Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 13 August 2019 00:00 - - {{hitsCtrl.values.hits}}

The Central Bank of Sri Lanka introduced a consolidation program amongst financial institutions to stabilise the industry in 2014

Source adopted; (Connelly M, 2016)

Hoping to find a better life, dockworker Kingsley Ofasa and eight other Ghanaian refugees stowed away on a Ukrainian cargo ship headed for the United States via France. The ship’s sailors discovered the refugees when they searched for water. Because of an earlier violation in New York City, the captain told the crew that they would be responsible for new fines if they got exposed again. The crew decided to avoid any penalty by murdering the stowaways, who had to fight to stay alive until docking in France.

The above is the preview of 1996 televised film‘Deadly Voyage’ whichis a directed by John Mackenzie and written by Stuart Urban. It tells the true story of Kingsley Ofosu, the sole survivor of a group of nine African stowaways discovered aboard the cargo ship MC Ruby in 1992 and subsequently murdered by that ship’s crew.

I happened to watch this film accidentally somewhere in 2016. It was heartbreaking to see how those refugees were fighting for their lives. The ruthless crew members enjoyed murdering those innocent refugees with no sympathy for them.

The above story has little relevance to the substance of this article. Nevertheless, I thought of elaborating on the story of this televisionfilm to understand how people react to circumstances differently. In this instance, it was the shipping crew who changed into a ruthless set of murderers. Therefore, under different circumstances, the application of change management process should be understood, sensibly and critically.

Central Bank of Sri Lanka (CBSL) introduced a consolidation program amongstfinancial institutions to stabilise the industry in 2014. They wanted large entities to acquire smaller entities for better results and better monitoring purposes. They also wanted to have better compliance and good governance in the industry. The failures of finance establishments have clearly exposed that the failed or struggling NBFIs (Non-banking Financial Institutes) had engaged in risky business models and lacked good governance.

The implementation of risky business ideas was mainly due to the policy decisions taken by the boards of such institutes and not as a result of their employees. Similar consolidation drives have taken place in Southeast Asian countries like Malaysia, Taiwan, and Singapore successfully to address weaknesses in the financial industry. While consolidation has occurred in most Asian countries, the success rate is a mix across the region. In more developed countries in the region, financial sector consolidation has benefited both the regulator, investorand other stakeholders such as customers and employees. Malaysia and Singapore have successfully implemented the model, even though they too had their problems. However, one of the main reasons for their success was the way they handled their human capital during and after the consolidation.

A new experience

A few acquisitions took place under this program in Sri Lanka. Unlike the dockworker Kingsley Ofasa, (Omar Epps) and eight other Ghanaian refugees who deliberately entered the cargo ship, the employees of smaller Non-Banking Financial Institutes (NBFI) didn’t have a choice. By default, they were compelled to work for the new owners. They were at the mercy of the new management of the larger institute or bank which acquired their institute.

For some, it was totally a new experienceon both sides. The change management model couldn’t be properly digested by most of the staff in thelarger institute as they were not properly and professionally trained to handle such change management procedures before,which very cumbersome and sensitive. Some of the employees of larger organisations weregiven to understand or unknowingly assumed that they had been given a bunch of guinea pigs to experiment on. The important part which they missed was that, though the company was small,most employees who had been working there before were experienced, competent and qualified enough to handle their respective operations. Only the policy of the government hadchanged.

Though the CBSL was supposed to monitor the consolidation process including the HR aspect of the existing staff of smaller institutes to some extent, it didn’t happen the way that it was proposed. One of the mandates of the Department of Supervision of Non-Bank Financial Institutions of the CBSL is to enhance the competencies of the staff of the NBFI sector,which they mostly do through conducting seminars and workshops. The officers of the larger organisations who were frustrated over a period of time without their due promotions and recognition in their respective organisations gained an opportunity to spread their wings in the newly-acquired territory. Some were offered double promotions along with corporate management designations that made them exult in their new roles. However, when they found they were not up to the standards expected for those positions, they turned to the blame game. They mainly targeted the competent employees who knew their role better than them who had been there longer. As a result, experienced non-banking financiers have moved out to other organisations, creating a vacuum in such organisations and even the industry.

Some acquired companies were compelled to change their business model for their survival and prestige. By doing this, these institutes have weakened the lending circle of the country. I have touched on many occasions on the importance of NBFI in a country of our calibre in this forum. NBFI develops the babes of the economy to the level of bankable customers. If a part of NBFI starts to deteriorate, banks will have issues finding customers. This leads to the entire lending circle of the country to become troubled and distorted. Banks may have to set up their own departments with their incompetent non-banking industry staff to fill the void, which is very risky.

This is the plight of some in these acquired companies. Some acquired companies were compelled to change their business model for their survival and prestige. By doing this, these institutes have weakened the lending circle of the country. I have touched on many occasions on the importance of NBFI in a country of our calibre in this forum. NBFI develops the babes of the economy to the level of bankable customers. If apart of NBFI starts to deteriorate,banks will have issues finding customers.

This leads to the entire lending circle of the country to become troubled and distorted. Banks may have to set up their own departments with their incompetent non-banking industry staff to fill the void,which is very risky.

The NBFI plays a vital role in the economy. It enables the financial intermediation process before the banks. It also facilitates the flow of funds between savers and borrowers. It gives high returns to savers and accommodates borderline borrowers who are not welcome by the banks. Handling such a processrequires special skills. The employees of NBFI, unlike their counterparts in the Banking Financial Industry (BFI), are more flexible, makedecisions quickly and are better finishers, which is how they have been trained by the NBFI.

Recently, I asked one of my old colleagues who is now retired from the financial industry about the criteria on which he used to evaluate a customer who dealt in dried fish. Almost instantaneously, he said the evaluation was half-done when he sensed the smell of dried fish from the customer and also from his documents. This was the exact answer I expected. This the way non-banking financiers are trained to make decisions. They are quick decision-makers, unique and exceptional. During an acquisition these skills should be valued for the betterment of the newly-formed entity.

How to execute a better consolidation program

The timing of the acquisition is very important. There can be manipulation before, during and after due diligence. When the price for the acquisition is negotiated, correct consultants should be used to gain guidance. We have seen big entities fooled due to negligence. Though the accounting standards are similar in the industry, manipulations can be done with the manually-fed data. Only a smart set of auditors from the industry can detect such manipulations.

Meeting regulator-set deadlines to get due benefits is another important factor in an acquisition. As the acquisitions take place as a result of CBSL’s consolidation program, they should be made aware of the process. It is not necessary to surprise the general public with the change in management. Instead, keepit simple and open. Hidden agendas might boomerang on strategists when the process is open and transparent. You never know the unknown information that you are going to get. When a fundamental error is made in the factors that decide the final price, the entire setup is disturbed. In such a situation, you can’t hold the staff responsible for the decisions taken stupidly and thoughtlessly at board level.

Depth of change

Once the acquisition is done, check the extent to which change is needed initially and periodically. Some aspects shouldn’t be changed at all because they are unique to the given organisation. The acquired entity should be operated on a narrative strategy. Under such circumstances, changing the business model will not give you the expected results. Hence, you should know what to preserve and what not to preserve of the acquired entity, such as the characteristics and resources of the organisation.

Common elements such as the leadership style, which is sunk into the staff groups and divisions, have to be considered during changing process. A new leadership style might disturb the flow.

Also the capability and capacity of the staff should be evaluated before the operation starts. If adequate human resources are not available, reinforcements should be introduced. Without keeping new employees guessing, make them aware of your moves as far as you can, genuinely. However, past wrongdoers should be dealt with appropriate remedial action to send a strong signal to others.

The implementation of risky business ideas was mainly due to the policy decisions taken by the boards of such institutes and not as a result of their employees. Similar consolidation drives have taken place in Southeast Asian countries like Malaysia, Taiwan, and Singapore successfully to address weaknesses in the financial industry. While consolidation has occurred in most Asian countries, the success rate is a mix across the region. In more developed countries in the region, financial sector consolidation has benefited both the regulator, investor and other stakeholders such as customers and employees. Malaysia and Singapore have successfully implemented the model, even though they too had their problems. However, one of the main reasons for their success was the way they handled their human capital during and after the consolidation.

Finally, the delegation of authority has to consider the new entity’s level of operations, capability, and capacity.

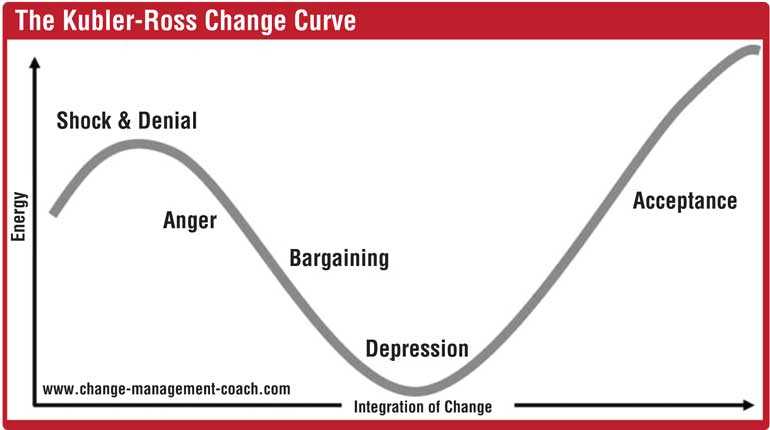

As per Kurt Lewin’s Change Management Model, the Unfreezing, Change and Refreezing phases should be appliedsystematically. When the setup is unfrozen the staff may feel unsecured. However, they must go through the following phases in the Kubler- Ross change curve and finally accept the change.

The most important factor in an acquisition process is the capability of the officers of the larger entity handling the human capital of the smaller entity during the change management process. If they are not professionally qualified and not competent enough to handle the above Kubler-Ross change curve, they will make large mistakes. It is a treat to watch how a competent set of experienced team handles the process of change management, methodically and systematically,to synchronise the existing and proposed operations. If some employees are not needed, they can be offered a Voluntary Retirement Scheme (VRS) for them to retire pre-maturely. However, if much valued human capital is lost assuming that they are of no use, the new management isin troublewhen sailing in their newly found sea.

If they want to harvest their dividends from the new business territory, they have to use the expertise of the acquired entity. If not, they have to bring their own business model from the large entity and install it in the new entity. This shows their incapability and incompetency in adapting to the change business model.

Conclusion

Let’s take a look at the advantages of this consolidation program. As mentioned earlier,CBSLwanted large entities to acquire small entities for better results and better monitoring purposes. They also wanted to have better compliance and good governance to stabilise the industry. Since the consolidation scheme is still an ongoing process, the large entities who are planning to acquire small entities have a responsibility towards the industry.

They should critically analyse whether they are going to change the business model, which the small entity has adopted, over a period of time. For this, they must critically analyse the core-competencies of the small entity and thestrengths of their human resources tobuild a different business model for the industry. By doing so, a meaningful, dynamic and effective consolidationapplication can be invented. This might help the CBSL to be on par with other successful consolidation programs in the region.

Unlike the plight faced by the dockworker Kingsley Ofasa, and eight other Ghanaian refugees in the Ukrainian cargo ship, amodel of such nature will also help the employees of small financial institutes towork with more dignity and pride.

[The writer is the founder of Infornets, an organisation formed to share credit- related information and financial knowledge, locally and internationally. He counts 35 years of experience in the Non-Banking Financial Industry of Sri Lanka and is a former CEO/General Manager of a Non-Bank Financial Institution. He is a board member of the National Science and Technology Commission (NASTEC), holds a Masters Degree in Business Administration from the UK, is a Member of Institute of Management of Sri Lanka and an Associate member of Sri Lanka Association of Advancement of Science. He can be reached via [email protected] or www.infornets.com.]