Thursday Feb 19, 2026

Thursday Feb 19, 2026

Friday, 17 April 2020 00:00 - - {{hitsCtrl.values.hits}}

This will be my third and final article on the issue of COVID-19 (the first two articles are http://www.ft.lk/columns/COVID-19-Sri-Lanka-should-reassess-strategy-soon/4-698250 and http://www.ft.lk/columns /Is-time-running-out-for-Sri-Lanka/4-698571).

/Is-time-running-out-for-Sri-Lanka/4-698571).

“Lives vs. Economy,” “Economy can be recovered, but lives can’t be,” are some of the opinions we have come across in the recent past. Unfortunately the public does not seem to have an understanding of the overall impact on the economy, which has resulted in a severe underestimation of the social, political and overall impact.

While almost all discussions related to the economy refer to “once COVID-19 is taken care of,” what we should realise is, if the remedial measures don’t start today, it would be humanly impossible to do it from where Sri Lanka will be, by the time “COVID-19 is taken care of”.

To put bluntly, this would be the worst economic downfall we have faced since independence. While Sri Lanka did undergo a war for many decades, the economy was never halted abruptly for weeks with no end in sight. Even during the late ’80s when the economy was halted (which is probably the closest to the current scenario), the global economy was doing fine. And most importantly, whatever challenges we faced in the past, escalated gradually and therefore everybody had time to adjust.

That’s the great difference of the current scenario. The environment turned upside down in a matter of weeks. Nobody had sufficient time to adjust and therefore many mistakes could occur inadvertently during these crucial weeks and months. We certainly have a very dangerous three to six months ahead, where we have to tread the economic path very carefully.

The economic fallout is unimaginable

While the situation remains dangerously unclear, an indicative description of the economic fallout from a continuation of the current economic shutdown could be as follows.

The daily wage earners who received Rs. 5,000 from the Government will need immediate assistance yet again. It has been four weeks and how they survived four weeks with that is a mystery itself. The frustration will be growing, which means the assistance expected from the Government will also be escalating. The Government is not in a position to afford anymore assistance. The imminent repercussions could be severe.

Tourism, apparel (which earned the majority of Sri Lanka’s foreign earnings at over $ 10 billion in 2018) and export segments are mostly out of demand. A substantial portion of those sectors would need significant assistance from the Government to survive the next three to six months. If the Government fails to provide such meaningful assistance, a substantial part of those segments would be out of business.

Apart from the permanent loss of foreign earnings to the country, the extent of job losses (including the impact on their families) would run into hundreds of thousands (as per JAAF, around two million is  dependent on the apparel industry alone). They may not find alternative employment in a hurry as the entire world struggles to come out of the worst economic depression since the great depression almost 100 years ago.

dependent on the apparel industry alone). They may not find alternative employment in a hurry as the entire world struggles to come out of the worst economic depression since the great depression almost 100 years ago.

The fall in foreign earnings in the next few months (and a permanent loss of a significant proportion) would erode Sri Lanka’s ability to import. As a predominantly import dependent economy, that would mean the closure of many import businesses and a loss of hundreds of thousands of more jobs. Government assistance would be needed to provide some level of income to these individuals, at least until they shift to alternative employment. Yet again, finding employment would not be easy. The repercussions, yet again, would be severe.

The impact on the banking and finance sector from the above possibilities is scary. As businesses close down and struggle, and individuals lose their income or experience significant reductions, the debt servicing capacity would deteriorate sharply. Banks and finance companies would struggle to curtail a mountain of bad debt whether it’s business loans, housing loans, vehicle loans and any other loans.

The lack of income levels could also mean a resort to savings for businesses and individuals, which could erode the deposit bases of these institutions. The resulting cash crunch would be a daunting challenge for the sector. Saving the financial system would be a herculean task and one wouldn’t even want to think of the possibility of a failure, let alone figuring out the extent of repercussions. The extent of stress caused by the minor fallout during the global financial crisis in 2009, would pale in comparison.

With Government required to provide strong support on multiple fronts, the reality is Government tax revenue could fall by over Rs. 600 billion in 2020. While the Government would earn significantly less income, it is expected to spend significantly more than its usual budget – an unsustainable equation.

The Central Bank has already “printed money” close to Rs. 200 billion over the last four weeks simply to honour regular public sector salaries, pensions, other welfare expenses and interest payments. Resorting to such tactics without a strategy to come out of the situation, could only result in a hyper inflationary scenario and a battering of the rupee, making matters worse.

Sovereignty would be at stake

The above scenario could result in two possible outcomes. Either it would need multibillion dollar financing or a pull back of the economy by several decades with a drastic reduction in quality of life of a majority. It is unlikely we would go for the latter, which could trigger severe civil unrest (while most would want to leave the country).

The former would leave us at the mercy of global lending agencies or more likely a powerful country. The vulnerable state of the country, the need for unprecedented multi-billion dollar financing at a time when the entire world is struggling, would naturally force Sri Lanka to agree to terms and conditions that is almost certain to surrender the country’s sovereignty. Sri Lanka would learn the hard way that there are no “friends” in the global economy but only “self-interest”. Our destiny could be to become a “stooge” of a powerful country.

The possible great escape

If we move immediately, we may still be able to get away from this disaster. As we are familiar with strategies used against COVID-19, “contact tracing” and “clustering” would be essential strategies to rescue the economy as well.

On one side, efforts should be made to isolate the severe economic problems to certain identified segments, as if it spreads to all parts of the economy it would be beyond control – similar to what was referred to as “community spreading” for COVID-19 (which we went great lengths to avoid). Similarly, careful assessment should be made to understand the key components of each critically affected segment, which could push the entire segment off the cliff.

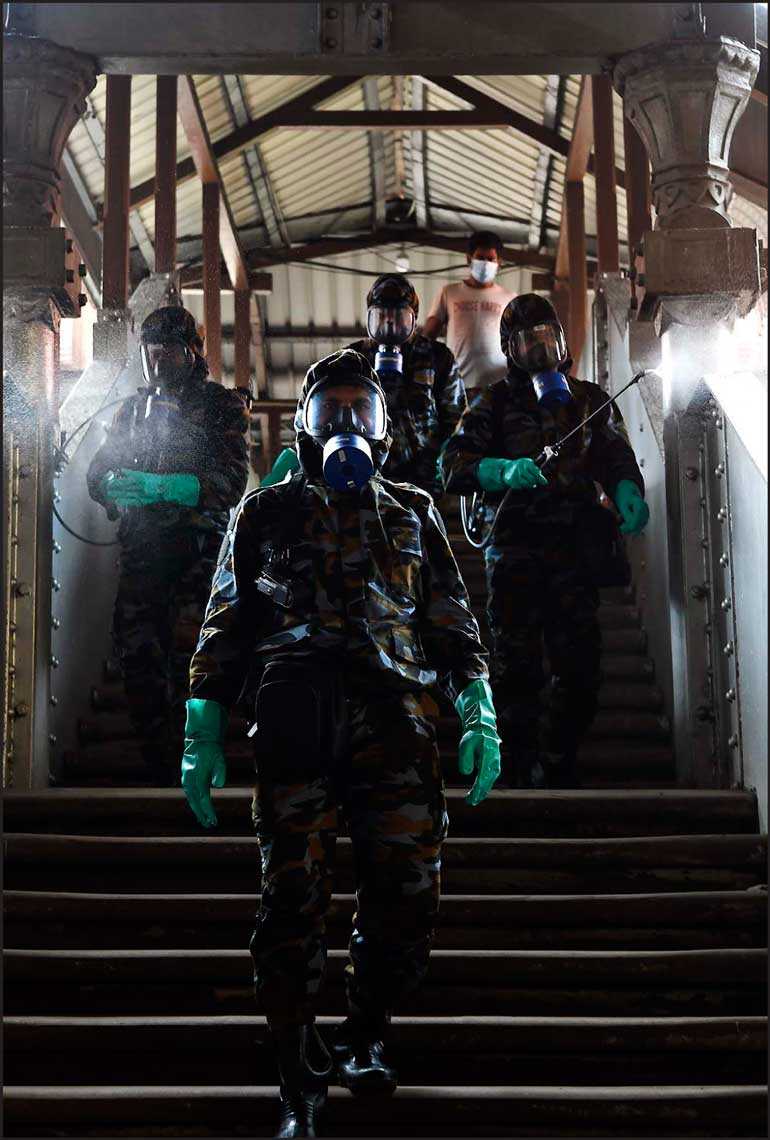

The aggressive measures taken by the health sector and security forces helped to contain COVID-19 in Sri Lanka so far. Even more aggressive and careful measures need to be taken by the economic managers to prevent the economic fallout. The following could be essential measures from now on over the next six months:

1. Engage tourism, apparel and export sectors to understand the assistance they need to survive the next three to six months and provide the necessary support (which could run into over Rs. 100 billion). Travelling overseas for leisure purposes should be prohibited for the rest of the year to encourage domestic travelling.

2. Provide significant support to the banking and finance segment to ensure the impact of rising NPLs and draining liquidity is addressed without a systemic failure (by allocating over Rs. 100 billion).

3. Provide some relief for individuals affected by the negative impact on import related industries and channel them for alternative employment (allocate around Rs. 50 billion for this purpose). 4. Stop development spending, negotiate for loan repayment deferments, reduce recurrent expenditure as much as possible, to ease the expansion of fiscal deficit. Still, the expansion in fiscal deficit by a few hundred billion rupees could be inevitable. The Central Bank should consider QE type measures to provide rupee liquidity, despite possible subsequent negative impact on inflation and exchange rate.

5. The import restriction measures could safeguard the foreign reserve position and maintain the foreign debt servicing capacity over the next six months, until the foreign earnings pick up again.

6. Lift curfew partially immediately so that the daily wage earners and all types of businesses that are still in demand could resume their businesses. This would provide a great relief to the Government by significantly reducing the need to provide subsidies across the economic spectrum.

Heroes galore

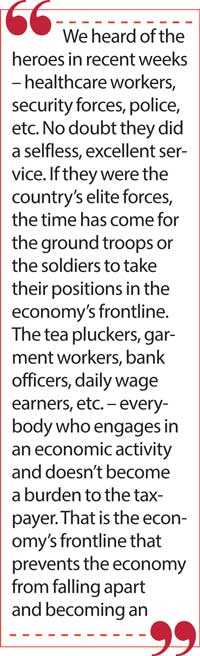

We heard of the heroes in recent weeks – healthcare workers, security forces, police, etc. No doubt they did a selfless, excellent service. If they were the country’s elite forces, the time has come for the ground troops or the soldiers to take their positions in the economy’s frontline.

The tea pluckers, garment workers, bank officers, daily wage earners, etc. – everybody who engages in an economic activity and doesn’t become a burden to the taxpayer. That is the economy’s frontline that prevents the economy from falling apart and becoming an easy prey to a foreign power.

The economy’s frontline would be bruised no doubt – with less income, debt worries etc. But their resilience would be the key to the fate of the country. Every single citizen would have to play his/her part. Tightening belts and reducing the burden on the Government could be crucial.

Every rupee of interest and debt repaid on time and non-lifting of fixed deposits and savings to compensate for the lost income would be an act of national service in the form of supporting the financial system. It would certainly not be the time to be engaged in petty party politics.

Decision time

We have heard of the great sacrifices Sri Lankans have made for the sake of the country over the past centuries. This is our turn. Our future generations would judge our generation by the way we come out of this. It’s decision time. Today. Now.

(The writer can be contacted on [email protected])