Sunday Feb 15, 2026

Sunday Feb 15, 2026

Friday, 24 September 2021 00:27 - - {{hitsCtrl.values.hits}}

In spite of the negative opinion on Sri Lanka’s ability to repay foreign debt by rating agencies and somewhat stemming from a fiscal crisis largely precipitated by COVID-19, the country repaid the $ 1 billion bond by the deadline and a further $ 400-500 million in other commitments, keeping intact its reputation for honouring sovereign debt.

In spite of the negative opinion on Sri Lanka’s ability to repay foreign debt by rating agencies and somewhat stemming from a fiscal crisis largely precipitated by COVID-19, the country repaid the $ 1 billion bond by the deadline and a further $ 400-500 million in other commitments, keeping intact its reputation for honouring sovereign debt.

Despite that, Moody’s Investors Service downgraded Sri Lanka’s current rating CCC+ to negative, citing its assessment of the country’s increasingly fragile external liquidity position and the risk of default. Unfortunately for the country, undue concerns about the repayment ability are pushing the cost of Lanka’s dollar debt higher.

According to CBSL data the total outstanding debt is Rs. 15 trillion. Debt/GDP ratio is 101%. According to Fitch Ratings, “We expect general Government debt to GDP to keep rising under our baseline to 108% by 2022 from 101% in 2020.”

Meanwhile, 60% of the total debt is local and 40% is foreign. The local component is set to rise further given that the pandemic is far from over. So despite the substantial macroeconomic stimulus, Sri Lanka according to economists is unlikely to soon revert to pre-pandemic levels till mid-2023, let alone recoup 2020-’21 economic losses.

Foreign currency debt

Foreign currency debt

According to CBSL data, total foreign debt was $ 49 billion; $ 31 billion is Government borrowings. Foreign borrowings have dropped from a high of $ 55 billion to $ 49 billion by ’21, showing a clear preference for local debt, given that the Government has good control of domestic interest rates. The single biggest challenge however now would be to keep inflation in check.

The challenge in the next few months of the year is largely to pay for the imports. According to CBSL data the trade deficit in 2020 was $ 6 billion. The trade deficit in the first half of 2021 was $ 4 billion. Analysts expect this to widen significantly due to a surge in oil and pharmaceutical imports.

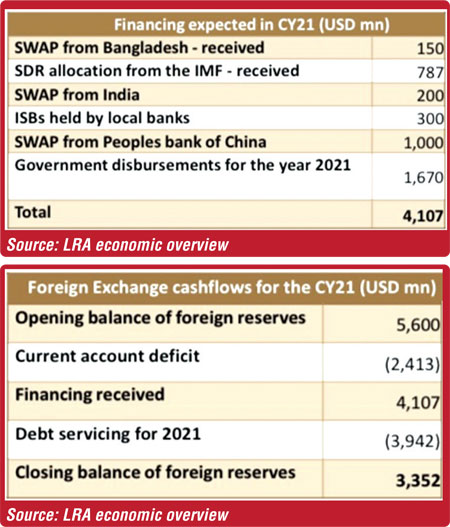

Our reserves are currently down to around $ 3.5 billion (see chart). The IMF SDR allocation of $ 780 million helped to boost our gross reserves. The reserves should enable Sri Lanka to meet its remaining debt maturities and interest through the rest of this year.

The big challenge for Sri Lanka in 2022 will be servicing of debt and interest and funding the trade deficit. The Government has to honour the next sovereign bond – a $ 1 billion bond in July 2022. The Government has said repeatedly that it will dip into its foreign exchange reserves to bridge any shortfall in repaying the foreign bonds and that it will not default at any cost. This confidence can certainly be challenged in 2022.

Balancing the books in 2022

LRA, a local rating agency now back in business, estimates that Sri Lanka will close the year at around $ 3.352 b (see chart). They estimate the Government will mobilise a total of $ 4.107 billion for ’21.

For the Government, meeting foreign-currency debt-servicing needs for 2022 should be its immediate concern. Two big payments according to reports need to be honoured in 2022 – a $ 500 million bond in January, followed by $ 1 billion of debt maturing in July. It is estimated a total of $ 5 billion will be required to service debt obligations (principal + interest) and other commitments in 2022. Some analysts put this figure at $ 7 billion.

The uncertain factors for 2022 will be the remittances remaining at current levels and Foreign Direct Investments picking up. It is important the rains don’t fail us, giving rise to an increased fuel bill to power the non-hydropower electricity generation and an increase in food imports to meet the drop in harvests.

Therefore the Government would need to get tough on imports. Vehicle imports and luxury goods will have to be curtailed significantly to manage the trade deficit in ’22 and the politicians and the public will certainly have to tighten their belts further to ride over the economic challenges in 2022.

Way forward

The bilateral currency SWAPs ($ 1,350 billion) whilst they serves their purpose – 80% of our foreign debt is in USD – some of the SWAPs may not be convertible to USD, adding further pressure to the reserves, given the debt overhang. Therefore a professional approach would be required to manage our finances going forward given our deteriorating debt trajectory.

International debt instruments have also changed over time, this means we need people who understand them to structure them. There are also many blended finance and innovative climate finance options available. It is very unlikely for any debt cancellation for developing countries. Therefore, we need to seek debt moratoriums and more flexible and concessional forms of financing, and other forms of fiscal management support.

The way forward for the country is clear, and well-lit; the Government needs to walk forward with a clear purpose.