Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Monday, 5 November 2018 00:00 - - {{hitsCtrl.values.hits}}

The relief package goes against what is known as ‘disciplining the budget’, a must for Sri Lanka to maintain balance in the economy and slow down the accumulation of debt

Midnight goodies package

According to a press release by Ministry of Finance (available at: http://www.treasury.gov.lk/article/-/article-viewer-portlet/render/view/program-for-economic-revival), a number of fiscal measures to relieve the public have been introduced on the direction of the new Minister of Finance. It is not clear whether these measures have been introduced after careful analysis of their impact on the budget, economy, and taxpayers. The Ministry feels that there is a setback to the economy due to slower economic growth and rising cost of living. The former is an accurate observation, since growth has continued to fall since 2013 and the most optimistic prediction for the next 4-year period has been between 4-4.5%. However, the latter contention is not accurate, since the nation-wide inflation, as measured by the National Consumer Price Index calculated by the Department of Census and Statistics, has been continuously falling in the last few months. It stood at 0.9% at end-September, a rate pretty much close to zero.

Danger of adopting pro-cyclical measures

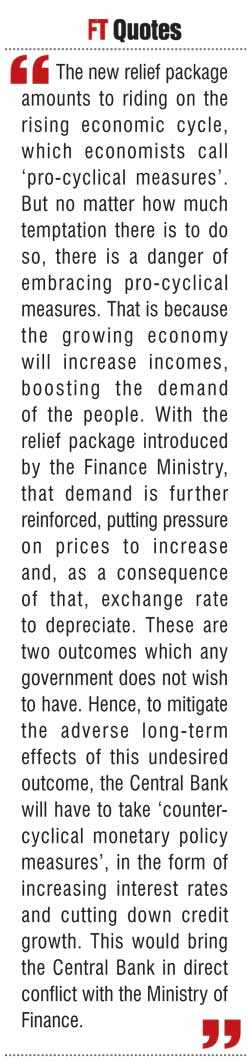

The Ministry has noted that the next few months will be a superb period for Sri Lanka. There will be a good agricultural output in the coming Maha Season, and higher hydro power generation thanks to the generous rains the weather gods have offered to the country. It implies that the economy will be on the upward cycle in the next year. Hence, the new relief package amounts to riding on the rising economic cycle, which economists call ‘pro-cyclical measures’. But no matter how much temptation there is to do so, there is a danger of embracing pro-cyclical measures. That is because the growing economy will increase incomes, boosting the demand of the people. With the relief package introduced by the Finance Ministry, that demand is further reinforced, putting pressure on prices to increase and, as a consequence of that, exchange rate to depreciate. These are two outcomes which any government does not wish to have. Hence, to mitigate the adverse long-term effects of this undesired outcome, the Central Bank will have to take ‘counter-cyclical monetary policy measures’, in the form of increasing interest rates and cutting down credit growth. This would bring the Central Bank in direct conflict with the Ministry of Finance.

Countering the goal of disciplining the budget

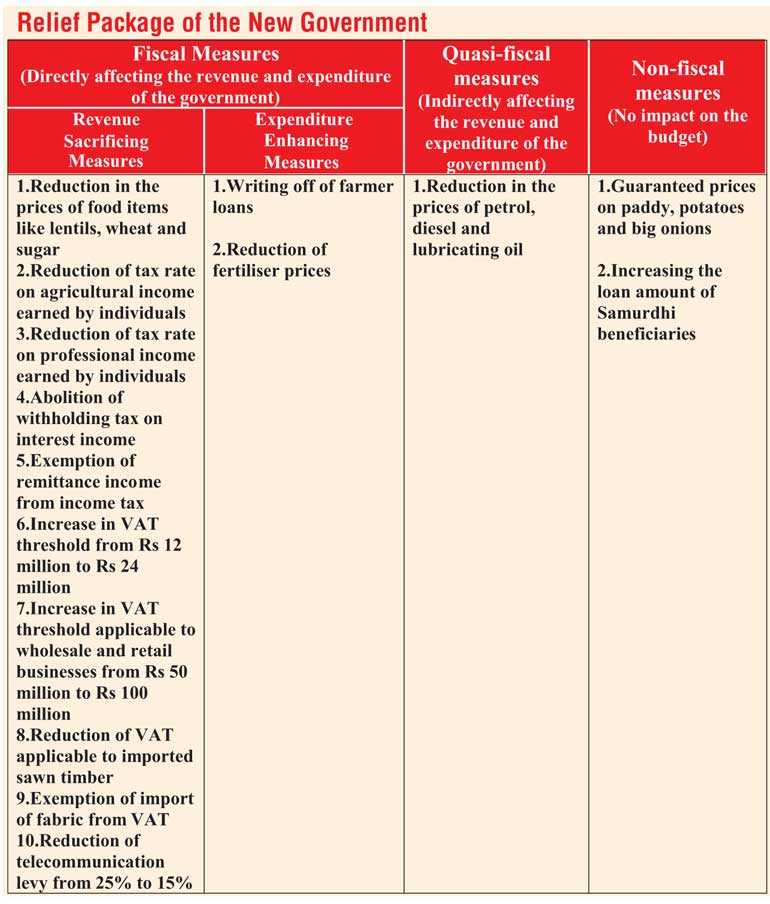

The relief package has 15 components. Of them, 12 are fiscal measures, 1 quasi-fiscal measure and 2 non-fiscal measures. Fiscal measures are directly related to the budget, quasi-fiscal measures, indirectly related, and non-fiscal measures not related. These are given in the Table. From a budgetary point, 10 measures are revenue-sacrificing measures, while three are expenditure-enhancement measures. Since they both lead to widen the budget deficit by increasing expenditure and reducing revenue, they are not neutral to the budget. In fact, they go against what is known as ‘disciplining the budget’, a must for Sri Lanka to maintain balance in the economy, and slow down the accumulation of debt by the Government.

Central Bank’s advice to discipline the budget by increasing revenue

Both the Central Bank Annual Report for 2016, and the Annual Report of the Ministry of Finance for 2017, have emphasised the need for ‘disciplining the budget’, which they have called ‘budgetary consolidation’ through effective revenue enhancement. Increasing revenue has been emphasised because Government expenditure programs, as they stand today, are not amenable to pruning. In a Box article in the Central Bank Annual Report for 2016 (Box 09 on pages 201-4), the Bank has informed Parliament, and through Parliament, the public, that what the Government should do is to work for attaining a sustainable debt level through the consolidation of the budget by enhancing revenue.

All governments should have a commitment to discipline the budget

That is because the present debt level is unsustainable on a number of counts. Since the Government revenue has not increased at the same rate as the growth in the economy, the revenue has been insufficient to pay interest, and repay the principal of the maturing loans. Consequently, all successive Governments have been forced to borrow more to meet the debt repayment obligations. This is known as ‘rolling-over of public debt’. It has not only put the budget in a precarious situation, but also contributed to unsustainable growth in the level of public debt. As a result, all Governments in the past have been caught in this trap. The way out was to increase the level of Government revenue as a percentage of the total size of the economy, known as the Gross Domestic Product or GDP.

Sri Lanka’s revenue to GDP is exactly half the average for Asia

The Central Bank, in arguing out its case, had given numbers relating to some selected countries in Asia for 2015. Sri Lanka’s government revenue to GDP ratio amounted to 13.3%. whereas the average for Asia had been double that ratio at 26.6%. Hence, there was a long way for Sri Lanka to go in order to prevent a total fiscal explosion. and through it, an implosion of the economy. Hence, the Central Bank had warned the Government that ‘it is crucial to continue with the necessary fiscal reforms with disciplined and determined political commitment, without deviating from the fiscal consolidation path, in order to achieve the envisaged fiscal targets in the medium to long run’ (p 204). This is a warning not only to the previous Government, but also to the new Government that has been formed.

Rare instance of both Central Bank and Ministry of Finance speaking the same language

Agreeing with the Central Bank’s recommendation, the Ministry of Finance in its Annual Report for 2017, again submitted to Parliament, and through it to the public, has outlined the medium-term fiscal strategy of the government. In more general terms, it has elaborated this strategy as follows: ‘Within the context of the broader framework of Government’s fiscal strategy, the medium-term fiscal framework is formulated with a view to furthering fiscal consolidation efforts, through a sustainable reduction of the fiscal deficit and public debt, while enhancing revenue mobilisation. In order to facilitate the Government’s fiscal strategy, various reform initiatives were undertaken in such areas as taxation policy and administration, expenditure management, Government debt management, reforms in state owned enterprises, public finance and procurement management, among others’ (p 8).

Finance Ministries love budget profligacy

This is a rare occasion where the Central Bank and the Ministry of Finance have been speaking the same language. Normally, what has happened in the past has been that when the Bank has been promoting budgetary discipline, the Ministry has been engaged in budgetary profligacy. This has been an eternal battle between Central Banks and Finance Ministries. Cash-strapped governments, without considering the long term adverse consequences, have been forcing Central Banks to give them cheap money on the one hand, and approving of their profligate policies on the other.

India’s RBI under attack

The latest episode has come from neighbouring India where Finance Minister Arun Jaitley, angered by the independent standing of the Reserve Bank of India, is reported to have said that ‘the nation India is higher than any institution’, meaning that RBI should be subservient to political authorities in the country (available at: https://www.economist.com/finance-and-economics/2018/11/03/indias-central-bank-faces-a-major-test-of-its-independence). This is the usual slogan used by politicians who are bent on exploiting the money printing powers of Central Banks for their political objectives.

In this background, the policy convergence between the Central Bank and the Ministry of Finance with regard to a common fiscal strategy was a welcome development. However, this development is going to be torn apart by the new goodies package announced by the Ministry of Finance.

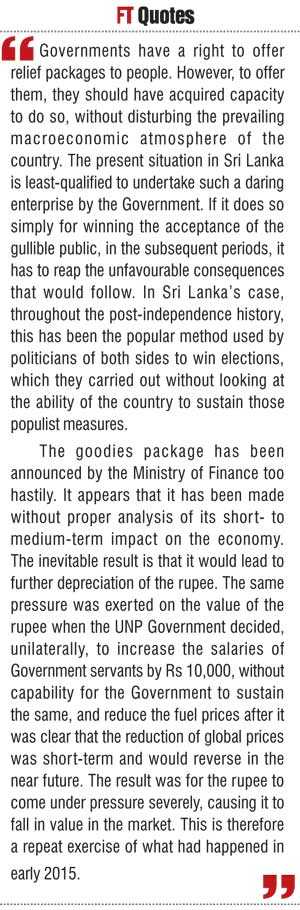

Offering goodies to people without resources

Governments have a right to offer relief packages to people. However, to offer them, they should have acquired capacity to do so, without disturbing the prevailing macroeconomic atmosphere of the country. The present situation in Sri Lanka is least-qualified to undertake such a daring enterprise by the Government. If it does so simply for winning the acceptance of the gullible public, in the subsequent periods, it has to reap the unfavourable consequences that would follow. In Sri Lanka’s case, throughout the post-independence history, this has been the popular method used by politicians of both sides to win elections, which they carried out without looking at the ability of the country to sustain those populist measures. Except in 1954 and 1955, when the country’s finances were managed by a Minister of Finance trained in the London School of Economics, M D H Jayawardena, in all the other years it was a deficit budget that had been put in place.

Domestic income increases end up in other countries via imports

The objective has been to promote economic growth through increased public expenditure programs. But, the examination of the post-independence history reveals that that is the only thing which has not been attained by Sri Lanka. Though budget deficits have been high, at around 7% of GDP on average, economic growth has been low at 4.4% on average. This is understandable because in a small open economy, dependent on international trade, whatever the income created by profligate fiscal policies is to be leaked out of the country through increased import of goods and services. When this is funded through external borrowings, another dimension in the form of interest payment and repayment of the principal will be added to this list, making it difficult for the country to maintain the exchange rate at a stable level. Thus, the Sri Lankan rupee, which was exchanged at 3.36 rupees per US dollar at the time of independence, lost its value continuously, reaching a level of Rs 177 per dollar at the last record. This value can be maintained only by releasing valuable foreign reserves built by the Central Bank by borrowing from abroad.

Using exchange rate as a ball game

The press release issued by the Ministry of Finance announcing the goodies package has expected to improve the position of the households by giving ‘additional income to their hands’. It is true that a certain group of people will get additional income into their hands. However, that will become the root cause of a series of economic ailments, as I have argued in my previous article in this series (http://www.ft.lk/columns/With-this-man-made-Constitutional-crisis--economy-will-be-the--casualty--resolve-it-quickly-or-peris/4-665587).

This is what I said in that article: ‘Thus, the exchange rate has been the most popular ‘ball game’ played by all political parties. When they are in the Opposition, they blame the Government in power for allowing the rupee to fall, implying that it is due to their bad economic management. But when they are in the Government, they justify its fall tooth and nail. Yet, like the caravan that moves while the dogs are barking, the rupee too continues to fall in value month after month, because no proper remedial measures are taken by governments driven by a populace that wants to import more and produce less.

‘Any money given to them through liberal Government spending is immediately spent on imports, rather than on investment. Recently, I asked MBA students of a state university what they would do if they are given Rs. 10 million each. The answer was unanimous that they would buy a car or travel abroad or spend that money to buy various electronic equipment that have become the fashion of the day. With that type of mentality, the increased income through expanded Government expenditure programs, financed of course by borrowing or printing new money, would end up as incomes of people in other countries. Thus, the pressure for the rupee to fall in the value in the market is unavoidable.’

Goodies packages

Hence, the goodies package has been announced by the Ministry of Finance too hastily. It appears that it has been made without proper analysis of its short- to medium-term impact on the economy. The inevitable result is that it would lead to further depreciation of the rupee. The same pressure was exerted on the value of the rupee when the UNP Government decided, unilaterally, to increase the salaries of Government servants by Rs 10,000, without capability for the Government to sustain the same, and reduce the fuel prices after it was clear that the reduction of global prices was short-term and would reverse in the near future. The result was for the rupee to come under pressure severely, causing it to fall in value in the market. This is therefore a repeat exercise of what had happened in early 2015.

As I mentioned at the beginning of the article, the Central Bank will have to take action, belatedly, to rectify the error by way of increasing interest rates and curtailing credit growth. That would be counterproductive to economic growth objectives.

(W A Wijewardena, a former Deputy Governor of the Central Bank of Sri Lanka, can be reached at [email protected])