Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 10 June 2022 01:40 - - {{hitsCtrl.values.hits}}

Having sat in Bank Board Debt Recovery committees for over a decade, debt restructuring is certainly not a pleasant task because it is a very stressful exercise for the defaulting party. More so for a nation. But if it is cleverly negotiated the debtor can come back to some position of normalcy with a credible commitment and hard work.

Having sat in Bank Board Debt Recovery committees for over a decade, debt restructuring is certainly not a pleasant task because it is a very stressful exercise for the defaulting party. More so for a nation. But if it is cleverly negotiated the debtor can come back to some position of normalcy with a credible commitment and hard work.

There are several international green funding platforms available that have not been tapped. Unfortunately in Sri Lanka the people who have mismanaged the economy have either left or disappeared. It is now left to the last man standing to deal with the debt and find a way out of the morass. However for those people left on the deck there is some hope as pointed out by Prof. Lee Buchheit, widely considered as a veteran having worked on over two dozen sovereign debt restructurings during his 43-year legal career.

He told the writer, “The Government should not give up hope. It is a difficult and disagreeable process but there is light on the other side,” Prof. Buchheit led the legal teams advising Greece in the 2012 restructuring of Government bonds totalling over 206 billion euros (the largest sovereign debt workout in history). He also advised the Republic of Iraq in the 2004-08 restructuring of $ 140 billion of debt accumulated by the Saddam regime.

Debt restructure

Debt restructure

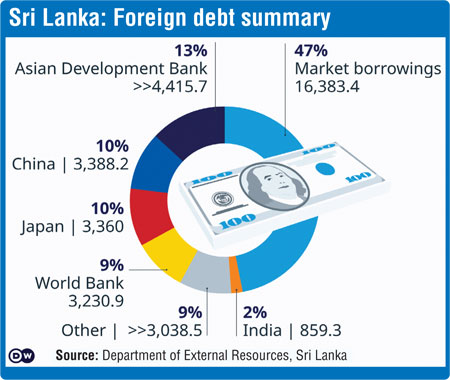

Clearly there are two major creditor groups that will be involved in Sri Lanka’s debt restructuring. The private bondholders and the bilateral, multilateral and other creditors. In the latter are the OECD countries known as the Paris Club, the No. 1 lender to Sri Lanka from this group is Japan. There are non-Paris Club lenders and other bilateral creditors are, No. 1 China and No. 2 India. The fourth is the multilateral lenders, like the World Bank, IMF and the Asian Development Bank. However once the process progresses towards an acceptable framework, there could be the emergence of the fifth group – PPP lenders. Sri Lanka will certainly be dependent on the IMF, first to assess how the pain of the restructuring will be shared?

Secondly, convince the bilateral lenders to agree on some kind of arrangement palatable to the Sri Lankan people, because finally it is the people in the country who will have to pay (bigger share) for the settlement to the creditors by way of higher taxes and haircuts on their investments. According to research the holdout creditor problem in sovereign debt workouts is a big nightmare/challenge. This is a tactic of holdout creditors: where funds seek full repayment of their original bonds through litigation, as opposed to participating in debt negotiations.

Prof. Buchheit however points out that the use of trust structures in sovereign bonds can discourage holdout creditor interest, at least for bonds that have not matured according to their original terms and fortunately, SL ISBs use a ‘trust indenture’. In addition, he points out that “deeper the debt relief that the sovereign must request from its creditors the longer it typically takes to persuade those creditors,” because according to Prof. Buchheit, “each of these creditor groups, if they’re being asked to give debt relief, have a right to know the terms of the loans of the other creditor groups and the treatment that they’ll be given to them.”

Recovery roadmap

Sri Lanka’s debt restructuring needs to be managed very professionally and more critically and objectively. That requires special skills, which the country is virtually starved of currently. This skill is beyond the Sri Lankan bureaucratic talent pool and we need to tap into the talent pool of the Sri Lankan professional diaspora, with credentials in the various aspects of this process. To get the best debt relief package for Sri Lanka, we must go to the world with a robust recovery road map highlighting the forex revenue forecast for the next five to ten years. Not even a small financial institution will give credit to a company without a road map.

We need to convince our creditors of Sri Lanka’s potential and on its credit reputation. The unplanned default hurt our international standing very badly. To manage this fallout and the restructuring we need competent, objective minded and virtually dispassionate bureaucrats to convey this message and negotiate hard with them, especially the private creditors. They are not interested in a debtor who continues to consume debt for their daily consumption/survival. As Prof. Buchheit points out, this exercise is not simply an arithmetic decision but must take into account social and political and even moral issues as to how much of the burden can be placed upon the citizens of Sri Lanka.