Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 28 July 2020 00:16 - - {{hitsCtrl.values.hits}}

It is prohibited to earn money illicitly as well as spending it on illegal activities. Even so, in many countries there are a considerable amount of transactions that inevitably go beyond the legally accepted framework of the country. Such illegal transactions which occur beyond the formal economic framework have a detrimental effect on the regular economic activities of any country. Therefore, various rules and regulations are in place in countries around the world to prevent the adverse impact of such abusive transactions.

There is a high risk of transferring illegally-earned money and spreading of the adverse impact of such transactions to other countries, especially due to the impact of globalisation. Therefore, there are strict enforcements towards international standards, which are the global recommendations in preventing such illegal transactions, and blocking the impact of such abusive transactions. In such a situation, if a person or group generates money in an illegal manner, they will conceal the origin of the illegal source of funds, in order to spend such monies within the legal economic framework. In this process, mostly financial institutions are used. However, the threat of using non-financial institutions for these purposes is also on the rise. Hence, this article mainly discusses the ways of money laundering using non-financial institutions. However, it gives a brief introduction to money laundering and its process, the impact of money laundering to the economy, utilisation of financial institutions during the money laundering process, and global conventions against them.

Money laundering

Among other things, illicit drug trafficking, arms trading, animal and human trafficking, prostitution, organised crimes, smuggling and tax evasion are key means of earning funds illicitly. Integrating funds earned from such illicit means into the accepted legal economic framework is essential if those funds are to be used for day-to-day transactions. Accordingly, in order to integrate illicitly generated money with legally accepted sources of money, the criminals use very sophisticated methodologies, because doing so is illegal.

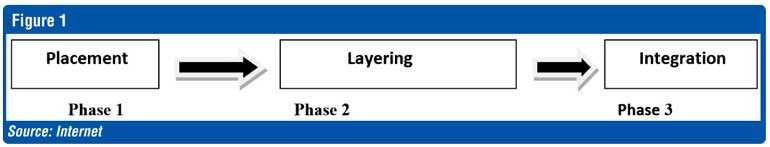

Thus, the process of legitimising the money generated from illicit means, by concealing the illicit sources of such funds and pretending as if they were earned through legitimate economic transactions, is called money laundering. Accordingly, generating money through activities designated as illegal in any country, using such monies for legal economic activities while hiding the illicit source of money, and thereby legitimising the wealth unlawfully collected, and then using such accumulated wealth for purposes such as spending a luxurious life, increasing criminal activities and illegal acts or otherwise, nurturing terrorist groups or activities, is identified as the process of money laundering. This process is typically given in three major phases, shown in Figure 1.

In Phase 1 shown in the above figure, the illegally earned money is transferred to the formal economic framework through entities engaged in lawful economic activities. Often this is done through financial institutions, especially through commercial banks. Also, non-financial institutions have a high potential for being misused during this phase.

During Phase 2, money launderers tend to transfer the money which they have already placed in the formal economic framework to different accounts. This is a very complicated process, which further attempts to keep hidden the nature of the money generated, so that the root of the transactions cannot be easily detected. In this phase, transferring money to both domestic and foreign persons’ bank accounts, and splitting such amounts into small units, is common. In most cases, electronic money transfer systems are used.

In Phase 3, the money layered during phase 2 is integrated with legally earned money, by engaging in legal economic activities. At this phase, mostly non-financial businesses are used. For example, money launderers tend to purchase luxury goods, lands and properties, and invest in various types of businesses, such as nightclubs, food stores, hotels etc. These investments do not seek economic profits, they are simply carried out to further hide the illegal sources of funds, and the funds invested will be taken away as and when it is required to clear their monies. Therefore, such investments always end up with damage to the society, not a benefit. By this phase, money launderers are able to largely suppress the illicit nature of the money generated.

Money laundering and its impact on economic activities

Money laundering has a detrimental effect on the economic activities of a country. The perceived risk of investing laundered money in businesses or purchasing of properties is that they are not invested for pure economic profits, or properties are not purchased for living/investing in such properties. They will soon be able to withdraw these investments, or sell these properties and re-generate their improper money. Also, there is a high possibility of using such funds to further their fraudulent criminal activities, or to nurture terrorism. Similarly, purchasing expensive items such as gems and jewellery is also carried out by some people with such purposeful aims. As a result of this unduly demand, the prices of these commodities and their market values will hike up without a proper economic reason. Such incidents will interrupt the smooth functioning (demand and supply process) of those economies. As a result of such actions, generation of artificial prices and market values cannot be prevented, as opposed to prices determined by the real demand and supply forces of the market. Also, there is a higher risk of worsening of the fraudulent and criminal activities, which may lead to collapse of the legal economic framework, thereby diverting economies to many social, economic and political instabilities.

Money laundering through financial businesses and global conventions against them

The use of banking and financial institutions for money laundering

Financial businesses are one of the main ways through which money laundering has occurred since the past. It is widely known that banks and other non-banking financial institutions have been used in attributing a legal appearance for the wealth earned illegally. For example, Mexican and Colombian drug smugglers have placed into the banking system an estimated $ 881 million worth of monies between 2003 and 2010, which they earned by illegal drug trafficking through a world-renowned bank. Since this bank did not have prudent measures, the bank was a breeding ground to convert drug traffickers’ illicit money into legitimate money. Following the investigations, in 2012, the bank was charged a fine of $ 1.9 billion by US law enforcement officials. Also, court orders were imposed for immediate enforcement of internationally accepted standards, which should be complied with domestically by the banking institutions in prevention of money laundering. (Source: Seven Pillars Institute for Global Financial & Ethics).

Financial Action Task Force

With the globalisation and advancement in technology, the illicitly earned money is not only laundered through financial institutions, but also their adverse effect is spread to various countries around the world. In view of the above, in 1989 systematic arrangements were initiated with the heads of the G7 countries to control the impact of money laundering on global economy. Later, with the worldwide expansion of these requirements, the Financial Action Task Force (FATF), an inter-governmental organisation to guide and coordinate global standards for money laundering was set up. As these global standards became crucial around the world, restrictions were imposed on laundering illicit money through financial institutions, i.e. banks as well as other non-bank financial institutions such as stock brokers, insurance agents, money exchangers and primary dealers. This trend led money launderers to search for new ways and means to carry out money laundering. Accordingly, the threat to the non-financial businesses and professions began to increase as money launderers approach such industries for laundering proceeds from illicit activities.

Money laundering through non-financial businesses and professional services

In any economy, the non-financial sector has a very wide scope, which consists of a range of different formal as well as informal industries and professional services. The common feature in many countries in the non-financial sector is the absence of a proper institutional structure overseeing the segment, and lack of legal requirements to issue proper business licenses for some sectors (However, this situation is not relevant for the professions such as law and accounting). For this reason, the worldwide organisations attempting to prevent money laundering face many difficulties in applying the globally accepted compliance measures for the financial sector to prevent such acts in the non-financial sector. When looking at the money laundering cases appearing around the world, non-financial businesses such as real estate businesses, gem and jewellery dealings, including precious and semi-precious metals and stones, gambling houses and casinos, as well as professional services such as accounting, legal, notary, and company service providers are among the key sectors which are heavily used by money launderers. The way in which money laundering is carried out using such non-financial businesses and professions (with or without their knowledge) are discussed below.

Money laundering through real estate businesses

The following example explains how real estate transactions are exploited towards laundering money. A person who had illegally earned a hundred million rupees in drug trafficking could use such drug proceeds to buy a real estate property by hiding the source of funds. Also, when buying real estate properties, it is often observed that they do not take over such properties under their own names. The following example illustrates that they follow very sophisticated strategies in such instances. An investigation by the Belgian legal authorities has found that a racketeer in that country had used the customers’ accounts of a notary public to purchase real estate properties. As the investigations have revealed, he had established a trading company for this, and this person was the sole shareholder of this shell company. He had misused the service of notary public through the accounts of his shell company and paid for the purchase of immovable properties while using the notary public as the front man to cover his identity. Later, he was found to be a well-known drug dealer in Belgium. He had bought immovable properties from illicit drug proceeds, and worked to conceal the source of money by using the professional service of a notary public while covering his true identity. (Source: Report on Money Laundering and Terrorist Financing using the Real Estate sector by the Financial Actions Task Force).

Money laundering through gem and jewellery transactions

Money derived from unlawful activities is also used to purchase precious metals and stones including gems and jewellery. For example, the money retained without paying taxes are used to purchase precious gems, and they can easily be transported from one country to another without getting the attention of customs officials as they can be easily fixed on to a jewel or attire. Ultimately, in that country, the gem is sold at a very high price to regain the ill-gotten wealth.

Such examples show that money laundering takes place through a variety of means, through a series of very complex transactions including cross-border transactions based on precious stones and metals such as gems and jewellery, instead of placing ill-gotten money directly into the formal economic framework through financial institutions. It also appears that non-financial businesses are used in these activities with or without their knowledge.

Misusing casino transactions for money laundering

Gambling businesses, such as casinos, are considered as high-risk entities for money laundering, where these transactions can be easily misused in the process of transforming unlawfully earned cash into legitimate cash. There are many global studies on casino business transactions with money laundering. The risk of money laundering at casinos is high as casinos are vastly cash sensitive. Many customers make gambling in cash. Also, the amount of money involved in a transaction is high. Further, these entities are mostly used by foreign customers, and due to these reasons the possibility of laundering money in casinos and gaming are high. For example, there are cases that exchanging small denominated (such as Rs. 20, Rs. 50, Rs. 100) currency earned from selling drugs for large denominated currency notes (such as Rs. 1,000 and Rs. 5,000) using casinos. Further, some casinos maintain personal accounts for their gamblers, and there are instances where illicit money has been transferred to various accounts from such gamblers’ accounts. Also, criminals use casinos as a medium of entertainment using illegally earned money.

Misuse of professional services for money laundering

Among other services, the professional services provided by lawyers, accountants and the notaries are the main sectors that attract money launderers. In this case, money launderers use the knowledge of those professional service providers (they will be charged for it, while providing such services willingly) with or without any knowledge of them. Money launderers were motivated to misuse these professional services, as initially there was no requirement of disclosing the source of the funds when real estate properties are purchased through lawyers and notaries, or when money is invested in other businesses, through lawyers or accountants. However, with the introduction of reporting requirements, these types of transactions have reduced.

It is also widely reported that managing and maintaining properties purchased from the laundered money or laundered money invested in other businesses were ultimately assigned into trust arrangements. As these trust service providers have the necessary legal conditions to act on behalf of trustees, the money launderers could easily hide their identity behind such arrangements. These arrangements also help keep the real beneficiaries of those properties or transactions unknown.

Prevention of money laundering occurs through non-financial businesses

The Financial Task Force (FATF) as the global policy setter against money laundering, terrorist financing and financing of proliferation, has now introduced the same set of Recommendations that it introduced to prevent money laundering through financial institutions to the non-financial institutions and professions, to prevent them being misused by criminals in converting illegally generated money to appear as legally generated funds. Accordingly, proper implementation of the regulations for anti-money laundering, countering the financing of terrorism, and the prevention of financing of proliferation for both financial and non-financial sectors is obligatory on all countries. The governments of countries are obliged to facilitate the legal, administrative, and institutional framework in this regard.

Accordingly, the 40 Recommendations of FATF on prevention of money laundering, terrorist financing and proliferation financing should be adopted by every country. Out of those 40 recommendations, there are 3 key recommendations (Recommendation No. 22, 23, and 28), which are directly applicable to the non-financial businesses and professions. Under these 3 major recommendations, the other recommendations relevant to financial institutions will also apply to the non-finance businesses and professions. The FATF time to time evaluates countries on their level of compliance with such recommendations through its assessments. Also, actions are taken against countries on their failures to comply with the global standards against money laundering, terrorist financing, and financing of proliferation.

In summary, governments are required to ensure that their non-financial sectors and professional services carry out proper due diligence on their customers. Accordingly, dealing with customer without a proper due diligence should be considered as an offence by law. The customer also should provide sufficient identity information to the non-financial businesses and professions. Similarly, if a transaction is suspicious or the source of the fund related to a transactions is suspicious, the details of such transactions should be reported to the appropriate authority that is assigned for the reporting of suspicious transactions or prevention of such fraudulent transactions. In Sri Lanka, the authority established for the said purpose is the Financial Intelligence Unit (FIU-SL), which has been established in the Central Bank of Sri Lanka. The FIU-SL acts as the authority to prevent money laundering in Sri Lanka within the powers vested by the Financial Transactions Reporting Act No. 06 of 2006 (FTRA). Accordingly, the FIU-SL is legally empowered to take legal actions against such non-financial institutions if they acted in contrary to the FTRA, or if they do not act in accordance with the FTRA and other rules and regulations issued thereunder. These legal actions include imposing penalties to enforce compliance, considering the nature and gravity of non-compliance. Also, imposition of a penalty by the FIU-SL does not prevent the relevant supervisory, regulatory or self-regulatory authority to take regulatory or disciplinary measures against these institutions, such as suspension of institutions from the carrying on of business or profession, or cancellation of a license issued by them. Further, when a penalty is imposed by the FIU-SL on a body corporate, every person who is a director, general manager, secretary or other similar officer of that body is liable to pay such penalty. If it is not a body corporate, every person who is the president, manager, secretary, partner or other similar officer of the body shall be liable to pay the penalty imposed. Further, providing false information to the FIU under the requirements of FTRA is an offense punishable on conviction to a fine or imprisonment. The FIU-SL supervises the financial as well as designated non-financial businesses and professions to examine their level of compliance under the requirements stipulated by the FTRA, and takes necessary corrective actions against non-compliances as and when examined. Hence, both the financial institutions and the non-financial businesses and professions are required to appoint a dedicated officer who is named as the Compliance Officer, who is responsible for ensuring the institution’s compliance with the requirements of the FTRA.

(The writer is a Senior Assistant Director of the Central Bank of Sri Lanka. The views express in this article are those of the writer’s and do not necessarily reflect the CBSL).