Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 7 July 2020 00:04 - - {{hitsCtrl.values.hits}}

With schools starting, businesses reopening, an election coming up and the curfew lifted, the big question on everyone’s mind is whether Sri Lanka is back to normal. Yet depending on who you ask and when you ask, the answer to this question is likely to be different because we are not too far into this recovery stage and much about the future remains uncertain. Therefore, I decided to take some time to analyse some data and better understand Sri Lanka’s recovery from the COVID-19 pandemic from both a public health outlook and an economic outlook.

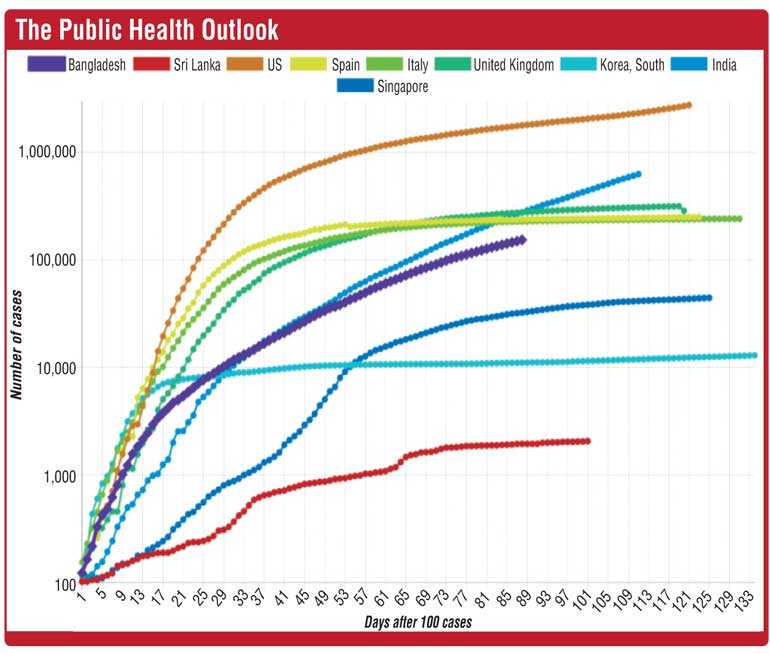

Public Outlook

Despite the mask adorned faces and ubiquitous hand washing facilities you might have seen, the public health risks posed by COVID-19 have been contained to a large extent thanks to the government’s draconian containment measures. There are less than 200 active cases in the country, and as seen in the given graph community spread is at a minimum in Sri Lanka when compared to its peers globally.

Nevertheless, complete recovery in the public health sphere will rely on the effective development and deployment of a vaccine. And it may take longer even beyond that point to restore public health to its pre-pandemic state due to the public healthcare provision disruptions and mental health damage caused by the lockdown itself and the isolation that it led to.

The economic outlook

Unlike with public health, gauging the extent to which Sri Lanka’s economic activity has recovered from this pandemic is a challenge because official economic indicators on output, employment, inflation, etc. aren’t collected and published in real time. Nevertheless, a lot of data is collected in today’s information age and although the conclusions we come to may be limited, we can use visualisations of some of this data to infer whether Sri Lanka’s economy is back to normal. Most of the visualisations seen below reflect data that Google has published in their COVID-19 mobility reports. This data is collected via GPS on the almost 10 million Android smartphones actively used in Sri Lanka and it’s used by Google to sell ads and provide services like live traffic on Google Maps.

Shopping and entertainment

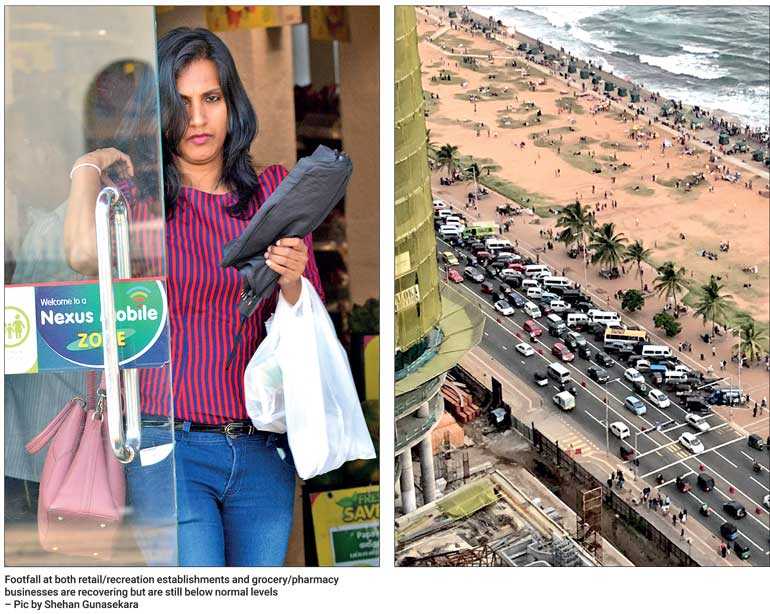

Shopping and entertainment is probably the worst hit sector by the COVID-19 pandemic and the ensuing lockdown. Despite a sudden surge due to the panic buying spree we saw back in early March, footfall across shopping and entertainment establishments fell to a minimum of around 80% below the base level in late March and early April. As seen in the visualisation above, footfall at both retail/recreation establishments and grocery/pharmacy businesses are recovering but are still below normal levels. As of late June, footfall at groceries and pharmacies have recovered quickly to just 4% below the base level because they provide essential goods and services. On the other hand, footfall at retail and recreation establishments has recovered more slowly to 16% below the base level by the same time.

Although this recovery in the shopping and entertainment space is promising, we must recognise that footfall only represents the number of people entering a shopping area at a given time. As a result, increases in footfall don’t always directly translate to increased consumption and economic activity. Moreover, since foreign tourist arrivals in Sri Lanka have declined to almost nothing, the recovery in terms of export income earned by the shopping and entertainment industry will probably take far longer than Google’s mobility data suggests. The import restrictions put in place by the government along with depressed incomes and low business confidence amidst this pandemic further support this conclusion.

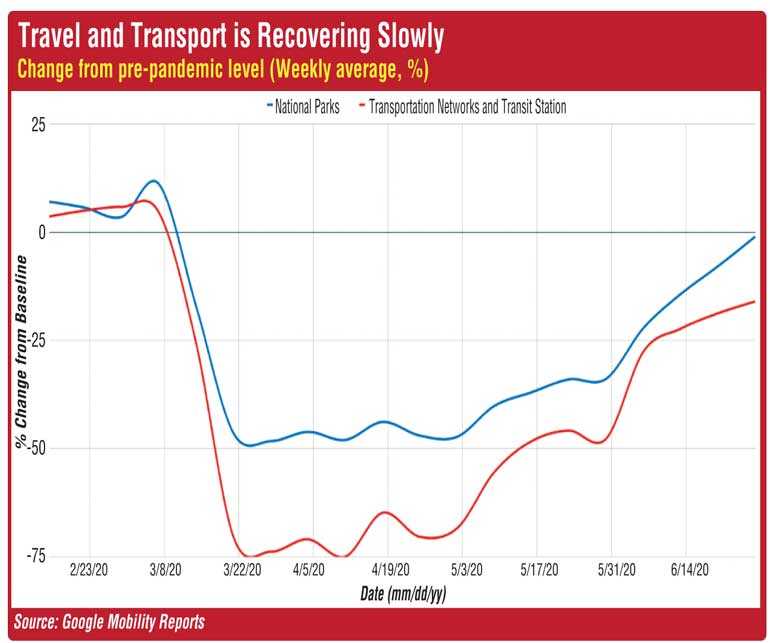

Travel and transport

Just like with the shopping and entertainment industry, travel and transport dropped to between 50% and 75% below the base level during the lockdown from late March to mid-May. Since then, Google’s data suggests that the use of transportation networks and transit stations has recovered more slowly to 16% below the base level. Interestingly, the number of visits to national parks has recovered almost completely to just 1% below the base level perhaps because people were forced to stay away from nature for months.

Regardless however, Sri Lanka’s tourism development authority reported that tourist arrivals were at zero from April to June and the travel and transport industry is unlikely to recover until we see increased tourist arrivals. The slower recovery in the use of transportation networks and transit stations to just 16% below the base level could be due to both the limits imposed on passenger numbers aboard vehicles and general health concerns associated with travelling on public transport.

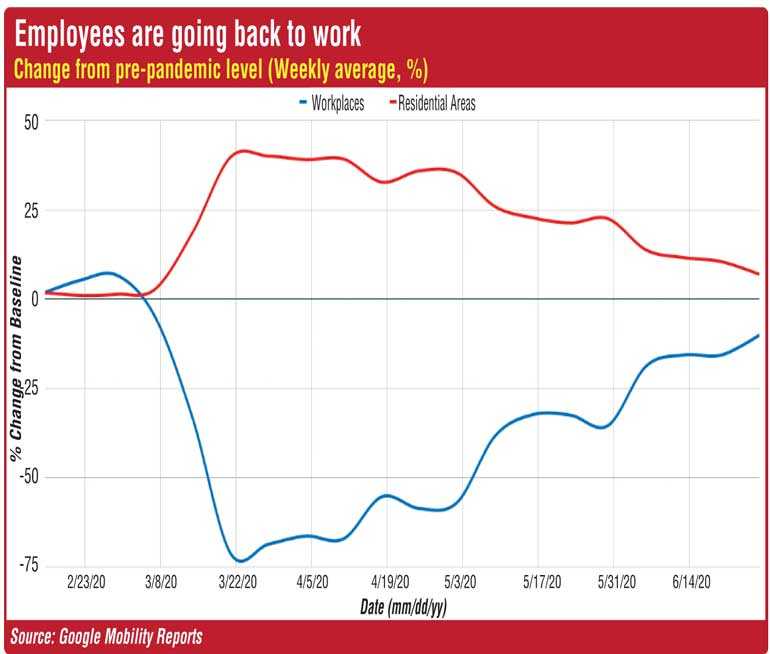

Back to work

According to Google’s mobility data, time spent at workplaces has recovered quickly to 10% below the baseline despite a sudden drop to a minimum of 71% below the baseline in late March. It’s quite interesting how the time spent at residential areas is almost a reflection of the time spent at workplaces in the visualisation above due to the fact that employees moved from working from the workplace to working from home during the lockdown.

Now that employees are returning to the workplace, the time spent in residential areas has gone down to just 7% above the base level from a maximum of 40% above the base level in March. This quick recovery suggests that at least in the white collar space, unemployment has not increased as much as it could have. Moreover, the disparity between the current time spent at work and home figures and the baseline may reflect the increased adoption of permanent work from home.

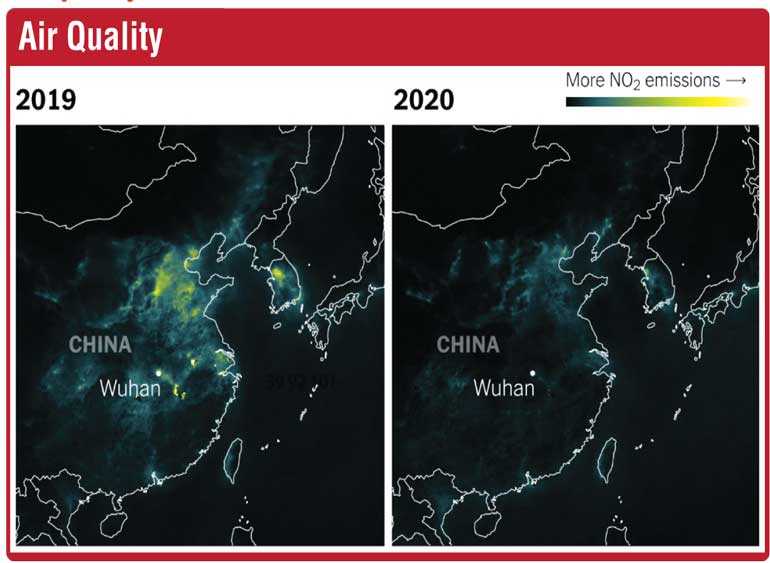

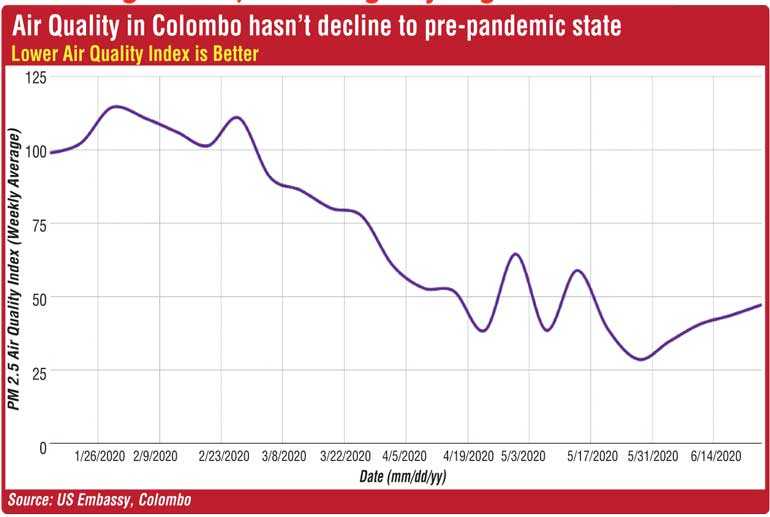

Air quality

Since increased consumption drives increased manufacturing and transportation, increases in economic activity almost always leads to increased greenhouse gas emissions and air pollution. As a result, as seen in the satellite image above we observed a significant increase in air quality in places like China during the great economic shutdown caused by COVID-19. Air quality data from Colombo suggests that there was a significant improvement in air quality as a result of the lockdown.

Although the economic recovery we are seeing through Google’s mobility data has led to an increase in the PM2.5 Air Quality Index and a decrease in air quality, air pollution has not increased to its pre-pandemic state yet. This may be because of the slow recovery in the travel and transport industry that Google’s data indicated. Furthermore, because air quality data isn’t strictly local, the economic slowdown in neighbouring India may have also contributed to lower air pollution despite economic recovery in Sri Lanka.

Promising results, but a long way to go

The data we’ve visualised in this piece suggests that both in terms of public health and the economy, Sri Lanka is on the right track to recover from the COVID-19 pandemic and return to normal. However, despite these promising results, there’s a long way to go on both fronts. From a public health perspective, the government has done well to recover from the immediate threat of rapid community spread that surges above the healthcare system’s capacity. Yet, returning to normal in terms of public health will take time as it relies on the effective development and deployment of a COVID-19 vaccine.

From an economic perspective, although the data we have looked at suggests that we are moving in the right direction, it’s difficult to fully understand the extent to which the economy is back to normal through real time data alone. Nevertheless, just like with public health, achieving complete economic recovery will likely take time due to Sri Lanka’s reliance on tourism and minimal government intervention to accelerate Sri Lanka’s macroeconomic recovery from the COVID-19 pandemic thus far.