Thursday Feb 19, 2026

Thursday Feb 19, 2026

Thursday, 2 December 2021 00:00 - - {{hitsCtrl.values.hits}}

Aerial shot of the beach

Investment in tourism is something that needs to be understood in its entirety if we are to make it a viable industry. Understanding it sooner rather than later is a vital factor in today’s context, especially given our faltering economy. Failing to understand the vital makeup of tourism investment may very well lead to a disastrous failure of this industry.

Investment in tourism is something that needs to be understood in its entirety if we are to make it a viable industry. Understanding it sooner rather than later is a vital factor in today’s context, especially given our faltering economy. Failing to understand the vital makeup of tourism investment may very well lead to a disastrous failure of this industry.

A primary fact everyone from the state sector to the smallest entrepreneur needs to comprehend, is that tourism cannot thrive in isolation. The entire system needs to be connected and integrated with civil society, local bodies, state agencies, etc., which are supportive of it from community to policy level and onward to the highest levels of Government.

The best example we have in Sri Lanka of a successful local industry that has come of age is the apparel industry. Yes, we knew it had potential 30 years ago, but until we figured out the need to implement proper supply chains and backward integration, we could not make it a sustainable enterprise that could withstand the volatility and fickleness of market forces. Today, our apparel industry has Government support in lobbying for concessions internationally, as well as enjoying a great deal of latitude at state sector level. This makes way for ease of investment and investor confidence.

Although the tourism industry is older than the apparel sector in our country, in my opinion, it has stayed stagnant and not developed much in terms of its vision and goals. The concepts are old and still take their cue from the 1970s. Sri Lankan tourism has not deviated from its parochial approach. While this formula does attract tourists, its structure is limited and does not fit into an overall master plan.

I cannot help but wonder if the whole industry is just moving from one season to another without any long-term goal. Are we only just thinking of a dollars and cents aspect rather than planning on taking advantage of the potential this industry has to bring in investors who can broaden its scope? Are we looking at tourism as just another home industry even though Sri Lanka is blessed with a tourism potential that only a handful of destinations can match? If that is not the case, why are we not doing more to attract big foreign investment i.e. the right kind that would in turn bring in the optimum visitor to our shores?

If we were to dig deeper, it can be seen that we are still a long way from being an ideal tourism investment destination. This is primarily because of the continuing volatility in our structural environment that does not give an investor the confidence to move in. While appointing an agency dedicated to attracting foreign investments might act as a catalyst in bringing the big bucks, that alone is not enough. It is the entire system that does not inspire confidence, simply because of the lack of a coherent master plan that can provide the stability and confidence the industry needs to attract such investment. If we are to succeed in this business, we need to be strategic in our approach.

At the moment all we can offer are some tactical solutions in the hopes of attracting some form of investment. But at the bottom of it all there are the shifting goal posts and state agencies not acting in tandem, which have become the bane of the industry and its investment climate.

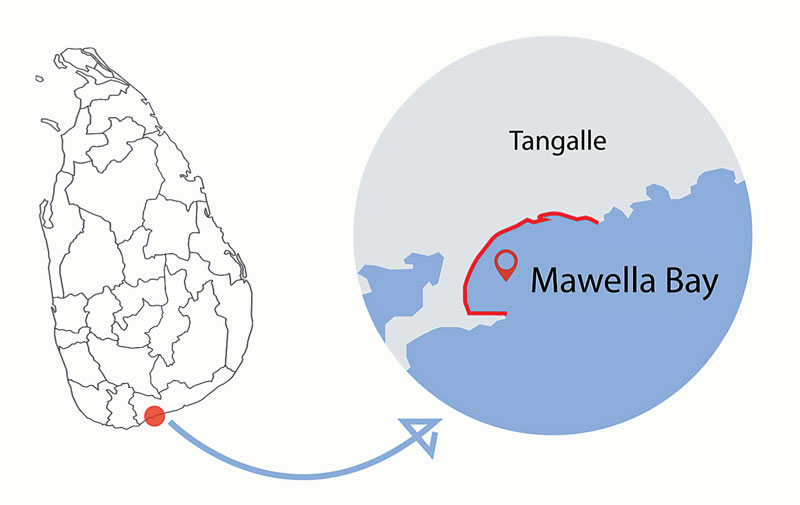

A case in point is the Mawella bay, a pristine bay on the south coast and one of the finest beaches Sri Lanka has to offer. It is a veritable gold mine for upmarket tourism, especially in light of the expressway extension right up to Hambantota, which makes it a comfortable journey of just under three hours from the airport to destination. If we had a masterplan that factors in the development of the expressways, this tourism goldmine should have been identified and protected for its huge potential. Even though this did not happen, the private sector took the initiative and many investors both local and foreign, bought land along this ideal location hoping to fulfil its potential.

Actually, to any rational investor it was a bit of a no-brainer, given its location just three hours from the airport to one of the nicest bays in the world. But surely the authorities too must have figured this out? The Tourist Board had even labelled the bay as having enormous tourist potential. Everyone was banking on developing the bay area into a unique tourism experience and a lot of development plans were underway, when suddenly disaster struck.

Much to the surprise of the hapless group of investors, authorities out of the blue, decided to build a fisheries anchorage, a move that was diametrically opposed to the investors’ plans and the Tourist Board’s vision. The investors/landowner’s concept was to develop the bay area properties into exclusive hospitality enterprises that would cater to a discerning high net worth clientele. All of those plans are now in abeyance and today the beautiful bay is on the verge of becoming another casualty like Unawatuna, which was once a beautiful internationally recognised beach destination but was destroyed due to the construction of a hard-coastal structure. Needless to say, this has become a nightmare for investors. Such ad hoc decisions made at local level with the sanction of State agencies, with little or no coordination, have created a huge quandary for investors, and delivers another very negative signal to potential investors in this sector.

Isn’t it time we designed a master plan for Sri Lanka›s tourism investors? I am not referring to the general tourism promotion that is ongoing. We cannot confuse the two because one is to increase the number of visitors into the country while the other is to develop the country’s potential as an investment destination. The latter is about property development and understanding how to do it. We need to recognise the complexities of our already existing bare land, and the potential it holds in terms of development. We need to put these properties into land banks/special zones, and develop unique concepts for them once they have been identified. These land banks/special zones have to be structured into an overall master plan which requires statutory conditions that will ensure development concepts that will not change once they are established. This kind of regulation is essential if we are to create investor confidence that will, in the future, develop Sri Lanka into an investment destination.

In my experience it is a global practice for any kind of large project to have development control regulations. These regulations take into account how each building block within the project would be structured, even to the finest detail. That level of planning not only gives investors a formula which they can build on, but provides them with an idea of what the surrounding neighbourhood would look like and the synergies they could take advantage of within that particular project. Development control regulations also allow for a level playing field for developers, sending investors a signal that they aren’t just paying for their own properties but also for the surrounding value additions which are part of the investment. It is unfortunate that Sri Lanka still does not have such policies in place when it comes to property development.

There is a lot investors in real estate have to contend with in Sri Lanka. Sometimes they are offered a faulty deed because the land registry is not streamlined. There is also the scary possibility that the goal post may shift when it comes to terrain development. For example, imagine, you invest in a property, thinking the land you are buying is in a residential area and suddenly, a couple of years down the road, you have heavy industry moving into your neighbourhood. Another example would be if you’re building a thoughtfully planned one story home and suddenly find a commercial high rise being built right next to you.

This encapsulates what is happening at Mawella Bay. I keep going back to it because what has taken place there is tragic. It is a beautiful bay in one of the most attractive locations in the south of Sri Lanka. The serene waters in this two odd kilometre stretch of bay that remain calm all year round, should have become the perfect venue for high end beach tourism, within a highly controlled eco-friendly environment. A project that could have brought in millions of dollars’ worth of investment and multi million dollars’ worth of recurring income. But alas what we now have in its place is destruction due to unplanned development. An anchorage/breakwater which is being built by state agencies has devastated the maximum potential and beauty of this magnificent bay.

As I pointed out earlier, investment in tourism is completely different to promoting it and attracting tourists. Investment cannot work in a bubble; we need designated state agencies who can coordinate and work with other state institutions to see that there is a level playing field created for potential investors. Unfortunately, Sri Lanka does not seem to have a plan that will get us to first base in this regard.

There is much talk about the ease of doing business and how investor friendly we are. While this might all be true to initially get an investor in the door, does the country›s responsibility end there? What about the need to see that they stay on for the long haul and that their experience as an investor in Sri Lanka is both profitable and memorable? The investment world is a highly competitive space and only countries with impeccable track records emerge winners. If we are to join the winners, we have to get our act together and fast.

The anchorage

The writer is the Co-founder of Connaissance De Ceylan Ltd., Visit Lanka Ltd., Culture Club Resorts Ltd. and Le Kandyan Resorts Ltd.