Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 22 January 2018 00:10 - - {{hitsCtrl.values.hits}}

Resurrecting an old pledge

The Deputy Minister of National Policy and Economic Affairs, Dr. Harsha de Silva, commonly known as Harsha, is reported to have announced the engagement of the International Monetary Fund (IMF) by the Government to amend the present Monetary Law Act (MLA) (available at: http://www.ft.lk/front-page/IMF-to-assist-in-revising-monetary-laws--Harsha/44-647288).

MLA is the law governing the operations of the Central Bank of Sri Lanka or CBSL. The areas of amendment, according to Harsha, have been the mandate and scope of the bank, its autonomy, governance and accountability. This is indeed a long felt need which the Government is seeking to fulfil today after sitting on it for three long years.

Bond Commission has suggested CB reform

Even the Presidential Commission on the Issuance of Treasury Bonds, commonly known as the Bond Commission, has recommended that the Government and CBSL should consider whether MLA should be replaced with appropriate legislation which will better suit the present day needs and aspirations of Sri Lanka (p 911: available at: http://www.presidentsoffice.gov.lk/wp-content/uploads/2018/01/CBSL%20Bond%20book%20edited%20A4%20no%20signature.pdf). However, the Commission has also recommended that it should be done after consulting the stakeholders and after obtaining the expert views on comparable exercises in comparable countries. Thus, obtaining the services of IMF is in order but the Government should go for setting up a mechanism for wide consultation and it should not be tried as a top-down legislation being proposed by a bunch of politicians seeking to better their own positions.

Need for streamlining key appointments to CB

The Commission has specifically recommended that the appointment of the Governor and those of the Monetary Board should be streamlined to facilitate the appointing authority to select suitable persons for the respective jobs. Another recommendation by the Commission has been the need for introducing a code of conduct for the members of the Monetary Board which cover the Governor, Secretary to the Ministry of Finance and the three private members.

The doctrine of trust

In the introduction to the report, the Commission has also highlighted that the Governor, Monetary Board members and officers of the bank are simply trustees functioning on behalf of the people of the country. Say the Commissioners: “We consider that, in these circumstances, that the Governor and other members of the Monetary Board, Deputy Governors and other senior officers of the CBSL hold those offices subject to the ‘Public Trust Doctrine’. They are subject to Public Accountability (p 22).”

The circumstances referred to by the Commission are that CBSL is a public authority, its officers including the Governor and the members of the Monetary Board are public officers and CBSL is an institution of highest importance to Sri Lanka and its people. The position taken by the Commission is accurate since CBSL has been created by society to deliver two public goods, namely, an inflation-free world and a trustworthy financial system. It is unlikely that the private sector could produce them with the same efficiency and efficacy as a neutral and apolitical central bank.

Political masters too should observe trust doctrine

Though the Commission has not said it explicitly, the trust doctrine referred to by it applies to the political masters functioning above the Central Bank as well. In Sri Lanka’s present case, they are the President, who formally appoints the Governor and the Monetary Board members, the Prime Minister under whose care CBSL has been awkwardly placed and the Minister of Finance who is statutorily responsible for the bank.

What it means is that none of these political masters should allow the misuse of central bank funds or powers; in the event they observe such a misuse, they should immediately take action to prevent it. This is because they are the guardians appointed by the people to safeguard CBSL.

President has been the saviour of CB

In this context, the action taken by the President with respect to the alleged bond scams right from the beginning has been compliant with the cherished Doctrine of Trust.

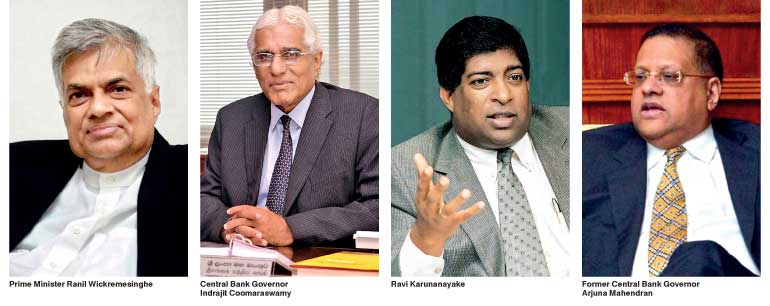

The President on more than one occasion revealed that he was opposed to the appointment of Arjuna Mahendran as Governor of CBSL, agreed to make the appointment after he was given a pledge by the Prime Minister, advised the Prime Minister to remove him when the news of the impropriety on Mahendran’s part broke out, did not give Arjuna Mahendran a second term despite the pressure from the Prime Minister and appointed a special Commission of Inquiry to identify the perpetrators of the bond scam so that appropriate legal action could be instituted against them.

In a coalition government in which the President does not have Parliamentary power, this is the best he could do to observe the Doctrine of Trust.

Legal meaning of doctrine of trust

This writer in a previous article in this series titled ‘Governor and Board members are trustees and not owners of the Central Bank’ elaborated on the economic aspect of the public trust doctrine as follows (available at: http://www.ft.lk/columns/central-banking-18-governor-and-board-members-are-trustees-and-not-owners-of-the-central-bank/4-400701): “A trustee has a legal meaning as well as an economic meaning. The legal meaning is that a trustee has to take the same care and caution when he handles the assets of the beneficiaries as when he handles his own assets. In other words, since he does not allow his own assets to perish but prosper, he should not allow the assets belonging to the beneficiaries to decay through negligence but take all measures to enhance their value. In this manner, the trustees of a trust are bound by a legal obligation and that legal obligation is known as ‘fiduciary obligation’ binding them”.

Economic meaning of Doctrine of Trust

“The economic meaning of a trustee too is derived from the legal meaning but it goes beyond that. Economics does not recognise that one can always be successful in his enterprises. He can be a success or a failure depending on how he organises his enterprise and what sort of market conditions he faces.

“Accordingly, in economics, a person would take a reasonable risk in order to make an expected amount of profits. These people in economics are called investors and they differ from speculators. The latter will take excess risk in order to make super or extraordinary profits. Both investors and speculators live in an economy and they are found side by side with each other.

“Society does not expect the members of the Monetary Board headed by Governor to function as speculators. Instead, they should function like investors who know the extent of risk they take and are knowledgeable of the need for introducing risk mitigating mechanisms in running central banks.”

Removing CB from Finance Ministry

When the CBSL was gazetted in 2015, for the first time in Sri Lanka’s history, under a Ministry other than the Ministry of Finance, namely, the Ministry of Policy Planning and Economic Affairs of which the Minister was the Prime Minister, this writer wrote in this series that it was unworkable both legally and operationally (available at: http://www.ft.lk/columns/listing-central-bank-under-pm-unworkable-legally-and-operationally-but-a-step-toward-banks-independe/4-384736).

This is because there was a need for close coordination of both fiscal policy and monetary policy for Sri Lanka to attain macroeconomic stability. Statutorily, it is the Minister of Finance who is responsible for every action of the bank.

New arrangement is unworkable legally and operationally

In this context, the powers given to the Minister of Finance by laws are inalienable. But in the new arrangement, the Governor had to serve two masters and conflicts arising from the two masters would be unavoidable. Hence, the Governor’s job was like that of an acrobat who had to walk on a tightrope carefully balancing every move he makes. The only salutary feature of this arrangement was the ease of bringing a new central banking legislation under the stewardship of the Prime Minister.

Advice to enact new CB legislation

Hence, it was suggested that within the 100-day program, the necessary legislative arrangements should be made to introduce an updated central banking law. For that purpose, it was pointed out that the Government need not reinvent the wheel since there is already a draft central banking law prepared by CBSL in 2004 with IMF technical support. Though the Ranil Wickremesinghe government of 2002-2004 had agreed to enact this law, it could not be done since it was voted out of power in the General Elections held in the middle of that year. The new Government shelved the idea of introducing a new law and it was therefore allowed to be dusted in the central bank archives. It was suggested that the government could retrieve it from the dusting place, update it to reflect the current conditions and enact as a priority-legislation. But nothing happened.

Finance Minister working in the opposite direction

When the new Government was formed after the General Elections in August 2015, making the same mistake, CBSL was gazetted under the Ministry of National Policy and Economic Affairs. The Prime Minister delivering the Government’s economic policy statement in Parliament in November 2015 promised to give autonomy to CBSL. However, what his Minister of Finance Ravi Karunanayake did was the opposite. Through various schemes he tried to undermine the independence of the CBSL, prompting this writer to warn the public of the emerging ominous development in an article under this series (available at: http://www.ft.lk/columns/be-warned- monetary-board-is-losing-its-powers-as-well-as-its-independence/4-562766 ).

monetary-board-is-losing-its-powers-as-well-as-its-independence/4-562766 ).

The main area of contention was the Finance Minister’s alleged attempt at grabbing the powers of the Monetary Board to operate the country’s national payment system and supervise and regulate the financial system.

Finance Minister’s accusing CB

In the meantime, in a public forum on the Budget 2017, the Minister Karunanayake had in a harsh tone accused the Central Bank of “failing on many fronts miserably” (available at: http://www.ft.lk/article/580366/Central-Bank-to-undergo-restructuring--Ravi-K).

His charge had been that the bank had deviated from its responsibilities under the law and allowed itself to be politicised. In his view, the Central Bank should confine itself only to its regulatory and monitoring functions without “dabbling in how to run the country”. Many activities done by the Central Bank are undesirable and by implication, they have impeded the action taken by the Government to put the economy on the right footing. Hence, along with the restructuring the Central Bank, all other pertinent legislations like the Banking Act and the Payments and Settlement Act would also be “revolutionised”. The Minister, without giving further details, had elaborated that the restructuring process would be spearheaded by both the President and the Prime Minister, implying that it is an action initiated by the very top of the government.

Attempt to erode CB independence

The tone of the Minister implied that the Government was to reduce the independence of the Central Bank and make it another department in the Ministry of Finance. If done, this would be a disaster and would go against the accepted principles of central banking. The loser at the end would be the Government and the people of the country.

This writer in another article in this series, while upholding the Government’s desire to reform the Central Bank, warned that it should not erode its independence in that exercise (available at: http://www.ft.lk/columns/reform-the-central-bank-but-dont-erode-its-independence/4-586305). Giving up the powers they enjoy would be a hard choice for politicians but the article argued it would help Sri Lanka to attain its objective of becoming a rich nation within a generation. That is because global experience has shown that when the country’s central bank enjoys independence, it has been more beneficial for the country to deliver prosperity to its people on a sustained basis.

Hence, the article under reference highlighted that a far-sighted government would choose to make its central bank independent of political patronage and influence. It is the biggest sacrifice which it can make for the sake of people.

Since the present government is dedicated to establishing a good governance system in the country, it was pointed out that it would not be difficult for the Prime Minister to make that hard choice, despite the pressure coming from his Cabinet colleagues to the contrary.

Minister of Finance ridiculing his own Governor

But the rift between the Minister of Finance and CBSL continued, worrying both the international community and local investors. There was a vocal battle in which Finance Minister Karunanayake is reported to have criticised the Governor of the Central Bank and its senior officers in public. Apparently dismayed by Governor Indrajit Coomaraswamy’s open and frank assessment of the state of the economy in the address he delivered when launching the Central Bank’s Road Map for 2017 and Beyond in early January 2017, it was reported that the Minister had equated the Governor to a hospital attendant who had helped the previous administration to send the economy, the chronic and acute patient, to the intensive care unit or ICU of the hospital.

The Minister is reported to have said that it was he who had taken the patient out of ICU. But the performance of the economy in 2017 has proved Coomaraswamy correct and it was most unfortunate for the Ranil Wickremesinghe Government not to hear his warning and take remedial action.

Failed attempt at stabilising exchange rate by Minister of Finance

The Governor’s right to speak the truth and how it would help the government to build a sound economy were analysed by this writer in a previous article in this series (available at: http://www.ft.lk/article/590141/When-a-Governor--speaks-like-a-Governor----- ).

Although Minister Karunanayake had pacified the Governor, later calling him a “good soul”, he had at the same time castigated two or three senior officers of the bank for conspiring to depreciate the value of the rupee in international markets, a move to embarrass the Government in his opinion. He had even threatened to reveal the names of these officers in the days to come (available at: http://www.dailymirror.lk/article/Ravi-K-vows-to-reveal-names-of-Central-Bank-saboteurs-busting-rupee-122195.html).

Minister Karunanayake had, according to the report, vowed to stabilise the exchange rate which was under pressure for depreciation within two months. As expected, the magic of Minister Karunanayake did not work. The rupee continued to depreciate and eventually when the problem became acute, the IMF had to be called to rescue it through a special funding arrangement.

Favourable nexus to reform CB

This unsavoury battle between Minister Karunanayake and the CBSL ended only after the appointment of Mangala Samaraweera as Finance Minister in mid-2017. Unlike his predecessor, he did not have any ambition to subdue the CBSL.

Hence, there is now a favourable nexus within the Government that would help Harsha to attain his goal. The nation has an obligation to support this move.

(W.A. Wijewardena, a former Deputy Governor of the Central Bank of Sri Lanka, can be reached at [email protected])