Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 2 September 2022 00:00 - - {{hitsCtrl.values.hits}}

US Treasury Secretary Janet Yellen

IMF Managing Director Kristalina Georgieva

IMF First Deputy MD Gita Gopinath

IMF Asia and Pacific Department former Deputy Director Kalpana Kochhar

I am hopeful that there will soon be convergence in the country and the incumbent Government, must endeavour to seek the “buy in” of as many stakeholders as possible, in order to implement and indeed sustain reform.

I am hopeful that there will soon be convergence in the country and the incumbent Government, must endeavour to seek the “buy in” of as many stakeholders as possible, in order to implement and indeed sustain reform.

The convergence

The convergence I speak of, is not simply among and between, traditionally opposing politicians, but also professionals, and among and between the Government, business and civil society.

A nation in waiting, a nation in want

I have commenced the title with “the need for speed and sensitivity” and necessarily so. It is not to offend the IMF team now in Colombo, or to offend our own team at the drawing boards, but in defence of a nation waiting in want, unable to sustain families and livelihoods, to engage in trade or business, whether self employed, or in small, medium or even big businesses.

Not an artefact, or archaeological site

The patient is not an artefact, an archaeological site, brick and mortar, but a people – a wide cross section of people, and among them, the vulnerable and least privileged, who certainly were not the architects of the rut we are in.

A future that was ours to see

Over the last two years, about 50 of us engaged the powers that be, through written recommendations, lending our names to such letters, but the future, the recipients of our letters saw, was different, while ours alas, has come to pass, and lingers on painfully.

Investing in empowerment or sustaining dependence, cash grants and social safety nets

The above is a caption, of an article of mine, which was triggered by a statement of Dr. Shanta Devarajan a World Bank economist specialising in South Asia, who, in studies done (in or before 2006) by the (World) Bank in India, Pakistan and Bangladesh, revealed that 92% of the consumption of Liquefied Petroleum Gas (LPG) is by the richest 40% of the population and that 57% of the diesel subsidy goes to the richest 40% of the population and had pointed out that if you eliminate the kerosene subsidy, take the money you save from that and give it as a cash grant just like a transfer payment to people, even if there is a leakage of a significant 40% of that cash grant, you still will be helping the poor more than you would with the kerosene subsidy.

Referring to the Rs. 50 million a day losses of the CEB, 16 years ago, he had said, “If you didn’t have that subsidy you could build 365 rural hospitals in a year!” In 2005, the Ceylon Petroleum Corporation spent Rs. 21 billion on fuel subsidies, Lanka IOC Rs. 7.4 billion and the CEB lost about Rs. 18.8billion – all more than 2% of GDP. Apparently three East Asian countries; the Philippines, Thailand and Indonesia had all adjusted their domestic prices of oil products to international price levels. (This statement is made in 2006). Indonesia was the last to do it and had suffered badly by continuing tosubsidise. We in Sri Lanka began doing it but abandoned it.

Electricity, fuel, transportation, construction and living cost rises

Electricity, fuel, transportation, construction and living cost rises

While recognising the folly of general subsidies for all, a nation with a heart and mind, should have rolled out the cash cushions, cash grants and handouts to the vulnerable, simultaneously with the price hikes. The hikes should have been explained, awareness enhanced and “buy in” sought.

The necessary surgery is long delayed, and we have an inventory of years of attempted reforms and of lost opportunities. The scalpel is again in our hands, there is greater convergence even among the previously less than aware political opportunists, hence we can now make a virtue out of necessity, but the situation is very delicate, the patient must survive, thus a Government on its part, must approach reforms sensitively while we all, have to cooperate and cooperate purposefully.

Sustainability of SOE reforms/restructure and repositioning, public listings and privatisations

Any program in this regard, must be supported by all or majority in Parliament whether in Government or in Opposition, to ensure continuity of reforms, from one regime to the next. Then we can also sustain debt! I have used the term restructure and reform, although the term I prefer is “Restructure & Reposition” – a term proposed to the then Government in 2015 so that the many productive, responsible and accountable public officials, working amidst and side by side, with others who clearly are not, will both “buy in” to the term reposition better, giving them an opportunity to reform with dignity.

An inadequately committed IMF

I say inadequately committed, since successive governments and successive IMF delegations and Resident Representatives, while having incorporated, caveats and conditions in letters of intent, did not adequately operationalise these, articulate action plans and timelines, follow up implementation of for example the oft referred to SOE reforms, and were even intimidated by previous governments to respond to questions on reform and privatisation, in public fora such as at the ICASL now CA Sri Lanka, at pre or post budget events.

IMF, supplemented by development partner interventions

My expectation in the above paragraph, is not an expectation of courage on their part, but the opening it would give us. If desired reforms are detailed, reasonably timelined and made a conditionality, we might well be able to in parallel, seek, obtain and deploy, technical, financial, grant or loan funded development partner assistance, from WB, ADB, JICA, USAID, DFID’s successor FCDO, and the many others.

Having been an independent consultant to the ADB, prepared CPSs – Country Partnership Strategies for post soviet nations, whether sector specific, grants or loans, or technical assistance on account of, “Institutional Development and Capacity Building” initiatives, or thematic “Governance and Institutional Corruption Risk Assessments” (GICRA’s), for Public Financial Management (PFM); Public Procurement and Anti Corruption, where reviews were done of the legal, institutional, and regulatory, gaps, deficiencies, and solutions and corresponding interventions, designed. Pursuant to donor coordination discussions to avoid overlap we also recommended the deployment of sequenced multi donor, interventions to ensure mid to long term sustainability of technical and financial assistance.

Gita Gopinath and her statements: “Rich nations helping poorer ones, need to be faster and broader”

It is against the background I have mentioned, in the preceding paragraphs, that I read what First Deputy MD, of the IMF, Gita Gopinath had to say recently, “More countries are likely to seek debt relief as a stronger dollar makes repayments tougher, and the program that rich nations have to help poorer ones needs to be faster and broader.”

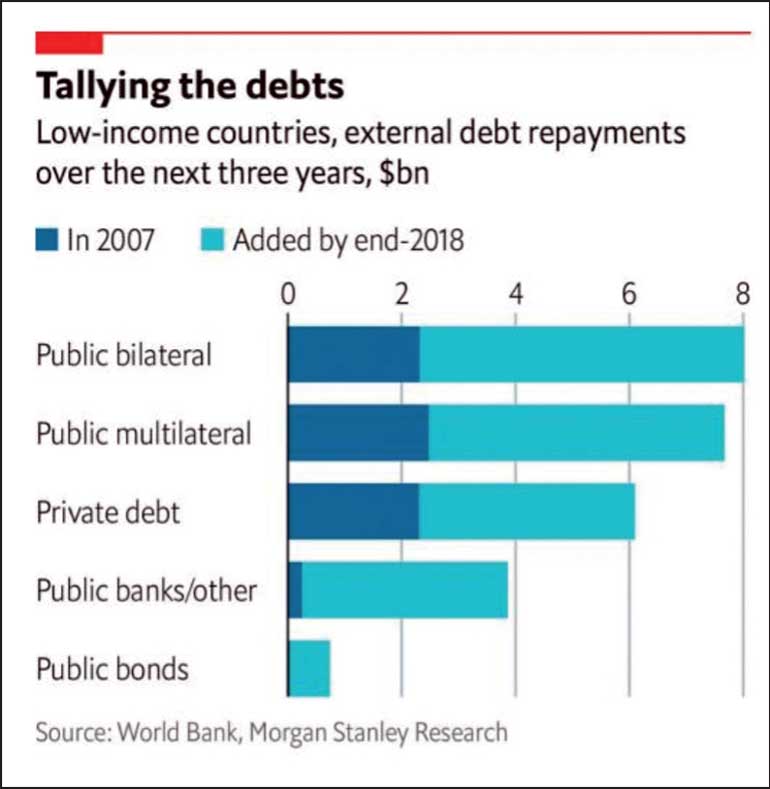

She also noted that “about 60% of low-income countries are at high risk of or already in debt distress, and about 20 emerging markets have debt that’s trading at distressed levels.” She adds, “Surging prices have unleashed a series of interest-rate increases worldwide by central banks, led by the Federal Reserve’s aggressive moves, which has supercharged the dollar.” “Meanwhile, developing nations have amassed a quarter-trillion dollar pile of distressed debt that threatens to create a historic cascade of defaults,” she says.

Sri Lanka, The Economist, ‘Forgive or forbear’

Even though much of what we in Sri Lanka are experiencing is self-inflicted, much of it, by the immediately previous regime, as well as many previous ones, but more recently, much has also been out of our control. In April 2020, two and a half years ago, the Economist, under a caption “Forgive or forbear: The G20 and poor countries debts” said as follows, “With weak currencies high borrowing costs and low export revenues, many poor countries will struggle to pay for imports and service their dollar debts, as the pandemic rages. To help them the International Monetary Fund and others are busy mobilising fresh loans,” and went on to say, “but the most obvious way to give poor countries more hard currency to work with, is to stop collecting it from them.” The full extract of that article is reproduced here.

US Treasury Secretary Janet Yellen

in June 2021, Janet Yellen told the US House of Representatives Appropriations subcommittee, “Debt relief for poor and developing countries would be hampered without new funding, while $ 2.7 billion in current unmet US commitments to the World Bank, International Monetary Fund and other institutions would grow, and that the G20 Debt Service Suspension Initiative for poor countries and a new debt restructuring ‘Common Framework’ both need funding from Congress. Without new funding, the United States could be forced to delay the multilateral debt process under the Common Framework and charge much higher interest rates on debt service suspensions.”

She said the Treasury’s budget request for fiscal 2022 includes funding for these initiatives as well as US contribution commitments to international financial institutions, such as the World Bank’s International Development Association fund for the poorest countries and that the budget plan also includes funding for the first-ever US contribution to the IMF’s Poverty Reduction and Growth Trust, a fund that aids poor countries. It also would allow the United States to lend IMF Special Drawing Rights (SDRs) through the trust to poorer countries that need them. Sri Lanka, while critiquing the IMF, availed itself of IMF’s new facility!

Georgieva and Gita, women more sensitive than men?

In lighter vein, given the stressful and indeed anxious moments we are going through at present, let me say that I notice that the IMF Negotiation Panel comprises, Head Peter Breuer, Deputy Head Masahiro Nozaki, and the IMF Sri Lanka Permanent Representative Tubagus Feridhanusetyawan. It would have been nice if there was a woman too. I remember a delegation once had Kalpana Kochhar, who I last met along with Nadeem Ul Haque and Jeremy Carter at then Leader of the Opposition Ranil Wickremesinghe’s Cambridge Terrace office. A passing reference to Kalpana, though in lighter vein, would not be complete or fair by Ms Kochhar, and who had a very impressive career with the IMF, and was due to retire last year.

I must pause to make mention of what MD Georgieva, said about her then. “She (Kalpana) had pioneered change in the institution, particularly on gender and emerging market issues, while always exhibiting a positive and caring management style.” Referring to the COVID issues, she had said, “Her caring spirit was especially evident during the current health crisis.”

Kalpana, was a Deputy Director in the Asia and Pacific Department (APD), seconded to the World Bank on a two-year stint as Chief Economist for the South Asia Region, and once a desk economist on Sri Lanka. She had led work on Korea and Malaysia during the Asian financial crisis of the late 1990s, and was an Assistant Professor at George Washington University in Washington DC.

Warm hearts and sensitive minds

I hope better sense will prevail on all fronts. Let us hope that, while Kalpana Kochhar has retired, Kristalina Georgieva and Gita Gopinath, motivated also by what Janet Yellen mentioned and helped make happen, and furthermore, encouraged by the first-ever US contribution to the IMF’s Poverty Reduction and Growth Trust – a fund that aids poor countries, will in consultation with Tubagus Feridhanusetyawan, pause for Sri Lanka. Application of their warm hearts and sensitive minds, when they finalise what Peter Breuer, Masahiro Nozaki, takes back with them on 1 September, will then help us, come out of this rut and come out of it soon. As I write this, my mind goes back to the many conversations and friendly debates I used to have, with previous Resident Representatives of the IMF in Sri Lanka – Koshy Mathai, Jeremy Carter, and Nadeem Ul Haque.

Governor Nandalal Weerasinghe

As I conclude I must wish Central Bank Governor Dr. Nandalal Weerasinghe all the best, lest he gets homesick for Brisbane where he was before he returned when I called to wish him from Sydney, where I was on a holiday, receiving daily the many WhatsApp forwards about his imminent appointment, during those three weeks, five months ago, when The Aragalaya – The Struggle, evolved from small night vigils to a “Struggle like no Other” winning affection and admiration world over. This article is dedicated to the apolitical, bold and creative, passionate and persevering, clear and articulate, young men and women, whose sincerity of purpose was wholesome, and whose mode and medium was refined and endearing.

(The writer holds an FCA (Sri Lanka), MBA (USA), and is a Chartered Accountant and Management Consultant in Colombo.)