Saturday Feb 21, 2026

Saturday Feb 21, 2026

Wednesday, 3 March 2021 00:00 - - {{hitsCtrl.values.hits}}

The coronavirus pandemic forced thousands of small businesses across the country to close their doors and quarantine. Many have lost their investment, jobs and their business. A year later, many businesses are still struggling to recover—some never reopened. The outbreak of COVID-19 and resultant lockdowns have cast a heavy toll on SMEs – Pic by Shehan Gunasekara

Overview

Overview

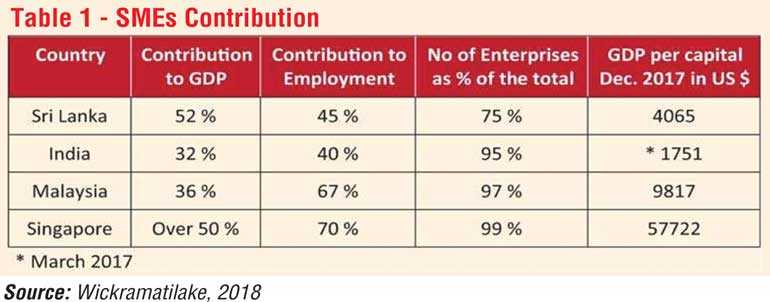

Entrepreneurship is a major contributor to the Sri Lankan economy. Most of the developed countries are relying heavily on this for their growth. The Micro Small and Medium Enterprises (SME) plays a vital role in the socio-economic development of the country. The Sri Lankan SME sector with over one million SMEs account for approximately 75% of the total number of enterprises while providing 45% of the employment and contributing 52% for the GDP. It is considered as the backbone of the economy. In Sri Lanka it is estimated that the MSMEs account for over 90% of the total enterprises in the non-agricultural sector and 45% of the total employment.

But the ongoing COVID-19 pandemic is causing untold human suffering across the country and is likely to leave an indelible impact on the continent’s small and medium-sized enterprises (SMEs).

Table 1 shows the SME sectors contribution to the GDP, GDP per capita, number of enterprises established and employment of several countries including Sri Lanka. This table’s figures prove that the GDP contribution of Sri Lanka is higher when compared with India, Malaysia and Singapore indicating the SMEs’ contribution to the economic development. Yet, the SMEs’ contribution to employment is relatively low when compared with Malaysia and Singapore.

So, COVID-19 lockdown has decreased economic activity significantly. Supply chain disruption has caused SMEs to face a longer cash conversion cycle. SMEs also need to continue paying recurrent costs for their business continuity, such as office rental cost and salaries to their employees. As a result, SMEs are incurring losses and delaying debt payments. SMEs’ immediate financial needs have been sharply increasing to (i) minimise the negative impacts of business disruptions and retain employment and (ii) take precautionary measures for the uncertainty of the scale and duration of the impacts of COVID-19.

The impact of COVID-19 on small enterprises

SMEs are the livelihood of Sri Lanka’s economy—and also the most at risk. COVID-19 is undoubtedly the biggest threat to our economy of this century. The coronavirus pandemic forced thousands of small businesses across the country to close their doors and quarantine. Many have lost their investment, jobs and their business. A year later, many businesses are still struggling to recover—some never reopened. The outbreak of COVID-19 and resultant lockdowns have cast a heavy toll on SMEs. Affected by problems of logistics blocks, labour shortages, and drops in demand, more than 80% of SMEs temporarily closed at the time of the first wave in 2020. At this point, we are going to see how much the loss caused by COVID-19 has affected the small business and recover from it.

It is the largest health crisis in living memory and the major economic crisis after the economic recession in 2007. It is clear that this pandemic is creating a vast significant economic impact globally. According to a global survey conducted by ACCA, the predicted fall in the global private economic output was 10% due to the lockdowns. At such a situation, the Asian Development Bank (ADB) has estimated that COVID-19 will cost Sri Lanka’s economy 1.5% of the GDP (Silva, 2020).

Even at the new normalcy, businesses everywhere are investing more in health and safety protocols to keep their customers and their employees safe. Many business owners are retraining their workers to thrive in a post-pandemic world. And drastically more employees are working from home more often. Thereby, there is a big need of SMEs to focus on new strategies in order to survive the economic crisis occurred due to COVID-19 and face any other such crises in the future while the Government itself has an important role to play regarding this.

Challenges

Many SMEs have already experienced a dramatic drop in demand. So, there are number of challenges have been facing by the SME holders after this pandemic such as attracting customers, retaining or recruiting skilled employees, accessing financial investment, expand business with adopting new technologies and many are the biggest challenges to continue the small enterprises. So, the first casualties of a recession or any economic shock—and the hardest hit—are SMEs

Reducing size of business in order to survive

The ILO has forecast that the pandemic could reduce global working hours by nearly 7% in the second quarter of 2020—equivalent to 195 million full-time jobs. McKinsey’s analysis suggests that, in regions as diverse as Africa, Europe, and the United States, up to a third of the workforce is vulnerable to reduced income, furloughs, or layoffs as a result of the crisis. Many millions of jobs could be lost permanently. That, in turn, would greatly dampen consumer spending, with knock-on effects across economies.

So, generally for the SMEs, it is a problem to keep the employees without an income generation from the business. So, it is imaginable that there will be lay-offs of temporary and contract basis employees while the permanent staff or the employees who perform the most important tasks in the SME businesses will be retained and advised to follow the work from home rule.

So, reducing or pivoting can be viable solutions to these challenges, but these create additional problems. Small businesses might be a one-person operation or a staff of a few. Therefore, cutting staff is not an option if they are already small, in times of trouble.

Hard to maintain customers remotely

In addition to attracting customers, maintaining them or encouraging them to return is even harder during times of crises. Relationships need nurturing even during “normal times.”

Difficulties in digitalisation

Small business customers about their challenges during COVID-19, how their business is doing these days and if they are able to make the move to digital.

Weaker financial structure

SMEs holders when they do have the access, they must borrow at a premium, or the alternative is borrowing from sub-prime lenders at a much higher rate of interest. In Sri Lanka, the problem of access and the cost of borrowing is severe. So, small businesses have less access to massive funding as they do not have the support of a larger corporation or credit rating that an established conglomerate can provide. In times of crises, they can be especially vulnerable as they might have a low credit rating or none at all.

There are currently two additional challenges:

1) less demand for their products and services

2) delays in payments from customers, which in turn delays their own ability to pay their suppliers on time. Delays in payments can happen in normal times, but are compounded in times of crises – paired with the uncertainty of when the market will recover again can lead to the business closing-down completely.

Government measures

Health systems across the world were struggling to cope up with the rapidly increasing number of COVID-19 cases in March 2020. The Sri Lankan Government, too, put several measures in place to contain the spread of the disease, starting from 12 March 2020. At that time, Government took many measures to support as a relief to the businesses, the Sri Lankan Government took steps and advised banks and other financial institutes to halt the collection of business loan repayments for a period of six months.

The Central Bank of Sri Lanka decided to set up a re-financing facility to implement the decisions taken by the Cabinet to introduce a wide range of concessions including a debt moratorium and a working capital loan for COVID-19 hit businesses and individuals (Central Bank of Sri Lanka, 2020).

In addition, there are some key government measures given below.

The Central Bank of Sri Lanka issued the following policies:

Debt Moratoriums:

Further relief measures with respect to existing and new loan facilities for businesses to face low level economic activity

Expansionary Monetary Policy

Liquidity was made available in the system

Way forward

There are some strategies to overcome challenges that small businesses, banks and the state need to change strategy to survive the economic fallout of COVID-19.

Prioritise people safety: Ensuring the safety and wellbeing of the employees in the workplace is essential. People are looking to their employer, community and government leaders for guidance. Addressing their concerns in an open and transparent manner will go a long way to engaging them and reassuring the business continuity. Protect workers: Promote SME sector to deploy the laid-off employees from organisations and make use of unused resources. So, create a granular view of who needs help to keep their job—or find new work.

Districts, and cities can quickly develop a granular view of where jobs are at risk and where there is additional demand for labour—by sector, occupation, demographics, and geography. That view needs to put special focus on small businesses and the most vulnerable workers, including those in the gig economy and the informal sector.

With the support of government and private sector, build smart, cross-sector solutions to get that help to them fast. As governments prepare to reopen economies post lockdown, they need to find smart ways to maximise employment and protect against new infections, following government guidelines and those of their local public-health agencies.

Reshape strategy for clients engaged: at this situation, clear, transparent and timely communications are necessary when creating a platform to reshape the business and to secure ongoing support from customers, employees, suppliers, creditors, investors and regulatory authorities. To keep their clients engaged and maintain an open channel of communication that remains relevant, several measures can be taken even when services cannot be delivered as usual.

These may include offering gift cards to use in the future, updating customers regarding when they plan to reopen again, phone/video call to see how they are feeling, or listening to their feedback so that business holders can improve your pricing, products or services. And consider alternative supply chain options. Companies that source parts or materials from suppliers in areas significantly impacted by COVID-19 will want to look for alternatives.

Financial accessibility: A full financial assistance should be given for the start-up industries which fully generate employment for the locals and use local raw materials for a larger extent. Though, to meet immediate financial needs, public debt relief is unavoidable for some countries. At the same time, governments should strive to widen the tax base, improve tax administration and increase the progressivity of the tax system. Governments can also explore innovative deficit financing methods like sustainability-oriented bonds. Going forward, less conventional financing mechanisms, such as catastrophe risk insurance and multilateral financial safety nets can help in enhancing the fiscal buffer for future shocks.

Create new market opportunity: Exploring new markets for the products which have faced a decrease in the demand. SMEs will have to readjust business and marketing strategies fast to generate revenue in a recessionary environment. For instance, SME exporters who have relied on Western markets will have to quickly shift to China and ASEAN which will come out of the pandemic-related global economic slump faster.

If their services could not be moved online, they could digitalise customer touchpoints such as scheduling or contactless payments and find new ways to communicate and establish a personal connection with their customers. Through digital technology, they managed to keep them close despite their physical distance.

So, once the situation is mitigated, SMEs should re-evaluate how robust their business management was facing the crisis, and then analyse options to become more resilient against future disruptions. At the same time, SMEs should be making decisions and taking actions during crisis with recovery in mind. When the crisis is over, it will be clear which industries have the resilience and agility to reshape their business strategy to thrive in the future.

Footnotes

How to rebuild and reimagine jobs amid the coronavirus crisis, 15.04.2020, mckinsey & company

Building a post-covid-19-resilient economy, 27.11.2020, unescaped.

The impact of COVID-19 on small and medium-sized enterprises: Evidence from two-wave phone surveys in China, 2020 working paper, ifpri.

https://www.vcita.com/blog/insights/balancing-sme-challenges-and-taking-a-look-at-the-new-normal-after-covid-19

The Impact of COVID19 on the MSME Sector in Sri Lanka, May, 2020.

https://journals.sagepub.com/doi/full/10.1177/1847979020971944

https://home.kpmg/xx/en/home/insights/2020/04/sri-lanka-government-and-institution-measures-in-response-to-covid.html

https://www.ey.com/en_gl/strategy-transactions/companies-can-reshape-results-and-plan-for-covid-19-recovery