Tuesday Mar 03, 2026

Tuesday Mar 03, 2026

Saturday, 29 September 2018 00:10 - - {{hitsCtrl.values.hits}}

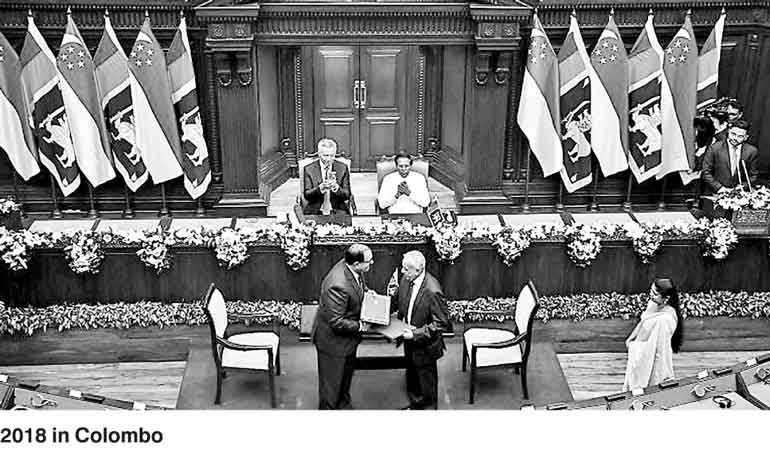

Singaporean Prime Minister Lee Hsien Loong and President Maithripala Sirisena witnessing the signing of the FTA between Singaporean Minister of Trade and Industry S. Iswaran and Minister for Development Strategies and International Trade Malik Samarawickrama. The FTA comes at a time when trade with Sri Lanka is growing, with bilateral trade reaching $ 2.7 billion last year. Singapore is also Sri Lanka’s seventh largest foreign investor.

Sri Lanka and Singapore signed the Sri Lanka-Singapore Free Trade Agreement (SLSFTA) on 23 January. This is a comprehensive Free Trade Agreement which covers goods, services, e-commerce, telecommunications, foreign direct investment, intellectual property and public procurement. Singapore and Sri Lanka signed a free trade agreement which will deepen economic ties and facilitates greater trade flows between the two countries.

Sri Lanka-Singapore Free Trade Agreement enters into force on 1 May

The Sri Lanka-Singapore Free Trade Agreement (SLSFTA) has been ratified and came into effect on 1 May. Negotiations on the SLSFTA were launched by Singaporean Minister of Trade and Industry S. Iswaran and his counterpart Minister for Development Strategies and International Trade Malik Samarawickrama, in the presence of Singaporean Prime Minister Lee Hsien Loong and Prime Minister Ranil Wickremesinghe on 18 July 2016. The agreement was subsequently signed on 23 January this year.

The SLSFTA is Sri Lanka’s first modern and comprehensive free trade agreement and will cover areas such as trade in services, e-commerce, telecommunications, investments, intellectual property and government procurement.

Many investments are planned. In fact, established players like flour producer Prima Group, which entered Sri Lanka in 1977, as well as newer ones like infrastructure firms Hyflux and Sembcorp. Even smaller firms like food court chain Food Republic are coming to Sri Lanka. These are all positive results from the FTA.

Sri Lanka would also benefit from Singapore investments, said DBS economist Irvin Seah, because there would be “procurement locally, hiring locally... and a transfer of technology and best practices”.

Bilateral trade hit $2.7 billion last year, up 27% from 2016. Singapore is also Sri Lanka’s seventh largest foreign investor.

The FTA was signed after 18 months of negotiations. A 2004 attempt to reach an agreement failed. Asked what had changed since 2004, PM Lee said the current Sri Lankan Government is on a path of economic liberalisation and wants more trade and investments.

In the lead-up to the FTA signing, some Sri Lankan businesses and professional groups expressed opposition to the deal. To address the concerns, the Government said it would look at new laws to counter sudden surges in imports and perceived unfair trade practices.

Prime Minister Lee said that any deal signed is considered a binding international agreement, and there are channels to settle disputes over differences in interpretation. On the protectionist backlash, he said there will always be pressures to preserve the status quo in any country. There will be winners and those adversely affected when a market is opened up to competition, he added. “The people who are adversely affected are... more concentrated and more effective at making some noise.”

Misconception on tariff

There was a misconception due to erroneous and prejudiced media reports that Singapore companies will not have to pay tariffs for exports to Sri Lanka on 80% of product categories for 15 years. In fact, tariffs will be eliminated progressively over 15 years after the FTA is in force. After 15 years, 80% of product categories will see zero tariffs.

What’s in the FTA

nTariffs will be eliminated progressively over 15 years, after the FTA is in force. After 15 years, 80 per cent of product categories will see zero tariffs. Thereafter tariff savings of $10 million yearly for Singapore firms.

nGreater market access for professional, environmental, construction, tourism and travel services.

nSingapore firms can bid for large Government procurement projects.

nLiberal rules of origin, so goods from other countries processed in Singapore will enjoy low tariffs.

nSafeguards against expropriation of and discrimination against Singapore investments.

The FTA is a boost in trade between the two economies and greater access for Singapore firms to the growing market.

Sri Lanka is a promising market and a fast-growing economy. It’s also a beautiful country with great tourism potential. On the whole, this FTA is likely to open up huge opportunities for Singapore and Sri Lankan companies.

The size of Sri Lanka’s economy – $ 81 billion (S$107 billion) in 2016 – is just over a quarter of Singapore’s, but its annual growth has averaged 6.2% since the end of the civil war in 2009. Its population is also close to four times that of Singapore.

Trade between the two countries last year was $2.7 billion, up from $2.05 billion in 2015.

With China pouring billions into the South Asian island country, investing in, among other things, a port and a financial centre, the FTA could also help Singapore benefit indirectly from the fruits of the Belt and Road Initiative there, he added.

The deal also covers services, with the two countries committing to allow greater access in each other’s markets for professional, environmental, construction, tourism and travel-related services.

On the FTA’s impact on Singapore, he said the Singapore market has always been more open.

Many investments are planned. Established players like flour producer Prima Group, which entered Sri Lanka in 1977, as well as newer ones like infrastructure firms Hyflux and Sembcorp. Even smaller firms like foodcourt chain Food Republic are coming to Sri Lanka. These are all positive results from the FTA.

It includes Sri Lanka’s first treaty commitment on government procurement. This will allow Singapore companies to bid for projects by several of Sri Lanka’s large central entities and State-Owned Enterprises.

Singapore and Sri Lanka are also committed to granting better access to each other’s services markets, said MTI, adding that the agreement includes sectors of interest to Singapore companies in the professional and trade-related services as well as environment, construction and tourism.

The SLSFTA also covers cross-border transfers of information by electronic means and data flows. MTI said this will benefit Singapore and Sri Lanka companies given the increase in demand for e-commerce and digital services.

There are also safeguards against discriminatory treatment based on nationality and protection against expropriation.

Under the agreement, the Singapore International Arbitration Centre is listed as an institution where Investor-State disputes can be heard. MTI said this is aligned with the objective of promoting Singapore as an arbitration hub.

Sri Lanka’s first modern and comprehensive Free Trade Agreement

The deal is Sri Lanka’s first “modern and comprehensive” Free Trade Agreement and will, said MTI, “position Singapore as an early and supportive partner of Sri Lanka’s economic liberalisation plans and development”.

To date, Singapore companies have established a presence in Sri Lanka in sectors such as construction, infrastructure, manufacturing, food and services. There are currently about 90 Singapore companies in Sri Lanka.

MTI said Sri Lanka was Singapore’s 36th largest trading partner in 2017, and bilateral trade amounted to S $2.7 billion. Singapore’s exports to Sri Lanka totalled S $2.5 billion, while Singapore’s imports from Sri Lanka totalled S $178 million.

Singapore’s top exports to Sri Lanka include petroleum and diesel, non-monetary gold and jewellery, while top imports from Sri Lanka include motor spirit, fuel oils, perfumes, clothing accessories and wheat flour.

Despite the rapid increase in Sri Lanka’s service exports such as tourism, tourist arrivals from Singapore comprise only 0.93% of total tourist arrivals to Sri Lanka. The SLSFTA thus has the potential for broadening trade in services including tourism, telecommunications, transportation, education, hospitality, health and finance among other areas.

The removal of tariffs will further increase business opportunities for local enterprises, providing greater access to import and export markets, and entry into new markets. Increased competition and access to a wider variety of markets will also benefit consumers through greater choice and lower prices. Sri Lanka however, needs to be cautious of not becoming a dumping ground for imports coming from third party (non-SLSFTA) countries attempting to evade tariffs through Singapore.

Turning to investment, Singapore is Sri Lanka’s fourth largest investor, preceded by China, Hong Kong, and India. FDI into Sri Lanka from Singapore accounted for 5.3% of GDP over 2014-17. While FDI into Sri Lanka has exhibited a rising trend, Sri Lanka attracts disproportionately only a very small proportion of FDI ($ 0.09 billion in 2015) compared to its regional counterparts (Singapore $ 65 billion in 2015).

Despite the fact that a number of Singapore companies have set up affiliates in Sri Lanka in sectors including food and beverage processing (Prima Ceylon), tourism (Shangri-La Hotels), infrastructure development (Shing Kwan Group, Next Story Group), construction (WohHup, Ley Choon), security (Certis Cisco) among others, the greater predictability provided by the SLFTA presents possibilities for further integration through financial markets and capital flows.

Despite the fact that a number of Singapore companies have set up affiliates in Sri Lanka in sectors including food and beverage processing (Prima Ceylon), tourism (Shangri-La Hotels), infrastructure development (Shing Kwan Group, Next Story Group), construction (WohHup, Ley Choon), security (Certis Cisco) among others, the greater predictability provided by the SLFTA presents possibilities for further integration through financial markets and capital flows.

FDI inflows will deliver significant gains for Sri Lanka in the form of technological know-how, innovation and investment in research and development. The entry of foreign affiliates into the downstream sector can also create an increased demand for local inputs.

While FDI inflows can lead to skill development and productivity increases for local firms, Sri Lanka should be mindful of not engaging in harmful bidding wars for FDI, which can lead to a ‘race to the bottom,’ eroding the country’s tax base and channelling public expenditures away from priority sectors.

The SLSFTA is Sri Lanka’s first treaty which covers Government procurement, permitting Singapore companies and state-owned enterprises to bid for projects. This agreement can help the government to cut down on spending by increasing supply sources of goods and services and create greater competition for Government procurement.

The agreement also provides a basis for strengthening bilateral cooperation mechanisms on electronic accreditation procedures and paperless trading and improving mutual commitments on intellectual property.

Trade agreements also have an important bearing on labour standards. Currently, of Sri Lanka’s total labour migrants, 0.5% are employed in Singapore. This agreement can generate greater employment opportunities for nationals of both countries, and lead to improvements in labour standards through the exchange of best practices.

While the SLSFTA provides an important platform for pursuing trade negotiations with other countries in the region, and mechanism for accession to the Regional Comprehensive Economic Partnership, the expected effects of the SLSFTA will depend to a great degree on the adoption of complementary institutional structures and policies.

Studies suggest that FDI will have positive spill-over effects on an economy only in the presence of a minimum threshold of human capital, well developed infrastructure facilities, and strong economic fundamentals. Therefore, in order to attract larger FDI inflows and achieve the full potential of FDI, sizeable investments in infrastructure and skill development are required over the medium term.

The experience of Taiwan and Korea highlight the significance of local technology creation led by the government which resulted in technology diffusion to local firms and positive FDI spill-overs. Similarly, fiscal consolidation and monetary policy focusing on maintaining low and stable inflation are important pre-requisites for Sri Lanka’s success to not only realising the full benefits of the agreement, but also future tariff negotiations with other nations at a bilateral, and broader regional level.

Maximising the benefits of this agreement will thus require increased policy coordination not only between the two countries, but also within Sri Lanka, between policymakers, the private sector and the Government.

(The writer can be reached via [email protected].)