Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 15 December 2020 00:01 - - {{hitsCtrl.values.hits}}

Last month a Sri Lankan online entrepreneur had to return investor money due to overvaluation of the company. This does not bode well for Sri Lanka’s reputation, which is battling the second wave of the pandemic and was also just downgraded by Fitch Ratings – Pic by Lasantha Kumara

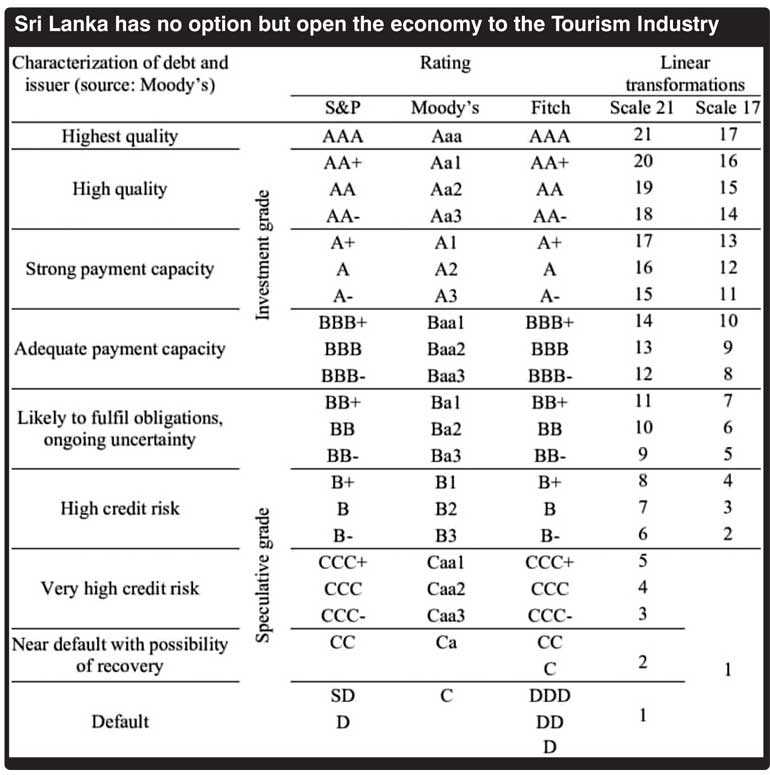

Last week the announcement by Fitch Ratings where Sri Lanka was downgraded to CCC on the criteria of ‘Long Term Foreign Currency Issuer Default Policy (IDR)’ shocked the business community given that import control is yet at play whilst Sri Lanka saves almost three billion from those who travel overseas for leisure and business.

In this backdrop to pay the stipulated debt of around $ 4 billion will not be a challenge. The decision by Fitch to my mind was harsh on a country that has never defaulted on its payments.

SL at level 4?

Whilst the Fitch report shook the foundations of Sri Lanka, we see that the pandemic is creating havoc in the country. Based on the reports emanating from the Public Health Inspectors (PHIs) and Mayor Rosy Senanayake, the direction pointed that Colombo is at level 4, which means that we are at community spread.

Presently 29,000 infected and 150 dead with sub clusters of the virus emerging in the Prisons and Police community does not augur well for a country that was ranked the second best performing globally for the management of COVID-19.

The reality from the Brandix Pokura has had a natural death including the AG’s direction for a formal investigation by the Police. The announcement in Parliament on the Ukrainian crew story did not get traction as many knew there was more to this underneath.

The news article on the controversy of Temple Trees being under lockdown further coloured the reality of the situation with the riot in the Mahara Prison adding salt to the wound.

In summary, Sri Lanka is in a catch 22 situation and we in the private sector must support the country as we are all fighting a new global enemy – COVID-19. The global statistics do not augur well as the number has crossed 60 million with 1.4 million fatalities too.

One wrong move?

What is sad to note is that on 22 October, Sri Lanka had the issue of the pandemic very much under control. I yet remember the day that UNICEF announced a ‘commendation’ note to Sri Lanka for having an enabling environment for kids to attend school. The lesson to the world is that ‘one’ slip and the virus eats into the country and then it hits the economy. It happened to the world and we saw Sri Lanka succumb to it with the second wave.

Good news

The good news is that Sri Lanka has mastered the art of identifying and then tracking the close contacts and isolation till the virus is dead. The Minuwangoda cluster that has ballooned to 25,000 plus is now dying with just under 50 patients daily. We have also seen the reality of making our companies work and keep the economy ticking. We have to ensure that the poverty rate will not hit the people who are sitting on the poverty belt.

Vaccine – Seven billion market

In the backdrop of the uncontrollable virus that is raging across the world, latest data reveals that more than 150 coronavirus vaccines are in development phase of the new product development process. The private sector is working round the clock to capture the opportunity that can make a company a billion dollar business over night. From a marketing perspective it’s an opportunity that happens only once in a million years. One product demanded by seven billion people is a ‘dream’ new product opportunity for a company.

Reality – 61 million/1.4 m deaths

Unfortunately the reality is different. We have been able to send a man to the moon or even do a brain transplant but the solution to the COVID-19 virus that has affected 61 million people and 1.4 million deaths is yet to be revealed.

The US Government has pledged $ 10 billion to develop and deliver 300 million doses of a safe, effective coronavirus vaccine by January 2021. The World Health Organisation is working on targeting to deliver two billion doses by end 2021. But no one can say that it is 100% safe and normally the incubation process of a vaccine is eight to 10 years. The brands to be launched in the next two weeks have taken only seven to eight months.

The top six vaccines?

It will be great if the efforts work so that we can once again move the global economy that is reeling towards a negative growth. But let’s keep in mind that the world took almost 15 years to bring a vaccine to market for mumps, which was the burning issue in the 1960s. Let’s also keep in mind that even after a vaccine is approved by FDA, the time taken to set up production and distribution is a tough task, especially if the temperatures required are -70 to -20 degrees.

The top six brands in the running are: 1) Oxford University: Named ChAdOx1 nCoV-19 from UK; 2) Pfizer: Named BNT162b2 from the US; 3) Sinovac: Name CoronaVa from China; 4) Moderna Therapeutics: Named mRNA-1273n from Massachusetts; 5) Sputnik V from Russia; and the final pick is 6) Bharat Biotech: Named COVAXIN from India. Let’s see how the diffusion process works where demand exceeds supply.

Fitch view of SL

Whilst Sri Lanka and the world is grappling on the COVID-19 issue, the downgrade to CCC from B- means that Sri Lanka is going to be increasingly challenged to meet repayment of external debt in the medium term.

The shock to the economy due to COVID-19 has resulted in a -1.6% GDP growth in Q1 and it is rumoured that Q2 is at -17%. Sri Lanka was just about recovering in Q3 when the second wave has once again created a blow to the economy.

The debt that we must service between 2021 and 2025 is $ 23.2 billion, which is $ 4 billion a year on average. The above GDP growth performance sure adds pressure to the country which is the logic that Fitch infers in the report released. But the good news is that Sri Lanka as a nation is very resilient in nature and has demonstrated a V-shaped recovery on industrial production and export performance as at July 2020, post the first wave.

To be specific from a $ 425 million monthly export performance during the first wave, by July Sri Lanka had fought back to a $ 1 billion revenue performance with companies like Singer demonstrating a 40% growth which sure tells us the fighting spirit of the private sector.

The Fitch report goes on to cite that the financing model needs to be reshaped as on average there is a high general government interest to revenues ratios. To be specific the revenue ratio from 2016 to 2020 is about 50%, substantially above the ‘CCC’ peer median by 11% says the report.

The key point highlighted is that Fitch believes the combination of financing sources like bilateral, multilateral and commercial financing can be challenging due to the current debt stock. The declining foreign exchange reserves which is at $ 5.9 billion adds to the down grade is the view of Fitch.

S&P lowers to CCC+

In the backdrop of the Fitch rating, S&P Global Ratings last week followed suit by lowering its long-term foreign and local currency sovereign credit ratings on Sri Lanka to ‘CCC+’, from ‘B-’, in tandem with the other two rating agencies, Moody’s and Fitch, which have already downgraded Sri Lanka over accelerated external financing risk.

However, the outlook on Sri Lanka’s rating was kept at ‘Stable,’ which reflects that, at this lower rating level, risks to Sri Lanka are relatively balanced over the next 12 months which was the good news for Sri Lanka. S&P forecasts the economy to contract sharply by 5.3% in 2020, largely due to the COVID-19 pandemic. But the rating agency expects the real GDP growth to accelerate to 4.3% in 2021, albeit from a low base and average 4.5% in 2021-2023. Sri Lanka has around $ 4 billion of debt repayments due annually until 2025. Its foreign exchange reserves stand at under $ 6 billion.

S&P expects Sri Lanka’s fiscal deficit to remain elevated at 10.2% of Gross Domestic Product (GDP) in 2021 and narrow gradually to 8.4% in 2023, while net general Government debt will exceed 100% of GDP in 2021 and remain high over the next five years.

SL – Drive revenue to 14.2%

Whilst the above analogy is interesting our objective must to be to increase Government revenue by 14.2% as targeted in the National Budget. We were on track on this KPI until the second wave that took the shine off Sri Lanka. In Q3 it is estimated that the GDP was hitting 7% plus as the Industrial Index got back the pre-pandemic levels and export revenue touching $ 1 billion plus but once again we find the economy in a catch 22 situation between health and money due to the second wave.

The above development will have an impact on the targeted budget deficit in 2021 which is at 8.9% from the current 7.9%, the logic being that the private sector is having issues on sourcing material to HR issues due to the concept of ‘geographic lockdowns’.

Tourism – numbers game

In this backdrop, the opening up of tourism was a no brainer given that the moratoriums on the loans are coming to an end in March and unless we stimulate the industries that have fallen the rating comes into play. Hence the game is on numbers now; 149 people dead with 32,537 people infected which means a 0.45% fatality rate. Hence in the next 35 days we will see 50,000 people getting COVID in Sri Lanka and at a 0.45% fatality rate the number will be another 100 people to be at 250. This is the reality of the second wave. The real challenge to my mind is to ensure that the third wave is avoided with the opening of the borders.

FDI decline -53%

Given the challenges we are up against, the reality is that GDP growth from 2015-2019 is 3.7%. Fitch is of the view that GDP will be at -6.7% in 2020 whilst Central Bank predicted a zero growth just before the second wave. S&P predicts a -5.3%. The 2021 view by Fitch is said to be +4.9% whilst S&P say +4.5%. But a point to note is that this performance will be better than US and Europe which means that we must target FDIs.

Sri Lanka has declined by -53% on FDI from a record level of $ 1.6 billion in 2018 to $ 758 million in 2019. The good news is that the overall FDI stock exceeds $ 13 billion in 2019.

Infrastructure, particularly posts and communication, absorbed the significant portion of inflows to the country. Manufacturing, IT, tourism and infrastructure recorded the highest growth rates but the growing competition between China (in the energy sector) and India (in telecommunications) is taking shape and currently benefiting the Sri Lankan economy and I guess we need to develop on this trend.

Next steps

It’s important to monitor the changing business climate post the vaccination that will be launched next week in the UK, especially in the tourism sector as Sri Lanka is also opening up the borders with the best practices followed by other countries.

(The writer is the Country Head of an International Artificial Intelligence company – Clootrack and based in Sri Lanka. He oversees Maldives and Pakistan.)