Sunday Feb 15, 2026

Sunday Feb 15, 2026

Friday, 21 October 2022 00:00 - - {{hitsCtrl.values.hits}}

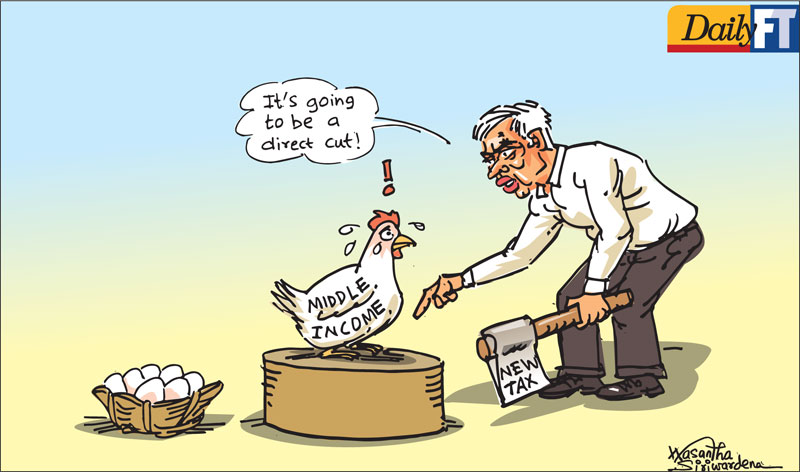

The policies of income tax, marginal tax, money printing, and capital controls discourage savings and must be revised

The economy is shrinking

The economy is shrinking

The economy can be likened to a train engine pulling carriages up a hill.

The engine represents the wealth generating component of the economy, which is the private sector. This is because the existence of the private sector depends on profits, and since profits are an increase in value over costs, the private sector is always a surplus to the economy. The carriages, on the other hand, are the government sector. Though this sector is important, it relies on private sector resources to maintain its size.

Despite the efforts of the engine to pull the carriages, the train has stopped moving forward, and is now sliding back down the hill. This is the Sri Lankan economy in recession. Currently there is a lack of foreign investment and the local private sector is the only means to stopping the slide.

The government sector is doubly burdensome

The Government obtains private sector resources through inflation (money printing), or seizes resources through taxation. What resources the government sector consumes becomes unavailable for the private sector to use. Thus the government sector is doubly burdensome to the economy, as on the one hand its weight must be pulled along by the private sector, and on the other hand it is starving the private sector of valuable resources needed for growth.

In order to stop the slide and start to inch up again the first priority is to reduce government expenditure. Just as the current size of the government sector is doubly harming the economy, a reduction in size will provide double the relief. It will have the effect of both lightening the carriages and increasing the size of the engine.

The importance of savings

The main resource of the private sector is savings. All economic growth takes place when entrepreneurs in the private sector make capital investments from savings. It is therefore vital to note that savings is the source and lifeblood of any economy, and the encouragement of savings translates to the encouragement of the economy.

What is savings?

Savings comes from underconsumption. By saving, the individual forgoes spending money today for some future date. In addition to improving discipline through thrift, savings also helps to prepare for unforeseen events such as medical emergencies, job losses, natural disasters, and so on.

If the individual deposits money in a bank (as is often the case) the bank is able to lend that money to entrepreneurs for investment. Bank deposits make the savings of individuals available to the wider public, and in so doing more easily facilitates economic growth.

If the individual saves money outside of the banking system, such as by keeping it under a pillow, the economy is still improved. This is because prices of goods and services are a function of money in circulation. When money is removed from circulation, prices will correspondingly fall.

In the following sections the negative impact of economic policies on savings will be discussed in brief.

Individual income taxes must also consider expenses

The income taxes for companies are on profits, i.e. income after expenses, but the income taxes for individuals have no relief from expenses (e.g. medical, food, rent, etc.).

This creates a situation where an individual with high expenses may have to use savings to pay for income tax. This is unfair and particularly damaging to employees and fixed income earners.

The income tax law should therefore be amended to take account of expenses and be consistent with corporate tax law. This will benefit savings in society.

Corporate taxes and income taxes are a double whammy

Private sector business is facilitated by profit margins, i.e. the percentage difference between the selling price and the costs. Corporate taxes are one such cost to business.

If the tax increases so must the selling price in order to maintain the profit margin, or the business will cease to exist.

Thus corporate taxes are simply an indirect tax to consumers. The Government has now increased corporate taxes. This is counterproductive as that cost, when passed on to employees or fixed income earners, diminishes their ability to save.

Employees and fixed income earners are in effect, doubly taxed as they must pay both the corporate tax and income tax.

The impact of marginal taxes on savings

If income increases so does savings ability. The Government must therefore incentivise earning higher income.

The current policy of higher marginal taxes can cause individuals to refuse higher salaries in favour of other non-monetary benefits. This is so that they can try staying within a lower tax bracket.

The policy also contributes to the brain-drain to foreign nations where an individual may be better able to hold on to their earnings.

Though marginal tax policy is common globally it is counterproductive to economic growth as it influences the wrong behaviour in employees and discourages savings.

Income taxes are counterproductive

Due to the aforesaid reasons income taxes are counterproductive to the economy. They are a burden and cost to business and individuals, difficult to administer for the Government and substantially hurtful towards employees and fixed income earners.

The Government would therefore do well to abandon this means of income completely and focus on the consumption tax (e.g. GST) as a means to earning what it needs.

How interest influences savings

The incentive for individuals to deposit money in banks is the interest rate. If inflation is higher than interest, savings is discouraged and consumption is encouraged.

Interest rates are related to money availability. The more money banks hold, the lower the interest must go. A society that is unable to save will have high interest rates reflecting the scarcity of saved money.

Central Bank (CBSL) printing discourages savings

In Sri Lanka the savings interest is relatively high when compared to what is global, but it is not as high as inflation (measured at about 50% in June). Sri Lankans are therefore being encouraged to consume and not save.

The reason why interest is low (in relation to inflation) is because banks are indirect recipients of free money printed by the Central Bank (e.g. through public sector deposits).

In order to raise interest rates and encourage savings the Central Bank must stop printing. This will create money scarcity in banks, which will cause interest rates to exceed inflation naturally.

Capital controls

The Government has implemented capital controls which prevents individuals from holding significant amounts of foreign currency. Holding wealth in foreign currencies is particularly attractive now due to central bank induced inflation.

These controls have the unintended consequence of discouraging Sri Lankans abroad from transferring their savings to local banks. Foreign remittances are therefore not taking place as they should.

The Government should remove capital controls in order to encourage remittances.

Conclusions

The Government is adopting common traditional methods to restore the economy. These methods are not universally applicable and in the context of Sri Lanka will fail. The Government must revise its stance and think out of the box by focusing on savings as a priority.

Savings are the lifeblood of the economy. In order to improve savings the Government must reduce expenditure first. In addition the policies of income tax, marginal tax, money printing, and capital controls discourage savings and must be revised.

As a means to address budget deficits taxes have been increased. This will have the effect of diminishing the strength of the (already weak) engine thereby causing the slide down the hill to become uncontrolled.

As a consequence the LKR may lose all of its value and hyperinflate. The economy will lose a substantial portion of its remaining vigour. The brain-drain will reach unprecedented levels hitherto unseen, and food starvation of a broad segment of society can become reality. The Government must therefore reverse this policy before it’s too late.

Further reading:

1. Entrepreneurship is the Key to Improving the Economy

(https://www.ft.lk/columns/Entrepreneurship-is-the-key-to-improving-the-economy/4-736385)

2. Fixing the Sri Lankan Economy

(https://www.ft.lk/columns/Fixing-the-Sri-Lankan-economy/4-738655)

(The writer currently resides in Singapore where he works as a civil engineer. He has a keen interest in economics. He can be reached by email at [email protected].)