Saturday Feb 21, 2026

Saturday Feb 21, 2026

Friday, 27 January 2023 00:00 - - {{hitsCtrl.values.hits}}

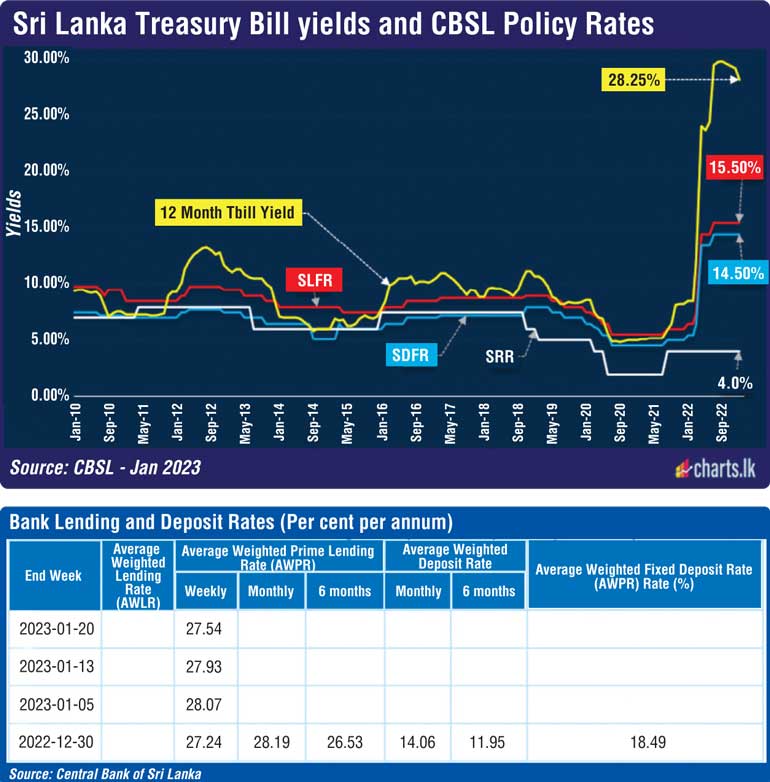

Deposit rates have dipped significantly over the last few weeks. We now need to see a drop in lending rates

According to Reuters, the World Economic Forum annual meeting was dominated by discussion and discourse of the risk of headwinds ahead, including inflationary pressures from China’s reopening and rising debt distress in the developing world, particularly emerging markets. Significantly the hardest bit according to Reuters, for Western nations – getting inflation down to 2%.

According to Daniel Pinto, JP Morgan’s President and Chief Operating Officer, “Things are not great, but they are much better than they could have been.” Then for Ukraine sympathisers, Davos was all about getting access to better weapons and financial resources to defend itself against Russia. Outside the Western hemisphere, fears of an economic downturn, heightened global geopolitical divisions and amplified by a worsening debt crisis in Africa and Asia were identified as massive risk factors.

Debt crisis

Moving to Sri Lanka – Central Bank Governor Nandalal Weerasinghe is on record saying, “Any domestic debt restructuring will be part of a negotiation process with creditors, which will take place after a program with the International Monetary Fund is in place. Firstly, financial assurances from bi-lateral creditors have to be received to qualify for the IMF program.”

He further noted, “It is then that we start discussions with the private creditors.” According to reports the IMF has discussed with China to find “a pathway for debt resolution for Chad, Zambia and Sri Lanka.” The challenge for Sri Lanka is to get creditors to agree to both the whole issue of debt sustainability and what can be a pathway for their contribution to Sri Lanka’s recovery.

Unfortunately to many of Sri Lanka’s creditors the debt stock looks unsustainable given our anaemic forex flows, in addition to creditors’ reluctance to provide firm assurances. Several experts suggest that the IMF could approve a smaller-scale emergency financing package, relying on the assurances given by the Paris Club and others. This would provide the Government with a lifeline, reducing the power of reluctant creditors and to conclude the restructuring negotiations expeditiously. This would help the country to support the recovering tourism sector and provide stability to the banking system, whilst looking to build an environment to attract investment into the country and drive up exports.

Debt moratoriums

Central Bank Governor Weerasinghe has said publicly that he is not in favour of extending debt moratoria for businesses. Whilst he has a better view of the economy than most people, perhaps – just perhaps, CBSL fails to take into account the current economic predicament faced by many sectors due to the high interest regime, particularly the tourism industry that was hit very hard by the pandemic and the Easter Sunday attacks. Moratoriums in my view have helped several businesses to stay afloat during the crisis, and discontinuing them now without a fill-in strategy could lead to even more financial mayhem for struggling companies. The Government needs to address this prior to lifting the moratoriums.

The Governor has gone on record with an alternative in asking the banks to “consider” rescheduling or restructuring these moratorium loans, leaving customers at the mercy of the bankers, who are, in today’s circumstances they are in, most likely to be less than enthusiastic about such largesse nor have an appetite for it. A multilateral/DFI funded pool of funds negotiated by the CBSL/MOF and extended moratorium debtors via the banks, would be a feasible option to replace the moratoriums in place (like the TDRF of early 2000s), with rescheduling and restructuring of these debts.

The country’s predicament is no different. We are asking our creditors for haircuts, moratoriums and restructuring of our debt. So why not set an example at home? Banks and NBFIs on the other hand whilst protecting the interests of their depositors, must also ensure that businesses can continue to operate and contribute to economic recovery, as national duty to future generations. (See also https://www.ft.lk/columns/Moratorium-management-key-to-banking-sector-stability/4-743624)

Way forward

The country, whilst focusing on getting inflation down, must get interest rates down to a level that the economy can recover and grow. It is very obvious the only way out of this crisis is to get the economy to grow. Therefore getting interest rates down to reasonable levels even at the expense of a manageable inflation band and ensuring those in essential and export sectors have access to affordable financing is key to any recovery. CBSL/Public Debt Department should actively advise GOSL to issue Treasuries at lower rate tenures on the yield curve and deprioritising tenure mismatching for now. In the final analysis given that internationally there is increasing pressure on the G20 to support a global transition to a greener future much faster than they have been doing so far. There lies Sri Lanka’s opportunity to redeem itself from our manmade economic crisis. The only challenge is the will and the competence of our officials to embrace green finance and plug into that low cost USD pool.

A concluding note of concern – though not in importance. That fiscal revenues have to grow is beyond argument. Achieving this by widening the tax net for direct taxes and duties, should be a top priority, if not an urgent item on the agenda of the Treasury and MOF. The pool for direct taxes is far too small, hemmed in by legacy attitudes towards the wealthy and the professional fee earning class, by an underperforming and inefficient tax assessment mechanism that is disconnected from wealth manifestation databases (land registry, vehicle ownership, extravagant splurges in entertainment and events, luxury travel and cruises and the likes).

A weak and inefficient collection system without powers of sanction, by a virtual army of less than professional tax consultants and advisors with no risk of liability or sanctions and by a bureaucratic morass of square plugs in round holes has led to only a minority paying taxes in Sri Lanka.

Reference:

https://www.reuters.com/world/davos-2023-outlook-brighter-than-feared-fraught-with-risks-2023-01-20/

https://amp.cnn.com/cnn/2023/01/20/business/davos-world-divided/index.html

The writer is a former Chairman of two commercial banks, director of a development bank and chaired the banking sector consolidation committee in 2015.)