Thursday Feb 26, 2026

Thursday Feb 26, 2026

Wednesday, 22 June 2022 00:10 - - {{hitsCtrl.values.hits}}

Import over-invoicing has a devastating impact on the economy and on the welfare of the masses compared to export under-invoicing

In Part I of this discussion we reviewed liberal explanations on Sri Lanka’s economic collapse showing its collective failure in explaining the magnitude of the crisis which far exceeds both quantitative and qualitative limits of their reasoning. In the following analysis we attempt to address this deficiency by showing the impact of capital flight through trade mis-invoicing or manipulation of export and import invoices by the corporate elite and the ensuing expansion of black market for foreign exchange in Sri Lanka.

In Part I of this discussion we reviewed liberal explanations on Sri Lanka’s economic collapse showing its collective failure in explaining the magnitude of the crisis which far exceeds both quantitative and qualitative limits of their reasoning. In the following analysis we attempt to address this deficiency by showing the impact of capital flight through trade mis-invoicing or manipulation of export and import invoices by the corporate elite and the ensuing expansion of black market for foreign exchange in Sri Lanka.

This network of illicit financial flows is also capable of absorbing foreign inflows like workers’ remittances, diverting it away from the formal banking system and in turn creating a dual exchange rate system. Consolidation and expansion of black market for foreign exchange forms the basis for a ‘foreign exchange liquidity trap’ rendering the monetary policy mechanism of the central bank more or less ineffective, especially in setting parameters to exchange rate fluctuations.

It triggered the collapse of the currency value by as much as 90% within a matter of weeks which is over five times greater than rupee depreciation warranted by real exchange rate appreciation as per IMF calculations as of February 2022. The process has now brought us face-to-face with a catastrophic humanitarian crisis marked by soaring inflation and an acute shortage of food, medicine and fuel hand in hand with rising unemployment.

Global Financial Integrity (GFI), an international organisation dedicated to the study and assessment of capital flight from underdeveloped and newly industrialised economies through trade mis-invoicing published a report titled ‘Illicit Financial Flows from 134 Developing Countries 2009 – 2018’ on 16 December, 2021. The report contains a startling piece of information on capital flight from Sri Lanka through trade mis-invoicing. Between 2009 and 2018 a staggering $ 41.5 billion was transferred out of Sri Lanka by the corporate elite through trade mis-invoicing at an annual average rate of $ 4.15 billion (see Table E, page 59). In April 2022 Sri Lanka defaulted $ 51 billion in foreign debt whereas foreign exchange illicitly transferred out by the corporate elite is as much as $ 41.5 billion between 2009 and 2018 alone.

Despite the absence of data for the next three years there are clear signs in the economy that the process accelerated especially in 2021. Domestic industrial output contracted over 5% as per industrial production index of Central Bank of Sri Lanka (CBSL) in 2021 while imports of machinery, raw materials and investment goods increased phenomenally mainly accounting for the increase in import bill during the year showing clear evidence of import over-invoicing by the corporates. Sri Lanka’s highest ever import bill was recorded in 2021 during a period that saw acute foreign exchange liquidity shortages, import controls hand in hand with collapsing foreign reserves.

Before addressing the magnitude of capital flight through trade mis-invoicing let us briefly look at how it is carried out. The two methods of trade mis-invoicing employed for capital transfer across national boundaries are import over-invoicing and export under-invoicing. Importers and exporters over-invoice their bills in commodities where taxation is close to zero. In Sri Lanka raw materials, machinery and other investment related imports are mostly tax-free and they constitute nearly 80% of the total imports expenditure annually including fuel imports. Import over-invoicing manipulates the price, volume and quality of the product to show a higher expenditure than the value of the consignment of imported goods. Expenditure that is in excess of what is imported is transferred to an offshore account of the importer. Export under-invoicing does the reverse by understating the actual export value and transferring the excess to an offshore account of the exporter.

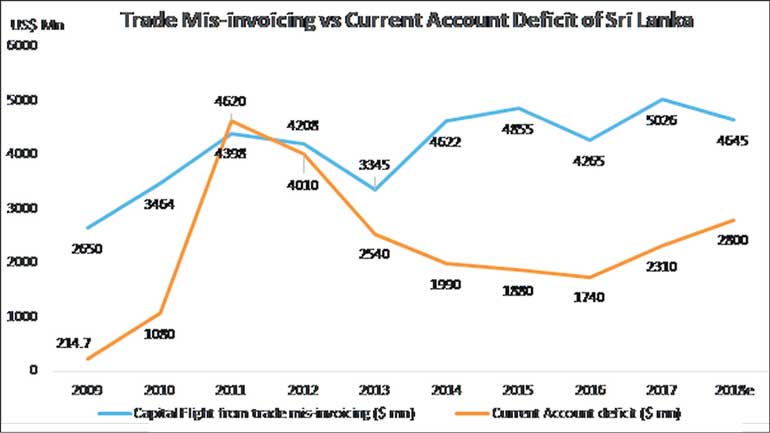

It is important to note that the annual average volume of capital transferred through mis-invoicing is significantly greater than Sri Lanka’s current account deficit in the balance of payments. The annual average current account deficit was $ 2.3 billion from 2009 to 2018 whereas the annual average capital flight through trade mis-invoicing was $ 4.15 billion indicating that Sri Lanka’s ongoing economic collapse and the balance of payments crises it periodically faces can be entirely attributed to trade mis-invoicing by the corporates (see graph below).

Furthermore, we have to assess the welfare loss of capital transfer by estimating the loss of incomes stemming from the withdrawal of funds from the economy. A moderate rate of return of 10% on capital transferred from 2009 to 2018 would produce an additional loss of $ 22.9 billion during the period. If the entire stock of $ 41.5 billion was reinvested within the economy during the next four years at 10% return the loss of return due to capital transfer is $ 16.6 billion. Both calculations assume that returns are not gainfully reinvested.

Total loss of foreign exchange triggered by trade mis-invoicing from 2009 to 2018 alone therefore amounts to a staggering $ 81 billion which is equal to Sri Lanka’s 2021 GDP. On the other hand, Sri Lanka lost around 30% of remittances over the years due to funds being channelled through black market (CBSL estimates) which amounts to around $ 2 billion each year. Recently the flow of remittances collapsed even further due to black market activity, wiping out its inflow by around $ 6 to $ 6.5 billion this year, which would be equal to Sri Lanka’s entire fuel bill in 2021.

Foreign reserves required to consolidate black market activity are provided by capital transfers through trade mis-invoicing, which in turn enables the flow of remittances to divert from official banking channels. Heart of the black market for foreign exchange therefore lies in trade mis-invoicing. On the other hand, it is needless to say the loss of Government tax revenue, colossal decline in tax to GDP ratio and the tremendous loss of social welfare over the years due to expansion in black markets is enormous. It is in this context that we should understand the ongoing economic collapse of Sri Lanka rather than through liberal explanations trying to inflate the tip of the iceberg of the problem.

It is a vindication of the fact that the corporate elite of Sri Lanka and in underdeveloped economies in general have colonised their own economies and adopted the model of a coloniser through altogether a different mechanism. Therefore, laws must be updated and reinforced to reflect the severity of the outcome of illicit capital transfers. Many people lost their lives from the consequences of lack of essential supplies like medicine, food and fuel, triggered by the lack of foreign exchange available in the banking system. Laws should be strictly enforced and updated to punish whoever involved in illicit capital transfers which should be considered tantamount to manslaughter.

There should be coordinated efforts by the monetary authority, the customs and the banking system as a whole to achieve this end together with the intelligence units of the security forces to gather information. However, it is difficult to expect that the banking system would comply given that the corporate elite owns the commercial banks leading to conflict of interests when monitoring its own financial transactions.

Professor Arun Kumar of the Jawaharlal Nehru University, author of ‘Understanding the Black Economy and Black Money in India’, 2017, emphasises the need to strengthen law enforcement in a coordinated manner and the need to build social and political resistance of the masses against black market activity by increasing public awareness of the problem. He notes that the Indian economy would be seven times larger and therefore per capita income would be seven times higher than the present level in the absence of capital transfers by its elite since the 1970s. If so India would have been the world’s largest economy by now.

In this light we must also delineate the difference in import over-invoicing and export under-invoicing with respect to their access to foreign exchange in the financial markets. Import over-invoicing has a devastating impact on the economy and on the welfare of the masses compared to export under-invoicing. The former is a method of purchase of foreign exchange that the importer had no involvement in producing. Therefore, its extent is not restricted by the volume of production. Import over-invoicing can purchase foreign exchange circulating in the domestic financial market unrestricted by the importer’s own economic activity. In contrast, capital transfer through export under-invoicing is limited by the value of export receipts. The excess of foreign exchange purchased by the importer over and above the value of the consignment of goods imported is supplied also through other non-export related inflows like labour remittances, foreign debt inflows like International Sovereign Bonds (ISBs), foreign direct investments and foreign portfolio investments; the importer gains access to all forms of foreign inflows when over-invoicing.

For instance, it is conventionally held by liberal economists like W.A. Wijewardena, Prof. Prema-Chandra Athukorala and Dr. Harsha De Silva that wasteful unproductive infrastructure projects of the Government and over-estimating expenses and embezzling project funds escalated Sri Lanka’s foreign debt problem. The crisis is therefore reduced to corruption and mismanagement in the State sector. However, we must note that the largest share of Sri Lanka’s foreign debt is not accounted for by project loans and the Government regularly borrowed from international capital markets and bilateral sources to boost foreign reserves and meet balance of payments deficits. In this light former Auditor General Gamini Wijesinghe publicly announced that Sri Lanka does not have physical assets equal to Government foreign borrowings.

This can be explained by capital flight through import over-invoicing. The importer gains access also to Government’s foreign borrowings aimed at meeting balance of payments deficits and boosting foreign reserves such as ISBs and bilateral loans. These foreign inflows including hard earned labour remittances were transferred out of the economy in billions each year by the corporate elite through import over-invoicing, the so-called engine of growth of the liberal economist. It explains the absence of physical assets equal to Government foreign borrowings over the years and also shows that market mechanism on its own only ensures the welfare of the elite as opposed to an efficient and fair resource distribution promised in economics textbooks. It rather ensures economic and social devastation for the mass of the people in the third world.

In this context Sri Lanka is currently facing the stage reached by most African countries in late 1980s when import over-invoicing drained foreign exchange liquidity in domestic financial markets to the extent that it is no longer possible and capital transfer through the trade account is then more or less restricted to export under-invoicing (see GFI report, 2021). Collapse of Sri Lanka’s exchange rate by nearly 90% since early March and the runaway inflation it triggered hand in hand with the disappearing real value of wages should be understood in this context.

Professor Prema-Chandra Athukorala asserts that the ongoing crisis was triggered by the non-tradable sector accounting for around 70% of the GDP. However, it is clear from the discussion above that despite the over-expansion of the non-tradable sector and the ensuing stagnation of production, Sri Lanka would not have faced a balance of payments catastrophe in the absence of capital flight through trade mis-invoicing. This is clear by annual average current account deficit remaining approximately half of capital transfers through trade mis-invoicing between 2009 and 2018, disregarding the gains lost through non-investment of capital in the domestic economy.

In response to the growth of black economy in the foreign exchange market Dr. W.A. Wijewardena and Dr. Harsha De Silva claim that rather than trying to wipe out the black economy through coordinated law enforcement, domestic interest rates should be increased sufficiently to stem speculative demand which in turn would redirect foreign inflows to the official banking system. However, the Mundell and Fleming model on balance of payments equilibrium delineates that out of monetary policy independence, fixed exchange rate and free flow of capital only two conditions can be attained simultaneously without impeding external sector stability.

What Dr. Wijewardena and them are proposing is to give up monetary policy independence to achieve exchange rate stability while allowing free flow of capital regardless of it being legal or illegal. This proposed arrangement is incapable of resolving the issue given that as we demonstrated above the outflow of capital through trade mis-invoicing and the loss of remittances gathered pace over the years regardless of the domestic interest rate. This indicates the gradual flourishing of a liquidity trap in the foreign exchange market in Sri Lanka portrayed by the flow of capital becoming increasingly unresponsive to the domestic interest rate.

Also, the rate of interest cannot be increased beyond a certain point without raising unemployment, loss of production and therefore creating disequilibrium in labour markets. Hence, the appropriate combination in the Mundell and Fleming framework is to retain monetary policy independence and fixed exchange rate while controlling the free flow of capital including its illicit component.

Part I of this article was published in the Daily FT on 7 June and can be seen at https://www.ft.lk/columns/ Rise-of-black-economy- for-forex-and-economic- collapse/4-735813