Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 29 November 2018 00:00 - - {{hitsCtrl.values.hits}}

Whilst Sri Lanka has been grappling on the 'Governance' criteria in the last one month, we see how the world is passing us by – not only Singapore, Malaysia or Bangladesh but now countries like Ukraine and Algeria as per the latest data released by Brand Finance. This performance does not augur well for the country given that Sri Lanka was recently judged the number one destination to visit by Lonely Planet for the year 2019.

Sri Lanka brand value analysis – 2018

In today's competitive world, a country’s image has many ramifications as it’s the most important asset that a country has. The quality of the Investments that one can attract, the export markets that can be captured and the tourists that visit a country can all be hinged to the image the country has in the market place.

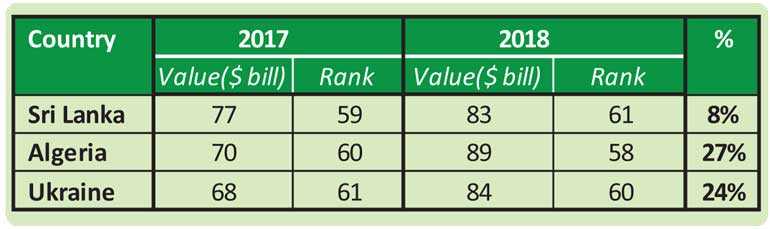

Sri Lanka was ahead of Algeria and Ukraine in 2017 but now they have beaten us in 2018.

Brand Value: 6 key criteria

Let me share a quick overview on the criteria used to calculate nation brand value. The Anholt-Roper Nation Brands Index looks at a country’s image by examining six dimensions of national competence, all of which are treated equally with no weighting. This gives an overall sense of a country’s reputation as a whole. The six dimensions are:

1. Exports: Examines respondent’s image of products and services from each country and the extent to which consumers proactively seek or avoid products from each country of origin.

2. Governance: Considers public opinion regarding the level of national government competency and fairness and describes individuals’ beliefs about each country’s government, as well as its perceived commitment to global issues such as democracy, justice, poverty and the environment.

3. Culture: Reveals global perceptions of each nation’s heritage and appreciation for its contemporary culture, including film, music, art, sport and literature.

4. People: Explores the population’s reputation for competence, education, openness and friendliness and other qualities, as well as perceived levels of potential hostility and discrimination.

5. Tourism: Captures the level of interest in visiting a country and the draw of natural and man-made tourist attractions.

6. Immigration and Investment: Looks to attract people to live, work or study in each country and reveals how people perceive a country’s economic and social situation.

But a key point to remember is that nation brand building is not about painting a story globally with catchy advertising. It’s more about ‘implementing actions so that the people inside the country’ talk positive of the country and the world feels the vibes. This in turn attracts better FDI, higher spending tourists visiting the country and exports making a deeper penetration into markets.

2018 – SL at 7.7%

On the above criteria the performance of Sri Lanka in 2017 was $ 77 billion, making Sri Lanka ranked 59th in the world ahead of Algeria and Ukraine which were at 60 and 61 respectively. In the 2018 Brand Finance report, we see that Sri Lanka has grown by 7.7% to $ 83 billion and ranked 61 globally whilst Algeria and Ukraine have grown by 27.1% and 23.5% to be ranked 58 and 60 respectively, beating Sri Lanka, which is unfortunate. In simple words it tells us that the pace at which Sri Lanka is performing is below the global industry average and hence the world is passing by. Let me do a deep dive on this.

Exports

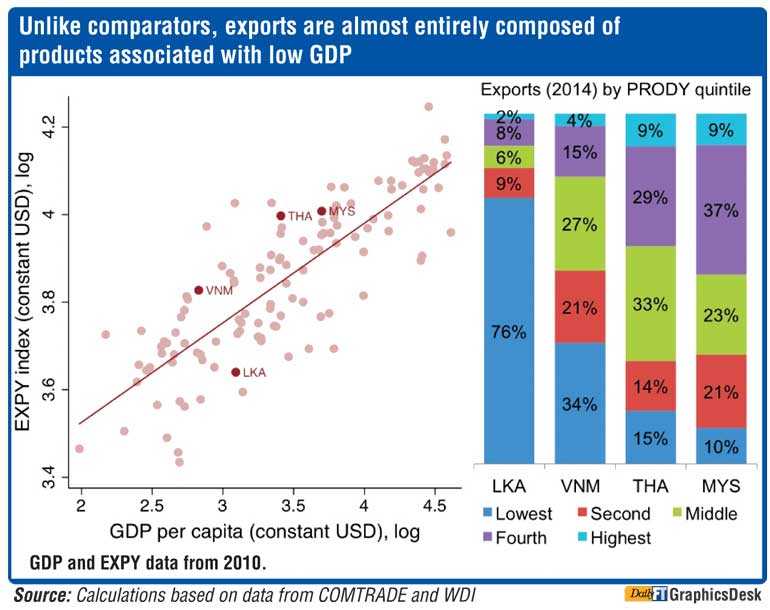

Whilst Sri Lanka crossed the export performance crossed at $ 11.3 billion in 2018 the percentage to GDP is around 20% which is way below countries like Vietnam at 86%, Thailand at 69% and Malaysia at 74% which is why competitiveness drops.

If one digs deeper, machinery and electrical exports account for only 8% of the export basket whilst competition countries average between 30-45% which is the key issue that makes Sri Lanka exporting products that compose of low GDP.

The Centre for International Development at Harvard University reveals that almost 76% of the products are at the lowest GDP growth range as against Vietnam at 34% and Thailand at just 15% which is why these entities are called industrial-driven countries as per the graph.

If one analyses the export basket in terms on complexity of the products we export, almost 76% of the products fall into the ‘Low Knowhow’ segment which means that we cannot ask a premium price and there are many substitute products in the global market that can be sourced which results in Sri Lanka’s exports not being of high demand. This is why the National Export Strategy (NES) launched in 2018 states that reforms are key to developing the export industry of Sri Lanka.

However, with the constitutional impasse, things are at a standstill. The cost to the country that needs to be computed and explained to the policymakers. The good news is that Sri Lanka's performance in the Service sector is relatively strong, especially in the 'Travel Services (Tourism)' and ICT sector. Hence we must build on this competitiveness criteria.

Investments

On the investment front whilst Sri Lanka can boast of $ 2 billion investment of FDIs in 2017, the fact remains that Sri Lanka has not seen any acceleration in FDIs in the last 20 years, especially after the war in 2009.

To be specific as per the report of the Centre for International Development at Harvard University, Sri Lanka and Vietnam were attracting the same export value in 1995 but thereafter Vietnam with radical reforms diversified the basket of FDIs and in fact attracted 106 high-profile manufacturing projects into the country whilst Sri Lanka is lagging behind at 16.

If one does a deep dive, the reasons for the poor performance is 'policy uncertainty'. The private sector faces severe constraints due to the unpredictable changes to tax policy, extending to trade policy whilst the tax policy uncertainty is also a major drag on the competitiveness on attracting investments.

A point to note is that if one checks from the private sector on taxation issues the key insight is not the percentage but the administration issues being the biggest obstacle. Hence the need of the hour is a strong government that can bring in radical changes so that Sri Lanka will not lose out to competitors.

Tourism

Whilst Sri Lanka crossed the two million tourist arrivals mark and touched the four billion dollar value in revenue, the industry is challenged with lower profitability issues with increasing costs and stagnating revenue per visitor given that the country as a tourism brand has not been promoted.

Whilst the industry had a lot of hope of getting a boost with the launch of a global marketing campaign, the fact is that since 2015 the campaign never took off ground due to poor political support. With the top seven global agencies taking part in the 2015 creative tender, just two days before the submission of the entries the tender was cancelled without a reason and board was de- solved by the policymakers.

For three years the industry fought to bring the project to life and finally a launch took place in November 2018 in London that went on to be debated by top two ad agencies on the ethics of using old creatives with a new tag line that only hurt the Sri Lanka tourism brand image.

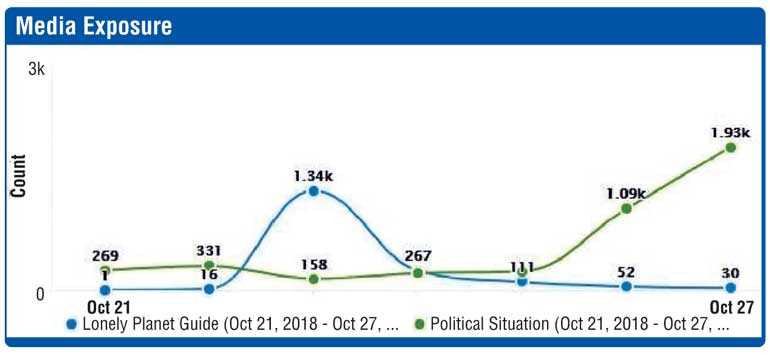

Media exposure on Lonely Planet vs. political situation

It is sad that the Nation Brand report dedicates a page for explaining the importance of building a tourism brand and the impact it can have on a country specifying the 'touch point developments' that must happen to position the country against competitors but Sri Lanka is yet on a promotional strategy which is not in synch to the world.

If one does a track on the media exposure we see that the current political issues beats the exposure on Lonely Planet, which highlights Sri Lanka as the number one place to visit in 2019.

What people forget is that consumers select brands and not products. Unless we take the proposition of driving brand image building on Sri Lanka tourism, we cannot change the profile of the tourism visitor to Sri Lanka. This in turn affects the revenue that can be generated to the country.

Conclusion and next steps

Despite Sri Lanka being inundated with 'constitutional experts' who can solve the current impasse, the reality is that Sri Lanka needs serious policy reforms to make it competitive and thus impact the overall nation brand value. If this is not done, the next belt of countries to beat Sri Lanka will be Slovenia, Panama, Iraq and Angola, which is very sad.

(The writer is an award-winning marketing professional and serves many private and public sector organisations. The thoughts are strictly his personal views. He is an alumnus of Harvard Kennedy School.)