Friday Feb 20, 2026

Friday Feb 20, 2026

Tuesday, 29 September 2020 00:53 - - {{hitsCtrl.values.hits}}

Sri Lanka’s geographical position is ideal to become a regional manufacturing and shipping hub. Taking this as an advantage, it is important to establish special economic zones in order to attract FDIs, create meaningful jobs for the younger generation and help Sri Lanka to be competitive in the global market

Special Economic Zones (SEZs) can be defined as ‘geographically delimited areas within which governments facilitate industrial activity through fiscal and regulatory incentives and infrastructure support’ (UNCTAD 2019, p. 128). These zones are widely used in most developing and many developed economies.

In these geographically delimited areas, governments facilitate industrial activity through fiscal and regulatory incentives and infrastructure support. For an example, in 1988 Hainan Island was made a separate province and a special economic zone, and by 2005 in India there were eight special economic zones in states like Kerala and Gujarat. By 2019, there were about 5,383 SEZs across 147 economies worldwide.

SEZs have become increasingly popular mechanisms to promote economic development. Over the last two decades, in particular, SEZs have significantly increased in number in emerging and transition economies. States promoting zones have sought to stimulate economic development both within and outside the zone. Within the zone, states aim to attract investment that will lead to new firms and jobs, and to facilitate skills and technology transfers. Outside the zone, states aim to generate synergies, networks, and knowledge spillovers to foster additional economic activity.

SEZs are typically designed to achieve the following four policy objectives:

(i) Attracting foreign direct investment and promoting exports and industrialisation.

(ii) Serving as ‘pressure valves’ to alleviate large-scale unemployment.

(iii) Supporting wider economic reform strategy.

(iv) Acting as experimental laboratories for the application of new policies and approaches.

The rationale for establishing Special Economic Zones in any country is the realisation that existing general infrastructure conditions and regulatory frameworks are not ideally helpful for attracting Foreign Direct Investment (FDI) or relocation of industries from excess capacity economies. In order to overcome these constraints, host countries need to establish specially designated zones with liberal policies, minimum bureaucratic processes and improved infrastructure facilities.

China’s experience in SEZs

China has successfully leveraged SEZs for economic transformation. Initially SEZs were used to experiment with market-oriented economic reforms and build experience, before reforms were implemented more widely. Now, a wide range of SEZs have been established to take advantage of local conditions. These encompass large national zones (whose objective is to foster broad-based, comprehensive economic development), high tech industrial development zones, free trade zones, and export processing zones, as well as others at both national and regional levels. Although there is no single model, all successful Chinese SEZs are supported by conducive government policies and commitments. Some of the features of successful economic zones are as below.

Features of successful SEZs:

The case for Sri Lanka

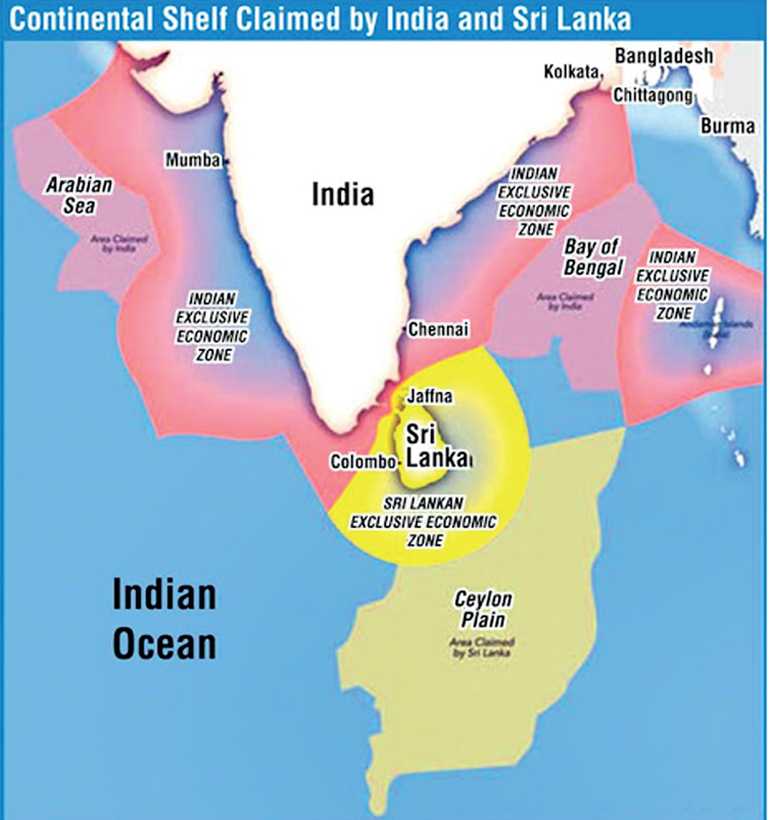

Sri Lanka, which occupies a strategic geographical location close to major global sea lanes and near the coast of dynamic Indian economy, has long aspired to be a regional trading and services hub in the Indian Ocean.

Sri Lanka has significant experience of SEZs in the form of Export Processing Zones (EPZs), which are a subset of SEZs focused primarily on manufactured exports. The first EPZ in Sri Lanka was established in Katunayake in 1978 under the authority of the Greater Colombo Economic Commission (GCEC), which was later renamed Board of Investment. Today, there are 12 EPZs in Sri Lanka concentrated in the Western and Southern Provinces, and an additional three are planned (BOI Annual Report – 2018). These zones have played a crucial role in the development of Sri Lanka’s exports, particularly the apparel sector, which today continues to account for around 50% of the country’s goods exports.

Sri Lanka’s geographical position is ideal to become a regional manufacturing and shipping hub. Taking this as an advantage, it is important to establish special economic zones in order to attract FDIs, create meaningful jobs for younger generation and help Sri Lanka to be competitive in the global market. As a mechanism for attracting foreign direct investment and accelerating industrialisation, it is the responsibility of the Government to take necessary action by promoting FDI and providing an environment conducive for investors to consider Sri Lanka as a suitable place for investment. In this regard, the Pathfinder Foundation had recommended in 2015 the following key actions, which are still valid:

(i) Identify the needs of both the host country and the investor and design SEZs

(ii) Adopt transparent and consistent pro-business, especially pro-FDI policies, and regulations.

(iii) Administrative processes must be streamlined and bureaucratic red tape in granting approvals must be minimised.

(iv) Policies and regulations must welcome technology transfers, innovations and technology know-how while protecting patent rights, trademarks, etc.

(v) The consistency of policies, irrespective of changes of government or political systems, must be guaranteed.

Sri Lanka had considerable potential for FDI four decades ago. In the early 1980s, companies like Motorola and Harris Corporation had plans to establish plants utilising facilities offered by the GCEC. Other companies, such as Marubeni, Sony, Sanyo and several foreign banks had investment plans in the pipeline. However, the 1983 race riots and the separatist war put an end to that nascent potential.

With the end of the conflict in 2009, Sri Lanka began to attract attention once again and by 2013 received approximately $ 1.4 billion as FDI. However, by that time, countries like Malaysia and Vietnam, which suffered from decades’ long war, had taken giant strides by attracting FDI. As a percentage of GDP, FDI currently stands at mere 2% and lags behind Malaysia at 3-4% and Vietnam at 5-6% (https://blogs. Worldbank.org/enpovertyinsouthasia….). Rate of FDI since 2013 has been disappointing. The major reason for the decline has been attributed to geopolitical risks and policy uncertainty for investors.

This situation could be seen by looking at the cumulative employment of BOI projects. As at December 2013, textile accounted for 60%, knowledge services for 4% and 12% for manufacturing. Disappointingly, the numbers were the same three years later, when it came to the apparel sector, which accounted for an unchanged 60%, manufacturing halved to 6.6% and there is no data available for knowledge services.

The outbreak of COVID-19 has severely impacted the apparel sector making it more difficult for the Sri Lankan economy. Taking this challenge as an opportunity to change the apparel dependent economy to more diversified export generation, Sri Lanka can use Special Economic Zones as an economic tool, which can play an important role in attracting FDI, creating more employment opportunities in order to achieve industrial development in a sustainable, efficient and effective manner. Comments can be shared at [email protected].

(The writer is Programs Executive, Pathfinder Foundation.)