Wednesday Mar 04, 2026

Wednesday Mar 04, 2026

Monday, 5 April 2021 00:04 - - {{hitsCtrl.values.hits}}

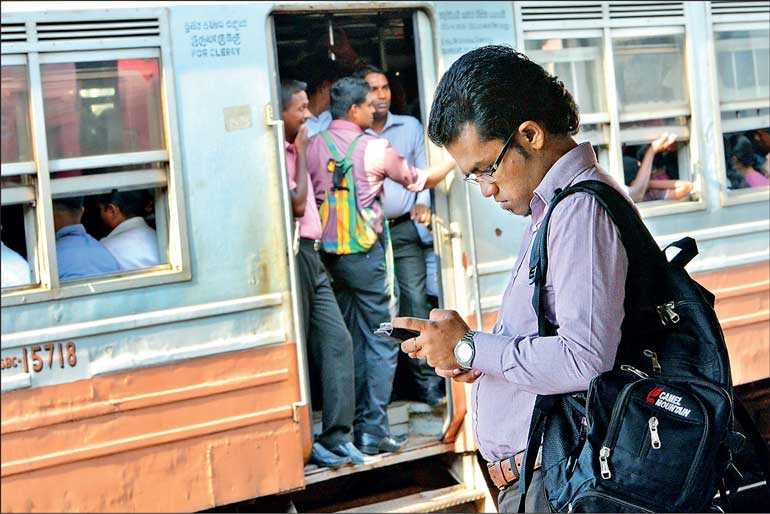

Sri Lanka’s unemployment today is about 5%, a little higher than the full employment level which is considered at about 4% of the labour force. Thus, one can argue that by printing money, Sri Lanka could increase employment as Keynes had presented in The General Theory without causing inflation – Pic by Shehan Gunasekara

Gideon Gono: dead body inflation is more serious than price inflation

Gideon Gono: dead body inflation is more serious than price inflation

The former Governor of the Reserve Bank of Zimbabwe, Dr. Gideon Gono, in a recent interview with Trevos, a Zimbabwean journalist, justified his money printing during the first decade of 2000 (available at: https://www.youtube.com/watch?v=pRbfMwsr3_E&t=743s). This profligate money printing caused his country’s inflation to be elevated to a world record level of 79.6 billion percent by November 2008 according to private estimates (available at: https://www.economicshelp.org/blog/390/inflation/hyper-inflation-in-zimbabwe/).

Without showing any sign of regret or tendering an apology, Gono said that economists have been wrongly interpreting inflation as the increase in the consumer price index. Citing Adam Smith’s ‘The Wealth of Nations’ as a support, he said that the real inflation in an economy should be the inflation of dead bodies all around the country. When that inflation hits an economy, he said that the Reserve Bank cannot remain unresponsive and must print money to feed the nation.

The question which a nation faces, therefore, should be whether it is the price stability that must be pursued or a goal of eliminating the piling of dead bodies in an economy. Surely, he said that the Reserve Bank did the best thing it has to do because the value of life is much more than the value of a physical commodity. This is Devil’s alternative, because you choose segregated life immediately in preference to wide-spread heavy cost of inflation later.

Stephanie Kelton: Deficit financing during the pandemic is an unmitigated disaster

This is Modern Monetary Theory or MMT, though it was not a vogue in early 2000s during Gono’s time. Today, when the world has been hit by the deadly COVID-19 pandemic, the advocates of MMT too have come up with the same argument. They said that when people are dying out there, a central bank cannot confine itself to an elusive objective of price stability. To maintain price stability, there should be an economy with people and if people are not there, there is no purpose of going behind that goal.

Stephanie Kelton, one of the fiercest advocates of MMT did not mince her words when she said in her 2020 bestseller, The Deficit Myth, that reducing the fiscal deficit during the pandemic was an ‘unmitigated disaster’ and the most ‘fiscally responsible way to manage the crisis’ was ‘with higher deficit financing’ (p 13). Governments, as monopolist currency issuers can, says Kelton, finance those expenditure programs because people would demand that currency for payment of taxes to government and use as a medium of exchange (P 23). There cannot be a limit for the currency issuer to issue that money. Echoing this argument, the former President of Zimbabwe, Robert Mugabe, is reported to have announced in 2007 that if the government did not have funds to finance his underfunded municipal projects, he would print money and finance them (available at: https://www.iol.co.za/news/africa/we-will-print-more-money-mugabe-363873).

Governments hiding bankruptcy by printing money

Though Gono had claimed that Adam Smith had supported his money printing exercise as a necessity when there are dead bodies all around, The Wealth of Nations testifies to the opposite. Smith had devoted one full chapter – Chapter III in Book V – to explain the complexity of public debt. He says that instances of fully and fairly repaying all the public debt – by public debt he meant domestic debt – are scarce in history. Instead, what is found is that nations which have accumulated excessive public debt end up in bankruptcy. But bankruptcy is concealed by making a pretended payment by reducing the metal base of a coin or equivalently increasing the denominational value of a coin.

How it happens is that everyone who holds public debt get fully paid by a coin for which the government has used a less quantity of real resources for its production. Denomination-wise, all public debt holders get fully paid but with a lower value coin. In the modern-day paper money system, this is equal to printing more money as advocated by Gono and modern money theorists.

Getting paid with a debased currency

Getting paid with a debased currency

Smith’s argument of hiding bankruptcy by debasing the currency can be explained as follows. Suppose a rupee coin has four silver ounces. By government proclamation, the denomination of a rupee coin is increased to two rupees. Now everyone who has lent the government a rupee or four ounces of silver gets repaid with only two ounces. In this way, governments can reduce the real value of public debt by half and according to Smith it is an expedient way of hiding bankruptcy by pretending the full payment of public debt. It is simply a fraudulent way of transferring resources from creditors who are savers to borrowers, in this case the sovereign governments. Smith blasts it as the most pernicious subversion of the fortunes of the people.

When a modern government issues paper money which has no metal content, inflation sets in the economy eroding the real value of that money. For instance, if prices have doubled, a Rs. 5,000 note has a real value of only Rs. 2,500. Hence, a person who has lent the government Rs. 5,000 earlier gets repaid now only Rs. 2,500. The difference between the two values is an inflation tax and as Smith has explained it with reference to coins of a lower metal base, such an inflation tax enriches the idle and profuse debtors at the expense of the industrious and frugal creditors.

In summary, what Smith says is that governments can either declare themselves bankrupt or hide that bankruptcy by printing money and imposing an inflation tax on people. Both are disasters making the deficit which MMT advocate call a myth a real disaster. It could be avoided only by running a prudent fiscal policy with constrained deficits, on the one hand, and spending government moneys in the most productive investments, on the other.

Parakramabahu I too resorted to debasing coins

A good example of debasing the coins to avoid bankruptcy could be found in the Polonnaruwa Period in ancient Lanka in the 11th to 13th centuries. According to Senarat Paranavitana who wrote the chapter on the economy of the Polonnaruwa Period to the Ceylon history series published by the University of Ceylon, the issue of coins with high-value metal ceased during the reign of the Parakramabahu, I. This implies that it was he who had debased the coins from gold to copper for the first time in Sri Lanka’s history. But the remark made by Paranavitana tells the whole story of modern monetary theory that had been practiced at that time.

“The king had forced people to use these debased coins causing enormous economic losses to them because after his reign ended, they ceased to be legal tender; however, such issue had brought an incalculable gain to the king who had issued them. By issuing more and more low-based coins, the king had been able to extract more and more resources from people. To minimise this forced extraction of resources from people and allow them to enjoy their wealth, King Nissankamalla who ascended the throne later had restricted the issue of copper coins during his period,” says Paranavitana. In modern times, printing of money to run budget deficits brings in the same effect to an economy.

Keynes’ response to great depression of 1930s

Those who advocate money printing as the strategy for a country to generate prosperity for its people rely on Keynesian economics attributed to the 20th century’s most influential British economist, John Maynard Keynes. This popular branch in economics arose from the publication by Keynes in 1936 of his masterpiece, The General Theory of Employment, Interest and Money. This was Keynes’ reply to the general economic depression that engulfed the Western world in 1930s with a massive economic depression accompanied by equally massive unemployment.

The ripples of the depression were present even in countries like Ceylon which wholly depended on trade with the Western world for wealth creation. For instance, according to the first Ceylonese Central Bank Governor, the late N.U. Jayawardena, exports fell from Rs. 378 million in 1929 to Rs. 166 million in 1932. So were the imports making the size of the Ceylon’s economy – Gross Domestic Product or GDP in today’s terms – smallest forever. If this were repeated, the results would be catastrophic. Keynes wanted to suggest a practical solution to this.

Poverty among plenty due to deficient effective demand

His diagnosis of the ailment was that prosperity shrinks in this way due to a fall in the demand for the goods and services – which he called the ‘effective demand’ – produced by a nation. The effective demand was the demand supported by ability and willingness to pay and not a mere wish to buy. The reference to nations here was advanced Western economies and not developing countries like Ceylon. It is the paradox of poverty among the plenty because there are goods, but people still go unemployed since they remain unsold.

The demand falls because people do not consume everything they earn. This deficiency in demand, he said, could be recouped by the government by stepping into the economy by increasing its expenditure. For this, he suggested deficit financing funded out of newly printed money. This was a revolutionary approach because prior to this, the accepted economic wisdom was that monetary sector and the real sector were a way apart and money, produced excessively would lead only to an increase in prices. Even Keynes subscribed to this view in his prior writings like the one released in 1923 titled, A Tract of Monetary Reform, often called ‘A Tract’.

Keynes: inflation tax reduces prosperity of a nation

Keynes had noted in ‘A Tract’ that in all the Western countries from 1914 to 1920 the money supply had increased considerably leading to inflation. The case in Germany was the worst because the price level in 1923 was higher by 7,650 times of the price level in 1913. He called this an inflation a tax imposed by governments on society to avoid being declared bankrupt, the notion proposed by Adam Smith earlier. It also redistributes wealth in a manner injurious to savers, but beneficial to borrowers.

In Chapter II, he has discussed how inflation serves as a method of taxation. It enables a government to have real resources transferred to it from the private sector in the same way traditional taxes do transfer resources. But the result of inflation tax is catastrophic. “Like other forms of taxation, these exactions, if overdone and out of proportion to the wealth of the community, must diminish its prosperity and lower its standards,” says Keynes. The printing of money does not stop at creating inflation and imposing inflation tax on people.

Drawing on Gustav Cassel’s purchasing power parity or PPP, presented only five years earlier in 1918, Keynes concludes that the long run exchange rate movement is based on the relative inflation rate between the UK and the foreign country, say the US. If the domestic inflation is higher than the foreign country inflation, to maintain the purchasing power parity, the local currency should be devalued; the opposite should be done, that is, the local currency should be revalued, when the domestic inflation is lower than the inflation in the foreign country.

Hence, the control of money supply is essential for stabilising both the domestic price level and the exchange rate. Keynes ends the book by recommending that the volume of paper money should be used as the instrument to stabilise ‘trade, prices, and employment’.

Money printing may work if unemployment is there

What this means is that Keynes’ earlier wisdom on money printing and inflation is quite different from what he has been understood as the advocate of the deficit financing. Is it a contradiction on his part? No, because in The General Theory, one full chapter – Chapter 21 – has been used by him to explain the theory of prices. He has broken his policy prescription into two parts: one, when there is unemployment in the economy and the other, when the economy has reached the full employment level.

The increase in the money stock will cause an increase in the effective demand, now known as the aggregate demand, by reducing interest rate and stimulating all the interest sensitive expenses, namely, consumption and investment. Such increase in the aggregate demand will cause both the output and prices to rise thereby eliminating unemployment. However, once the economy reaches the full employment level, there is no more space for the output to rise. Hence, the consequence of money printing at that stage is the elevation of wages and prices causing inflation to set in. Thus, Keynesian prescription is only for that short period when there is unemployment in the economy. Accordingly, if the economy is in full employment level, following Keynesian prescription is a road to disaster. It behoves the advocates of modern monetary theory to recognise this difference in the working of printed money in an economy.

A full employment economy will get overheated by money printing

Monetary theory tells us that it is not money per se that leads to inflation. Money is needed for an economy to function smoothly. When the volume of output – in other words, real GDP rises – an increased amount of money is needed to facilitate the exchange of that output among people. Hence, an increase in money supply linked to the real growth in the economy is not inflationary.

If money does not grow at the same rate as the real growth, the general prices will fall – called deflation – and Keynes in his ‘A Tract’ has said that it would impoverish the labour and enterprise through a cut in production. Hence, what the central banks should do is to avoid both excess money production and deficit money production. In other words, both inflation and deflation should be avoided.

Sri Lanka’s governments in the past have imposed inflation tax

All governments in the post-independence Sri Lanka have violated the upper bound of this rule. As figure 1 shows, money has been issued more than real growth causing inflation to raise its ugly head. Some governments have done it more excessively causing inflation too to rise to higher levels. This is clearly discernible during 1978 to 1982. The same result can be seen in 2020 too with a massive increase in excess money. For instance, when the economy contracted according to official sources by 3.6% in 2020, money supply has increased by 25%, causing the inflationary pressures to be around 29%. The price index has not shown this because of the suppressed inflation through controlled prices of a large number of consumer goods. Thus, while all governments have practiced modern monetary theory to some extent, the present government has done it to an extreme.

Solve structural problems before venturing into money printing

Sri Lanka’s unemployment today is about 5%, a little higher than the full employment level which is considered at about 4% of the labour force. Thus, one can argue that by printing money, Sri Lanka could increase employment as Keynes had presented in The General Theory without causing inflation. This does not happen because of the structural problems that inhibit production in the economy. These structural problems range from excessive regulations and restrictions, inefficient public sector, rent-seeking private sector to inadequate and outdated production methods. These issues need be addressed before Sri Lanka seeks to generate prosperity by printing money.

Futile attempt at holding a tiger by tail

Following MMT by the Central Bank in the present juncture is like holding a tiger by the tail. If the grip is loosened for whatever the reason, the chances are that the tiger will turn around and attack. In the case of the economy, that attack will take the form of setting it on inflation, on the one hand, and causing the exchange rate to fall further, a situation which even Keynes had admitted.

(The writer, a former Deputy Governor of the Central Bank of Sri Lanka, can be reached at [email protected].)