Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Wednesday, 30 June 2021 00:10 - - {{hitsCtrl.values.hits}}

|

CBSL Governor Prof. W.D. Lakshman’s statement on 28 June was long overdue but timely

|

The Central Bank (CB) on Monday according to Daily FT made a public plea to avoid unnecessary speculation over the country’s foreign reserves or debt servicing commitments, saying both issues were being satisfactorily addressed by the Government.

The sudden rise to this speculation was largely due to the fact that so far only around 35% of a $ 100 million auction of bonds for settlement on 30 June has been sold. In addition to this, also due to the speculation about LC settlements, Sri Lanka has to settle $ 180 million in maturing Sri Lanka Development Bonds. It is likely the CBSL will manage the 30 June settlement.

Veteran economist now CBSL Governor Prof. Lakshman went public (CBSL Release 28 June) to say: “I wish to assure the media, the general public, the business community and the investor community that the conditions of foreign currency liquidity observed in the domestic market at present are temporary and are driven by excessive speculative activity.”

He further stated: “We request these operators in the market to remain calm and not fuel undue speculation, which is not in the national interest, as the careful management of the situation without undue disruption, will result in a beneficial outcome to the country as a whole.”

A long overdue statement by the Governor, but timely.

Debt stock management

Debt stock management

The country’s crisis position in foreign currency liquidity in the domestic market is largely due to the massive drop in tourism related income of around $ 4.5 billion both direct and indirect. The government therefore needs to make sensible and objective decisions in the next 24 months to bridge this deficit. Some measures have been proactive and have worked. For example, the restrictions in car imports, etc.

However, to come out of this crisis, we must grow our exports and services and export more workers. Now to export we need raw materials and skills. If banks are going to play hide and seek with LCs and not honour DP terms in a timely manner this will not happen; many of the MNCs will do offshoring with their payments, starving the Government of much-needed foreign exchange.

Key questions

What is the six-month foreign exchange earnings and payments forecast? Are the banks and Government aware of the shortfall? What is the borrowing ability and appetite of commercial banks? Has CBSL studied the balance sheets of banks? Also what are the IMF standby arrangements?

This is not the time for knee-jerk reactions from the Government, instead the Government should give confidence to the foreign exchange markets by managing the crisis with professionalism and certainly and communicating regularly with the private sector.

Way forward

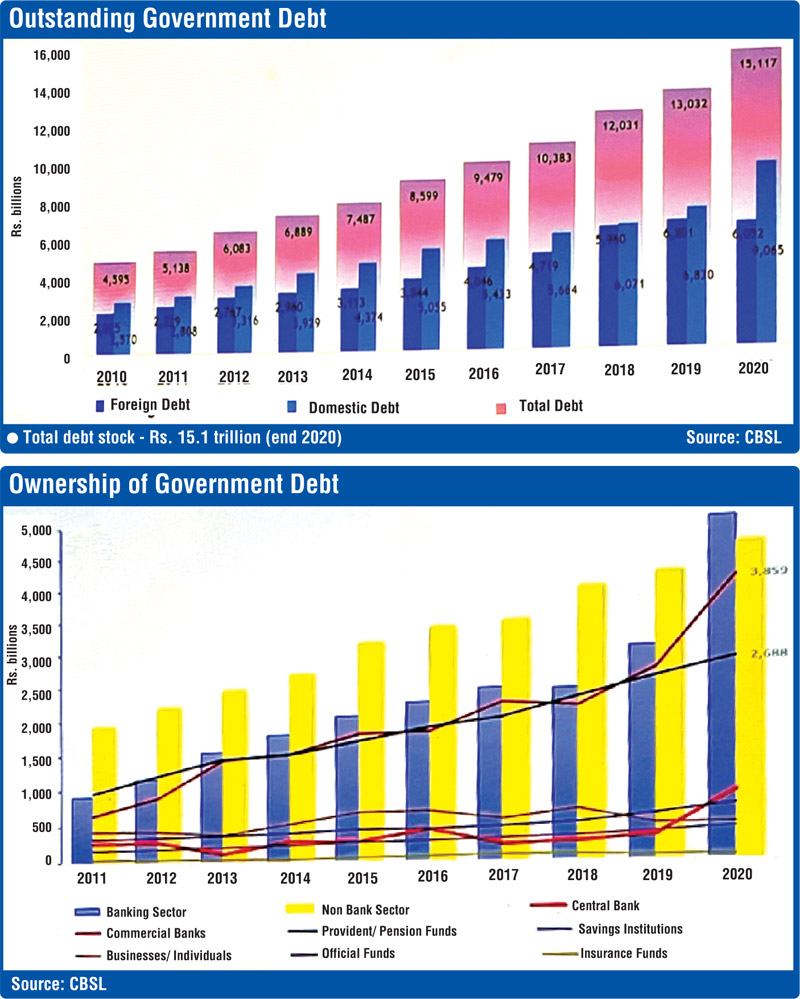

Due to the drop in Government tax revenue the Central Bank has been printing a large stock of rupees to buy LKR bonds, resulting in foreign exchange shortages and driving up domestic six months and one year yields gradually up to 10% in the interbank market. Something the Government must manage going forward given the Government’s huge local borrowings.

Also given that tourism sector borrowings are firmly tied up in moratoriums and the industry not very likely to return to 2018 levels until early 2023, the Government for a start must address the tourism sector debt crisis before it is too late and sinks some of the banks. There are many solutions proposed by the tourism industry that will work.

The current foreign exchange situation cannot be managed by issuing a statement of comfort, instead those who are managing the economy should study how Iceland, Ireland, Greece and Latin American countries got out of their foreign currency crises by adopting sensible policies and proper restructuring of debt without taking postures of arrogance.

Also they must stop playing football with the IMF and the West. Political power in a democracy to democratically-elected leaders is not carte blanche to do as they want. Sensible policies and sound economic management will certainly get us out of this FX crisis.

(The writer was a bank director from 2003 to 2021.)