatically further affected the income stream of the airline.

CEB and CPC continue to run at losses and very little appears to be done other than the introduction of the price based formula for fuel. The Government delayed the introduction of this formula which should have been introduced much earlier so that the impact would have been gradual with the gradual increases in OECD fuel prices.

Any increase in kerosene, which is the fuel most used by poor people for cooking purposes always causes problems. There were numerous protests especially by the fisher folk and the Government has been forced to reduce these prices.

One solution to reduce the financial burden of carrying SOEs is privatisation which will be strongly opposed by the Opposition and many independent parties. Furthermore certain essential industries like the CEB and the CPC should be under the control of the State for strategic and other reasons.

However another solution would be to create an umbrella organisation like Temasek in Singapore which is very successfully managing large organisations under which many government utilities have been incorporated. Such an umbrella organisation owned by the State but operated by highly skilled professionals appointed to boards of various different companies and responsible to the Government can perhaps be another solution.

Overall economic performance in 2018

The overall economic performance in 2018 has been far from satisfactory although export income has increased substantially so have the imports. Unless a dramatic increase can be achieved in the Export Economy whilst controlling Imports to an extent, our country can never overcome its fundamental imbalance in the economy.

Exports

Export performance rebounded strongly in 2017 after two bad years. The strong growth in export earnings was underpinned by the restoration of the EU/GSP plus facility, recovering external demand, expansion in development in export related industries, increase commodity prices in the international market, conducive external trade policies, together strong institutional support and the flexible exchange rate policy maintained by the Central Bank.

This increase has continued in 2018 and the total exports recorded around $ 17.5 million against an EDB projected target of $ 18 billion. I believe that the EDB has targeted to achieve $ 25 billion by 2019 but this may not be achievable unless there is a diversity of new innovative export products to service the niche markets.

Imports

Expenditure on imports rose considerably by 9.4% to $ 20.9 million in 2017 recording a historically highest value for imports. I believe that the import expenditure has further increased in 2018 to around $ 25 billion, demonstrating that our export economy cannot keep pace with the demand for imports which are ever increasing, some of which are being used in the Export Industry.

Inflation

According to the Central Bank Report, the National Consumer Price Index (NCPI) exhibited mixed movements during 2018, recording 125.8 Index Points in January and reaching 127.1 index points in December.

The Colombo Consumers Price Index (CCPI) also exhibited a similar trend to that of the NCPI during the year.

Headline Inflation as measured for the year-on-year, change of CCPI mostly remained within the target band of 4-6% during the first nine months of 2018 and decreased below 0.4% thereafter.

Inflation arising from Imported Items in the consumer basket of the official price Indicies declined during the early months of 2018 and subsequently reversed this trend recording a peak in October and declined thereafter.

Core Inflation – The NCPI based year-on-year Core Inflation, which reflects the underlined inflation in the economy remains subdue during the year.

Employment

The unemployment rate increased to 4.4% in 2018 from 4.2% in 2017, with the highest unemployment being reported among females, youth and educationally qualified categories. Skill mismatches have resulted in labour shortage and a need to import labour for selected industries. As human capital has been identified as one of the key enablers of the economy development of a country, the efficient utilisation of Sri Lanka’s large untapped talent is essential.

Foreign employment

The total number of departures for foreign employment declined marginally despite the increase in female departures, with male departures declining by 8% and female departures increasing by 12.3%.

Foreign employment has a great impact on the Sri Lankan economy due to private worker remittance being one of the main sources of foreign exchange earnings and due to the significant role played in reducing the unemployment and generating income that reduces poverty.

However, the over dependence on private remittances poses threats to the Sri Lankan economy due to possible variability in labour demand in foreign labour markets resulting from economic recessions, political unrests and conflicts.

In addition, the Social Problems and Social Costs associated with migration of females and human rights violations such as exploitation, non-payment or under payment and physical abuse and the labour shortages in several industries in Sri Lanka present a strong case for reducing the over dependence on worker remittances for improving foreign exchange earnings.

Tourism

The Lonely Planet had declared Sri Lanka as the best Tourist Destination. The Tourism Industry has the potential to become the highest foreign exchange earner in Sri Lanka. However, it has to be supported by addressing the barriers to which future growth is exposed.

Sri Lanka has positioned itself as one of the best Tourist Destinations in the region, with an annual average growth of 20% on tourist arrivals during the Post Conflict Era, compared to the low growth of 1% during 2000 to 2009. The average daily spending by Tourists has increased substantially while average duration of stay has also increased. Despite these recent developments, Sri Lanka has not reached its potential, compared to other countries in the region such as Thailand, Singapore, Malaysia, and Cambodia. A comprehensive Tourism Strategic Plan (TSP) 2017/2020 has been introduced which includes policy reforms towards achieving a medium term target of $ 7 billion tourist earnings by 2020.

Once again there seems to be a problem in implementing the marketing plan, as the AG’s department has queried the appointment of a Marketing Agency without following the proper tender procedure, and as such there will be a further delay in implementing the marketing plan.

Earnings from Tourism continued to be a major source of foreign exchange to the country supported by a healthy growth in Tourist Arrivals in 2018. Arrivals grew by 10.3% to 2,333,796 recording the highest Tourist Arrivals in a year. Earnings from tourism increased from 7.6% to $ 4,381 million in 2018 in comparisons to $ 3,925 in 2017. Furthermore the average spending per tourist rose to $ 173.08 per day from $ 170.01 in 2017.

Unfortunately the 21 April bombings at three five-star hotels and two churches has very adversely effected tourist arrivals with occupancy rates going down dramatically, both in the South West region and the Eastern Regions.

The Government has introduced a relief package for the industry with a moratorium on repayment of loans for a three-year period and the tourism sector has discounted hotel rates, thereby attempting to induce more tourism arrivals. Furthermore, free visas have been made available to tourists from some 38 countries, thereby incurring a revenue loss of Rs. 4.3 billion.

Despite all these efforts on part of the Government and the Tourism Industry, it is unlikely that the industry will recover in 2019 and the recovery will be witnessed only in 2020 winter season. The debacle in the Tourism Industry caused by the events of 21 April will have a very serious impact on the overall economy of the country. Unless the Government can ensure the security of tourists, very few will risk visiting the country, however exotic unless security is ensured.

Agriculture and industry

Agriculture recovered from the negative performance observed during the past two years, the valued added agricultural activities grew by 4.8% in 2018 against 0.4% contraction in 2017.

Agriculture recovered from the negative performance observed during the past two years, the valued added agricultural activities grew by 4.8% in 2018 against 0.4% contraction in 2017.

Total Paddy Production of the country grew significantly in 2018 amidst favourable weather conditions. Paddy Production which was effected by adverse weather conditions in 2017, recovered an increase of 64.9%, resulting in a production of 3.9 million metric tons during 2018. Rice imports witnessed a considerable decline in 2018 due to the availability of sufficient stocks in the domestic paddy market.

A declining trend in tea prices which were reduced from early 2018 and continued till the end of the year. During 2018 the average price of tea decreased to 581.58 per kg from 620.44 per kg in 2017. The average export price (FOB) recorded a decrease of 4.4&% to $ 5.06 per kg in 2018, compared with $ 5.29 per kg in 2017.

Rubber production declined by 0.6% to 82.6 million kg in 2018 from 83.1 million kg in 2017. The performance of minor export crops continued to weaken in 2018 as in the previous year. The slowdown witnessed in sugar production in 2017 continued in 2018. Total domestic sugar production registered a decline of 7.7% to 51,265 metric tons in 2018.

The Fisheries Sector witnessed a marginal set back with total fish production declining by 0.8% to 527,060 metric tons during 2018.

The value added of Industrial Activities grew marginally by 0.9% in 2018. The value added of manufacturing activities grew by 3% in 2018.

Poverty alleviation

Poverty levels in the country have continued to decline as per the household income and expenditure survey (HIES) 2016 of the Department of Census and Statistics. Accordingly the Poverty Head Count Ratio (PHCR) stood at 4.1% in 2016. However, a considerable portion of the population was just above the poverty line and had a high risk of falling below the poverty threshold due to shocks, such as national disasters and price hikes of basic commodities.

Trade balance

The deficit in Trade Account widened in 2018 although at a slower pace reflecting the impact of prudent policy measures introduced by the Central Bank and the Government.

The terms of Trade which represents the ratio between Sri Lanka’s Export Prices and Import Prices, remained broadly unchanged in 2018. The Export Price Index increased by 4.2% to 100.4 index points, while the Import Price Index increased by 4.1 % to 01.1 Index Points.

Debt trap

The country is in a serious debt trap with new debts been created to amortise existing debts and the debt liability continuously increasing. It was reported that the Central Bank had raised $ 2.4 billion after launching its first International Sovereign Bond (ISB) which will be largely used for debt repayments.

These bonds were rated ‘B2’ and ‘BB’ by Moody’s. Although these bonds were issued just after the IMF extended its $ 1.5 billion extended fund facility and the Government presented its Budget for 2019, these ratings were considered to be junk bond ratings.

As such, interest indications were around 6.90% on the five-year tranche and 7.90% on the 10-year tranche. So you can see that we are borrowing at high interest rates to pay outstanding loans. Unfortunately, it will be very difficult and almost impossible for Sri Lanka to get out of this debt trap.

It has been mentioned often that the debt trap has been caused by borrowing from China which was also indicated in a report in the New York Times. This has vehemently denied by the CEO of China Harbour Engineering Company (CHEC) which was involved in construction of the Hambantota Port and the Mattala Airport.

He claimed that the debt trap is a fabrication of the Western World and emphasised that the total Chinese loans accounted is 10.6% for $ 10.5 billion of the total debt of the country which amounted to at that time $ 51.824 billion. Besides, he stated that 65.5% of the Chinese Loans of $ 3.38 billion were at a much lower interest rate than International Market Rates.

It should however be noted that when global institutions lend money for large scale projects, they normally asses the feasibility of the project and the ability to repay the loan. However, the unsolicited bid to build an airport in Mattala in the middle of the jungle, in traditionally elephant homeland, was not effectively assessed by the Exim Bank of China which lent the contractor $ 190 million out of a total cost of around $ 250 million.

It appears that the Chinese Government through the Exim Bank very often lends money not on the feasibility of the project but for other strategic reasons. Furthermore even the investment in the Hambantota Harbour development which ultimately cost around $ 400 million was not based on a detailed feasibility study and it was again an unsolicited contract.

Both these projects have become white elephants for Sri Lanka. The Yahapalana Government has managed to literally sell the Hambantota Port (99-year lease) together with 15,000 acres of land and thereby more or less liquidated the loan.

The Mattala Airport is also a total failure becoming an airport with hardly any planes landing or taking off. It now appears that the Government is negotiating to enter into a joint venture with the Indian Air Ports Authority on a 70%: 30% basis to operate this airport.

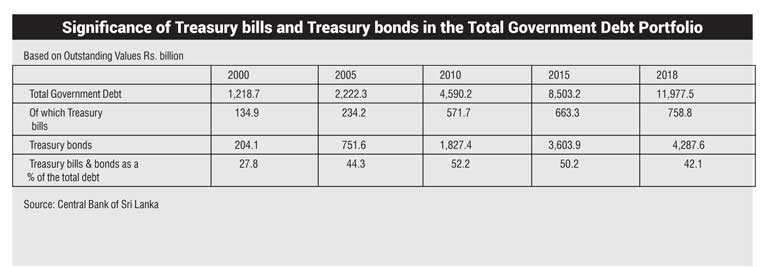

The countries debt situation is also unmanageable. In an article in the Daily FT on 30 July on the subject ‘Foreign Investments in Government in Security Markets: Sri Lanka’s perspective’, the author Swarna Gunaratne refers to the undernoted table showing the total government debt increasing from 1,218.7 billion in 2000 to 11,977.5 billion in 2018 clearly indicating that we appear to have lost control with regard to repayment of the overall government debt.

In an article titled ‘Sri Lanka’s debt sustainability: way out is not just to sustain debt but to come out of it’ by W.A. Wijewardena, he stated: “As far as its mounting external and domestic debt is concerned, the long term way out is three-fold.

Already, two firms – Lanka Harness that supplied senses for airbags in motor vehicles and MAS Group that supplies canvass for NIKE shoes – have successfully joined the race, but the country needs a critical pool of such enterprises and the future industrial policy should be geared to developing such a pool. If foreign earnings rise at a faster rate, meeting the foreign debt obligations will not be a critical issue for the country.

Hence, what is needed is not a patchwork as is been done today, but the introduction of a long term policy strategy to get out of the debt trap.”

Unfortunately, everyone’s attention including the possible candidates is now focused on winning the Presidential Election. It is unlikely that any of the potential candidates have given serious thought to the debt trap the country is now engulfed in or considered formulating a medium and long term plan to get over this serious problem.

The Presidential Elections will probably be followed by Provincial Elections and then by the General Elections during which period no serious effort will be made in overcoming the dead burden. In fact the Government will only exacerbate the debt trap by giving more handouts with a view to increasing their vote base.

In the past, such handouts have never changed the inevitable election result, but only made it more difficult for any successful government to handle the fundamental economic issues which the country has been plagued with in recent times.

(The writer is the former Chairperson of Commercial Bank PLC and United Motors PLC, former Deputy Chairman of Hayley’s PLC and former Chairperson of ICC Sri Lanka.)