Monday Feb 23, 2026

Monday Feb 23, 2026

Wednesday, 2 October 2019 00:00 - - {{hitsCtrl.values.hits}}

Presidential Election 2019

With the Presidential Election scheduled to be held on 16 November 2019, the policymakers of the main political parties are busy in drafting the election manifestos of their respective presidential candidate.

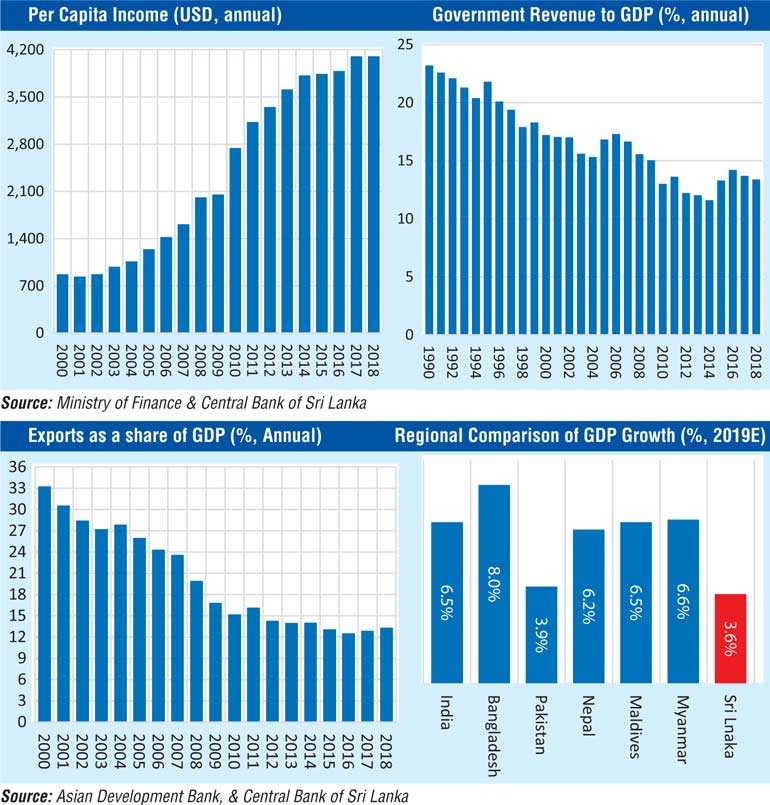

Needless to say, the economy takes the centre stage of all election manifestos. Sri Lanka, being a country with just over $4,000 per capita income, aspires to reach higher income country status within the shortest possible time.

The country is at the crossroads after 70 years of obtaining the independence. Though we have progressed over the years, we are lagging behind in terms of economic development, in comparison to the peer group at the time of obtaining independence.

As of today, South Asian region records historically highest ever growth and remains the best growth region in the whole world. However, we have decoupled from the regional growth prospects, largely owning to our own problem. Under such scenario, the upcoming Presidential Election is viewed a turning point, which could possibly take the country towards economic prosperity if the right policies are adopted and implemented.

The economic policies should focus on addressing the structural challenges of the economy as well as shielding the threat of slowing down global economy.

Addressing twin deficit

Economies that have both a fiscal deficit and a current account deficit are often referred to as having “twin deficits”. Sri Lanka has been running a budget deficit and current account deficit for last many decades. The bloated public sector with low productivity drains major part of the fiscal revenue. The tax burden is higher, especially on the low-income earning segment of the country due to disproportionately large indirect taxes.

The expenses for providing employment benefits to the State sector and paying interest cost for the existing borrowings have grown tremendously over the decades. The provision of essential public goods through public finance has become a challenge.

Despite being a highly-taxed State, the fiscal revenue as percentage of the GDP has declined over the years. As a result of low fiscal revenue and higher expenditure, the Government continue to finance significant portion of the expenditure through new borrowings. This has resulted in piling up Government debt.

On the other hand, the growth of export income over the last few decades remains negligible. In contrasts, the import expenditure has grown disproportionately. This is a result of the imprudent macroeconomic policies, adopted in the past. Such policies had dragged down country’s competitiveness and exports.

The production of non-tradable goods in the economy has taken a major share. The traditional exporters have been struggling for the existence and compelled to venture into sectors serving domestic market. Other competitors engaged in the sectors, serving domestic market were able to outgrow the traditional exporters. The growth of disposable income generates demand for more and more imported goods.

Since the demand for imports are more than what is exported, the exchange rate continue to depreciate. If there is a permanent gap between imports and exports (both goods and services), the exchange rate depreciates in the long run.

What policies should we adopt to break this paradox? The policies should be promoting more entrepreneurship culture, drive our export competitiveness, State become investor friendly, attract Foreign Direct Investments into export industries and services, produce more tradable goods, drive exports, create more jobs and raise the income level of the citizen, generate larger direct tax revenue and encourage private sector participation in the infrastructure building and managing.

Improve export competitiveness: The prudent exchange rate policy is a perquisite. The exchange rate policy should target to maintain the country’s export competitiveness vis-à-vis our competing countries.

Labour reforms: The structural labour reform is an essential part of improving export competitiveness. The education reforms should be implemented and fast-tracked to improve number and quality of the young labour force. Structural rigidness of the labour force is serious issue. The laws should be enacted to improve the labour market mobility.

The labour shortage in the labour-intensive manufacturing industries are acute, hence labour mobility from regional countries is required. We can learn from the GCC or Singapore how effectively we can attract the labour required for unskilled and manual categories. To retain the aspiring youth within the country, it requires to improve their skill set and employability. The policies should have extra weight on improving the level of education and employability of the local youth.

Tax reforms: Policy inconsistency is the biggest issue. The government should give assurance that the framework of the tax regime won’t change at least for the next five years. It is required to give assurance that there is no retrospective taxation. The major reform is required in the tax collection process in which leakages are estimated to be nearly 200% of the current tax revenue.

The formal sector is highly taxed. The policies should target to reform IRD, aiming operational improvement to increase the tax collection though the use of new techniques such as artificial intelligence and data science. The current status of the IRD is a waste of state resources. It is duty of the elected government to take the support of IRD unions and broader civil society to reform the tax collection process to save our motherland and stop borrowing from our children’s future.

Improve the government function: The State sector is highly overstaffed and inefficient. However, on the other hand, there are areas in the government which has not improved since the independence. For example, the land ownership documentation. The excess labour in the government sector should be pooled and used on project basis to improve the critical areas of the government, especially the service delivery. The investment is required not only in massive buildings, but in the infrastructure for enhancing the quality of service delivery via embracing new technology.

The government function should be investor friendly. The attitude change is required for the government mechanism. The regulatory agencies should be more business friendly and efficient to facilitate business expansions. The government should embark on a program to implement a culture change within the government. The private enterprises generate income for the government and they should be served effectively and efficiently, so that the government revenue could be enhanced. Key Performance Indicators (KPI) may help in this regards and the wellbeing of the state employees should be linked to such KPIs. Those enhancements will help the country to achieve improved ranking in ‘Doing Business’.

Incentivise exports: The export industries had been neglected for a long. The country’s exports are highly concentrated, as a result the export income has been stagnant. Mere tax concessions won’t help to attract more export oriented investments. The FDI framework should be more visible and transparent. The land ownership should be simplified and the law should be consistent. Constitutional assurance should be provided to protect the business ownership rights.

Our policy should explicitly target to benefit from the strategic maritime location and the infrastructure, we have already built, in terms of port terminals, road network connecting two ports and airports. Development of Hambantota Export Zone is a must. The government should clear the issues prevailing with regards to land allocation to the free trade zone in Hambantota and engage with the Chinese government to expedite implementation of free trade zone. The policy should be in place to expeditiously implement the proposed Free Financial Zone to be housed within the port city.

Battling with the external environment

The new president and the government will face a tough external environment, combined with higher external volatility and low international growth prospects.

The pressure from external environment will amplify due to our own problems. The country is in the middle of huge external debt repayment cycle, known as ‘Bunching Period’ (2019-2023).

During this period, the government has to repay nearly $ 4.5 b each year. The repayment is financed via new loans. The expansionary monetary policy of the Fed may help to a certain extent due to availability of liquidity in the system. However the country should implement consistent pro-growth policies to build up and maintain investor confidence.

Keynesian Growth Model

The growth model of the government prior to 2015 was viewed as inward looking and heavily relied on government spending on infrastructure development. The infrastructure was largely financed through the government debt. The resultant construction boom was a major contributing factor to higher economic growth during 2010-2014. The Keynesian economic model rely on the government spending to spark the growth engine when the economy is slipping towards a contraction.

This model is not sustainable in the long run unless it is supported by the increased privet spending. It has to be augmented with increased private spending. To attract private spending consistently, the government policy should be investor friendly, transparent and predictable. Similarly, the government should explore the other options to finance large infrastructure projects in the pipeline. There are multitude of financing options available to the government to expedite spending on the infrastructure. One such avenue is Public Private Partnership (PPP) in building large infrastructure projects.

National assets

The performance of the State-Owned Public Enterprises (SOEs), providing essential services to the nation is appalling and poor. There are few alternatives, such as privatisation and management improvement. It is required to apply private sector style performance based management culture within the State-Owned Public Enterprises (SOEs) in order to improve the management and increase the productivity.

In creating the assets, which are beneficial to society at large, the ownership really is not important as long as the benefits of those assets are effectively shared among the civil society. We should think in broader sense in developing public assets with effective partnership of the private sector in order to overcome fiscal limitations and meet the public aspiration within the earliest possible time.

(The writer is a CFA charterholder; capital market specialist and Certified FRM. The views and opinions expressed in this article are those of the writer and do not necessarily reflect the official policy or position of any institution.)