Friday Mar 06, 2026

Friday Mar 06, 2026

Monday, 19 April 2021 00:05 - - {{hitsCtrl.values.hits}}

Palm oil is used by Sri Lankans in almost every aspect of life; from toothpaste to shampoo to soap to lipstick to confectionary – palm oil is an integral component. It is in 50% of all consumer products and plays a central role in a slew of industrial applications

Dr. Shatadru Chattopadhayay

Dr. Shatadru Chattopadhayay

A couple of days back, Sri Lanka’s President Gotabaya Rajapaksa ordered all palm producers to remove the trees in a phased manner and replace them with rubber trees. Sri Lanka also banned palm oil import, affecting around 200,000 metric tons of palm oil mainly supplied by Malaysia. As per the press release, the Sri Lankan Government intends to stop palm oil consumption completely. In this context, Solidaridad Asia as an organisation working closely with the farmers of Sri Lanka would like to present an analysis on the impact of the ban on palm oil.

An official ban on palm oil production and imports with a vision of stopping palm oil consumption across the nation is quite unprecedented. I believe the Sri Lankan Government’s decision may inadvertently provide ammunition to the anti-palm oil campaigners worldwide working overtime to create a binary thinking in which companies, consumers and even governments are faced with only two options: to use or to ban palm oil. Therefore, it becomes crucial to have a balanced and fact-based analysis of palm oil production and trade in Sri Lanka.

Not easy to replace the miracle product – palm oil

Palm oil is used by Sri Lankans in almost every aspect of life; from toothpaste to shampoo to soap to lipstick to confectionary – palm oil is an integral component. It is in 50% of all consumer products and plays a central role in a slew of industrial applications. Palm oil’s ubiquitous presence in our lives is, in part, down to its unique chemistry. It is no wonder that palm oil consumption worldwide is predicted to grow at the rate of 5.5% CAGR, with more than 70% share of the food and confectionary industry.

Despite this, there is a theoretical possibility of substituting palm oil with coconut oil in the confectionery industry while maintaining the standard taste, quality and commercial viability. So, it is not surprising when the confectionery manufacturing industry of Sri Lanka raised concerns over its survival and security of jobs due to the ban on palm oil imports. The LCMA has warned that the palm oil ban will lead to the closure of factories and loss of thousands of jobs for people who are already struggling amidst COVID-19 related slowdown.

“The sudden decision by the Government has caused significant stress and additional burden to all confectionery, bakery and food processors severely. It affects all food processing industries, their viability and employees engaged,” says Lanka Confectionery Manufacturers Association (LCMA) Chairman S.M.D. Suriyakumara.

Palm oil ban may discomfort Malaysia

Sri Lanka imports around 90% of its total 200,000 tons from Malaysia. The volume affected by the Sri Lankan ban is insignificant, considering Malaysia produces and trades in around 20 million tons of palm oil per year. Malaysia’s Minister of Plantation Industries and Commodities Datuk Dr. Mohd Khairuddin Aman Razali said that Sri Lanka’s decision “is a discrimination against the country’s product. But it will not affect the country’s oil palm industry”. Earlier this year, Malaysia took legal action at the WTO against the European Union and member states France and Lithuania for restricting palm oil-based biofuels.

The Malaysian petition pleaded that the palm oil ban is inconsistent with the WTO’s Agreement on Technical Barriers to Trade, the General Agreement on Tariffs and Trade 1994, and the Agreement on Subsidies and Countervailing Measures. Because of this background, Sri Lanka’s top two export products to Malaysia – apparels and rubber becomes vulnerable. A dialogue between Sri Lankan and Malaysian stakeholders may help create a common understanding.

Is coconut oil more sustainable than palm oil?

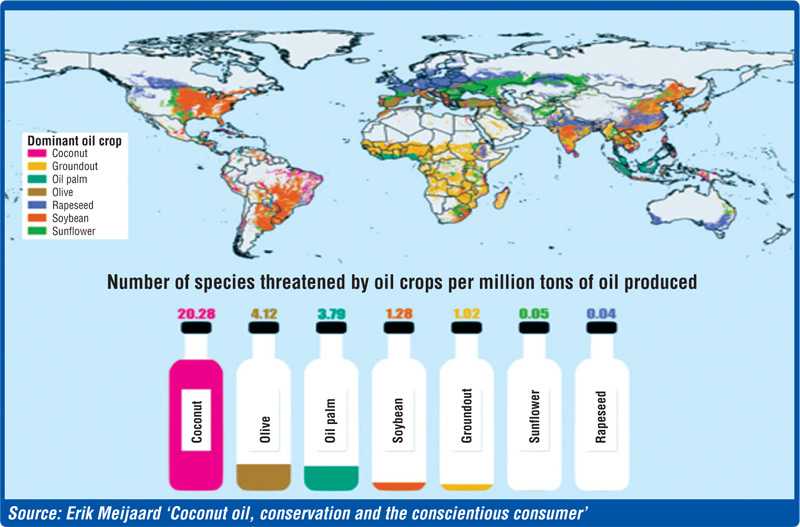

Coconut accounts for approximately 12% of all agricultural produce in Sri Lanka, with the total land area under cultivation covering 409,244 hectares (in 2017). Sri Lanka is one of the major exporters of coconut products in the world. While palm oil gets all the bad reputation, coconut is perceived as a sustainable alternative. A recent study (Current Biology, July 2020), found that coconut oil production, by some measures, is more destructive than palm oil production. Coconuts affect 20 threatened species per million litres of oil produced, while palm oil only affects 3.8 species per million litres. Of course, these findings are not conclusive, and already there are many critiques to them.

But the study clearly shows that most coconut growing countries were forested in the past. Still, in 2015 an average of just 11.2% of their land area remained under ‘primary’ forest (n=95, SD=17.7), with coconut expansion being the main driver of deforestation in some of them. Compared to that, Indonesia and Malaysia, which produces around 83% of all palm oil globally, have 50% and 18.7% are under primary forests, respectively. We have heard about the threat to the Orangutan population due to palm oil production. But how often have we heard that coconut farms were responsible for the extinction of the Marianne white-eye (Zosterops semiflavus), a tiny bird from Seychelles? Did we know that the Ontong Java flying fox (Pteropus howensis) disappeared from the Solomon Islands with the expansion of coconut plantations? Essentially, all edible oils impact the environment one way or another, but these impacts are often not well publicised.

A case for palm oil production in Sri Lanka

An import ban makes sense only when a robust import substitution plan backs it up to stop the foreign exchange outflow of around Rs. 30 billion each year. So, which crop can potentially replace palm oil in Sri Lanka? It will be most probably coconut considering its pre-eminence in Sri Lanka. But the numbers tell us a different story.

To replace 200,000 tons of palm oil imports through local production of oil palm, Sri Lanka will require only 50,000 hectares of land. The identical production volume replacement by coconut oil would require 200,000 hectares of land in a land-scarce Sri Lanka. Oil palm has four times more land productivity than coconut.

The cost of production (COP) of edible oil is an essential consideration for its feasibility from the producer’s and consumer’s perspective. Oil palm is by far Sri Lanka’s most profitable crop. Coconut generates Rs. 245,000 per hectare per annum, while tea and rubber produce Rs. 45,000 and Rs. 50,000 respectively, whereas oil-palm generates Rs. 514,000 per hectare per annum. The figure does not change dramatically even if the benefits of import tax for palm oil is discounted. Today Sri Lanka’s rubber industry faces massive challenges due to low international prices.

According to the reports, Regional Plantation Companies currently make a loss on every kilo of rubber produced. On the other hand, higher profitability from the oil palm crop would enable the plantation sector to provide an opportunity for the plantation workers to improve their earning capacity and enhance their quality of life.

On average, an oil palm harvester working on the Nakiyadeniya estate – Sri Lanka’s first oil palm estate – has been able to bring home an average wage of as much as Rs. 50,000 per month. Such substantial incomes have, over time, positively transformed the communities around the estate. By contrast, today’s average wage of a rubber tapper is Rs. 18,000 per month.

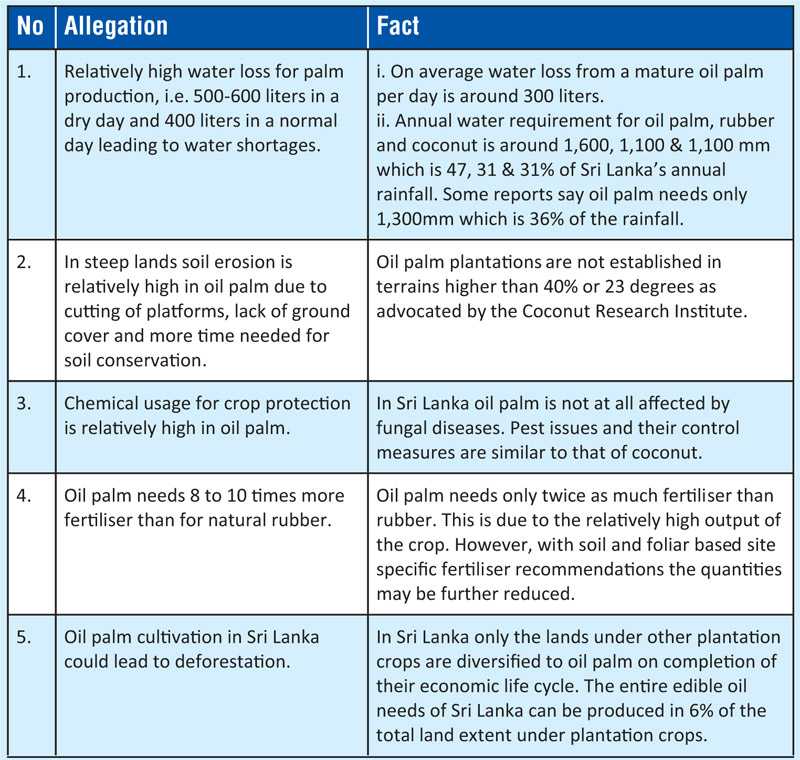

Sustainability debates around palm oil production in Sri Lanka

Unfortunately, like elsewhere in the world, the palm oil sector in Sri Lanka is a victim of a concerted environmental NGO campaign. Much of these campaigns fail to present an unbiased assessment of palm oil vis-a-vis other edible oils. Let us examine some of the major criticisms and analyse if facts back them up.

Potential way forward?

The Sri Lankan Government may consider creating a level playing field for sustainable production and trade in all vegetable oils in Sri Lanka without specifically targeting palm oil. A rules-based, open, non-discriminatory, equitable production and trading system in vegetable oil is conducive to world food security, improved nutrition and sustainable agricultural development.

Pressure on land use will grow in Sri Lanka in the coming decades because of urbanisation, increased population and the urgent need to restore natural ecosystems. Balancing palm oil imports with increased palm and coconut oil production in the country would enable this transition. Therefore, it is crucial to have a consistent framework for all vegetable oils in Sri Lanka to benefit the producers, companies, and consumers.

Sri Lanka has a great potential to save precious foreign exchange and create green jobs for the country’s rural workers by expanding palm oil production. The cultivation and processing of oil seeds contribute to 17 of the goals of SDG 2030, including poverty alleviation, contributing to the development of rural economies, especially smallholders’ improvements in education, health, communications and transport.

According to Stanford University’s research, “at least 1.3 million people were lifted from poverty in Indonesia as a direct result of the expansion of the palm oil industry”. Similarly, the Malaysian model of oil palm cultivation is being studied and replicated in many developing countries globally as a means to replicate Malaysia’s success in reducing poverty from 50% down to less than 5% in just a few decades.

Therefore, Sri Lankan stakeholders for edible oil could join hands with the Government and civil society to develop a scientific plan for edible oil security. Such a plan could lay down a road map for diversifying less productive plantation land to a smart mix of oil palm and coconut plantations, generating gainful employment for the workers and remunerative returns to the farmers.

Emotions have strongly dominated Sri Lanka’s public debate on palm oil, and it will continue to remain so in the years ahead. However, palm oil should not be made into a scapegoat and punished due to selective criticism by the usual lobbies. It is time to move toward a more balanced and fact-based discussion and focus on how industry, government, and civil society actors can drive the palm oil industry’s positive transformation in Sri Lanka.

(The writer is MD, Solidaridad Asia.)