Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Saturday, 4 February 2023 00:26 - - {{hitsCtrl.values.hits}}

A fragmented world would only help deepen the overarching economic problems impacting the entire world, while cooperation among nations is the only feasible way to pass the storm

Globalisation has helped to lift billions of people out of poverty especially in the last 30 years after the collapse of the Soviet Union in 1989 and end of the Cold War in 1991 by means of increasing income levels and improving efficiency resulting in reduced cost of goods and services. Globalisation has taken a step back, and near-shoring and friend-shoring are increasingly gaining popularity due to the unprecedented uncertainty caused by headwinds of the pandemic, China-US tensions, rising inflation and interest rates and Russian invasion of Ukraine. Fragility of economic dependence has raised fears of decoupling of economies leading to an increasingly fragmented world.

Globalisation has helped to lift billions of people out of poverty especially in the last 30 years after the collapse of the Soviet Union in 1989 and end of the Cold War in 1991 by means of increasing income levels and improving efficiency resulting in reduced cost of goods and services. Globalisation has taken a step back, and near-shoring and friend-shoring are increasingly gaining popularity due to the unprecedented uncertainty caused by headwinds of the pandemic, China-US tensions, rising inflation and interest rates and Russian invasion of Ukraine. Fragility of economic dependence has raised fears of decoupling of economies leading to an increasingly fragmented world.

In the UN Secretary General’s address at the World Economic Forum 2023 held in Davos, Switzerland in January, he highlighted that the gravest levels of geopolitical division and mistrust we face in generations is undermining everything. Decoupling of the world’s two largest economies – the US and China would create a tectonic rift that would create two different sets of trade rules, two dominant currencies, two internets and two conflicting strategies on artificial intelligence. This is the last thing we need amidst the polycrisis the world faces. The East-West divide would cut global growth and clearly impact the rest of the world and nations which are at the brink of recession as well as facing economic crisis due to high debt levels such as Sri Lanka.

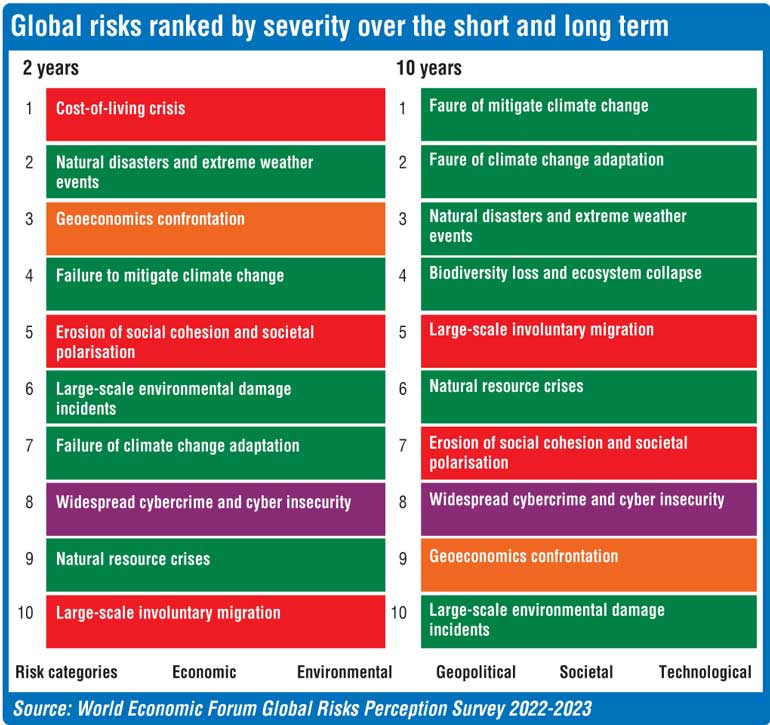

Rising cost of living tops the list of risks affecting global economies in the next two years as per the World Economic Forum. Rising inflation is both driven by excess demand caused by large amounts of liquidity infused by the central banks during the pandemic to trigger economic activity, as well as supply driven due to the constraints caused by the Russia-Ukraine war and China’s zero-COVID policy. 2023 begins with a backdrop of economies trying to control inflation by limiting excess liquidity by ways of rising interest rates and seeking ways to transform supply chains to be resilient, tackling the food crisis and record high energy costs.

Russia which continues to influence the energy sector is expected to further cut its energy output in 2023. While global recession fears and slow growth expectations may reduce the demand, China’s reversing of its zero-COVID policy is expected to considerably push demand up. Volatility in the energy sector has created a silver lining whereby this can be a turning point towards sustainable energy sources with the International Energy Agency (IEA) predicting global renewable energy capacity to double over the next five years leading the way towards limiting global warming and fighting climate change. Climate related risks are significant both short-term and long-term for which gradual progressive actions are required while balancing energy transition and energy resilience.

Despite the fact that the move away from globalisation would inevitably cause especially developing nations to suffer resulting in increase in poverty levels, sentiments expressed by the leaders across the world who gathered at Davos, Switzerland indicate building resilience rather than decoupling is the way forward, and emerging nations are considered to be the bright spot compared to the rest of the world with expectations of increasing demand and growth potential.

Meanwhile Oxfam, a British-founded charitable organisation focusing on the alleviation of global poverty, has released a report to coincide with the opening of the World Economic Forum titled ‘Survival of the Richest’ with startling revelations on inequality of income distribution which is attributable to the inefficiencies the globalisation has resulted in. Since 2020, the richest 1% have captured nearly twice as much money as the bottom 99% of the world’s population which is almost two-thirds of all new wealth. Food and energy companies have more than doubled their profits in 2022, paying out $ 257 billion to wealthy shareholders, while over 800 million people went to bed hungry.

The report also reveals the failure of global tax systems to achieve a fair redistribution of wealth driving to polarisation of politics and rise of populism across the world – only 4 cents in every dollar of tax revenue comes from wealth taxes, and half the world’s billionaires live in countries with no inheritance tax on money they give to their children. A potential tax of up to 5% of the world’s multi-millionaires and billionaires could raise $ 1.7 trillion a year, enough to lift 2 billion people out of poverty, and fund a global plan to end hunger.

While it’s impractical for supply chains to completely diversify away from China, considerable diversification is expected to take place in order to build resilient supply chains immune to geopolitical tensions and other uncertainties. Key reforms towards ease of doing business is essential for emerging economies to leverage on the expected evolution of global value chains. De-globalisation of the world economy would drive costs up and further increase inflation which would have a hit on the living standards of the entire world. As per the World Trade Organisation – trade is part of the solution to the big problems we face. Decoupling of economies would be tremendously costly, and de-globalisation would create supply vulnerability problems of its own.

Instead, a process of “re-globalisation” – implying that building deeper and more diverse international markets by bringing countries and communities from the margins of the global economy into the mainstream offers a more promising path to build resilient markets whilst reducing poverty and exclusion. In addition, as per WTO – trade facilitation, services trade liberalisation and regulatory cooperation, and prospective rules on digital trade would help foster the re-globalisation process thereby helping countries lower trade costs and tap into global value chains.

Global leaders cannot deny the fact that supply chains played a vital role in responding to the pandemic – one of the greatest challenges of recent times affecting the entire world, and global cooperation on trade is essential in managing the current food crisis and energy crisis, and to progressively achieve net zero emissions commitments. Unless governments leverage the full potential of trade by way of collaboration, recovery from the prevailing challenges would be more expensive and less efficient.

The re-globalisation towards resiliency should ensure that lessons learnt from the globalisation of the past are addressed and vulnerable communities and areas of the economy are not left behind. A fragmented world would only help deepen the overarching economic problems impacting the entire world, while cooperation among nations is the only feasible way to pass the storm (a storm on a number of fronts) the world is encountering.

(The writer is a finance professional with interests in finance, business, and current affairs, and can be

contacted at [email protected].)