Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 12 October 2021 03:13 - - {{hitsCtrl.values.hits}}

The recent boom has been entirely driven by share purchases among local investors

The share market (stock market) is an essential part of the modern ‘capitalist’ economy. Without properly functioning share markets, many countries would not be as prosperous as they are. The share market serves as an indicator of the state of the economy as well. A gradually rising share market is usually aligned with a growing economy and increasing investor confidence. A share market’s orderly, fair, and transparent process of ‘efficient price discovery’ (the act of deciding the proper price of a share/security through timely, publicly available information) plays a pivotal role in economic advancement.

The share market (stock market) is an essential part of the modern ‘capitalist’ economy. Without properly functioning share markets, many countries would not be as prosperous as they are. The share market serves as an indicator of the state of the economy as well. A gradually rising share market is usually aligned with a growing economy and increasing investor confidence. A share market’s orderly, fair, and transparent process of ‘efficient price discovery’ (the act of deciding the proper price of a share/security through timely, publicly available information) plays a pivotal role in economic advancement.

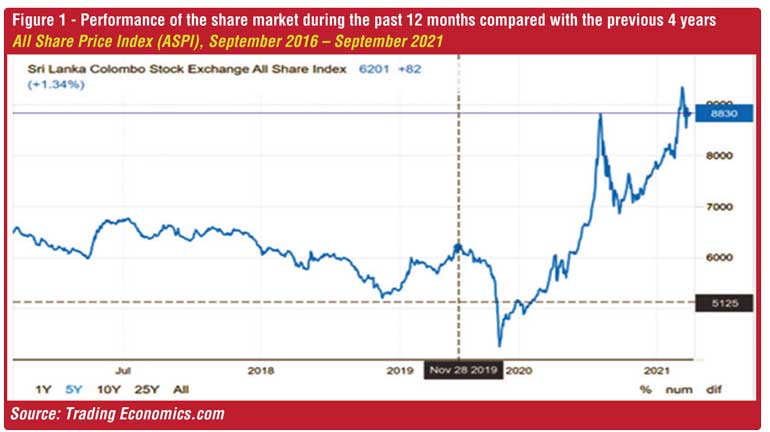

A four-year gradual decline of Sri Lanka’s share prices since 2016 with a sharp drop in March 2020 caused by the economic uncertainties of COVID-19 has now ended. The market began to pick up (despite minor corrections) from April 2020 and had recovered some of the past losses by the end of December 2020. In January 2021, a record-breaking rise in share prices took place: the All-Share Price Index (APSI) increased by 30.35% (or 2056 points) and the index of the largest 20 companies (S&P SL 20) increased by 31.2 % (or 835 points) (Figure 1).

Bloomberg recognised that these increases were the best in the world. The Prime Minister of Sri Lanka, understandably, congratulated all participants of the market for this outstanding achievement. Continuing the gains, the year-to-date (YTD) ASPI is up 39.65% and S&P SL20 by 34%. The Colombo Stock Exchange’s (CSE) market capitalisation is up by 42% YTD to Rs. 4.215 trillion. Both the ASPI and S&P SL20 gained 5% in September 2021 (Daily FT, 1/10/2021).

The recent seemingly outstanding performance of the share market is of course an excellent outcome, particularly for the investors who invested in shares prior to the sharp price increases. However, an examination of this performance of the share market is warranted as it occurred without any gains in the real economy or in the performance of the companies. The purpose of this article is to shed some light on the remarkable performance of the share market and suggest some strategies for investors to secure and enhance their gains. As the role of the policy advisers and the Government is also crucial for investor confidence some comments are directed at them.

As Figure 1 depicts, ASPI did not record an overall increase for the period 2016-2020. A gradual decline since 2016 was followed by a sharp drop in March 2020, but the Index recovered by September/October 2020. Almost 60% increase in the Index during the past 12 months, and a particularly the sharp increase of 30.35% in January 2021, has cancelled out all the losses suffered during the previous four years. The Index recorded a mere 1.34% increase for the past five years. (Computations are as of 28 September 2021).

As can be seen in Figure 2, the S&P 20 (the largest 20 companies index) also shows a similar pattern to ASPI. Interestingly, its decline in the previous four years (2016- March 2020) was slightly more than the decline of APSI during the same period. The increase in the index during the past year (42,26%), including the sharp increase in January 2021 (31,2%), has cancelled out almost all the losses suffered during the previous four years. The Index decreased only by 1.37% during the last five years. (Computations are as of 28 September 2021).

The performance of the share market (both indices) in Sri Lanka during the last year, particularly since early 2021 is outstanding. Compare this with the disappointing performance of the share market during 2016-2019. Another comparison is that, on average world indices increased just by 12% so far this year. The broad index of USA share market, S&P500 increased only by 20% since the beginning of 2021.

Some concerns

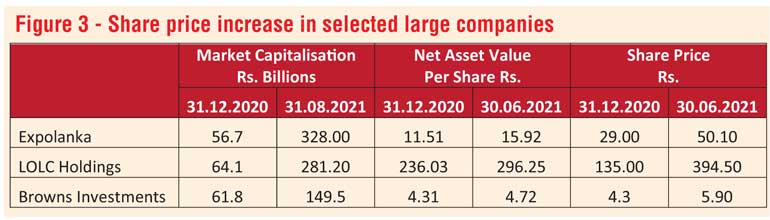

The sharp rise in the share market has been driven by a few large companies (Figure 3). The share prices of some of these companies have increased almost two to three-folds within six months without the backing of the net assets per share (NAV). It is not unusual for growth companies to have a large divergence between their NAV and market share price (e.g., Google [Alphabet Inc.]). Without specific information about the realistic growth prospects of these companies, it is not possible to make any concrete judgements. However, this is concerning and needs to be further examined.

Another intriguing feature of the recent share market ‘boom’ in Sri Lanka is that it has happened against the backdrop of foreign investors leaving en masse the market. This is very concerning. They dumped net $ 273 million (about Rs. 56 billion) worth of shares in 2020, and net $ 25 million (about Rs. 5.1 billion) worth of shares in January 2021 (Bloomberg). This exodus is continuing. The increase in the share market indices in Sri Lanka came solely through local investors. They have bought a gross Rs. 345 billion worth of shares in 2020, and further Rs. 155 billion worth of shares in January 2021 (source: Colombo Stock Exchange). This suggests that the recent boom has been entirely driven by share purchases among local investors.

Reasons for the outstanding performance of Sri Lankan share market during 2020-2021

The immediate reason for the outstanding performance of the share market is the heavy buying by local investors. This leads to the next question: What made them to invest heavily in shares in 2020 and 2021 amidst the COVID-19 pandemic?

The main reasons are:

1)Sharply increased money supply (M2) in the country. The addition to money supply during 2019-20 was Rs. 1,781.6 billion, and in 2021 (up to June) Rs. 627 billion. The total money supply increased to Rs. 10,033 billion by July 2021 (Source: The Central Bank of Sri Lanka). The money supply increased mainly because of “money printing” by the Central Bank of Sri Lanka to provide funds to the Government to overcome the shortfall in its revenue (budget deficit) and to pay foreign debts. As of 1 October 2021, the Central Bank had provided Rs. 1,669 billion of printed money (FVMP) to the Government (Ceylon Today, 02/10/2021). (The heavy outflow of foreign exchange from the country negated some of the effects of this heavy money printing on the total supply of money in the country, Wijewardena, Daily FT, 28/9/2021). The increase in the total money supply has made money abundant and cheap in the economy. Obviously, a significant portion of this increased money supply has ended up in shares.

2)Reduction in the reserve requirements (SRR; the money multiplier of the banks) by the Central Bank. Commercial banks have increased their lending and all except one main commercial bank reported sharply increased profits for the past year. Due to lack of data, it is not possible to examine the purposes for which the money was lent. It is assumed that a significant portion may have ended up in shares.

3)Reduction in interest rates: The Central Bank of Sri Lanka reduced its policy interest rate from 6.5% to 4%. Investors could borrow money at a lower interest rate than before, and some investors seem to have bought shares using the borrowed money (and on margin accounts). Similarly, the interest rates of treasury bills have been forced down by the Central Bank to facilitate the Government to borrow cheaply (Wijewardena, Daily FT, 28/9/2021). Lack of demand for treasury bills indicates that the financial institutions have been using their money elsewhere, perhaps for buying shares or for lending to clients for buying shares.

4)The pandemic stimulus package given by the Government for businesses in 2020: the package included the Central Bank releasing Rs. 230 billion at rates between 4% to 4.5% and giving 15-year tax exemptions for some investors.

5)Increase in personal income tax allowance to Rs. 3 million and VAT threshold to Rs 300 million, scrapping of PAYE tax and withholding taxes, Reduction of income tax rates, VAT (from15% to 8%), standard corporate tax (from 28% to 24%)

6)Perceived beneficial or less harmful effects of COVID-19 for listed companies, mainly to large companies (e.g., supermarkets chains, financial institutions). This superficial observation partly based on the sharper increase in the S&P 20 Index than the increase in ASPI.

All these factors seem to have led to investors engaging in hedging behaviour (seeking cover) against expected future inflation by investing in shares; speculative behaviour with the hope of making a quick profit; and genuine investing behaviour with a preparedness to take moderate risks with the expectation that the future returns from shares will more than compensate for the risk they are taking. (This last type of behaviour is generally considered a good thing for the share market and the economy.)

The conclusions that can be made from the foregoing analysis are:

a)The share market in Sri Lanka achieved unprecedented and unparalleled growth during the past nine months. This is a welcome reprieve for the shareholders who had been languishing during the preceding four years.

b)This growth was triggered by monetary and fiscal measures: increased money supply (liquidity) in the economy, low interest rates, stimulus packages given to businesses, various tax reductions and exemptions.

c)The investors have engaged in more than usual hedging, speculation, and risk-taking behaviours.

d)The share market growth did not happen as a result of achieved earnings (performance of companies) or economic growth (performance of the economy). This was generally the case with USA markets too.

Outlook, precautions, and strategies

Holding on to the sharp gains accrued from the beginning of this year, while facing new risks that are in the horizon, is going to be a challenge. Possible disruptions in international supply chains and shortages of goods ranging from semiconductors to rice can affect the performance of companies (see, Harvard Business Review article: https://hbr.org/2020/09/global-supply-chains-in-a-post-pandemic-world). The Central Bank has already announced its intention to use monetary policy tools to unwind the monetary stimulus. Share markets generally like to see more money and low interest rates in the economy.

In addition to the economic and business risks faced by the market, the alleged manipulative behaviour and insider trading; herd behaviour and panicked buying and selling by the individual investors present another layer of risks. The reopening of the country after a successful vaccination program may give an opportunity to the economy to operate in full swing with a renewed vigour to catch up lost grounds.

However, there is much to catch up in terms of real economic growth (GDP growth) and earnings of companies to catch up with the already increased prices. Shareholder’s expectations are already ‘priced’, i.e., reflected in the existing share prices. If these expectations do not materialise, the share market could be seen as a ‘bubble’ and a harmful panic-mode might set-in.

Having a broad, well-diversified share portfolio positioned to gain from the expected post-COVID-19 economic recovery is likely to be a good strategy. While diversification reduces the expected/actual return from shares, it reduces the risk more. It is important to identify sectors and companies therein which might benefit from the opening of the economy after COVID-19. It is prudent to construct/rebalance portfolios with prospective winners within those sectors.

Then there is the choice between ‘growth’ and ‘value’ in forming the portfolio. For defensive investors, it is prudent to maintain a balanced position. Investors should also think about having a broader portfolio including shares, cash, real assets (e.g., land, gold, antiques) given the possible volatility in share prices and the probable depreciation in the value of money (i.e., the Rupee).

Some comments for the Government and policy advisers

When evaluating the effect of recent increase in share prices on the wealth of the population, one needs to keep in mind that only a small percentage of people in Sri Lanka directly own/invest in company shares. Hence, the positive wealth effect of the increased share prices for the public is negligible. The overwhelming majority of people who did not have direct or indirect investments in shares have become relatively poorer, widening the country’s wealth (and income) disparity. While allowing rich and well-to-do people to create and enjoy their wealth, the government need to collect income, profit, and capital gain taxes at reasonable levels to find money to provide social services and to look after the less fortunate people of the country. The generous fiscal and monetary stimulus given to the business sector has enriched the already well-to-do/high-net-worth sections of the community.

In making their investment decisions, share market participants (investors) always think about the future, not about the past. Their expectations about the real economy, the real performance of the companies (the future returns: capital gains from further increases in share prices plus dividend income) are the things they consider when they buy, continue to hold, or sell shares.

If Sri Lanka is unable to achieve a significant economic growth, companies will not be able to maintain their performance and growth. In such a situation, further healthy increases in share prices and payment of dividends will not be possible; even maintaining the current level of the share prices will become a challenge.

To achieve and sustain a significant economic growth, business entrepreneurships need to be encouraged and facilitated, and markets need to be allowed to function. Judging from the past record, direct involvement by the Government or the bureaucracy is not a viable alternative. It is no secret that most of the state-owned enterprises (e.g., SriLankan Airlines, Petroleum Corporation) are a drain on the economy. The Government and the policy advisers seem to mix up the recent share market performance with the growth prospects of the economy at large. To ensure real economic growth, the Government needs to maintain a business-friendly environment.

The above companies belong to Transportation, Diversified Financials and Capital Goods sectors, respectively.

(Professor Samson Ekanayake is a former Head of Finance and Financial Planning disciplines at Deakin University Australia. He has held several senior management positions in academia and commerce during a career spanning over 40 years. Share Market, and Financial Risk Management are two of his research areas.)