Saturday Feb 14, 2026

Saturday Feb 14, 2026

Tuesday, 26 July 2022 00:05 - - {{hitsCtrl.values.hits}}

Delaying policy action will lead to worsening economic conditions and greater hardships for people as well as make the path to recovery more difficult

What is the outlook for the Sri Lankan economy?

What is the outlook for the Sri Lankan economy?

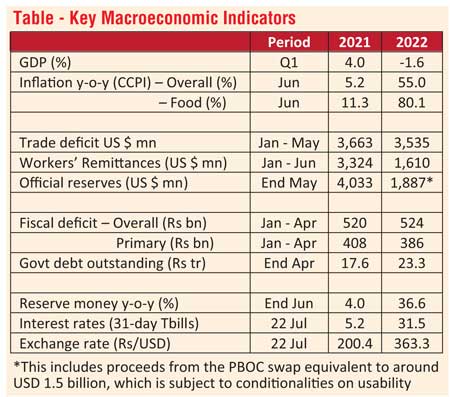

Sri Lanka is facing the worst economic crisis in its post-independence history. Inflation is more than 50% and food inflation is running at 80%. The economy contracted by 1.6% in Q1 2022 and is estimated to contract by 7% in 2022, pushing the economy back several years. Despite strict policy measures to reduce imports, the trade deficit only marginally narrowed to $ 3.5 billion during the first five months of 2022 and workers’ remittances continue to fall. Foreign reserves remain at a precariously low level exerting pressure on the exchange rate. With few changes to fiscal policy, the deficit continues to widen while the outstanding debt of the Government has ballooned to Rs. 23.3 trillion at end April 2022.

What policy actions are required to turnaround Sri Lanka’s economy?

Much of the heavy lifting to address macroeconomic imbalances has been through monetary policy measures. The Central Bank of Sri Lanka (CBSL) raised policy interest rates in several steps and market interest rates continue to adjust upward. The exchange rate was allowed to adjust from 8 March 2022 although it has been held at around the current level for over 11 weeks despite the strengthening of the USD in international markets. Supporting the exchange rate at a given level as well as the mandatory conversion of export proceeds and surrender requirements may not augur well for maintaining competitiveness in export markets or for attracting remittances. However, without the support of fiscal policy, restoring macroeconomic stability will be a difficult or near impossible task.

Policymakers need to understand the critical nature of the current economy. Delaying policy action will lead to worsening economic conditions and greater hardships for people as well as make the path to recovery more difficult. Some policies can be put in place immediately and do not need an IMF program to be in place. One of the key priorities of the new Government will be to enact legislation enabling more taxes to be collected while ensuring strict oversight on government expenditure. This is fundamental to reducing the fiscal deficit which has been the root cause of macroeconomic instability.

How important is it for Sri Lanka to enter into a program with the IMF?

How important is it for Sri Lanka to enter into a program with the IMF?

An IMF program itself is not necessary for implementing policies to restore macroeconomic stability or undertaking much needed structural reforms to kickstart growth. The importance of an IMF program is that it comes with balance of payment support which would help shore the country’s foreign reserves and stabilise the currency. It would also give confidence to other donors to provide financing to purchase critically needed food, fuel and medicines as well as supporting a cash transfer system for vulnerable households and much needed expenditure on education and health which are vital for enhancing the productivity of our current and future workforce.

An IMF program would also determine the country’s path to debt sustainability which is critical for negotiating with our creditors. Until a sustainable debt path is worked out it would be difficult to finalise a debt restructuring plan.

The main objectives of an IMF program as articulated in a document released after the recently concluded discussions are restoring macroeconomic stability and debt sustainability; protecting the poor and vulnerable; safeguarding financial stability; stepping up structural reforms to address corruption vulnerabilities and unlocking Sri Lanka’s growth potential. These are objectives all Sri Lankans can agree on and would want for the country.

However, achieving these objectives require policies and reforms that will be painful in the short term.

But unless the country goes through this pain it will not emerge from this crisis and may end up facing cycles of crises as witnessed in countries where economic reforms have been derailed. Of course, the burden of the cost of adjustment needs to be borne by those who can afford to. Lockdowns due to the COVID-19 pandemic and the current economic crisis have likely pushed millions of Sri Lankans into poverty. They need to be cushioned from the negative impact of economic reforms through adequate social safety nets.

How important are institutional reforms and eliminating corruption?

If the Government wants its citizens to tighten their belt and pay more taxes, citizens have a right to know how these additional resources are being utilised and whether it is in the best interest of the people of this country. Greater transparency and accountability are crucial to improve taxpayer compliance, regain trust of international partners, as well as encourage foreign inflows from private entities. But transparency and accountability are needed not only in the use of funds but also in policy-making. Misguided policy decisions accelerated the economic collapse. The use of high-cost borrowings to finance infrastructure projects yielding negative social returns, better processes for selecting projects and more transparency at every stage of implementation.

The role of CBSL in financing the fiscal deficit calls into question the decision-making processes within key government institutions and the need for greater reliance on rules rather than discretion in the implementation of policy. Strengthening the independence of the Central Bank of Sri Lanka through legislative and institutional reforms is required. But without fiscal discipline this will not amount to much. Better enforcement of fiscal rules (limits on fiscal deficits and debt) and independent fiscal institutions (providing oversight and monitoring) are needed to restore fiscal credibility and bring the country’s debt back to a sustainable path.