Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 17 May 2021 00:00 - - {{hitsCtrl.values.hits}}

The Port City at the initial stage should target for facilitation of South Asian trade among the hostile neighbours quite like Dubai facilitated the trades within troubled Middle East

The Parliament of Sri Lanka has announced that the proposed Port City Economic Commission Bill will be debated on 19 and 20 May. It is indeed a positive step amidst the pandemic situation in the country. The focus on the development aspects simultaneously with pandemic control efforts is the key for continuous economic survival. If we fail to focus on economy while attempting to control the pandemic situation, the economic recovery will take long.

The Parliament of Sri Lanka has announced that the proposed Port City Economic Commission Bill will be debated on 19 and 20 May. It is indeed a positive step amidst the pandemic situation in the country. The focus on the development aspects simultaneously with pandemic control efforts is the key for continuous economic survival. If we fail to focus on economy while attempting to control the pandemic situation, the economic recovery will take long.

The Port City Economic Commission Bill by its name is the governing law of the land. It has sub-sovereign status or a certain level of autonomy with regard to commercial operations within the zone, which is not a new concept. The concept of ‘free zone, free economic zones and free financial zone’ is dated and well-established around the world.

I have discussed the Concept of Free Zones and their economic importance in my previous article (http://www.ft.lk/Columnists/Concept-of-Free-Zones-and-their-economic-importance/4-682510). The history of free zones is dated back to 1959; it was first established in Shannon, Ireland known today as Shannon Free Zone, spread across 600 acres adjacent to Shannon Airport (https://en.wikipedia.org/wiki/Shannon_Free_Zone).

Asia quickly learnt and adopted the concept. The countries like Singapore and Malaysia, taking the first mover advantages established very successful free zones. Those free zones played a vital role in economic development of those countries.

The establishment of a free economic zone in Sri Lanka dates back to 1978, the first in South Asia with the enactment of the Greater Colombo Economic Commission and the establishment of Katunayake Export Processing Zone (KEPZ). Since then, many steps were taken to improve and widen the framework. The establishment of KEPZ signifies the birth of a successful apparel manufacturing sector in Sri Lanka, the single largest export income earner today.

However, the world of free zone evolved and expanded at a much faster than the rate at which we adopted. The most successful financial centres in the region such as Singapore and Dubai adopted the concept of free zone beyond the manufacturing and processing and established a novel concept ‘free financial zone’. The establishment of such free financial zones enabled them to overcome one of the major challenges, the lack of trust in the local legal and regulatory system in establishment of a global financial centre.

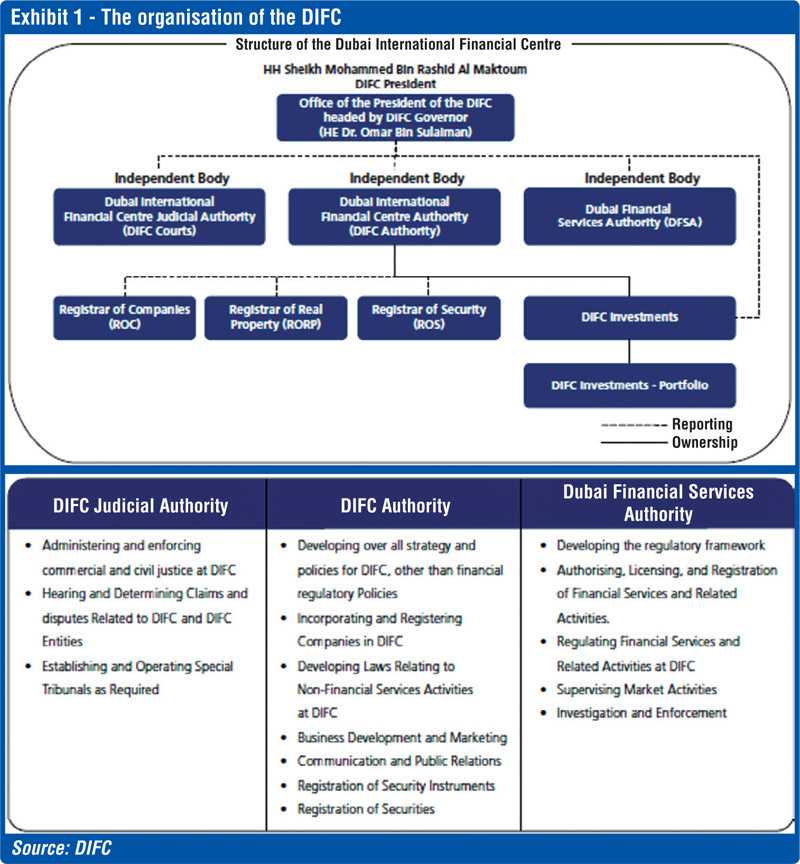

One of the fastest growing and successful ‘free financial zones’ in the world is Dubai International Financial Centre, widely known as ‘DIFC’, established in 2004. The emirates with a legal system based on the Islamic law principles, lacked the necessary global recognition for an international financial centre. Birth of the DIFC with a fully-fledged legal system including its own judiciary, chaired by a chief justice was a game changer. Since then, DIFC has accented to 16th place in The Global Financial Centres Index (GFCI) in 2021 rankings.

The DIFC legal system is a comprehensive framework and is available online (https://www.difc.ae/business/laws-regulations/legal-database/). The DIFC is an integrated financial centre completely insulated from commercial and civil laws of the emirates for conduct of financial transactions, with a comprehensive state-of-the-art regulatory system which eventually received global recognition. The success of any financial centre depends on its legal system and the regulator. The key component of a financial system is the regulatory process.

To maintain the highest level of credibility, The Dubai Financial Services Authority (DFSA), the regulator of DIFC, has always employed highly credible foreign regulators, vastly experienced at key financial centre regulatory bodies. Similarly, DIFC courts comprise of foreign judges with international reputation and a chief justice of high credibility. The mechanism and the credible team together have created the trust among the global financial market participants to do business at the DIFC.

Quite similar to the benefits of an economic or an industrial free zone for attracting FDIs, boosting exports, diversification of the economy and creation of employment opportunities for local labour force allowing them to compete in the international scale, financial free zones attract financial capital, talents and trade flows.

Key components of a financial centre

Leadership

With the above introduction to the DIFC, we should evaluate the proposed Port City Economic Commission Bill objectively. To give high level powers to the DIFC, the role of its chairman has been entrusted to the deputy ruler of the Dubai. In contrast, the president or the minister in charge will appoint the chairman of Port City Economic Commission. This arrangement has diluted the power of the commission to an ordinary body. If the commission is to be chaired by the President himself, the Prime Minister or at least the minister in charge of the subject economy or finance, the commission would have been made more powerful.

Dilution of role of the regulator

The registration of companies under the Port City Commission will not be different from companies incorporated elsewhere in Sri Lanka; the registration will be under the registrar of companies. Contrastingly, the DIFC has its own company registrar with its own company law.

Port City regulation is entrusted with existing regulatory bodies such as Central Bank and SEC. It should be evaluated whether existing regulators have the capacity to compete with global financial centre regulators like DFSA. The fact is the existing regulators lack international experience in financial centre regulation in the global context. Moreover, expecting a credible regulatory system under such inexperienced regulators is far from reality. As a result, the objective of modern global financial centre housing under the port city will be a tough ask.

Judiciary system

Except an Arbitration Centre under the international arbitration code, the legal system applicable under the Port City will be the local legal system. Major difference in the DIFC as a financial centre is, it has a separate legal system, a commercial and civil law enacted by the DIFC and a separate court system. Port City will have to refer commercial and civil disputes to the local judicial system. There is no proposal to establish even a special commercial court under the Port City, dedicated for resolving civil and commercial disputes within the Port City. To make a port city a reliable financial centre for the region, the port city should have enacted its own legal system and commercial courts system. In that sense, the proposed Port City Economic Commission Bill will not bring major attractiveness and competitive advantages to the port city for the development as an international financial centre.

Conclusion

Conclusion

Sri Lanka adopted the concept of free zone much earlier than its peer group, setting up the first industrial free zone in 1978. Since then, the concept of free zone has expanded into many sectors, latest being the financial free zone. Despite the early start, Sri Lanka lacked the progression in embracing the changes while countries like Dubai, Malaysia and India established financial free zones.

The key pillars of a financial free zone are the constitution of its formation, the regulator and the judicial system. In comparison to the most competitive regional financial centres such as the DIFC in Dubai, the Port City Economic Commission Bill doesn’t have provision to establish a credible mechanism to attract global financial market participants.

Nevertheless, the proposed Port City Economic Commission Bill is one major step towards a long journey. The major advantages of Sri Lanka are its comparative cost, the strategic maritime location and being at the edge of South Asia; a home of one quarter of the global population with a robust growth outlook. The Port City at the initial stage should target for facilitation of South Asian trade among the hostile neighbours quite like Dubai facilitated the trades within troubled Middle East. Eventually, the scope of the port economic commission should enhance to house a state-of-the-art regional financial centre, initially targeting to be the financial centre for the South Asia.

(The writer is a CFA charterholder and Certified FRM with local and international financial market experience over the last two decades. The views and opinions expressed in this article are those of the writer and do not necessarily reflect the official policy or position of any institution.)