Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 22 November 2017 00:00 - - {{hitsCtrl.values.hits}}

Changing consumer needs and preferences: Convenience and accessibility at the fingertips around-the-clock

Changing consumer needs and preferences: Convenience and accessibility at the fingertips around-the-clockToday, as a society we are noticing a historical shift from cash-based transactions to digitisation of financial transactions, and from the use of traditional banking channels to e-channels. Cashless transactions are becoming more of a norm rather than an exception. A notable shift in our mind-set has transpired in the last 10 years.

Technological innovations and changing consumer appetite (such as the demand for convenience and around-the-clock access to banking services) have driven a shift in consumer demands and usage patterns away from traditional banking channels and methods.

Bank cards such as credit, debit, and loyalty cards have become a ubiquitous item in our daily lives. Last year (2016), the number of credit, debit and prepaid cards is 19.50 billion. This is expected to increase 24% to 26.09 billion by 2021. Card based transactions for goods and services worldwide reached 257.17 billion in 2016 for Visa, UnionPay, Mastercard, JCB, Diners/Discover, and American Express (Nielsen report).

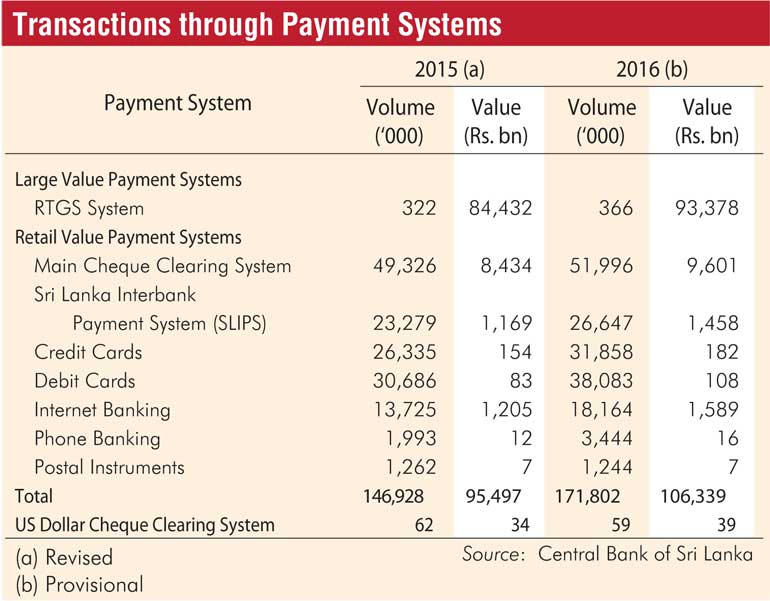

A similar trend can be observed in Sri Lanka. Over the last decade, financial services have been clamouring to gain market share by enticing potential consumers by way of special promotions for credit/debit card usages and incessant advertising campaigns for their products and services. They appear to have certainly achieved this objective since according to Visa International there are presently over 17.73 million debit cards and 1.31 million credit cards in circulation in Sri Lanka; that is over half of all Sri Lankans owning a debit card (end of 2016).

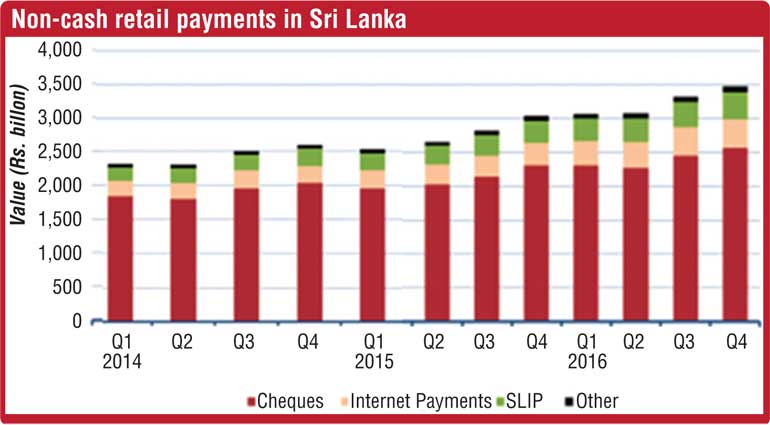

In recent times we have observed newer and more sophisticated payment channels being offered to consumers; namely, internet and mobile banking. An increasing portion of consumers is now comfortable performing routine transactions, such as utility payments, fund transfer and balance checking, via online services provided by their respective financial institutions.

Though mobile banking and internet banking has been around for over a decade, its adoption rate and popularity have grown over the last few years. Customer attitudes towards mobile banking have become positive due to the emergence of advanced mobile and smartphone technology, advancements in functionalities and security features, and an overall increase in the use of smartphones by the banking public.

Mobile financial services not only fill the need for “anytime” banking for customers, they also have the potential to reach out to a large unbanked population. Low operating costs and higher penetration rates of mobile phones across all demographics make this particularly attractive in developing markets. While mobile financial services offer an enhanced value proposition to current and future banking customers, the medium also provides a viable business case for banks through reduced operational costs and increased revenues.

With the emergence of technologically-advanced mobile phones, there has been a significant surge in the demand for better mobile banking services. Mobile banking is fast approaching a tipping point due to increasing demand from customers supported by faster adoption cycles for mobile banking. Banks that embrace and develop a holistic mobile banking strategy are expected to be better positioned to drive customer acquisition, improve profitability, and increase customer retention.

Increasing bank branches – Is it the viable solution to attract and retain today’s customers?

The natural tendency for providers of financial services has been to rapidly expand their branches and offices in order to cater for the increased customer base. Branches have always played an important role and remain a key banking channel. However, it’s imperative that banks adapt to the changing needs and preferences of today’s customers in order to remain competitive in the market. Retail banks today are under pressure to improve their quality of service, while also reducing costs to remain competitive in an extremely volatile and uncertain market.

Improving customer service is crucial for banks in the current market and economic scenario, where product and price no longer provide a clear competitive edge. Distribution channels play a key role in delivering an enhanced customer experience as customer interactions begin and end with channels. Banking customers are increasingly expecting more convenience, accessibility, personalisation, and reliability across the distribution channel network.

Banks need to deliver these features by leveraging innovative technologies and solutions for a seamless and personalised experience. There is a clear demand for banks to invest in their channel networks to make them more customer-centric and user-friendly, while in the process improving the channel efficiencies for a better return on investment and increased profitability.

As branch networks typically constitute around 75% of a bank’s total distribution costs, the key challenge banks face today is to justify the high branch-operating costs at a time of lower branch-driven revenue growth. It is not uncommon to hear of banks conducting campaigns with slogans such as ‘100 branches in 100 days’, ‘200 branches in 1 year’, etc. Outwardly this may appear to be an effective way of servicing their consumers better, but at a functional level this incurs sizeable capital and operational expenses to that particular institution.

Each location requires its own hardware/software infrastructure, personnel and other recurring overheads. And in actuality, physical visitations by customers to these branches might in fact be marginal, and the services rendered even less so. Overall this is not an efficient and realistic method of servicing customers spread throughout the country, and certainly not a sustainable operational model over extended periods. If banks can effectively transition their customers from higher-cost to low-cost channels such as the mobile and online channels, they can reduce their overall cost to serve while also improving their return on investment.

A realistic solution to the impediments of maintaining hundreds of bank branches is the deployment of mobile branchless banking services to authorised agents. This is implemented using mobile POS terminals and/or smartphones with snap-on card reading devices. An authorised agent has issued these terminals and they will be able to provide services such as cash credit, account opening, fund transfer, etc. at a fraction of the cost of operating a fully-fledged office complex. This also extends the service rendered to the consumer as the agent is now able to provide a ‘banking-at-your-doorstep’ type of experience.

The key challenge banks face today when adopting new product/channels are their existing legacy applications, systems, and bank processes which often operate in silos. Systems are designed rigidly, and are virtually impossible to integrate with any type of 3rd party service with the core systems without engaging the core solution provider – and this generally means exorbitant fees for the bank. In certain situations, the costs are so prohibitive that the new product/channel is abandoned altogether.

In a more holistic perspective, all financial institutions today face an almost crisis-like fracture across its service channels connecting to their core banking systems. ATM switches, POS terminal management, card management services, public/private key infrastructure, etc. are all provided by an assortment vendors, causing heterogeneous integration a nightmare at best. In fact in many cases institutions have had to undergo complete backend system overhauls, at stupendous expense, simply to introduce a new service channel. Investments in new hardware, software licenses and employing domain experts in respective verticals add an undue stress on the institution’s bottom line.

Consequently, this results in an unstructured allocation of HR components causing the formation of different groups for different products; that is, a different cluster of IT teams for core banking, card management, mobile POS and disaster recovery, etc. This invariably causes vertical dependencies across domain experts since each team works independently of each other and not under a unified umbrella of governance or policy. The scarcity of specialist resources occasionally leaves the institutions in the hands of its IT departments! This is certainly not an acceptable scenario for an institution to who the image of public trust and reliability is of paramount importance.

A viable concept to overcome this present impasse is to build an Omni-Channel Synchroniser which is common to all front-end services, and thus provide a single point of interconnection to the core banking and other back-end services. The Omni-Channel Synchroniser will communicate with all different listener channels and route the respective messages to the core banking system via a secure pathway. Thus, a single platform will provide the ability to integrate ATM, card issuance/acquisition, mobile device transactions, dispute resolution/reconciliation and fraud management services with the core banking systems without having to implement changes to the back-end.

Ideally, an Omni-Channel Synchroniser would provide four essential services mandatory for any payment platform.

Omni-Channel Synchroniser will provide a unified medium for all external channels to communicate with the respective internal systems, and vice versa, using industry standard/specific protocols. This is the keystone to transparency between the front and back end services permitting varied systems to integrate seamlessly. Back-end systems could be local middleware (such as SLIPS or LankaPay), core banking system, card management, access control system, etc.

Front-end channels could be ATM, mobile or internet banking, mobile wallet, etc. Irrespective of the front-end channel and the back-end system, the Omni-Channel Synchroniser will be a ‘hub’ which provides a common point of integration for all services to interconnect. A vendor only has to expose their system(s) to the channel listener in one instance. The advantages of such an implementation are obvious and substantial, as noted in the following sections.

Each of the front end services connecting to the Omni-Channel Synchroniser would require its own secure communication channel. This signing and encryption functionality will be provided by Omni-Channel Synchroniser using PKI infrastructure. MAC authentication and military grade encryption will ensure that each message from each channel is authentic and valid.

Since the Omni-Channel Synchroniser provides a common gateway for all systems to integrate, financial institutions are now empowered with the capacity to introduce a common security strategy across the entire network. No longer are they shackled by having to adhere to varying security policies or restrictions of differing vendors. The institution themselves sets out the security policy that each system has to adhere to in order to ‘plug-in’ to the channel listener.

Since the security layer is common across the entire enterprise, all solutions can use the same security algorithms and policies highly effectively and with increased simplicity. Customers are free to choose their own authentication methodology based on their preferences and convenience. For example, single or multifactor authentication can be chosen based on the type of the transaction or the transaction value. For instance, instead of supplying a customer with multiple PINs for different products, the institution can now readily deploy a one-time-password (OTP) solution where a verification code could be sent to a mobile device for the customer to complete the transaction.

Moreover, Omni-Channel Synchroniser supports multiple authentication techniques such as PIN based authentication, and biometric authentication such as face ID, touch ID and voice recognition .This serves a considerable benefit from the perspective of customer experience to a consumer who now no longer requires memorising several different codes; just one password or biometric feature to access the mobile device. This scenario is prohibitively costly to implement in a multi-vendor multi-platform environment where different channels operate across its own channel, resulting in the consumer having to change his/her behaviour in order to better suit the requirement of the institution.

A key shortcoming in heterogeneous systems is that it is an arduous task to reconcile suspense/intermediate accounts from different databases and data streams. A single point of transaction logging will ensure that all batch/pending updates can be accurately and efficiently reconciled with the intermediary accounts. This additionally provides the mechanism to identify unsuccessful, duplicate and reversal transactions irrespective of the front-end channel initiating it, which can then be actively communicated to the consumer either via call-center or mobile device. This form of ‘we’re–on-the-ball’ approach only serves to bolster the customers’ confidence in the dependability and trust in the institution.

Since all channels are communicating through Omni-Channel Synchroniser, fraud management can be deployed at a single point instead of operating a different FMS for each of the channels separately. And since the resolution and reconciliation is also in a unified state, the institutions can take a more active, rather than passive role in the preventing of fraudulent transactions from transpiring even before they have occurred.

Key benefits – Core transformations that lead to tangible savings

The Omni-Channel Synchroniser provides a substantial advantage in reducing integration complexities that are prevalent today. New channels can be added or removed according to business requirement without having to interfere with backend changes. This translates to visible reductions in software upgrade/ modification expenditures. This provides the institution with the leverage to implement a ‘test-bed’ for ongoing innovations and to fine-tune their product line up to better align with the customer experience.

Reduced integration effort and time directly translate to the ability of the institution to deploy new and innovative products to the market without being delayed by external dependencies, such as vendors’ delays to roll-out patches and updates, etc. In a nutshell, rapid time-to-market of products and services.

Omni-Channel Synchroniser allows a superior and strong security policy to be deployed to all the channels of the institution. This will include strong user authentication techniques, message/media signing and authentication and secure channels of communication. A single instance of public/private key infrastructure can be used to deliver this enhanced level of protection across all the products and services of the institution.

The unified nature of the Omni-Channel Synchroniser inherently implies fewer types of systems to manage independently thus requiring less staff to maintain the entire solution suite – there will be no different IT groups or any dependencies across varied systems.

Since the Omni-Channel Synchroniser provides a common gateway to all the front end channels, it allows financial institutions and regulatory bodies to enforce controlling mechanisms aligned with the country’s lawful requirements pertaining to electronic payment and settlements, payment devices and consumer privacy and authentication. This specifically relates to Sri Lanka’s Electronic Transactions Act and Computer Crimes Act of 2007 which can now be effectively implemented and imposed across the electronic transaction landscape of the country thereby cultivating the necessary foundation for a digital economy.

Omni-Channel Synchroniser is a proven solution that provides palpable value by reducing the total cost of ownership across multiple services by introducing layers of transparency between the core system and the new channels. The industry as a whole needs to embrace the concept of being able to deploy new channels as and when the market dynamics require it, quickly and effectively.

In an increasingly consumer-driven environment, it is the institution that has the agility and adaptability to change that has the first-mover advantage. This conviction needs to trickle down from the top of the corporate pyramid across all tiers to all the actors in the organisational fabric.

In a very real sense, it is the developing nations that would find it easier to embrace newer technologies and concepts due to the reduced maturity levels in the regions-mature institutions operating on archaic concepts and systems need to incur far greater costs to change the plethora of interdependent systems that have been integrated over time. Adaptability is and will be, the key to survival in times ahead.

(The Writer is a well-known payment solution architect and industry veteran. He is the Group Director and Chief Executive Officer of Epic Technology Group, the premier and award winning regional technology leader. Viraj is a founder member of Epic, which has an impeccable track record of over 20 years serving corporate organisations.)