Sunday Feb 15, 2026

Sunday Feb 15, 2026

Wednesday, 6 September 2017 00:00 - - {{hitsCtrl.values.hits}}

Infrastructure development is a key component of the economic development process of any country. The demand for infrastructure rises with the growth of affluence in an economy. In the Sri Lankan context, the Government has funded all major investments in infrastructure projects and public investment was used as an anchor for the economic growth in the past. This has drawn criticism from the economists who believe long-term growth of non-tradable sectors vis-à-vis tradable sectors have contributed to the imbalances in the economy.

Infrastructure development is a key component of the economic development process of any country. The demand for infrastructure rises with the growth of affluence in an economy. In the Sri Lankan context, the Government has funded all major investments in infrastructure projects and public investment was used as an anchor for the economic growth in the past. This has drawn criticism from the economists who believe long-term growth of non-tradable sectors vis-à-vis tradable sectors have contributed to the imbalances in the economy.

The situation is further complicated as those major investment projects with questionable socioeconomic benefits are funded through borrowed funds and such borrowings are to be serviced from tax revenue since the economic returns from those investments are insufficient to service debts.

Though many countries have initially relied on government funding for infrastructure development, the infrastructure financing options have broadened during the last few decades. Governments increasingly find it difficult to finance infrastructure projects entirely; hence private sector participation on a commercial basis is sought.

Other developing countries that are ahead of us in the development process, have adopted successful alternative modalities, known as Public-Private Partnerships (PPPs) for facilitating rapid development of critical infrastructure, which have contributed to the acceleration of industrial development. Furthermore, such modalities have attracted Foreign Direct Investment (FDI) and subsequently contributed to stabilisation of fiscal and external balances.

Needless to mention, our infrastructure development is lagging behind competitors in the region since the Government has historically relied on public finance for funding critical infrastructure projects. This has added enormous pressure on the Government’s fiscal operations and hindered the development process of the country.

This paper attempts to understand the need of such alternative modalities to catch up a lagging infrastructure sector, review our past experience, identify different PPPs modalities and understand how to employ PPPs for the expansion of infrastructure in the road sector.

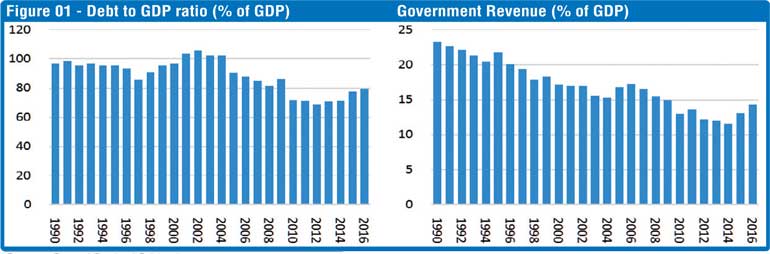

As noted above, reliance of public finance for the development of infrastructure has not only been a major constraint for infrastructure development, it has also contributed to increase the fiscal burden and level of national debt (i.e. debt to GDP ratio). In addition, key SOEs are also highly indebted in investing into certain infrastructure projects with low economic returns, aggravating the country’s indebtedness and fiscal vulnerability.

Economists argue that disproportionate public sector borrowings cause serious misallocation of resources within the economy. Productive private investments are curtailed due to the crowding out effect and subsequently impact the overall economic growth and economic wellbeing of the people.

Further complications occur when those borrowings are used for building non-productive assets. If the economic returns from the underlying investments are inadequate for servicing the debt, the Government is compelled to increase taxes to cover the revenue shortfall. This in turn affects and further slows down economic growth.

Sri Lanka has successfully tested PPPs several times in recent history for the development of port terminals in  the Port of Colombo (South Asia Gateway Terminals – SAGT and Colombo International Container Terminals – CICT) and introducing independent power producers (IPPs) for power generation.

the Port of Colombo (South Asia Gateway Terminals – SAGT and Colombo International Container Terminals – CICT) and introducing independent power producers (IPPs) for power generation.

The PPPs in the above sectors have contributed to the expansion and increase the competitiveness of the sectors while providing uninterrupted services. Certain infrastructure requires management expertise in addition to large capital investments. Our experience in the above sectors are testimony to the fact that well-executed PPPs could bring about dual benefits.

Countries have used variant of PPP modalities such as concessionary agreements, Build-Operate-Transfer (BOT), Build-Own-Operate-Transfer (BOOT) and Build-Own-Operate (BOO) for development of infrastructure. For increasing the operational efficiency and capital productivity of existing infrastructure assets, the governments opted into management agreements, long-term leasing, concessionary agreements, and Takeover-Operate-Transfer (TOT).

These modalities has contributed in attracting long-term FDI inflows into the country. It also important to indicate the investor community that the Government use PPPs as a strategy in the economic agenda and create a continuous deal flow for them to commit funding for researching the economy, conducting in depth sector analysis and feasibility studies.

The establishment of National PPP Agency in the Ministry of Finance is one positive step towards streamlining PPP activities. Infrastructure investments has a direct link to public finance, fiscal policy and national planning. As a result, housing the national PPP agency within the Ministry of Finance makes much sense. Further, coordination and cooperation with public finance, fiscal operations and other line ministries are required in implementing a successful PPP regime.

The State-owned SLPA has borrowed $ 1.271 billion for construction of Hambantota Port. Economies of scale is the critical factor in deciding the profitability of port operations in the modern container shipping industry. With limited scope and operation, Hambantota Port had become a severe drain on public finance.

Under the prevailing circumstance, the best option for the Government to revive the operation of Hambantota Port was to hand over the port operation to a reputed port operator through a suitable PPP mechanism. The Government, after long deliberation, signed the PPP agreement with the selected PPP operator, China Merchant Port Holdings Company Ltd. (CMPH).

Despite the unwarranted criticism from the opposition, it is a major win for both the Government and public. The Government is compelled to stress its public finance (tax revenue or new borrowings) to service debt and cover losses so long as Hambantota Port remains in the Government balance sheet. The private operator will use their network to generate and divert cargo volumes to make the port a commercially-viable business operation. The revival of port operations will generate new employment and economic activities while proposed industrial zone in the adjacent area should attract foreign capital and export-oriented manufacturing.

Sri Lanka had directed a disproportionate share of public investments in the recent past towards the development of main inland transport links within the country. However, the status in public transport still remains poor, and thus requires large investments.

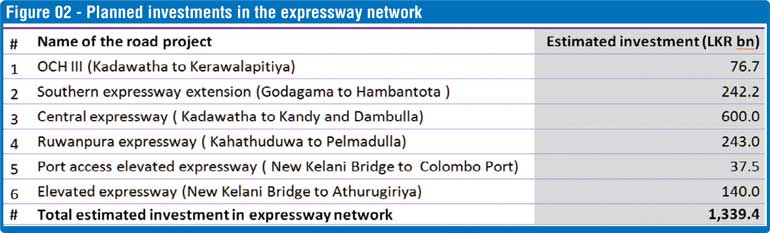

The Government understands that there is a limit in directing further public finance towards the development of inland road networks (i.e. expressways) and public transport facilities (i.e. metro rail). The proposed Central Expressway connecting the capital city with Kandy and North Central Province requires nearly Rs. 600 billion during the next four years. In addition, the Government has committed finances (nearly Rs. 360 billion) for other large expressway projects i.e. the extension of Outer Circular Expressway (OCH) from Kadawatha to link Colombo Katunayake Expressway, extension of Southern Expressway beyond Matara and construction of elevated expressway from New Kelani Bridge (under construction) to Port of Colombo (known as Port Access Highway).

This leaves no room for additional finance for other proposed major expressway projects i.e. Ruwanpura expressway (to link Ratnapura, Pelmadulla and the hill country region with the capital city) and elevated expressway from New Kelani Bridge to Athurugiriya.

Understanding the above limitations, the Government has decided to test PPP for proposed elevated expressway from New Kelani Bridge to Athurugiriya. If the Government could close a successful PPP structure for the elevated expressway, it will be a strong case for offering the proposed Ruwanpura and other expressways on similar basis to source inward investments into roads.

The main risk factor of a typical road PPP is the demand risk. The complexities arise due to connectivity with other expressway operators, legality for deciding toll charges and standards for operation and maintenance of road. Main variants of PPP structure for expressways could be listed as follows:

A. Toll/fare based: The operator is exposed to the demand risk of the expressway and is responsible for the collection of toll from the expressway users. The downside risks of toll based operations are Government policy with regards to toll charges and the impact of new competitive modes of transport on the expressway traffic.

B. Toll/fare plus viability gap fund: The Government through availability of viability gap funding to the developer minimise the demand risk.

C. Annuity: This method is a modern development to road PPPs as the demand risk is completely removed from the operator while it allows the other improvement through participation of private capital and operational efficiency. The effective structure of the PPP is retained, but instead of toll revenues, the government pays an “annuity” availability payments on an agreed frequency. The return expectation of any investment is proportionate to the risk of the investments. As such, the return expectation under annuity models should be lower and close to the return expectation of a fixed income investment.

A successful PPP in developing infrastructure would contribute to accelerate the country’s development process by attracting inward foreign investments, improving operational efficiency and facilitating the adherence to international best practices for operation and maintenance. This will therefore allow such infrastructure projects to be commercially viable and broaden funding options for future developments.

PPPs are not immune to failures. If such failure occurs, it is the duty of the Government to understand the reason for failures and take remedial action; however it should not be viewed as impediment for future PPPs.

Concept of privatisation of national assets by PPP is a narrow definition and is grossly misused in the Sri Lankan context. PPP for infrastructure projects opens up a whole new set of foreign capital into the development process and increases the long-term wellbeing of the people. Our past experience, as well as the experience of regional peers, serve as important evidence to alleviate those unjustified concerns about PPPs, raised primarily due to fear of non-familiarity.

For greater stakeholder support in using PPPs as a key strategy for infrastructure development, the Government and relevant authorities should continue to engage them, bringing about positives and benefits.

(The writer is a CFA charterholder and a capital market specialist. The views and opinions expressed in this article are those of the writer and do not necessarily reflect the official policy or position of any institution.)