Monday Feb 16, 2026

Monday Feb 16, 2026

Wednesday, 30 August 2017 00:00 - - {{hitsCtrl.values.hits}}

The Institute of Chartered Accountants of Sri Lanka has adopted three new Accounting Standards which will be effective soon.

The Institute of Chartered Accountants of Sri Lanka has adopted three new Accounting Standards which will be effective soon.

SLFRS 9 – Financial Instruments and SLFRS 15 – Revenue will be effective from 1 January 2018 whereas SLFRS 16 – Leases will be effective from 1 January 2019. For companies whose financial year is December, they are effective from 1 January of the respective years and for those who are obliged to report quarterly, the first reporting date will be 31 March. Companies whose financial year end is March, these standards will be effective from 1 April of the respective years and the first reporting date for quarterly reports is 30 June. Consequently we have less than half a year to fully accomplish the implementation of SLFRS 9 and 15.

These standards, unlike some of the other standards, are expected to bring major changes to the financial statements of the entities particularly on their reported revenues, assets and liabilities.

SLFRS 9 replaces LKAS 39 – Financial Instruments – Recognition and Measurement, and will significantly impact the provisioning methodology on financial assets and expected to result in recognising significant amounts of additional loan loss provisions under the new Expected Credit Loss (ECL) Model.

Though this Standard is expected to mostly impact the banks and financial institutions it doesn’t relieve other entities completely. Those entities with significant amounts of investments, trade receivables and financial liabilities are likely to be impacted by SLFRS 9. The new ECL Model will provide investors with useful information on changes in credit risk exposure.

SLFRS 15 will have a significant impact on revenue recognition methods of companies which have long term contracts with the customers. It establishes a single, comprehensive framework for revenue recognition. The framework will be applied consistently so that comparability in the ‘top line’ of the financial statements is expected to be improved.

Presently the inconsistencies and weaknesses in revenue Standards may have resulted in companies accounting for similar transactions differently, which led to diversity in revenue recognition practices. The new comprehensive framework ensures that contracts with customers that are economically similar will be accounted for on a consistent basis.

SLFRS 15 will have little effect on the amount and timing of revenue recognition for many straightforward transactions such as retail transactions. For other contracts, such as long-term service contracts and multiple-element arrangements, IFRS 15 could result in some changes either to the amount or timing of the revenue recognised by a company.

SLFRS 16 introduces a single lessee accounting model and requires a lessee to recognise assets and liabilities for all leases with the exception of those contracts with a term of less than 12 months. A lessee is required to recognise a right-of-use asset representing its right to use the underlying leased asset and a lease liability representing its obligation to make lease payments. This will be a very significant change from the current finance and operating lease model for lessees.

A lessee measures right-of-use assets similarly to other non-financial assets (such as property, plant and equipment) and lease liabilities similarly to other financial liabilities. Consequently a lessee recognises amortisation of the right-of-use asset and interest on the lease liability. Assets and liabilities arising from a lease are initially measured on a present value basis. The initial lease asset equals the lease liability in most cases.

SLFRS 16 substantially carries forward the lessor accounting requirements in LKAS 17 as it currently stands. SLFRS 16 transitional provisions allows to continue existing finance leases as it is while existing operating leases will have the option for full or limited retrospective restatement to reflect the requirements of SLFRS 16.

The remainder of this article will focus on the significant changes that are introduced by SLFRS 9 – Financial Instruments. SLFRS 15 and 16 will be discussed in the next article which will follow.

The significant changes in SLFRS 9 that the financial statement preparers need to be familiar with are those in relation to classification and the ECL Model for impairment provisioning. Classification of the financial assets leads to application of the measurement and provisioning criteria.

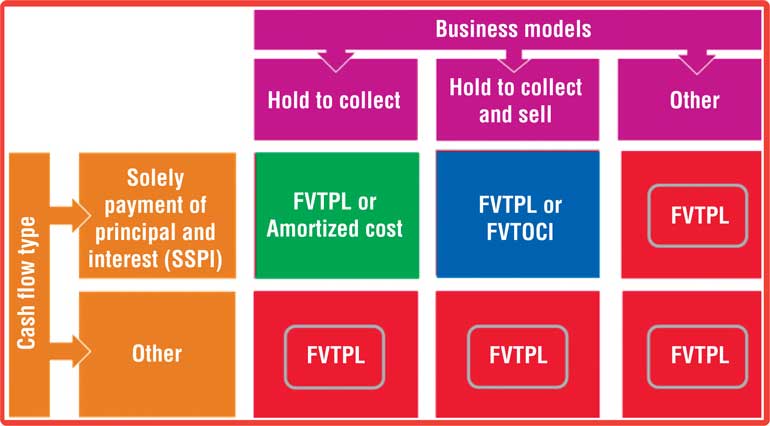

Any financial asset can be classified and measured at fair value through profit or loss (FVTPL). However, financial assets which are not equity and satisfy certain criteria are permitted to be classified and measured either at amortised cost or fair value through other comprehensive income (FVTOCI) as appropriate. Eligibility to qualify for these alternative classification and measurement categories are based on two criteria (a) the entity’s business model for managing the financial assets; and (b) the contractual cash flow characteristics of the financial asset.

The business model refers to how an entity manages its financial assets in order to generate cash flows. Cash flows may be generated by collecting contractual cash flows, selling financial assets or both.

If the cash flows are generated by collecting contractual cash flows, such business model is called ‘hold to collect’. Having some sales activity is not necessarily inconsistent with this business model. For example, sales that are infrequent or insignificant in value may be still consistent with this business model.

If financial assets are held in a business model whose objective is achieved by both collecting contractual cash flows and selling financial assets, such model is called ‘hold to collect and sell’. Compared to a business model whose objective is to hold financial assets to collect contractual cash flows, this business model will typically involve greater frequency and volume of sales.

The other criterion for determining the classification of a financial asset is whether the contractual cash flows  attached to the financial asset are ‘solely payments of principal and interest’ (SPPI). Often it will be readily apparent whether contractual cash flows meet the SPPI criteria but sometimes closer analysis is required. Interest predominantly comprise of a return for the time value of money and credit risk.

attached to the financial asset are ‘solely payments of principal and interest’ (SPPI). Often it will be readily apparent whether contractual cash flows meet the SPPI criteria but sometimes closer analysis is required. Interest predominantly comprise of a return for the time value of money and credit risk.

For contractual cash flows to be SPPI they must include returns consistent with a basic lending arrangement. For example, if the contractual cash flows include a return for equity price risk then that would not be consistent with SPPI.

Financial assets with SPPI cash flows are eligible for amortised cost or fair value through other comprehensive income (FVTOCI) measurement dependent on the business model in which the asset is held. In essence, if a financial asset is a simple debt instrument and the objective of the entity’s business model within which it is held is to collect its contractual cash flows, it can be measured at amortised cost.

In contrast, if that asset is held in a business model the objective of which is achieved by both collecting contractual cash flows and selling financial assets, then the financial asset is measured at fair value in the balance sheet but fair value changes can be accounted through other comprehensive income. All other financial assets should be measured at fair value and the fair value changes are accounted through profit or loss. The classification and measurement options for non- equity financial assets are shown in Table 1.

Investments in equity instruments do not qualify for SPPI and therefore are measured at fair value. However if the equity financial asset is not held for trading, the fair value changes are allowed to be accounted through OCI as an option. All other equity investments falling under SLFRS 9 should be measured at fair value through OCI.

This is done by looking at loan losses separately for financial assets that are performing as, or better than, expected and those that are performing worse than expected. For example, suppose that a bank lends money and grades the loan as a ‘C’ on the bank’s credit rating scale.

Simply put, as long as the loan is graded ‘C’ or better, a loan loss provision will be recognised that reflects a portion of the total losses expected on such a loan over its life. However, if that loan is subsequently downgraded and is considered by the bank to have ‘significantly increased in credit risk’, in other words to be underperforming, the bank would need to increase the loan loss provision to reflect the full lifetime loss expected to occur over the life of the loan, because of its new lower credit quality. An economic loss is suffered so this is reflected in the financial statements.

The US Financial Accounting Standards Board (FASB) is also proposing a move to a forward-looking expected credit loss model for companies using US Generally Accepted Accounting Principles (GAAP). However, while the direction of travel for both the IASB and the FASB is towards a more forward-looking model, the two standard-setters have a slightly different approach despite efforts to agree on the same solution. The FASB’s model will require that all expected credit losses (as for the underperforming loan in the example above) are always recognised. That recognition will start from the day a loan is made or a financial instrument is acquired.

The IASB does not believe that recognising full lifetime losses on day one faithfully represent the economic situation (a bank does not suffer such a loss when it lends on market terms). The IASB is also concerned that requiring banks to recognise all expected losses whenever money is lent would allow a bank to improve its profits by curtailing lending and thus decreasing its loan loss provisions. This could have unintended economic consequences, especially in an economic downturn.

Even though LKAS 39 did not require waiting for actual default before impairment is recognised, in practice this was often the case. The main objective of the new impairment requirements is to provide more useful information about an entity’s expected credit losses on financial instruments.

The model requires an entity to recognise expected credit losses at all times and to update the amount of expected credit losses recognised at each reporting date to reflect changes in the credit risk of financial instruments. This model is forward-looking and it eliminates the threshold for the recognition of expected credit losses, so that it is no longer necessary for a trigger event to have occurred before credit losses are recognised. Consequently, more timely information is required to be provided about expected credit losses.

Furthermore, when credit losses are measured in accordance with LKAS 39, an entity may only consider those losses that arise from past events and current conditions. The effects of possible future credit loss events cannot be considered, even when they are expected. The requirements in SLFRS 9 broaden the information that an entity is required to consider when determining its expectations of credit losses.

SLFRS 9 impairment model is applied to all financial instruments that are subject to impairment accounting. This includes not only financial assets classified as amortised cost and fair value through other comprehensive income but also lease receivables, trade receivables, and commitments to lend money and financial guarantee contracts. However a simplified approach is available for trade receivables where the companies have the option to classify all trade receivables in stage 2 and recognise lifetime losses.

SLFRS 9 requires the financial assets to be considered under three categories for loss provisioning purposes. (1) Financial assets performing as or better than expected (Stage 1); (2) Financial assets performing worse than expected but not yet defaulted (Stage 2); and (3) Financial assets not performing or defaulted (Stage 3).

Stage 1 comprise of new financial assets and financial assets originated in a previous period, but still performing as expected (in terms of credit risk) at the time of origination without any change in its risk characteristics. For those financial assets in stage 1, an entity needs to determine three things:

(1) The events that could result in a default of the anticipated cash flows;

(2) The probability (P) that such event could occur within the forthcoming 12 months;

(3) The loss that the entity is exposed to (Loss Exposure – LE) if there is a default.

The entity needs to recognise a loan loss provision equal to P x LE. This is called the 12-month expected credit loss.

Stage 2 comprise of financial assets where the performance (in terms of credit risk) has deteriorated below what had been expected originally and such deterioration is considered by the entity as significant though there have not been defaults yet. For these financial assets, an entity needs to determine the three things as for stage one with the exception that the probability (P) should be that a default event could occur during the remaining lifetime of the asset. The entity recognises a loan loss provision equal to P x LE which is called the life time expected credit loss.

Stage 3 is as same as the loss provisioning category in LKAS 39. When the financial asset is actually credit impaired and defaulted they are brought under this category. Since the default has already been taken place there is no relevance of probability of default. Therefore the lifetime expected loss need to be calculated based on the exposure considering discounted present values of the estimated cash flows with reference to estimated timing.

Interest revenue in respect of financial assets in stage 1 and 2 are recognised on the gross carrying amount whereas for those in stage 3 are recognised on the net carrying amount.

SLFRS 9 requires lifetime expected credit losses to be recognised when there are significant increases in credit risk since initial recognition. Expected credit losses are updated at each reporting date for new information and changes in expectations even if there has not been a significant increase in credit risk.

The assessment of whether lifetime expected credit losses should be recognised is based on a significant increase in the likelihood or risk of a default occurring since initial recognition. Generally, there will be a significant increase in credit risk before a financial asset becomes credit-impaired or an actual default occurs. Therefore the entities need to establish criteria to periodically assess the credit risk of its financial assets to determine whether there is a significant increase.

An entity should consider reasonable and supportable information that is available when determining whether the recognition of lifetime expected credit losses is required. Assessment of significant increases in credit risk may be done on a collective basis, for example on a group of financial instruments. This is to ensure that lifetime expected credit losses are recognised when there is a significant increase in credit risk even if evidence of that increase is not yet available on an individual level. Lifetime expected credit losses are expected to be recognised before a financial instrument becomes delinquent. Typically, credit risk increases significantly before a financial instrument becomes past-due.

As stated at the beginning, the effective date of SLFRS 9 is just a few months away.

The entities will have to re-compute the expected losses on 1 January 2018 (1 April 2018 for 31 March reports) upon transition. The current provisions may encompass only stage 3 losses. Therefore stage 1 and stage 2 losses will have to be calculated and it could be an additional loss that may arise on 1 January. This is expected to deplete the capital base of entities which they should also be mindful of.

There are practical expedients available for transition. For example upon transition, if segregation of performing assets in to stage 1 and stage 2 is practically difficult, all such assets may be carried as stage 2 assets. This method is mostly relevant in respect of trade receivables as their life time, in most cases, be less than 12 months. However classification of all performing assets in stage 2, while convenient, will result in a lager loss provision.

Therefore, the entities need to evaluate all transition options available and select the most appropriate one to be applied on 1 January. Once applied it cannot be reversed.

(The writer is Managing Director – BDO Consulting Ltd.)