Saturday Feb 14, 2026

Saturday Feb 14, 2026

Friday, 4 November 2022 00:00 - - {{hitsCtrl.values.hits}}

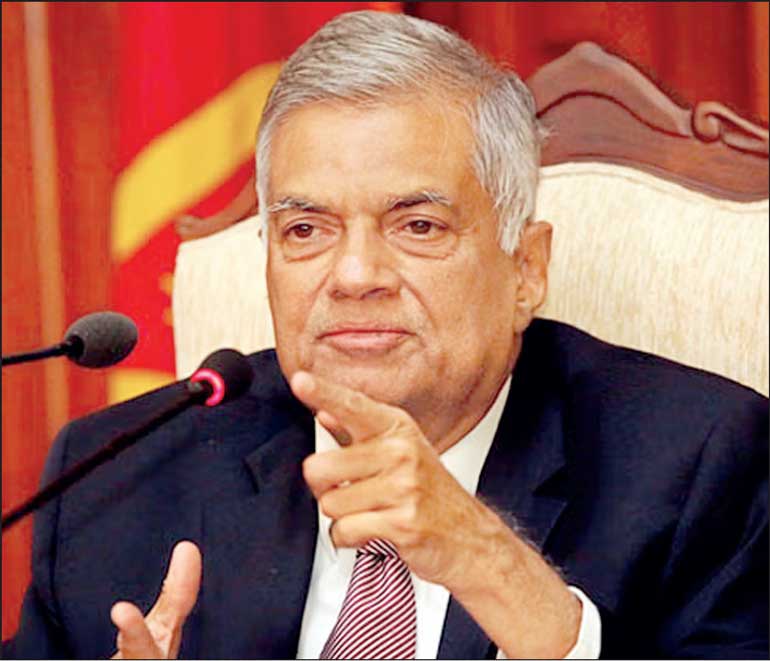

President Ranil Wickremesinghe

President Ranil Wickremasinghe (RW), having inherited a devastated economy from his predecessor, has drawn up a plan, which is more a dream than a plan, to transform Sri Lanka into an export-driven economic paradise by the centenary year of independence, 2048.

President Ranil Wickremasinghe (RW), having inherited a devastated economy from his predecessor, has drawn up a plan, which is more a dream than a plan, to transform Sri Lanka into an export-driven economic paradise by the centenary year of independence, 2048.

Whether he would live to celebrate the realisation of his dream or mourn for its failure, at the ripe old age of 99, none can predict. While wishing him success, it is worth looking at the reality on the ground which, like his predecessor’s dream of “vistas of prosperity and splendour”, points towards a rocky road with lots of pot holes.

The primary task that confronted RW was to restore some semblance of economic stability to arrest the rapid descent towards the point of nadir. Without any indigenously drawn economic agenda, the only alternative available to him was to seek external help and that too through the celebrated IMF – the lender of last resort to troubled economies in the neo-liberal world order.

For the 17th time in its history, Sri Lanka went to the IMF for instructions and funds. To any student of international economics, the typical prescription from IMF is a familiar lesson. Accordingly, the first instruction by IMF to any economy that suffers from a twin deficit, i.e., in budget and balance of payments, is to repair the first to tackle the second. However, both repairs could be undertaken simultaneously if the Government in power could structure an inclusive economic plan with a fixed timeframe. RW’s Government does not have it.

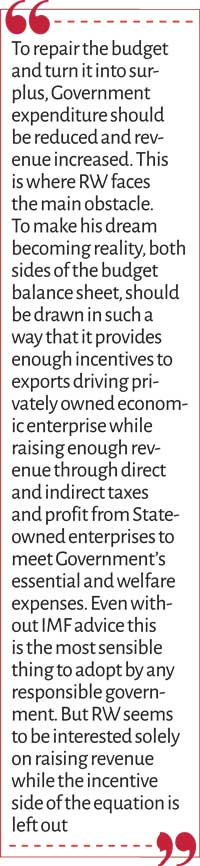

To repair the budget and turn it into surplus, Government expenditure should be reduced and revenue increased. This is where RW faces the main obstacle. To make his dream becoming reality, both sides of the budget balance sheet, should be drawn in such a way that it provides enough incentives to exports driving privately owned economic enterprise while raising enough revenue through direct and indirect taxes and profit from State-owned enterprises to meet Government’s essential and welfare expenses. Even without IMF advice this is the most sensible thing to adopt by any responsible government. But RW seems to be interested solely on raising revenue while the incentive side of the equation is left out.

Firstly, raising the rates of direct taxes on personal and corporate incomes is no way to provide incentives to export oriented enterprises, which have to be the backbone in RW’s transformation strategy. Yet, the Ceylon Chamber of Commerce (CCC) has accepted these rates although with a piece of advice to RW to discipline public expenditure. The question is, will CCC also advice its own members not to indulge in tax evasion exercises in the name of tax minimisation by way of expert or shoddy accounting practices and exploit the weakness in Government’s tax administration.

While imposing his taxes RW has not taken any step so far to improve the efficiency in tax collection. CBSL Chief Dr. Weerasinghe’s advice not to allow any exemption from tax obligation should be taken as a hint at the unethical practices prevailing in tax administration. In the area of personal income tax also the burden of payment would fall more on public servants whose pay packet would be net of taxes while employees in the private sector would be allowed to report their taxable income at the end of the financial year.

In short, without reforming tax administration and punishing tax dodgers there is no way RW would reach his revenue target through direct taxes. If private companies feel that tax rates are excessive, they would try to shift their theatre of action to low-tax countries, which would jeopardise RW’s export strategy. Everything hinges on tax administration which is operating in a system infested with corruption.

This is why the onus of collecting tax revenue falls heavily on indirect taxes notably the VAT. In the name of broadening the tax base, low-income earners are netted into the tax scheme. Even an unemployed person who goes to purchase a couple of tablets for his or her headache for example would be paying VAT. There is obviously economic injustice in resorting to indirect taxes.

To balance that however, IMF has recommended the implementation of a safety net, and to meet the financial burden arising from it RW has introduced a welfare tax. Once again, in a system that has no up to date data on families and individuals entitled to receive welfare payment on the one hand, and with corrupt administrators on the other, distribution of welfare benefits would be a source of wide discontent.

The target of raising Government revenue by 65% in 2023 of which 90% is expected to come from taxes is unrealistic given the short comings of tax administration. In the meantime, to make the tax burden acceptable and ease the pain it is causing, there had been occasional announcements of price reduction on selected consumer items. Having raised the price of an item by 100% for example and then reducing it by 10% is a form of cheat.

Secondly, on the expenditure side, RW is faced with two major issues on which he has said nothing so far. An over-sized public administration with an army of an otherwise unemployable staff, and a 300,000 strong security-personal including the Army, Navy, Air Force and Police are an unaffordable dependency burden placed on Government’s meagre resources.

The first is the product of swabasha education and the second the result of war against Tamils. The genesis of both lies in the politics of ethno-nationalism, the bane of the country. IMF would have advised RW to downsize the two, but he would know the political danger in listening to that advice. This is another pot hole along his road to transform the economy.

Thirdly, the SOE white elephants. They are a drain on the economy, but privatising them, which IMF would love, is not the solution. They are continuing to run at loss, because of corruption and nepotism. Unwilling to clean them up, because of political fallout, RW has decided to sell them for dollars. Once they are sold and privately-owned either by local or foreign agencies, consumers would be forced to pay the price set by the monopolists for goods and services delivered by them. Will there be any control or ceiling on those prices? When a SOE sets the price there is also a welfare element added in it, which will disappear under private pricing.

Thirdly, the SOE white elephants. They are a drain on the economy, but privatising them, which IMF would love, is not the solution. They are continuing to run at loss, because of corruption and nepotism. Unwilling to clean them up, because of political fallout, RW has decided to sell them for dollars. Once they are sold and privately-owned either by local or foreign agencies, consumers would be forced to pay the price set by the monopolists for goods and services delivered by them. Will there be any control or ceiling on those prices? When a SOE sets the price there is also a welfare element added in it, which will disappear under private pricing.

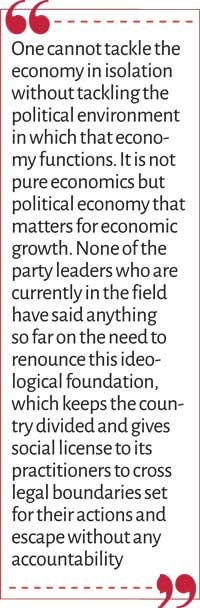

In whichever way one analyses the difficulties facing the economy in moving forward, politics and the ideological foundation on which it operates present a stumbling block. One cannot tackle the economy in isolation without tackling the political environment in which that economy functions. It is not pure economics but political economy that matters for economic growth.

None of the party leaders who are currently in the field have said anything so far on the need to renounce this ideological foundation, which keeps the country divided and gives social license to its practitioners to cross legal boundaries set for their actions and escape without any accountability. RW too, without addressing this fundamental issue, hopes to create the unity needed for his economic transformation, just by offering pardons and amnesties to victims of this pernicious ideology.

To illustrate how ethnonationalism has affected the economy one has to look at the fate of the plantation industry, particularly tea production. By the time the British left, Ceylon tea had already captured a niche market internationally.

After independence, in the name of export diversification and industrialisation, this industry received only a stepmotherly treatment from successive governments. But one of the factors that drove that policy was the fact that tea plantations were dominated by Tamil labour. It is this ethnonational politics that still hinders economic development. Today, Ceylon tea has lost its niche status to other competitors, a historic tragedy.

In the final analysis therefore, without an ideological transformation that should be reflected in the Constitution of the country, even if the President were to achieve zeroing the budget deficit, the dream of transforming the economy to another export-driven mini dragon and raising Sri Lanka to First World status would, in all probability, remain just a dream.

(The writer is from the Murdoch Business School, Murdoch University, Western Australia.)