Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 11 February 2020 00:01 - - {{hitsCtrl.values.hits}}

Matters that came up for investigation before the Committee on Public Enterprises (COPE) sometime back, debated with much ardour, appear to have lost the passion and consigned to

|

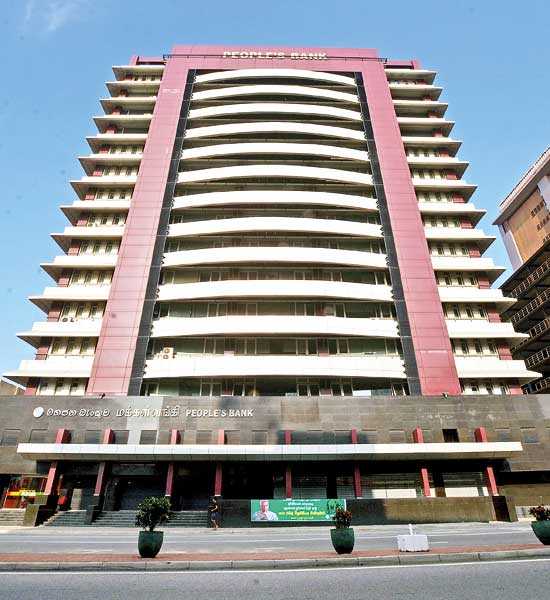

| Viewed today, in hindsight, the picture before us shows how hilarious the episode has been, with the deceitful manner in which the bank officials attempted to cover up the lapses and how the recommendations made by COPE are being consigned into abeyance. This state of affairs is not only confined to the People’s Bank, but all public institutions that come before COPE know if they skip the day, it would be the end of the matters – Pic by Shehan Gunasekara |

Nevertheless, there is very little known now about the outcome of some serious revelations and exposures made in this forum. The Ceylon Petroleum Corporation (CPC), Ceylon Electricity Board (CEB), SriLankan Airlines, and People’s Bank were some of the important State enterprises that came under the probe among those adversely reported on by the Auditor General.

The theatrics of the investigations protracted due to highly unethical and mysterious happenings reported, caused the public dismay and sensations leading to the expectation of corrective measures both remedial and punitive.

This fate has not only befallen the COPE findings. Some of the many Commissions of Inquiries appointed to examine, investigate and look into other controversial episodes, too, have lost the way, vanishing in a puff of smoke.

In a sharp contrast, the COI appointed by President Sirisena to investigate allegations of large-scale frauds at SriLankan Airlines, SriLankan Catering, and Mihin Lanka – the report of which was handed over to the President in July 2019 – appears to have provided the insights into several serious corrupt practices culminating in the arrest of the controversial former CEO of SriLankan Kapila Chandrasena

and his wife.

But the report of another COI appointed by President Sirisena to investigate and inquire into serious acts of fraud, corruption and the abuse of power, State resources and privileges from January 2015 to December 2019 was caught up in a transition period of the Presidential Election, falling between the outgoing and incoming Presidents. When asked, President Sirisena stated that the report is now at the Presidential Secretariat. According to available information, this COI report, too, has highlighted instances of corruption and mismanagement that have been going on in several other institutions, including People’s Bank.

Our attention remains focused, stirred by the intensity of emotion, on the last COPE investigations of the Parliament, staged with a live broadcast via public media. It looks as if it was an orchestration designed to diffuse public consternation than a serious step towards reformation and correction of prevailing disorders.

Dubious lease agreements worth billions of rupees with arguable cancellations leading to further losses, appointment of inappropriate and unfit individuals to posts of chairmen and directorates, including senior management positions, endless lending and borrowings from State banks – and even private banks – providing bottomless resources for jobbery, loss-making projects masterminded and influenced by errant politicians, wasteful expenditures, and violation of procurement policies were among the highlights of

the exposures.

Follow-up remedial action is extremely slow, and the stalling appears to be due to the overlapping of regimes responsible for the wrongs. Both regimes have intermittently worn the hat of accusation, interchanging it during periods when they come to power, raising and suppressing things at

their convenience.

The infamous oil hedging deal is an ideal example. It is public knowledge that the hedging process, which caused losses running into several billions to the State in various forms, enriched several private banks – mostly foreign-owned – and the CPC lost all cases evasively pursued to circumvent the fraudulent involvement costing huge amounts to the State.

People’s Bank, the second largest State bank, had to write off more than Rs. 5 billion as losses. All this has now gone out of public focus, leaving the culprits at large. Judging from what little action we have seen, it is obvious that most of the revelations are destined to be consigned to the dustbin of history in the course of time instead of the warranted corrective actions.

It is rather strange to see the indifference displayed towards such a situation by the global ‘god fathers’, such as International Monetary Fund (IMF) and World Bank (WB), who have been seriously advocating reforms of the SOEs.

"Our attention remains focused, stirred by the intensity of emotion, on the last COPE investigations of the Parliament, staged with a live broadcast via public media. It looks as if it was an orchestration designed to diffuse public consternation than a serious step towards reformation and correction of prevailing disorders"

This may be due to their commitment for fast-tracking liberalisation, promoted by them openly, which inherently accommodates and acknowledges such things as minor lapses. In this unfortunate environment of a corrupt nexus at the helm of affairs wielding powers in exchange, we have to look at things with fine-combed scrutiny.

In this context, let us take a closer look at the COPE findings that have been so passionately dramatised through wide media coverage to review the outcome. Of the several investigations  completed by COPE, we have to focus our attention on a few selected cases which would qualify to serve as examples of our

completed by COPE, we have to focus our attention on a few selected cases which would qualify to serve as examples of our

viewpoint.

The verbatim report of the COPE inquiry dealing with the audit queries of the People’s Bank is chosen for this purpose. The revival of COPE in the new term of Parliament under the chairmanship of Handunnetti makes this more pertinent, although there is an uncertainty of its continuity under the impending imminent dissolution of the Parliament, hence proceedings of COPE on 5 September 2019 from 2:30 p.m. to 5:10 p.m. as recorded in the verbatim report referred.

Viewed today, in hindsight, the picture before us shows how hilarious the episode has been, with the deceitful manner in which the bank officials attempted to cover up the lapses and how the recommendations made by COPE are being consigned into abeyance. This state of affairs is not only confined to the People’s Bank, but all public institutions that come before COPE know if they skip the day, it would be the end of the matters. Let us now examine the case

in point as appearing in the

verbatim report.

COPE referred to directives given and recommendations made at the previous meeting on 17 July 2018 and observed that the bank has failed to carry those out. COPE also referred to the loans written off by the bank and commented that there was a big increase. Compared to 2016, it reflected an increase of Rs. 482 million. As of 2018, the bank had written off a sum of Rs. 895.91 million as ‘unrecoverable loans’.

Non-Performing Loans (NPL) rate had increased to 3.11, and during the first nine months of 2019, the total transferred to NPL was Rs. 6,294 million. Compared to 2016, it is a 100% increase. The first 10 customers in the NPL list accounted for a total amount of Rs. 37,727 million. COPE had noted that one loan in this category granted to CML/MTD Construction Ltd. had been rescheduled 219 times.

COPE had pointed out that facilities had been granted to CML-MTD Construction when Jehan Amaratunga was the Executive Vice Chairman of the Walkers CMA Group, serving at the same time as a member of the People’s Bank Board of Directors.

As of 27 September 2019, out of the facilities granted to Walkers CML Group, a sum of Rs. 3,946 million had been transferred to NPL. COPE also noted that a total sum of Rs. 3,339 million, i.e. 85% of the total NPL, was without adequate securities.

The explanation given by the bank’s General Manager (GM) about MTD Walkers is noteworthy. He had stated that these loans had been given considering the cash flows. He informed COPE that they had a discussion on that day itself about the sale of shares of this company to a local investor and expressed confidence of the possibility to recover this huge sum.

But it is public news now that this share transfer is not taking place, as reported in the Sunday Times of 2 February, “MTD Walkers to close business, as the proposed share transaction will not be pursued, as there has been no forward movement on the deal”.

It is difficult for anyone conversant with basic commercial knowledge to believe how a share transaction between a seller and a buyer could settle a loan of the company unless there was a legal claim lodged in that respect!

COPE noted that the total amount outstanding as at 20 August 2016 was Rs. 2,742 million with accrued interest. The explanation tendered by the People’s Bank GM was that the facility was granted on a Treasury Guarantee provided by Mihin Lanka.

Answering a query by the MPs, the GM had said the guarantee was still valid and due to expire on 31 December; and that the company is under liquidation, therefore the bank could recover the dues in priority during the liquidation process.

According to this, it is clear that the bank is saddled with no tangible security and has to rely on liquidation proceeds. If the company does not have assets, then what? If the bank could enforce the Treasury Guarantee to meet the obligations, then there is no necessity to await the outcome of a liquidation. The other issue is the bank continues to keep the loan in the current section despite the liquidation process, which is contrary to CBSL regulations.

The bank was questioned about this directive, stating that it was irregular to recruit in this manner.

The bank, in response, said they had recruited only 80 school leavers as trainees. COPE had pointed out that recruiting from lists submitted by politicians was wrong and should be discontinued as it was a clear instance of undue political influence.

COPE noted that People’s Bank had awarded 13 construction projects, costing Rs. 1,964 million, to People’s Property Development, a company floated under the bank’s subsidiary, People’s Leasing.

COPE pointed out that the bank had continued this practice even after it had directed them to stop it. COPE also pointed out that an audit company, KPMG, had earlier commented against this.

CEO/GM Vasantha Kumar was due to be discontinued from his contract period in July 2018 on his reaching 60 years of age. A request had been made at the earlier COPE meeting to give him a further extension of six months. COPE had decided that it should not be given and categorically directed the bank to discontinue him on the due date.

COPE had sent that decision in writing on 19 July 2018 to the Ministry of Public Enterprise Secretary and to the Ministry of Finance Secretary. The Ministry of Finance Secretary acknowledged the direction of COPE. This matter was raised in Parliament, too, and Minister Kiriella had then pledged that the service of the person would not be extended. But Vasantha Kumar’s services had been continued till 14 April 2019, overlooking all the above directives and assurances. During this period, the following payments had been made to him.

COPE directed as follows:

Another alarming revelation from the COPE investigation was the case where two bank vehicles were released to this CEO as a ‘take-home gift’. The following details had been highlighted.

to Vasantha Kumar at a book value of Rs. 113,698, as computed by the bank

COPE pointed out that it is highly irregular for the bank to devalue a new vehicle bought in April 2018 to Rs. 133,000 just in a matter of six months! Will COPE monitor whether the bank had complied with the directives, or will the bank sweep it under the carpet?

COPE pointed out that the Bank had agreed to pay $ 11 million to a company called Silver Lake for this project. Up until 26 August 2019, the bank had paid $ 7.3 million to

this company

The bank had compensated the supplier in respect to two modules out of seven, the full payments before completion of the work; the payment had been made on 28 December 2017, whereas the User Acceptance Testing process had been started only on 12 January 2018 and 28 September 2018.

COPE had noted that in addition to the agreed amount, the bank had from time to time paid large sums on account of module changes and hardware modifications. COPE had pointed out that a total sum of Rs. 452,587,000 had been paid in

this manner.

In addition to all these, a sum of Rs. 84 million was paid to the local agent, Just in Time Technologies, without any documentary proof except the invoice submitted by

the supplier.

The GM, explaining the circumstances for this payment, said before COPE that they were not previously aware about such a claim for payment but came to know only after the invoice had been submitted by the supplier. “We only reimbursed this amount of Rs. 84 million,”

he claimed.

After protracted discussions, COPE directed the bank to submit the details of the forensic audit conducted by the bank to determine the officials responsible for this payment, and the bank agreed to do that in six months.

During the COPE investigations, former Chairman Hemasiri Fernando admitted that “due to the total lack of knowledge, there had been lapses on our part. When we realised that we were falling into difficulty, we started acting on this”.

What we observe is that huge amounts of public money have been wantonly wasted due to lack of knowledge, mismanagement, fraudulent operations, unsavoury collusions, corruption, and many other underlying factors.

Huge amounts of loans granted very recently are transferred to NPL. The big question is, could anyone be held responsible and accountable? The COPE inquiry has ended. Auditors have reported the shortcomings they had come across. Another COPE has started. There will be yet another after the elections. So what?