Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 29 July 2020 00:25 - - {{hitsCtrl.values.hits}}

An opportunity has emerged for Sri Lanka to attract high quality Foreign Direct Investments (FDIs) in the prevailing COVID-19 backdrop.

The study has identified the biggest pain point which influences the lack of FDIs being non-conducive policy. Policy reform will serve as a critical enabler that will set-in place the appropriate ecosystem to attract FDIs into Sri Lanka. Critical cogs in the wheel of FDIs will need to be identified, relevant policy streamlined and bottlenecks eliminated.

Whilst the thrust in infrastructure development is considered as an important factor in attracting FDIs, the heavy capital expenditure (Capex) requirement cannot be overlooked. At present there does not seem to be sufficient fiscal room for the incumbent Government to engage in an explosive Infrastructure development drive. The thrust in the short to medium term should be to expedite the bringing online of the existing infrastructure projects that are currently funded and underway.

A conducive fiscal environment at a latter point in time will allow Sri Lanka to actively partake in infrastructure led growth. However, in order to further reinforce the economic impetus and positive spillover that is envisaged due to the development drive in infrastructure projects, it is vital to draw up a 10 year roadmap showcasing all potential investible infrastructure projects which can be showcased on a prioritised basis to both local and foreign stakeholders. It is essential that this road map is endorsed by all parties concerned to ensure continuity of such projects in the event that a change in regime is to take place. This will showcase further stability to prospective investors.

The majority of the factors that need to be aligned in order to facilitate the flow of FDIs into Sri Lanka, whilst not being Capex heavy, is weighted greatly around policy reform. The recent taskforce that was set-up to curb and mitigate the spread of COVID-19 has been effective. A similar taskforce should be set-up to fulfil the policy reform mandate in a short space of time.

The time is now to proactively seek out policy reform by putting in place the people, comprising of public sector officials, private sector practitioners and industry think-tanks to formulate, amend, and finally implement actionable policy to improve the attractiveness of Sri Lanka as a key FDI destination in the region.

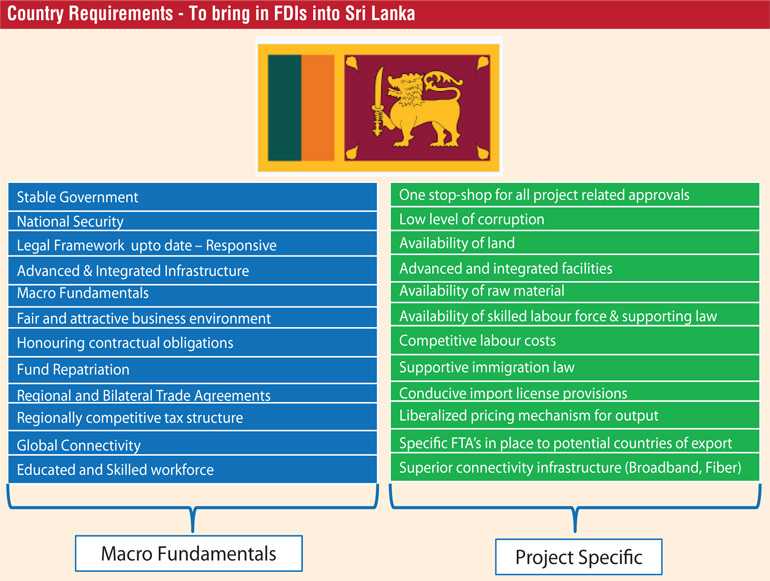

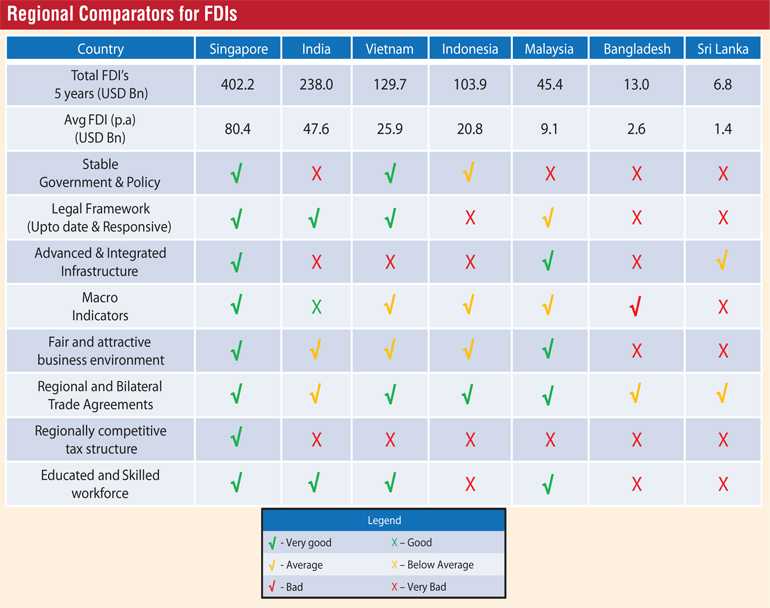

Eight key variables that influence and attract FDIs into countries with particular reference to six regional competitors will be discussed further.

Eight key factors to attract FDIs

1) Stable Government and Policy

2) Legal Framework (Upto date and responsive)

3) Advanced and Integrated Infrastructure

A connected transport network with integrated transport hubs.

Development of Light Rail Transits (LRTs), further develop existing railway lines and expressways.

Developing the Airports, Shipping Docks and Ports.

Developing the communication networks.

Developing the required utilities infrastructure – Water, electricity, gas, sewage and solid waste.

Ensuring the costs of utilities are regionally competitive.

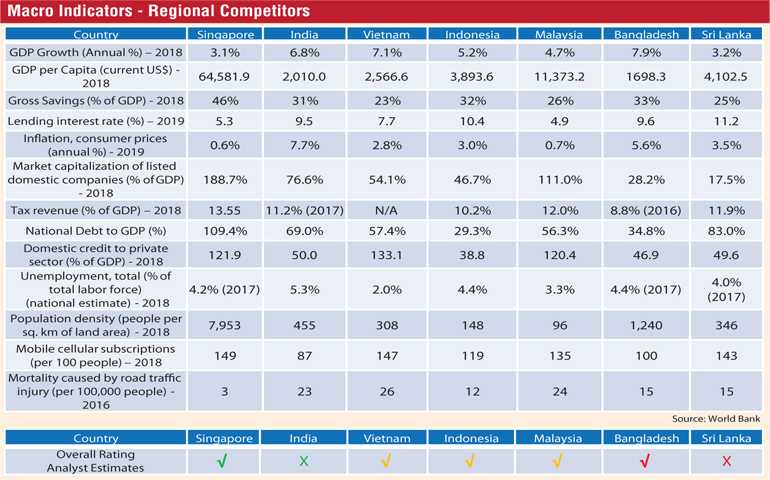

4) Macro Indicators

5) Fair and attractive business environment

6) Regional and bilateral trade agreements

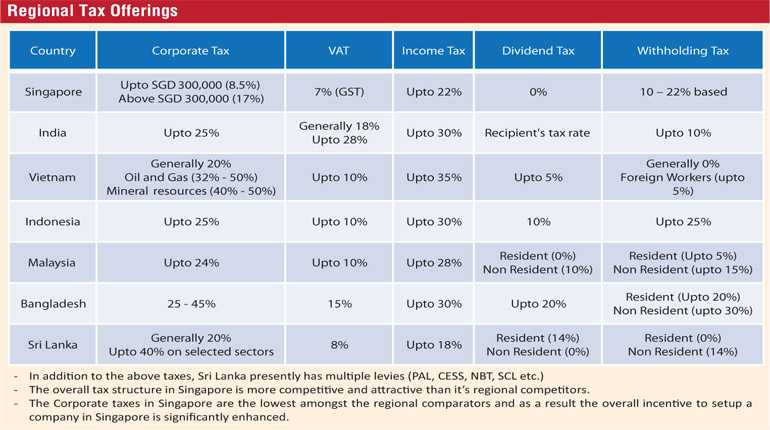

7) Regionally competitive tax structure

8) Educated and Skilled Workforce

Following is a deep dive on the 8 key factors to attract FDIs with regional comparisons.

1 Stable Government and Policy - What we have | What we need

What we have:

What we need:

Regional benchmarks

Singapore: Most competitive economy in the world | 1st in the world in political and operational stability | Least riskiest country in the world |Highest GDP per capital in the region – $ 58,248.

Vietnam: Policy is set every five years by the Party congress and adjusted twice a year by plenary meetings of the Central Committee | The President, as Head of State, represents The Socialist Republic of Vietnam on internal and foreign affairs | People’s Committee (province, district, and commune) governs management affairs within its administrative location, manages, directs, operates daily activities of local state bodies and executes policies | The government is committed to ensuring a stable socio-political environment, protecting the legitimate rights and interests of investors, and creating an enabling environment for FDI enterprises in the country | The State Bank of Vietnam works closely with ministries and central and local government agencies to come up with proactive monetary and fiscal policies to put inflation under the control and stabilise the macro economy so that Vietnam will achieve rational economic development growth.

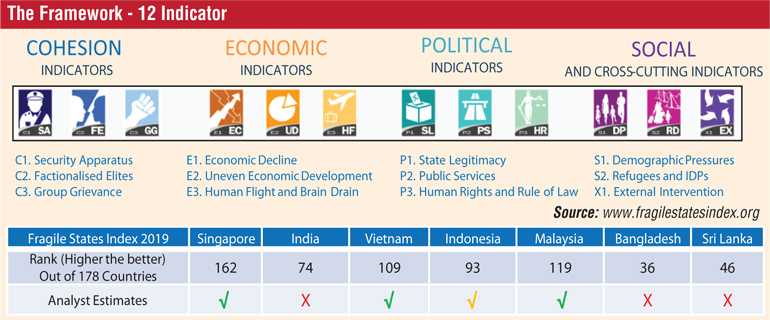

Stable Government and Policy - The Fragile States Index

The Fragile States Index (FSI) produced by The Fund for Peace (FFP), is a critical tool in highlighting the normal pressures that all states experience and helps identifying when those pressures are outweighing a state’s capacity to manage those pressures. By highlighting pertinent vulnerabilities which contribute to the risk of state fragility, the Index – and the social science framework and the data analysis tools upon which it is built – makes political risk assessment and early warning of conflict accessible to policy-makers and the public at large.

Twelve conflict risk indicators are used to measure the condition of a state at any given moment. The indicators provide a snapshot in time that can be measured against other snapshots in a time series to determine whether conditions are improving or worsening.

2 Legal Framework - What we have | What we need

What we have:

What we need:,

Regional benchmarks

Singapore: Investment Law

Singapore has signed Bilateral Investment Treaties (BITs) with 46 countries. These agreements mutually protect nationals or companies of either country against war and non-commercial risks of expropriation and nationalisation.

Procedures relative to foreign investment

Acquisition of holdings – possible. A majority stake in the capital of a local company is legal in Singapore.

Obligation to declare – It is obligatory to declare if the proposed company name includes a trademark or patent name or the name of another company/business already existing in any other country.

Requests for specific authorisations – Although Singapore’s legal framework and governmental policies do not require any specific authorisation to invest in the country, certain limits exist in such sectors as telecommunications, broadcasting, domestic news media, financial and some professional services. For these sectors, the Articles of Incorporation may include shareholding limits that restrict ownership in corporations by foreign persons. Moreover, Finance Ministry approval is required for the acquisition of local banks when exceeding the specified share limit.

Singapore: Office Real Estate and Land Ownership Law

The possibility of buying land and industrial and commercial buildings – It is possible to buy real estate in Singapore.

Risk of expropriation – Singapore has no law forcing foreign investors to transfer ownership locally and has not expropriated any property till date.

Singapore: IP Law

Singapore has signed Bilateral Investment Treaties (BITs) with 46 countries. These agreements mutually protect nationals or companies of either country against war and non-commercial risks of expropriation and nationalisation.

National Organisations:

The organisation responsible for the protection of intellectual property in Singapore is the Intellectual Property Office of Singapore (IPOS).

Regional Organisations:

APEC Intellectual Property Rights Experts Group

Association of South East Asian Nations – ASEAN

International Memberships:

Member of the WIPO (World Intellectual Property Organization).

Signatory to the Paris Convention For the Protection of Intellectual Property.

Membership to the TRIPS agreement – Trade-Related Aspects of Intellectual Property Rights (TRIPS).

Singapore – Law on Competition

The Competition Act was enacted to provide a generic competition law to protect consumers and businesses from anti-competitive practices of private entities.

Guidelines are intended to help businesses understand how the Competition and Consumer Commission of Singapore (CCCS) will administer and enforce infringements of the prohibitions in the Act. This will improve transparency and provide greater clarity to businesses on the competition law regime. These Guidelines are finalised after seeking input and feedback from the public.

Singapore: Securities Law

Comprehensive regulation and guidance covering 32 key areas and stakeholders in the capital markets, trust business and financial adviser segment.

Singapore: FX Control Act

There is no exchange control in Singapore. Capital and profits can be repatriated out of Singapore without hindrance. Bank accounts can be denominated in currencies other than the Singapore dollar. As a matter of policy, the Monetary Authority of Singapore imposes restrictions on the amount of Singapore dollars that can be loaned to non-resident financial institutions.

Singapore: Customs Ordinance

Imports

The following types of imported goods are subject to customs or excise duties (the rates depend on the specific goods concerned):

Intoxicating liquors | Tobacco products | Motor vehicles | Petroleum products | Biodiesel blends.

Certain dutiable goods are exempt from customs and excise duties if they are imported by persons and/or organisations listed in the Customs (Duties) (Exemption) Order.

All imported goods are subject to goods and services tax at the rate of 7% of the taxable value of the imported goods, unless they are imported into special zones for re-export.

Imposition of the goods and services tax is governed by the Goods and Services Act.

Exports

Singapore does not impose export tax.

3 Advanced and Integrated Infrastructure - What we have | What we need

What we have:

What we need:

Regional benchmarks in infrastructure (Singapore)

Singapore: World-class infrastructure | Jurong Island is Singapore’s centrepiece for refining, petrochemical, and specialty chemicals activities. Its highly integrated infrastructure closely connects both customers and suppliers | Under Singapore’s Precision Engineering Industry Transformation Map (ITM) they intend to broaden and deepen their foundation in advanced manufacturing by leveraging on digital technologies and developing capabilities in advanced robotics, additive manufacturing, advanced materials, sensors, lasers and optics | Under the Research, Innovation and Enterprise (RIE) 2020 plan, the Government will invest S$3.3 billion in Advanced Manufacturing and Engineering R&D | The Technology Centre for Offshore and Marine Singapore (TCOMS) features nearly S$107 million worth of best-in-class infrastructure, including a deep-water ocean basin | Singapore is a leading location for best-in-class manufacturing plants, where innovative products are launched and produced.

Industry leaders like Pfizer, Novartis, Sanofi, AbbVie and Amgen have global manufacturing hubs in Singapore for a wide range of products including Active Pharmaceutical Ingredients, drug products and biologics drug substances | 8 of the top 10 pharmaceutical companies have facilities in Singapore, manufacturing 4 of the top 10 drugs by global revenue | Singapore is a key node in the global supply chain for products ranging from storage and memory products, to micro electro mechanical systems (MEMS) | These manufacturers are supported by a rich ecosystem of leading materials and equipment and electronics manufacturing services players | Electronics Industry Transformation Map (ITM) aims to grow the sector by transforming the current installed base of companies through productivity, automation, and upgrading the manufacturing product mix.

Singapore: Transport - Key Stats

- 64% of households are now within a 10-minute walk of a train station compared to 57% in 2012.

- 79% of public transport journeys under 20km are completed within 60 minutes compared to 76% in 2012.

-67% of all peak-period journeys are now undertaken on public transport, compared to 63% in 2012.

-In 2019, 12% of the country’s land area was used for roads.

-The average amount of time people spend commuting on public transport, to and from work, on a weekday is 84 minutes.

-On average, a typical family using public transport on a daily basis spends about 4.8% of its disposable income on public transport.

-Concession rates are given to children, students, senior citizens, national servicemen and people with disabilities.

-All train and bus journeys can be paid for using cash, contactless stored value cards as well as Mastercard or Visa contactless credit and debit cards.

-Forty per cent of Singapore’s public transport journeys are made via rail, with the percentage set to increase as newer rail lines are being built.

-The total rail length in 2019 was 227.9km | There are currently 156 Mass Rapid Transport (MRT) and Light Rail Transit (LRT) stations across 5 MRT and 3 LRT lines.

-Average daily ridership on the Mass Rapid Transport (MRT) and Light Rail Transit (LRT) has increased by 5.7% to 3.5 million rides a day in 2019.

-The Mean Kilometres Between Failure (MKBF) was 690,000 train-km in 2018, more than three times of the 181,000 train-km in 2017.

-The number of buses on the roads has gradually increased over the years and in 2018 there were 19,379, an increase of the previous year’s 19,285 | Bus ridership is at 4 million per day.

-The increase in daily bus ridership comes on the back of initiatives such as the $ 1.1 billion Bus Service Enhancement Program (BSEP), under which 1,000 new buses and 80 new bus routes were added.

-The total privately-owned cars in 2018 is 551,575. This is a reduction of 55,000 private cars since 2013 when there were 607,292.

-The number of daily journeys made using privately owned vehicles fell to 4.2 million in 2018, a 13 per cent decrease from 4.8 million in 2013.

-Trips made using Personal Mobile Devices (PMD), bicycles and on foot increased from 2.2 million in 2012 to 2.6 million in 2017

-440km of cycling paths.

Integrated Transport Hubs (ITHs) provide more seamless connections between bus and train. These fully air-conditioned transit hubs, which are interchange stations integrated with malls, give commuters convenient access to amenities as part of the public transport journey.

Reduced fare structure to encourage more pre-peak travel. Commuters now pay lower fares if they tap in at any MRT or LRT station before 7:45 a.m.

New smartphone apps have given Singaporeans the ability to plan door-to-door journeys with the combination of transport modes that best meet their needs. To further improve their travel experience, the MyTransport.SG app includes a multi-modal journey planner that provides real-time, customised information about different transport modes.

Upskilling and reskilling transport workers - Transport workers are trained to meet the diverse needs of all Singaporeans. He authorities actively collaborate with the National Transport Workers’ Union (NTWU), National Taxi Association (NTA), National Private Hire Vehicles

Association (NPHVA), as well as point-to-point and public transport operators, to ensure that transport workers remain well-equipped to meet those needs.

Redesigning facilities to meet commuters’ needs – Steps being taken to construct nursing rooms at selected bus interchanges and MRT stations | Exploration of the possibility of having quiet rooms which are designed for people who need access to a quiet and calming space during their journey | Installation stroller restraints in buses | Installation of elder-friendly seats with armrests that make it easier for seniors to stand up from a sitting position at bus stops.

Reducing Noise Pollution - For an enhanced living environment, noise barriers along elevated railway sections are installed. They are built on stretches that face noise sensitive developments.

Land Transport Master Plan (LTMP) 2040 Objectives - Singapore:

-A transport network that is convenient, well-connected and fast.

-A transport ecosystem characterised by gracious behaviour and inclusive infrastructure.

-A transport environment that supports healthy lives and enables safer journeys.

4. Macro Indicators

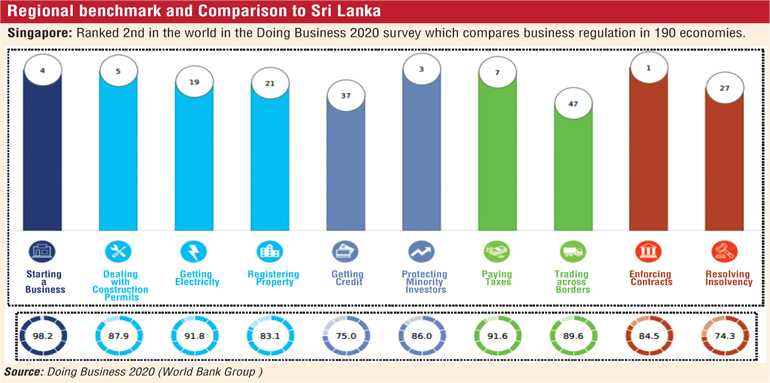

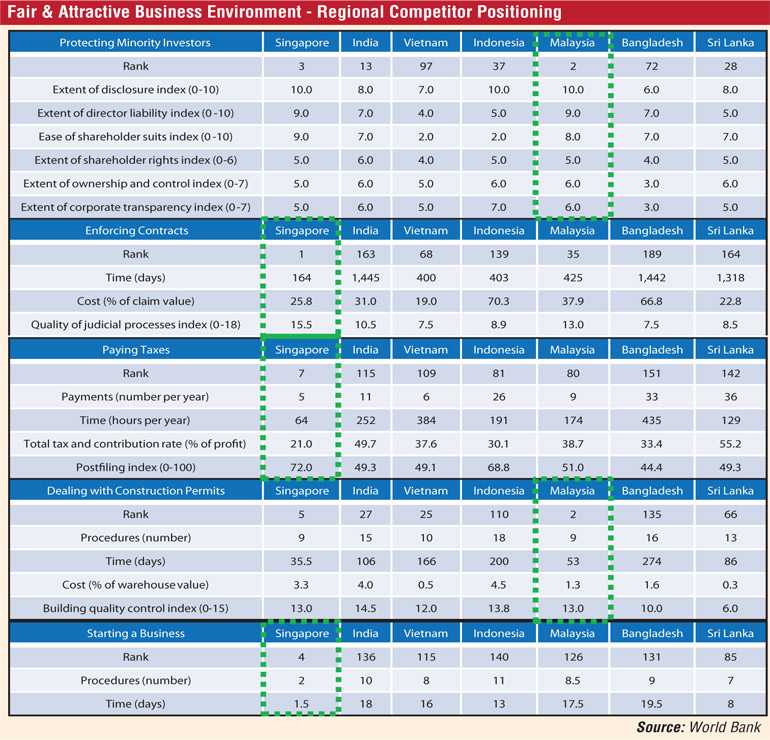

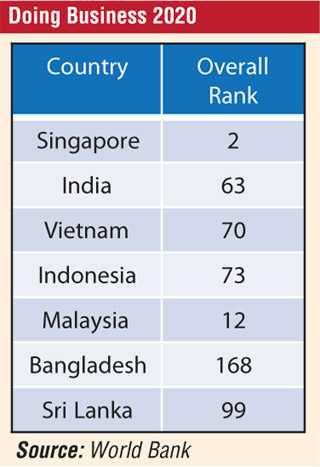

5. Fair & Attractive Business Environment - What we have | What we need

What we have:

What we need:,

Regional benchmark

Singapore: Ranked 2nd in the world in the Doing Business 2020 survey which compares business regulation in 190 economies.

6: Bilateral Trade Agreements - What we have | What we need

What we have:

What we need:,

7 Tax Structures - What we have | What we need

What we have:

What we need:

Regional benchmarks

Singapore: Start-up companies in Singapore can take advantage of a tax exemption of up to $125,000 on the first $200,000 of income for their first three consecutive years of business | Qualifying offshore funds are also exempt from tax on some income, including income from dividends,7 gains, profits, and interest from traditional investments including deposits, bonds, shares, stocks, and securities | Global trading companies are eligible for concessionary tax rates of 5% to 10% for three or five years if they qualify for Singapore’s Global Trader Program. Singapore typically grants Global Trader status to companies with established track records in international trade | Businesses can attain the Development and Expansion Incentive (DEI). This awards businesses that migrate to business activities that add more value (such as investing in projects that advance key industries like manufacturing), with a five to 10 percent tax break after the initial tax holiday has ended.

Vietnam - Extends investment incentives to a number of industries and projects that it has identified to be of strategic importance for the country | Vietnamese policy in recent years has broadly promoted projects in high tech industries, large capital, or labor-intensive investments, and projects that are expected to have a tangible impact on social conditions, such as education or healthcare | Foreign investors investing in economic zones benefit from tax incentives extended by the Vietnamese government.

8 Educated and Skilled Workforce - What we have | What we need

What we have:

What we need:,

Regional benchmarks

Singapore: Developing a high quality teacher workforce

Recruitment

The Ministry of Education carefully selects prospective teachers from the top one third of the secondary school graduating class. Strong academics are essential. Teachers receive a stipend equivalent to 60% of a teacher salary while in training and commit to teaching for at least three years. Interest in teaching is seeded early through teaching internships whilst a system for mid-career entry exists as well.

Training

All teachers receive training on the Singapore curriculum at the country’s National Institute of Education at Nanyang Technological University, either in a diploma or a degree course depending on their level of education at entry. There is a close working relationship between the Institute and schools, where master teachers mentor every new teacher for several years.

Compensation

Each year, the Ministry of Education examines a range of occupational starting salaries and may adjust the salaries for beginning teachers to ensure that teaching is seen as equally attractive with other occupations for new graduates. Teacher salaries do not increase over time as much as some other professions but there are many opportunities for teachers to assume other roles.

Professional Development

Teachers are entitled to 100 hours of professional development per year. Courses at the National Institute of Education focus on subject matter and pedagogical knowledge and lead towards higher degrees. Professional development is school-based, led by school staff developers, whose job it is to know where there are problems in the school. Ex. A group’s math performance, or to introduce new practices such as project-based learning or new uses of ICT. Each school also has a fund through which it can support teacher growth, including the development of fresh perspectives by going abroad to examine aspects of education in other countries.

Performance appraisal

In Singapore, teachers’ performance is appraised annually by several people on multiple measures, including their contribution to the academic and character development of all students in their charge, their collaboration with parents and community groups, and their contributions to their colleagues and the school as a whole. Teachers who do outstanding work, receive a bonus from a school bonus pool.

Career Development

After three years of teaching, teachers are assessed annually to see whether they have the potential for three different career paths - master teacher, specialist in curriculum or research, or school leader, each with salary increments. Teachers with potential to be school leaders are moved to middle management teams and receive training to prepare them for their new roles. Middle managers’ performance is assessed for their potential to become assistant principals, and later, principals. Each stage has a range of experiences and training to prepare candidates for school leadership and transformation. There is a clear understanding that high-quality teaching and strong student performance require effective school leaders.

Singapore: Skilled Workforce – Establishment of SkillsFuture

Help individuals to make well-informed choices in education, training and careers

Through collaborations between the Government, industry, and institutions, individuals will have exposure to a wide range of occupations and industries from a young age. They will also have access to ongoing information about the changing needs of the labour market.

Develop an integrated, high-quality system of education and training that responds to constantly evolving industry needs

Education and training will be reviewed on a regular basis to ensure that a sound and broad-based education for the young is complemented with full menus of continual learning options – including opportunities to develop new specialisations.

Promote employer recognition and career development based on skills and mastery

Employers will be involved in designing and implementing a framework to enable employees to advance in their careers through skills ladders.

Foster a culture that supports and celebrates lifelong learning

This will involve a long-term effort to respect every job for its requisite skills, and value the achievements of individuals who attain mastery in their own fields. It will also promote the habit of learning throughout life – for work as well as for personal development and interest.

Initiatives to support the Employers:

iNnovative Learning 2020 or iN.LEARN 2020 is a learning innovation initiative led by SkillsFuture Singapore. iN.LEARN 2020 will drive the use of blended learning in Continuing Education and Training (CET) to meet the dynamic learning needs of business enterprises and individuals.

This learning innovation initiative aims to foster closer collaboration among CET partners and practitioners, such as training providers, adult educators, enterprises, consultants and technology vendors to enhance the quality, accessibility, and effectiveness of learning.

P-Max is a SkillsFuture initiative that aims to:

Help small and medium-sized enterprises (SMEs) to better recruit, train, manage and retain their newly-hired Professionals, Managers, Executives and Technicians (PMETs).

Enable SMEs to establish better communication channels between supervisors and staff and to adopt progressive HR practices (e.g. goals setting, performance management) for newly-hired PMETs within their SMEs.

Help newly-hired PMETs to better acclimatise to the new SME work environment and to encourage better retention of PMET in SMEs.

The SkillsFuture for Digital Workplace, formerly known as Future@Work, is a national initiative designed to equip Singaporeans with the mindset and skills to prepare for the future economy.

SkillsFuture Earn and Learn Programme – Under this programme, fresh ITE and polytechnic graduates will get placed with employers and learn through structures on-the-job training and institution based training. Employers can receive up to S$ 15,000 to offset the cost of developing and providing the structured training.

SkillsFuture Employer Awards – The SkillsFuture Employer Awards recognises exemplary and progressive employers that champion skills development. They grow their talent pool and bring the best in their employees, offering learning opportunities and structured skills-based career pathways.

(The writer Hardy Jamaldeen is directly instrumental in bringing in investments exceeding Rs. 7 billion into Sri Lanka and is a key lobbyist for real estate and investment reforms to attract FDIs into Sri Lanka. He is a finance professional with over 20 years of experience and a seasoned commercial property investor and advisor. Hardy is the Founding Managing Director of Steradian Capital Investments Ltd. and Executive Director of Lanka Realty Investments PLC where he is responsible for financing, corporate structuring, acquisitions and development. He is also the Executive Director of several real estate companies, focusing on commercial, residential and leisure property investment and development. Hardy serves as a Director of Hayleys PLC, Talawakelle Tea Estates PLC, Haycarb PLC, Singer (Sri Lanka) PLC, Singer Industries (Ceylon) PLC. He is a Fellow of the Association of Certified Chartered Accountants, UK and holds a degree in Engineering and Business from the University of Warwick, UK.)

Sources

General

- https://www.theglobaleconomy.com/rankings/wb_political_stability/

- https://aric.adb.org/fta-country

- https://worldpopulationreview.com/countries/countries-by-national-debt/

- https://data.worldbank.org/

- https://fragilestatesindex.org/

Singapore

- https://www.nordeatrade.com/fi/explore-new-market/singapore/investment

- https://unctad.org/en/pages/newsdetails.aspx?OriginalVersionID=2274

- https://santandertrade.com/en/portal/establish-overseas/singapore/foreign-investment

- https://www.businesstimes.com.sg/government-economy/singapore-remains-a-top-fdi-destination-globally

- International Institute for Management Development (IMD), IMD World Competitiveness Rankings 2019

- Cornell University, INSEAD and World Intellectual Property Organization, Global Innovation Index 2019

- United Nations Conference on Trade and Development, World Investment Report 2019

- World Bank Group, DataBank, World Development Indicators. Accessed 4 February 2020

- http://www.insis.com/en/articles/singapore-s-free-trade-agreements

- http://www.insis.com/en/articles/singapore-s-free-trade-agreements

- https://www.aseanbriefing.com/news/tax-incentives-businesses-singapore/

- https://www.rikvin.com/taxation/singapore-corporate-tax-incentives/

- https://taxsummaries.pwc.com/singapore/corporate/tax-credits-and-incentives

- https://www.enterprisesg.gov.sg/financial-assistance/tax-incentives/tax-incentives/global-trader-programme

- https://www.guidemesingapore.com/business-guides/taxation-and-accounting/introduction-to-taxation/singapore-tax-system-and-tax-rates

- https://www.iras.gov.sg/irashome/Individuals/Locals/Learning-the-basics/Individuals-Required-to-Pay-Income-Tax/Taxes-on-Investments-in-Singapore/

- http://www.mgimenon.com/MGIMenonDoingBusinessGuideSingapore.pdf

- https://uk.practicallaw.thomsonreuters.com/4-524-0309?transitionType=Default&contextData=(sc.Default)&firstPage=true&bhcp=1

- https://uk.practicallaw.thomsonreuters.com/4-524-309?transitionType=Default&contextData=(sc.Default)&firstPage=true&bhcp=1#co_anchor_a347048

- https://www.doingbusiness.org/content/dam/doingBusiness/country/s/singapore/SGP.pdf

- https://www.ssg.gov.sg/skillsfuture.html

- https://asiasociety.org/global-cities-education-network/how-singapore-developed-high-quality-teacher-workforce

- https://www.channelnewsasia.com/news/singapore/singapore-public-transport-system-among-best-in-the-world-10637978

- https://en.wikipedia.org/wiki/Transport_in_Singapore

- https://www.budgetdirect.com.sg/car-insurance/research/public-transport-singapore

- https://www.lta.gov.sg/content/ltagov/en/who_we_are/our_work/land_transport_master_plan_2040.html

- https://www.lta.gov.sg/content/dam/ltagov/who_we_are/our_work/land_transport_master_plan_2040/pdf/LTA%20LTMP%202040%20eReport.pdf

- https://www.budgetdirect.com.sg/car-insurance/research/public-transport-singapore

- https://www.edb.gov.sg/en/how-we-help/incentives-and-schemes.html

India

- https://www.thehindubusinessline.com/economy/india-among-top-10-fdi-recipients-attracts-49-billion-inflows-in-2019-un-report/article30608178.ece

- https://economictimes.indiatimes.com/markets/stocks/news/fdi-in-india-rises-to-61-96-billion-in-2017-18-government/articleshow/64506567.cms

- https://economictimes.indiatimes.com/news/economy/finance/india-replaces-china-as-top-fdi-destination-in-2015-report/articleshow/51932057.cms

- http://investinindia.com/why-invest-india

- https://santandertrade.com/en/portal/establish-overseas/india/foreign-investment

- https://www.india-briefing.com/news/indias-free-trade-agreements-4810.html/

- https://taxsummaries.pwc.com/india

- https://cleartax.in/s/income-tax

- https://www.corporateservices.com/india-dividend-distribution-tax-eliminated-2020/

Vietnam

- https://www.vietnam-briefing.com/news/fdi-in-vietnam-investment-by-sector.html/

- https://www.vir.com.vn/vietnam-lures-3546-billion-usd-fdi-in-2018-64870.html

- https://www.bangkokpost.com/world/1386002/vietnams-2017-fdi-inflow-rises-10-8-

- https://www.reuters.com/article/vietnam-economy-fdi-idUSL4N1EG1XP

- http://vietnamnews.vn/economy/280482/fdi-reaches-23-billion-in-2015.html

- https://www.statista.com/statistics/1011568/vietnam-number-fdi-projects/

- http://fia.mpi.gov.vn/news/80/Open-Business-Environment/en

- https://www.vietnam-briefing.com/news/tax-incentives-foreign-investment-vietnam.html/

- https://emerhub.com/vietnam/top-11-reasons-why-to-invest-in-vietnam/

- https://taxsummaries.pwc.com/vietnam/individual/taxes-on-personal-income

- https://taxsummaries.pwc.com/vietnam/corporate/taxes-on-corporate-income

- https://www2.deloitte.com/content/dam/Deloitte/global/Documents/Tax/dttl-tax-vietnamhighlights-2019.pdf

- http://infrastructurevietnam.com/

Indonesia

- https://www.nordeatrade.com/en/explore-new-market/indonesia/investment

- https://www.nasdaq.com/articles/fdi-into-indonesia-falls-below-2019-target-but-seen-rising-this-year-2020-01-29

- https://www.thejakartapost.com/news/2020/05/19/us-pharma-firms-think-twice-about-relocating-to-indonesia-experts.html

- http://www.oecd.org/economy/indonesia-economic-snapshot/

- https://www.lowyinstitute.org/publications/politics-indonesia-resilient-elections-defective-democracy

- https://www2.deloitte.com/content/dam/Deloitte/id/Documents/tax/id-tax-indonesian-tax-guide-2019-2020-en.pdf

Malaysia

- https://www.thestar.com.my/business/business-news/2020/04/21/malaysia-approved-rm2079bil-in-investments-in-2019

- https://santandertrade.com/en/portal/establish-overseas/malaysia/foreign-investment

- https://taxsummaries.pwc.com/malaysia

Bangladesh

- https://www.dhakatribune.com/business/economy/2019/06/24/report-bangladesh-tops-fdi-list-in-south-asia-in-2018

- https://bdnews24.com/economy/2016/08/16/bangladeshs-net-fdi-in-fy-2015-16-surpasses-2-billion-mark

- https://www.thedailystar.net/business/news/bangladesh-eyes-fdi-boom-the-post-pandemic-era-1904614

- https://thefinancialexpress.com.bd/views/fdi-policy-of-bangladesha-review-1577805006

- https://santandertrade.com/en/portal/establish-overseas/bangladesh/investing

- https://newsin.asia/bangladeshs-growth-stems-from-political-stability/

- https://www.nordeatrade.com/en/explore-new-market/bangladesh/taxes

- https://www2.deloitte.com/content/dam/Deloitte/global/Documents/Tax/dttl-tax-bangladeshhighlights-2020.pdf?nc=1

Sri Lanka

- http://www.customs.gov.lk/tradeagreements/home

- https://blogs.worldbank.org/endpovertyinsouthasia/six-ways-sri-lanka-can-attract-more-foreign-investments

- http://www.ft.lk/front-page/SL-likely-to-miss-3-b-FDI-target-for-2019/44-687888

- http://www.ft.lk/article/594657/FDI-in-2016-dips-54--to---450-m-as-policy-inconsistency-weighs

- http://www.dailymirror.lk/business-news/Sri-Lanka-likely-to-target-US-2bn-FDI-this-year/273-180904

- https://taxsummaries.pwc.com/sri-lanka

- https://www.doingbusiness.org/content/dam/doingBusiness/country/s/sri-lanka/LKA.pdf

- https://www.dhammikaperera.lk/ministry_of_higher_education.html