Monday Feb 23, 2026

Monday Feb 23, 2026

Monday, 31 October 2022 00:00 - - {{hitsCtrl.values.hits}}

Tax hikes

Tax hikes

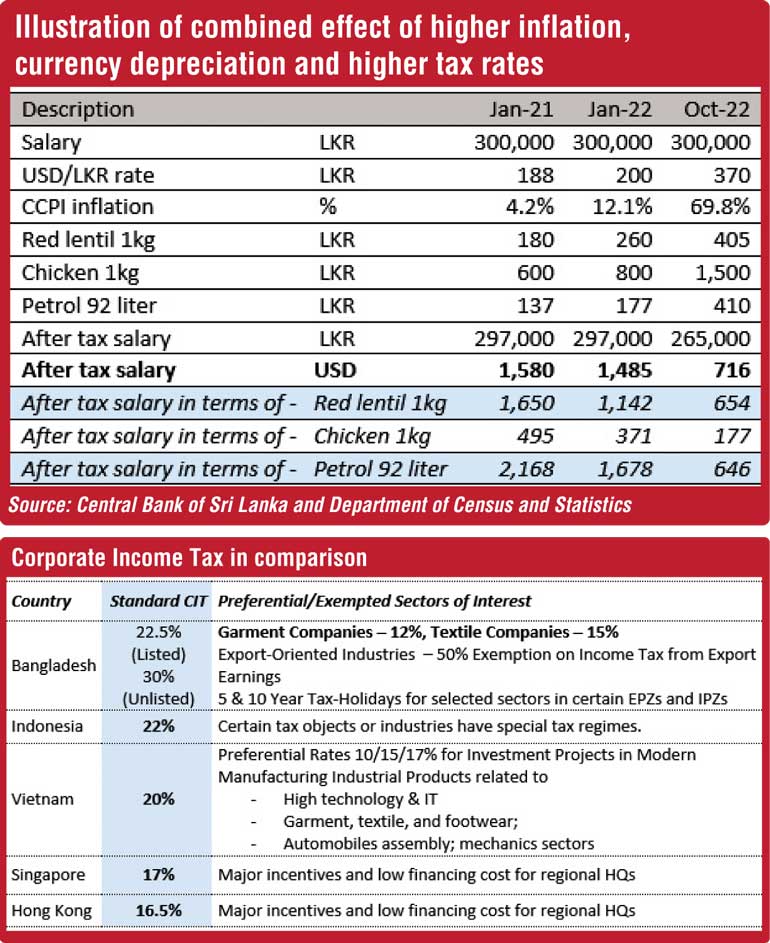

The Government of Sri Lanka introduced further tax reforms less than three months after the interim budget was presented by the President in September 2022. Under the proposed new tax reforms, most tax rates applicable for individual income taxes and corporate income taxes were raised. Individual income tax which was capped at 18% at the highest bracket previously, is now raised to 36% while corporate income tax increased from 24% to 30%. The most significant change came in the form of removal of concessionary rates offered to economically important segments such as agriculture, industry, and exports.

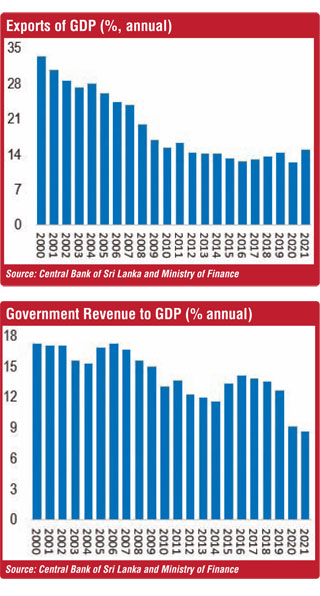

It is a well-understood fact that Sri Lanka has over the years experienced a reduction in the Tax to GDP ratio; as a result, the country was running a huge and unsustainable fiscal deficit to finance mostly inelastic public expenditure. The tax hike came at a time of severe distressful economic conditions with galloping runway inflation of around 70% with depreciation of LKR against USD of around 70-80%.

|

| President and Finance Minister Ranil Wickremesinghe

|

|

Individual income tax

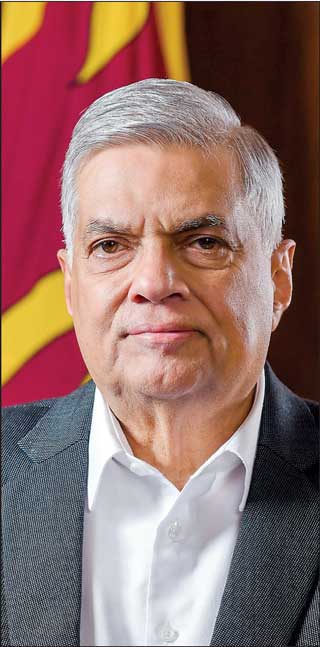

Though it was discussed at length, the root cause of the current economic problem is often misunderstood by many Sri Lankan citizens. For the past three decades, our reliance on an inward looking economic policy led by disproportionately heavy, debt-funded public spending, the complete negligence of an export-oriented industrial economy and failure to link Sri Lanka with the rest of the world’s supply chain, could be identified as the main structural reason for the economic crisis. Economists argue that the GDP growth since 2000 was largely derived from the non-tradable sectors while the tradable sector contribution to the GDP has diminished over the decades.

It is important to understand the difference between tradable goods and non-tradable goods and the implication of a growth model driven by the non-tradable goods. Non-tradable goods can only be consumed within the economy in which they are produced; they cannot be exported or imported. Tradable goods are exported and imported

across the borders. Countries could export tradable goods and earn foreign exchange. In contrast, non-tradable goods do not generate export income; hence the country cannot earn foreign exchange.

The long-term growth derived from non-tradable goods will increase the wealth of citizens, but won’t generate any export income. The economic growth though it is derived from non-tradable goods will increase disposable income of the people. Higher disposable income will increase the demand for imported goods. Sri Lanka’s economic growth in the last decade primarily derived from non-tradable sectors and higher disposable income increased the demand for consumer goods such as motor cars, fuel, electronics which are not produced in the country. Low exports or low foreign exchange inflows and more demand for imported goods created a continuous gap between merchandise imports and exports.

The higher tax should technically discourage consumption by lowering disposable income and reducing the purchasing power. Taken together, higher inflation, currency depreciation and higher tax rates should severely curtail the spending power and as a result should reduce demand for imported goods. This should cushion the impact on exchange rate in the long term.

Though the proposed tax is expected to higher revenue for the Government, the increased tax rate does not attract any new layers to the tax net. This hike will only serve to charge more tax from the existing taxpayers. No action is proposed to broaden tax net by taxing the informal sectors.

The large number of individual income tax payers are employed in the formal corporate sector with a high calibre of formal education and professional qualifications. The labour in the formal sector is highly movable. The current tax hike will speedup already experiencing severe brain drain as formal sector employees find it extremely difficult to maintain their lifestyle being employed in Sri Lanka.

Tax on exports

While corporate income tax rate was raised to 30% from current 24%, most concessions given to economically important sectors were removed. Key sectors amongst the affected are exports and agriculture where the tax rate was increased from 14% to 30%. One will argue that exports sector LKR income has grown due to exchange rate depreciation and the sector has good profitability. This is a fallacy and this tax hike is viewed as an extension to the three-decade-long export discouraging and isolating economic policy. This policy could deprive Sri Lanka whatever small foreign exchange earnings base from exports.

Export companies in many sectors are globally competitive and mobile. The sector will move to more encouraging, business friendly and competitive destinations. With this proposed hike, Sri Lanka will be very uncompetitive in terms of corporate income tax among its peer group countries. On the other hand, cost base has increased by many folds and exporters are struggling with power cuts, fuel shortage and many other issues.

While the economic crisis and IMF negotiations are forcing the Government to find measures to strengthen revenue collection immediately, the tax policies should target minimising structural weaknesses of the economy, which could propel the country into major structural imbalances in the long run. We are experiencing today the outcome of three-decade-long short-sighted policies. In 2016/17, an international consultancy firm suggested with their experience in other similar countries and results of a desktop audit that the country’s tax net could be broadened 2X with implementation of such a program. However, no government has opted to look into similar broad base tax reforms; instead resorts taxing the easy, already taxed segment. If the country plans to continue these tax policies without serious efforts to broaden the tax net learning from international experiences, the country will not be able to achieve adequate revenue growth.

Further, the government expenditure is inelastic with huge interest cost and inflexible state sector pay structure including a large non-productive military budget. Though a disproportionate amount of funds are spent on the state sector, the productivity of such expenditure is extremely low. Thus, the proposed tax reforms not only fail to resolve structural issues, it will also aggravate issues such as brain drain and deceleration of exports.

(The writer is a CFA charterholder; capital market specialist and Certified FRM. The views and opinions expressed in this article are those of the writer and do not necessarily reflect the official policy or position of any institution.)