Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 29 April 2020 02:35 - - {{hitsCtrl.values.hits}}

Travelling in unchartered territory needs expert navigation and swift reflections; the same could be said as a metaphor for governments across the world battling the novel pandemic.

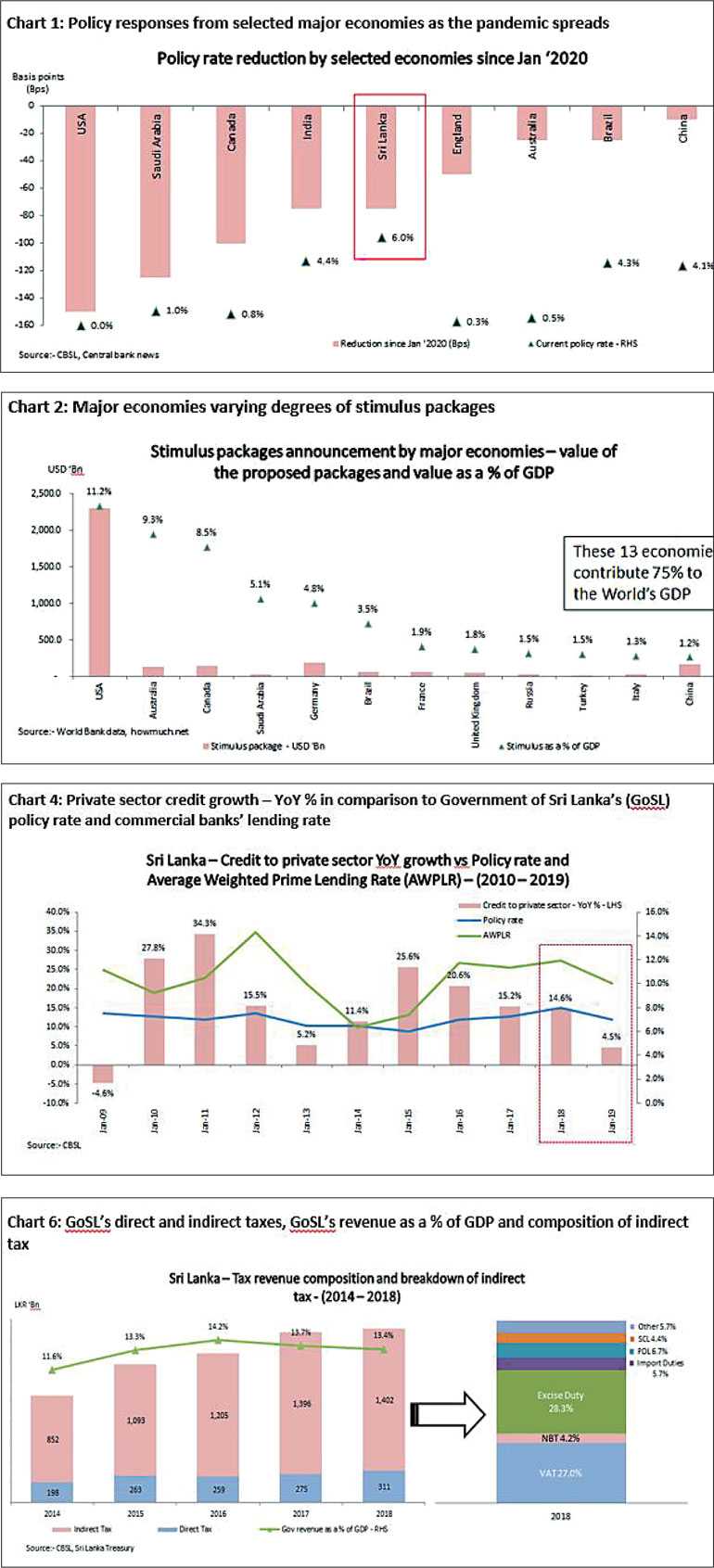

We witness a rare cohesive downward policy response from central banks across the globe in order to revive their economies which have been severely battered due to the ongoing pandemic. A question that remains to be answered is, how effective are these monetary policy tools to bring best out during this once-in-a-century kind of a crisis?

Most of the readers here are aware that a handful of bigger economies had already gone into negative interest rate territory well before COVID-19 was discovered in December 2019 without much success i.e., Japan and a few countries from the Euro bloc, hence at this critical juncture mere responses from monetary policy tools alone may not be sufficient.

Governments may have to fledge their fiscal space

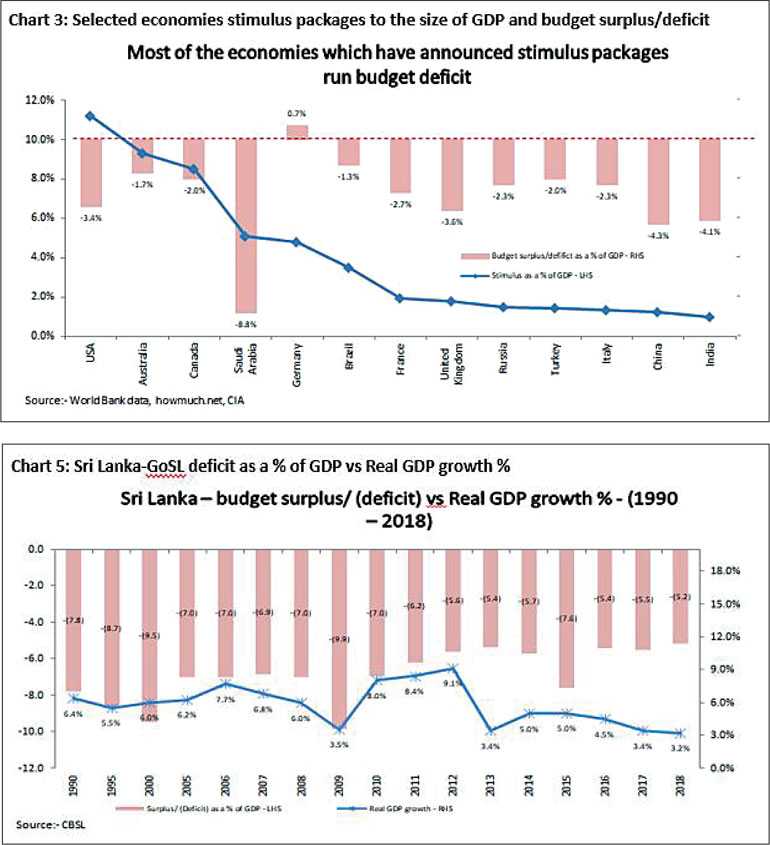

A pandemic of the scale of COVID-19 would require a pull strategy instead of a push strategy. Here, a push strategy could be paralleled to a strategy which induces corporates and individuals to borrow at reduced interest rates and spend it on economic activities in order to revive the economy. This may not materialise at this time around because most of the corporates and individuals are heading into a leap in the dark; with so much of uncertainties of future prospective, corporates may freeze the hiring and expansions, individuals on the other hand will have to be compelled to save for rainy days instead to consume immediately. This gridlock requires a government-led stimulus packages to stimulate the ailing economies in order to restart their stranded growth engines; I term this as a pull strategy. In laymen’s terms fiscal stimulus can be called “free money,” however in finance there is no free lunch, thus this also comes with a cost and toll onto government coffers. Nevertheless cash transfers/grants and other Government freebies may give an impetus for people to spend, at least on the essential services. These I believe serve two purposes; one is to keep the vulnerable people abreast during this horrific situation, and the other is to stimulate otherwise a stagnant economy through consumption. Not every economy in the world is blessed to have required space for the said fiscal stimulus to take place to their likings; especially governments in emerging economies may not have much headroom to go for such a response when they are already running deficits in their fiscal accounts. But in this pandemic it looks like governments with budget deficits also have unveiled generous stimulus packages to fight the oncoming recession.

Can Sri Lanka buckle up and go for a fiscal stimulation?

In Sri Lanka, policy rates and bank interest rates are on the declining trend since the mid of 2018 but credit given to private sector has not picked up as expected it to be, in fact it’s been at a standstill for a while now.

The underperforming Sri Lankan economy has been the reason for lacklustre performances in private sector credit growth. The reasons the economy is underperforming have been analysed, discussed and properly documented, hence I shall not be discussing the same here. Since monetary policy responses may not bring the desired outcomes Sri Lanka also should get ready with its fiscal tools to fight the pandemic.

It goes without saying that Sri Lanka has a very pessimistic chance of going for fully-fledged stimulus packages due to the rather pathetic economic situation it has found itself in. With a twin deficits running for decades along with ever-increasing debt to GDP, coupled with an anticipated drop in Government revenue, partly due to a slew of tax reliefs given in December 2019 (it is estimated that Rs. 250-300 billion Government revenue to be shaved off, ~ 2% of GDP) and expected reduction in future economic activities, may exert pressures on Sri Lanka’s currency as well as its chances of going for international markets for refinancing its maturing debts.

However, I strongly believe this is a time for the Sri Lankan Government to bite the bullet and announce a well-thought-out economic packages which effectively covers vulnerable segments, i.e. people who are in the below poverty line, daily wage earners who have lost their income and corporates which have got the hardest hit such as tourism, textiles, etc.

Such measures will undoubtedly bloat the fiscal deficit, increase the need for financing and will result in an elevated debt to GDP ratios. But the Government has no other options apart from going in for a fiscal stimulus in order to jump start the economy while keeping its entire population in loop until it emerges from this pandemic.

Since 1990, Sri Lanka has been in fiscal deficit continuously and recorded its highest deficit as a percentage of GDP of 10% in 2009 (yet another crisis year for Sri Lanka); hence, during this time also Sri Lanka may go into such a deep deficit taking the economic hit. However, its ever-increasing debt to GDP ratio, maturing foreign loans along with an expected drop in revenue, to the tune of 2% of GDP, may come back to haunt the economy in the long run.

Sri Lanka may have to hike taxes and broaden tax bases whilst strictly rationing its spending belt

The Sri Lankan Government is in a critical juncture and they may have to act now without procrastinating to get their fiscal house in shape in order to progress and seize any opportunities come in their way post COVID-19 era. First of all the Government may have to find ways to increase its ailing Government revenue, at least to a manageable ratio, while reducing its recurrent expenditure, which forms 80% of their expenses and 60% of it goes as principal and interest payments whilst one-fifth is spent on salaries and pensions. It’s of paramount importance for the Government to fully step into a progressive tax regime, which is defined as imposing higher taxes on high income earners, in order to reverse the current direct to indirect tax composition of 18% : 82%. Global study suggests that as income status increases contribution from direct tax is increasing, in fact among high income countries direct tax contributes to ~58% to the total tax revenue. Another study suggests with the increase in total tax revenue as a percentage of GDP per capita income of the country is increasing, which is very much intuitive with the higher Government revenue investments and developments take place. In Sri Lanka, Government revenue, in which tax revenue contributes to 90%, is hovering in the range of 13%-15% since 2009 suggesting there should be more contribution needed from tax bases, especially from direct tax sources.

Collaborating with private sector and embracing digitisation a way forward to Sri Lanka

The Government needs to put its multi-year-old plan of Public-Private Partnership (PPP) model in action at least post COVID-19 without further delaying it as time is ticking for them to act. Priorities should include, but not be limited to, the following: digitising the economy, collaborating with private sectors, bring in sweeping changes in State-Owned Enterprises and let go of non-strategic investments. In the second phase of economy restructuring Sri Lanka should focus on improving their rank in the Doing Business index by way of reviving decades old acts and policies in order to target most vital equity infusion to the country known as Foreign Direct Investment (FDI).

The Government should stick only to providing leadership roles and shuffling resources across the industries through their policies and directions, unveiling a model similar to the one practiced in Singapore could be a starting point. Sri Lanka should also educate the general public to gradually shift away from the mentality of relying on government support to conduct their day-to-day operations (one-fourth of the workforce is relying on agri sector despite its contribution to GDP is in a single digit of 8-9%, this is mainly due to Government is looking after them through the safety net transfers), and need to instil the benefits of a self-sufficient country. In addition to these GoSL must sketch a well-thought-out plan to increase its participation in the Global Value Chain (GVC) in the years to come as its current participation index, according to ADB, stands at 18% in 2018.

(The writer is a former manager – research of a leading stock brokering firm in Sri Lanka and an award-winning equity research analyst. He possesses eight years of experience in the Sri Lankan capital markets. He is also a freelance writer and can be reached via [email protected].)