Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 7 October 2019 08:35 - - {{hitsCtrl.values.hits}}

This new series is based on business leader Dhammika Perera’s recently revealed ‘Economic Growth Strategy and Action Plan to increase GDP Per Capita from $ 4,000 to $ 12,000’. The document outlines goals and action plans for 23 Ministries and today’s column focuses on the Ministry of Finance and Planning

GOALS

Create a better Sri Lanka through finance

1.Sound fiscal management. To ensure that the revenue to support investments in Sri Lanka’s social and economic priorities is raised and spent in a fair, responsible and efficient way.

2.Precision poverty reduction. Allocation of modern technologies to identify poor households through 50 indicators evaluating key factors that contribute to poverty in these households; and allocate investments to reduce poverty levels to that of a developed nation.

3.Development of human capital. Prioritise upgrading primary, secondary and tertiary education and ensure enrollment of 50% of total 360,000 students per annum to public and private universities. Rebrand and upgrade the quality of Technical, Vocational and Educational Training (TVET) and ensure enrolment of 40% of total 360,000 students per annum to TVET education, thereby only 10% of total students per annum fall into the unskilled labour market.

4.Sound social policy framework. To support the Government’s efforts to promote equal opportunities for all citizens across the country and to meet the Government’s priorities for promoting jobs, transforming the agricultural sector (inclusive of increasing agricultural productivity of farmers, farmers’ household income, equitable consumption of a safe, affordable, nutritious diet year around and women’s empowerment in agriculture) and economic growth.

5.Inclusive and sustainable economic growth. To create the conditions necessary for a strong, long-term and clean economic growth, thereby increasing the standard of living and wellbeing of Sri Lankans.

Sri Lanka's population growth per annum is at an average of 190,000. Therefore, in order to maintain the current economy, it is necessary to create an additional 62,400 jobs per annum.

(Source: Jobless Growth, World Bank, 2018)

Okun’s law states that for every 1% decrease in the unemployment rate, gross domestic product increases by 3%.

Establish and implement a district-wise job generation plan to decrease unemployment. This is to be monitored monthly and the Government is to aid private sector investment.

The Laffer curve illustrates a relationship between rates of taxation and the resulting levels of Government revenue. It illustrates the concept of taxable income elasticity i.e. taxable income changes in response to changes in the rate of taxation.

A key reason for the lack of investments in the country at present is due to incorrect tax rates as our current rates, tax investors higher than our competitors, thereby discouraging investment in the country.

Therefore, it is required to maintain a tax rate at the revenue maximising point in order to attract the highest possible investment to the country.

Changing the tax and Customs duty policies, to increase greenfield and brownfield, local investments and foreign direct investments, for economic growth, increased district-wise job generation and goods and service exports.

Action plan

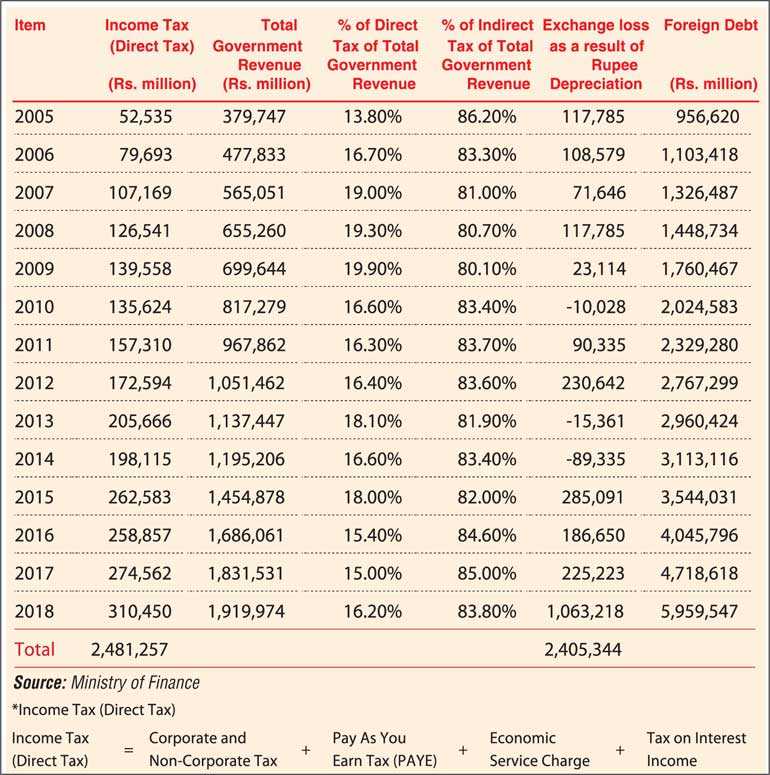

During the past 14 years, direct Government tax revenue on a cumulative basis was Rs. 2,481 billion whereas Rs. 2,405 billion was incurred as an additional payment due to rupee depreciation to make foreign borrowings rise to Rs. 5,959 billion by last year. Therefore, to stop the rupee depreciating beyond 2%-3%, it is essential to bring in investments, especially foreign direct investments and to enhance exports regardless of the direct tax revenue.

Powerful economics flourish by deploying citizen centric fiscal policies that are both transparent and have clear accountability

Policies relating to the Department of Inland Revenue

Total Government revenue in 2018 was Rs. 1,919 billion. Introduce an Artificial Intelligence-based (AI) monitoring system should be introduced to both Customs and the Department of Inland Revenue for the purpose of monitoring evasions (after introducing IBM Watson in Switzerland, Customs revenue increased by 10%) after which, Government revenue will be increased by 15%, generating an additional Rs. 287 billion.

1. Maintain the current rate of corporate tax for the following industries:

i. Financial services, except insurance and pension funding

ii. Wholesale trade except of motor vehicle and motorcycles

iii. Manufacture of tobacco products

iv. Telecommunication

v. Gambling and betting activities

Whilst reducing the current rate of dividend tax and capital gain tax to 0% (which will help in additional job generation)

2. Reduce the current rate of corporate tax to 0% and provide a guarantee for new ventures through an agreement with the BOI at the reduced rate for the next 25 years for the following industries:

i. Education

ii. Information service activities - any type of BPO, KPO, provision of infrastructure for hosting, data processing services and related activities, web portals, news syndicates and news agency activities furnishing news, pictures and features to the media, computer-based telephone information services, information search services on a contract or fee basis and news clipping services, press clipping services and other digital services

iii. Human health activities

iv. Air transport

v. The manufacture of motor vehicles, trailers and semi-trailers

vi. Waste collection, treatment and disposal activities; materials recovery

vii. Water collection, treatment and supply

viii. Sewerage

ix.Manufacture of other transport equipment

x. Fishing and aquaculture

xi. Remediation activities and other waste management services

3.Reduce the current rate of corporate tax to 12% for existing ventures not mentioned in points one and two.

4.Reduce the current rate of corporate tax to 12% for new ventures not mentioned in points one and two and provide a guarantee for the reduced rate for the next 25 years for all sectors (in the Western Province) and for the other eight provinces to be granted a discount of 80%, thereby charging an effective rate of 2.4% (which will help in additional rural district-wise job generation).

5. PAYE tax of 12% will only be charged Starting from a monthly income bracket of Rs. 500,000.

Policies relating to Sri Lanka Customs

Out of the prevailing 7162 HS Codes in Customs, 90% of Customs revenue is generated through 500 HS codes (6-digit). The tax structure of these 500 HS codes that generate 90% of the Customs revenue is to be restructured, benchmarking that of Malaysia, Thailand and India (that will help local industries and create additional jobs). As a result, Customs revenue can be increased by 10%.

Government capital investments

Government capital investments, also known as the Public Investments Program (PIP), where the benefits span many generations of Sri Lankans, paying for them through some borrowing is fairer and more efficient.

Borrowings will be made in a responsible and sustainable manner to help instil financial discipline and distribute the share of funding more equitably across current and future generations.

Government recurrent spending

Recurrent spending needs in areas such as precision poverty reduction, primary, secondary, university, technical and vocational (TVET) education is to be recognised as necessary expenditure.

Currently, Sri Lanka takes the easier route by funding some of these recurrent expenditures through borrowings. This is not ideal in the long run as such borrowings shift the burden of paying for today’s needs onto future generations. A fairer and more robust approach is to meet recurrent spending with recurrent revenue. Hence, we must continually review our tax system to ensure its resilience.

Future policy and strategy planning for Sri Lanka

The Ministry of Finance and Planning should be responsible for future policies and strategic planning for Sri Lanka. Any policy proposed in the Budget to have an economic analysis that the Ministry of Finance can use to validate proposed policies.

Implement a Management Information System (MIS) to track the progress of Budget promises. Asset management systems should be implemented to monitor and ensure maximum utilisation of Government assets and resources.