Saturday Feb 14, 2026

Saturday Feb 14, 2026

Friday, 28 September 2018 00:00 - - {{hitsCtrl.values.hits}}

If you look at the successful economies of our region they have followed economic policies that are diametrically the opposite of what our nation state has followed. These economies had;

1. Low nominal interest rates

2. Competitive to slightly depreciated exchange rates

3. Low government deficits

By following these policies they were able to grow their exports and build prosperity.

We are unable to implement the preceding prescription as our Central Bank more closely represent our political classes. Former governors and governing hopefuls fill the paper with falsely-framed interpretations of the facts and the current Governor says things that he lacks the backbone to implement.

Monetary Policy Review no. 6 of 2018 is round the corner (2 October) and it is strongly suggested that the Monetary Board unanimously consider moving towards low nominal interest rates. Even a slight reduction would be in the interests of the Central Bank.

It must be noted that the Central Bank is moving towards inflation targeting when setting rates and the implementation is due early next year but there is nothing like the present to implement a good idea. What is being suggested would also help smoothen out the shock to the reduction in rates brought about by switching to inflation targeting. So why reduce rates now? Three reasons.

1. To be in line

with declining

long-term rates

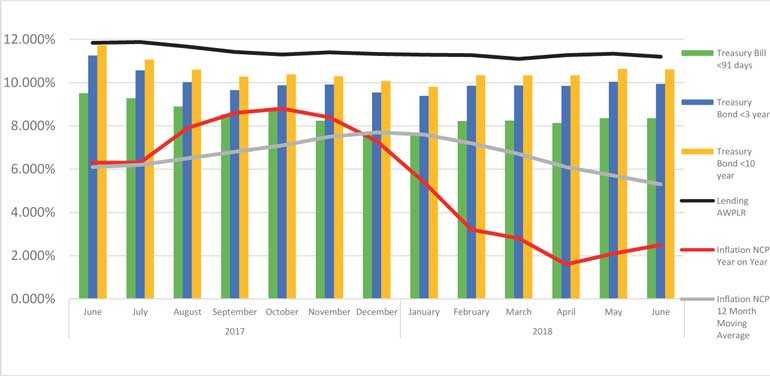

Rates, inflation, prime lending rates, and Government financing costs are already on a declining long-term trajectory. Anyone saving for retirement would be well served by buying out a mix of long-term rates from the Government, a proxy State institution, or something too big to fail.

Notably as a retail investor it is practically impossible to access the Government debt markets. This is because of the lack of integration with any accessible intermediary. More alarmingly, the DEX trading system for corporate debt is also closed to retail investors. Atrad has the inbuilt functionality to provide us access via their portal but have been prevented by regulatory diktat.

Our Central Bank is often likened to the Catholic Church that prevented people from engaging in finance. The structuring of the micro finance bailout, wherein they guaranteed the return of the predatory lender, would also suggest that they shared an anti-minority world view. There is also no incentive to access the Government debt market as the transmission of policy to the financial sector is very slow. That is to say that lending institutions only amend their rates well after the Central Bank has changed policy. Normal people do not hold Government debt. It is a low-paying instrument. The institutions that hold Government debt do so as they are required to do so by regulation. The chart shows the holding of Government Treasury bonds.

As can be seen by the line graph the amount of Government issuance of Treasury bonds is going down. This in conjunction with the amount of funds that by regulatory decree have to hold government funds are growing bigger. In my opinion this should then result in lower rates for Government debt.

As there is little opportunity for me to share in the returns gained in trading in this market I lack the drive to learn about it. The Central Bank which recently claimed itself to be a knowledge society is actively preventing me from seeking this knowledge. However as seen from the data there has been a decline in rates.

2. Psychological

This rate announcement comes surrounding the buzz around the recent decline the USD/LKR exchange rate. One must admit that certainty and thereby confidence in the economy is slightly lacking. Many notable economists argue that the Central Bank could have prevented a lot of this speculation by offering government debt that guarantees a USD computed return in locally denominated currency. That is to offer the USD Treasury rate plus a risk premium paid in the equivalent LKR terms made accessible to jittery exporters.

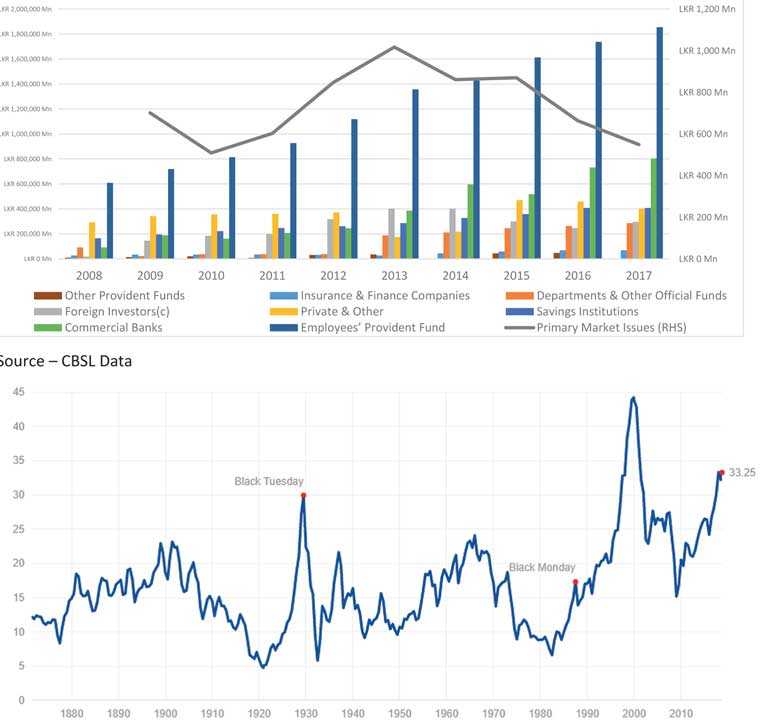

Though the Governor has done a commendable job in terms of communication he must now also realise that his role is also motivational. The graph tracks Robert Shiller’s PE ratio. Robert Shiller, of predicting the housing bubble fame, now advises people to exit US equity markets as they are overvalued.

It has never been a better time to invest in emerging markets as the dollar is strong and those markets are currently highly undervalued. People buy shares for their earnings and the US is currently very expensive. Shiller argues that the growth in the US markets is due to ‘irrational exuberance’. This is driven by the Trump phenomenon.

Smart money would be leaving the US economy as we speak and Sri Lanka should place itself to receive US funds when this madness eventually crashes but in the meantime it would be beneficial to maintain some level of stability. In this regard as Indrajit lacks the charisma to be a motivational speaker, he could use interest rate movements to signal confidence in the currency.

3. Because I said so

Both the Prime Minister and Mangala Samaraweera have publicly called for a reduction in interest rates. Members of the Monetary Board would be well served by heeding this call. Rates are invariably going to be lower when targeting inflation becomes the objective of monetary policy and the Central Bank has quite unequivocally stated that this will be coming in early next year.

Rumour has it that the current Governor is not in good favour with the two powerful green members and this would be an easy olive branch to offer.