Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 18 January 2021 00:00 - - {{hitsCtrl.values.hits}}

The setback due to the pandemic has aggravated some of the perennial macro-economic and sectoral problems in Sri Lanka. For example, borrowing and accumulating external debts has been a practice of successive governments since 1978, which was the year of partial liberalisation of the economy. During the early periods, when Sri Lanka was considered a low-income country, we were entitled to substantial grant aid as well as concessionary finances.

The setback due to the pandemic has aggravated some of the perennial macro-economic and sectoral problems in Sri Lanka. For example, borrowing and accumulating external debts has been a practice of successive governments since 1978, which was the year of partial liberalisation of the economy. During the early periods, when Sri Lanka was considered a low-income country, we were entitled to substantial grant aid as well as concessionary finances.

This relatively low interest facilities and lenient conditionalities provided incentives for the governments to keep borrowing for many development projects, from bi-lateral and multi-lateral lending agencies, irrespective of inflated costs of many of these projects. In most of these cases, financial benefits also have spilled over to Sri Lankan politicians, bureaucrats, and technocrats. Notwithstanding such leakages, these foreign funded projects increased the availability of more sophisticated infrastructure and utilities in sectors such as, electricity, highways, drinking and irrigation water, as well as the Colombo Port and airports. In addition, education, agriculture and health were the prime targets of both Sri Lankan policy makers and donors/lenders.

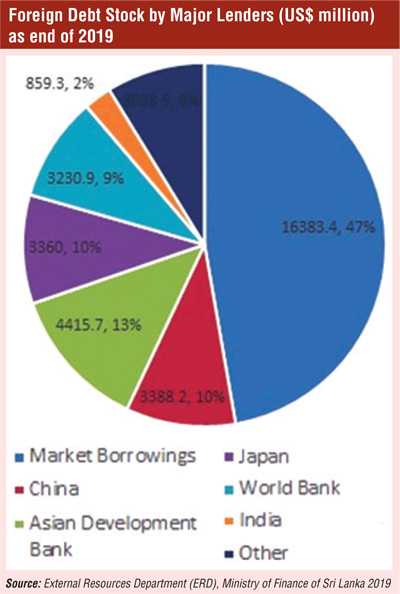

There was a period that Sri Lanka was termed as “a Donor Darling” (of course, Sri Lanka become a darling of the Western donors primarily due its subservience to the West under Jayawardena-Premadasa regime). However, since we attained lower-middle income country status, concessionary funding has not been available and therefore, most borrowings have been at commercial or near commercial lending rates. In this context, the country has accumulated over $ 34.7 b debt1 up to 2019. These borrowings have been for development projects, import of consumption items and direct budgetary support to meet current expenditure, including debt servicing. The current debt situation is depicted in the chart.

At the moment, one of the most critical challenges for the Rajapaksa administration is managing or preferably reducing Sri Lanka’s debt while meeting the current level of foreign exchange requirements and hopefully implementing necessary development projects.

While the selected development projects are generally presented to the multilateral donors; World Bank and ADB as well as bilateral lending institutions such as JICA, US-AID and similar institutions in China and European countries, seeking loan financing, the rates of lending are equal or closer to the market rates. Since 2007, borrowing through International Sovereign Bonds (ISBs), which became a common practice, has now emerged as the most serious challenge for the current government to ensure sustainability or reduction foreign debt.

The focus of this article is to discuss alternative methods of managing the debt in spite COVID 19 pandemic that has pushed almost entire world (other than China) into a recession.

In this context, conventional economic policy pundits, academics and consultants recommend that the emerging economies such as Sri Lanka should seek the refuge in International Monetary Fund (IMF) Programs. Based on the IMF guarantees the countries in foreign debt crisis will be eligible for further assistance from other multilateral and bilateral lenders, while qualifying for accessing the International Sovereign Bond Market. According to this prescription, without the support and blessing of the IMF, we have no way of securing sufficient funding for re-payment of maturing debt, balance of payment requirements or development programs.

Since the election of the new government all our well-known economists, and many so-called experts have been promoting the above policy prescription as Sri Lanka is, according their assessment, at the verge of a default and economic collapse. Most, if not all, of these pundits were expecting the Government will continue to proceed with the borrowing from the international markets subscribing to Samurai or Panda bonds. Surprisingly our conventional economic advisors are increasingly becoming impatient and critical of the Government for not negotiating with the IMF to enter into a program which will be entitled and receive loan facility and more importantly in turn qualify for raising finance through ISBs. Does this process lead to a reduction of debt or payback of loans? Of course not, nor reduction of debt burden or the severity of the debt problem.

As an IMF program is likely to impose conditionalities to meet the Fund’s debt sustainability parameters, the readers may perhaps understand that, this approach is not even to reduce the severity of the debt problem but for reducing the burden over the next few years by extending maturities probably through some form of ‘Grace Period’. The bottom line will be that Sri Lanka will continue to have challenging debt dynamics which I would like to call it as ‘IMF/ISB debt trap’ as long as we fail to achieve substantial increase of exports and FDI. In other words, we will merely be postponing and aggravating the debt problem unless we can accelerate growth by increasing production of tradable goods and services which will earn or save foreign exchange.

Cost of raising funds through International Sovereign Bonds

A sovereign bond is defined as a debt instrument issued by a national government to raise generally foreign currency requirements in case of countries such as Sri Lanka. Sovereign bonds are denominated in foreign currencies such as USD, the Euro, Japanese Yen and Chinese Yuan. The successful issue of ISBs require several steps engaging highly professional individuals and institutions including global banking giants. Under each of these steps many upfront costs are to be incurred by the government. A typical bond issue involves, fees (commissions) and other expenses. Three large components of the fees, according to a World Bank document are for the lead-managers, rating costs and legal expenses. Interestingly those transaction costs are paid at time of issuance (upfront).

In spite of the competition among the banks there is little transparency especially with regard to bond issues of countries like Sri Lanka. Another major expense is often for obtaining a rating for each bond which is generally similar to the fee for the lead-managers. There are also expenses for legal counsel, marketing especially road shows, fiscal and paying agents and advisors. Cost will also depend on which markets are targeted for the road shows undertaken in major cities in developed market economies.

Throughout the Sri Lankan history of issuing ISBs people have only learned about the total value of the bond issues and subscribed but not the direct and indirect costs that have been incurred in the process, for example, officials of the Central Bank, Ministry of Finance, etc. will be travelling to several capitals in the world for negotiations, road shows and other associated events, etc. incurring scarce foreign exchange of Sri Lanka. Of course it should have provided very tempting incentive for this approach

Some economists who are faithful followers of IMF policy prescriptions prefers to identify the IMF/ISB Debt Trap as the symptom not the cause of the problem. According to them the debt trap was caused by poor fiscal outcomes over many years and IMF/ISB debt was incurred to meet deficit financing.

In this article, the most pertinent and decisive issue to raise is, what should be the alternative policy recommendations of our learned economists. As we all are well aware if Sri Lanka qualifies to receive assistance from the IMF, such funding will be for as balance of payment support subject to certain conditionality which are likely to include; removal or reduction of subsidies, removal of import controls, non-strategic assets privatisation, etc. and many such measures of government interventions. Many, if not all these adjustments will be painful to the ordinary citizens and therefore, make it difficult to sell politically. If Sri Lanka for that matter, any other country in our predicament is not willing to go through an IMF austerity program with its stringent conditionalities, what options are available for them. Let’s discuss what appears to be the economic management strategy of the current Government.

With the lockdown of the world economies and disruption of global value-chains, the Sri Lankan Government was compelled to ‘close the economy’ to some degree. Subsequently, the Government policy makers seem to be implementing a fairly well-managed import administration scheme and associated measures to ensure enhanced foreign exchange savings. Current import management scheme has selectively targeted non-essential ‘big-ticket’ items.

In order to prevent further deterioration of the debt situation the Government seems to be minimising new borrowings for implementation of numerous development projects with commercial characteristics. Both acceding to IMF austerity program, as well as, controls imposed by the Government will have contractionary impact on the local economy. Of course, second option will reduce the confidence of capital markets, foreign equity investors and even some local enterprises. Generally, IMF programs are sold to a government in need of balance of payment support on the basis that agreement with the Fund would pave way for the country to achieve a higher sovereign rating and confidence of the investors in ISBs.

Pertinent question here is, as learned economists, professionals and advisors, are they in a position to develop an alternative development strategy for Sri Lanka in order to overcome the current difficulties reducing the severity of the debt burden created primarily through borrowings from ISBs. It appears that the, current administration is developing a strategy that will cause less pain to the people than under an IMF program and have more positive outcomes in terms of output, employment and incomes.

Unfortunately, however, in the past, we have rarely seen Sri Lankan policy makers or even academics develop alternative concepts or strategies instead of repeating what they have learned as classical, neo-classical or Keynesian schools and reinforced by the training programs conducted by multilateral or bilateral lending agencies.

In conclusion, let me quote once again from my recently published article;

“Whatever the reasons are, instead of thinking independently on their own most of our economists parrot their mentors in the west for short-term gains like easy recognition and self-fulfilment promoting the same formula aggravating the vicious circle and perpetuating the misery of our people. Irony is that when a solution is needed the only thing some of our experts are capable of recommending is to seek refuge in borrowing from multilateral or bilateral lending agencies. Most Sri Lankans need to be reminded that Sri Lanka has already gone under 16 IMF programs and has reached the current predicament. This reminds us the famous saying attributed to Einstein that ‘insanity is doing the same thing over and over again and expecting different outcomes’.

Signs are that the current administration is deviating from the orthodoxy and searching for innovative and pragmatic development path.

(The writer is Managing Director, Veemansa Innitiative, Think Tank and Advocacy Group. This article is based on a keynote address delivered by the writer at the eighth International Research Conference conducted by the Department of Economics and Statistics, University of Peradeniya.)

Footnotes

1 Foreign Debt stock by Major Lenders, in US $ Million, External Resources Department (ERD), Ministry of Finance of Sri Lanka 2019. See more; http://www.erd.gov.lk/index.php?option=com_content&view=article&id=102&Itemid=308&lang=en