Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 18 February 2022 00:00 - - {{hitsCtrl.values.hits}}

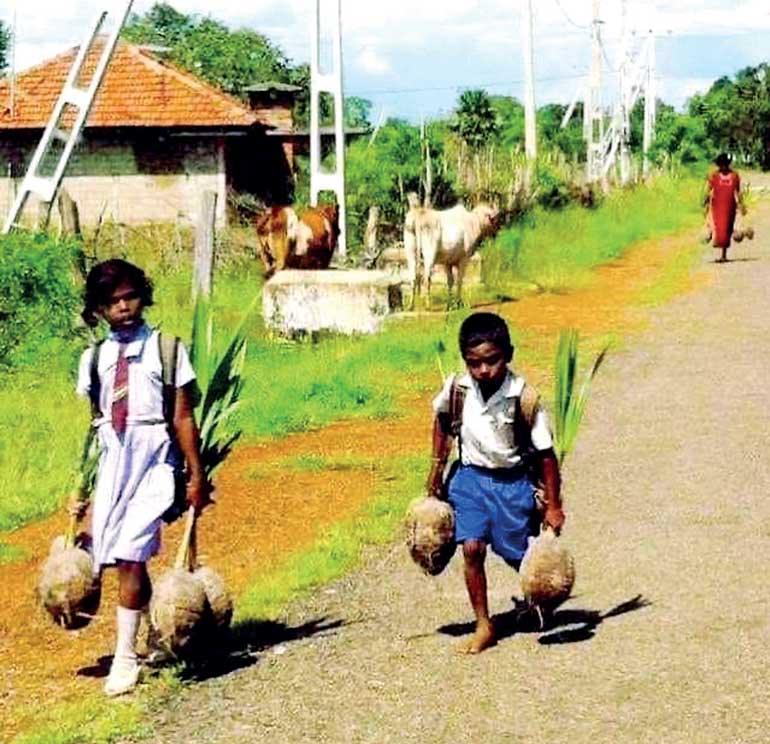

We should not forget these young people in the rural areas, who have no clue what’s going on other than the ever-rising food prices

According to the Daily FT, despite restrictions and forex shortage, 2021 import figures soared by 28.5% or $ 4.6 b to $ 20.6 b; highest in three years. The December inflows was the highest ever at $ 2.2 b. The FT noted that Sri Lanka’s love for imports remains irresistible as confirmed by the Central Bank’s latest data, up sharply by 47%.

The FT noted that Sri Lanka’s love for imports remains irresistible as confirmed by the Central Bank’s latest data, up sharply by 47%.

The all-time highest imports figure recorded was $ 22.2 billion in 2018, the same year Sri Lanka had the highest ever tourism income of nearly $ 5 billion. In 2017, imports was $ 21 billion. The rise in imports is despite various measures taken by the CBSL to discourage non-essential items amidst the acute foreign exchange shortage. If this trend is not addressed, it will certainly aggravate the shortage of foreign exchange further.

Policymakers

The big worry for CBSL must be the growing monthly deficit between the imports & the exports. Today, whilst the USDs surrendered by the banks and not on the market are being used to import oil and essentials, the USD not surrendered by the banks are not traded freely in the market, for use of other permitted imports. The large volume of LCs opened in the last three months on supplier credit of 30-60 days will fall due at the time the $ 1 billion ISB falls due in June 22. The repo window too is running out of steam. It is said that, after a case of tea exporter importing potatoes the CBSL has informed that they will not be hospitable to any grey market transactions of this nature.

Also, companies with retained USD and willing to open LCs for non-USD clients, will do so with premiums paid under the table. Black market transactions it is said are now at 253+. Government will obviously not devalue the LKR given the impact on GDP figures and COL. The CBSL may need to encourage institutions with strong Balance Sheets to go to the international currency markets and offer them some kind of protection for the exchange risk.

Limited options

Fuel, textile articles, machinery equipment, medical and pharmaceuticals and fertiliser imports are a must to keep exports at current levels. The importation of consumer goods and non-food consumer goods have increased by 46% according to the FT. These numbers need to be looked at carefully and restrictions need to be put in place fast. Ex Central Banker W. Wijewardena in an article written by him to the Financial Times said that the “Gotabaya Rajapaksa administration had made serious policy errors in the recent past when it announced an unsolicited, attractive tax concession to income taxpayers, the estimated revenue loss was around Rs. 650 billion, and the Government went to the banking sector for financing the budget.”

“In 2020 and 2021,” he further says, “the Government had borrowed from the banking sector, that is, the Central Bank and banks, a net sum of Rs. 3,500 billion marking an increase by 125%. This is a colossal sum. Accordingly, the total money stock in the country had expanded during this period by Rs. 3,023 billion or 40%. The consequence of this extraordinary money growth was the building of inflationary pressure in the domestic economy, on one side, and depletion of foreign reserves putting pressure on the rupee to depreciate in the market.”

Whilst those responsible for this short-sighted decision must be held accountable, as a country we need to move on, given that Sri Lanka needs financing support of around $ 6 billion to get over 2022. We have already earned the unfortunate title of global beggar. Greece and Iceland went through a similar crisis. They got through the crisis with sound policy interventions and austerity measures. Zimbabwe and Argentina, did not.

Way forward

Our politicians must rise up to the occasion – a big ask given their sorry track record. Importers can no longer be allowed to over-order stocks anticipating a forex crisis around the corner. The country’s current predicament does not allow this. We need to focus all our efforts to export more and attract FDI, whilst we spend less. Those who say we should open up, must put their money where their mouth is. The people cannot keep on blaming the Government, especially the. 6.9 million who voted for them. They must take the responsibility for their actions; unfortunately, the 5,2+ million people who did otherwise, also have no choice, given the magnitude of the crisis that can bury everyone together. A joint effort is what will get us out of this economic crisis, with Gotabaya acting as the catalyst. The question is? Can he, and will he?