Monday Feb 23, 2026

Monday Feb 23, 2026

Tuesday, 2 October 2018 00:00 - - {{hitsCtrl.values.hits}}

1.Introduction

Due to the influence of International Monetary Fund, the income tax law of Sri Lanka witnessed a near paradigm shift with the introduction of Inland Revenue Act No.24 of 2017 (new IRA) by repealing Inland Revenue Act No.10 of 2006 with effect from 1 April 2018. Unlike the Inland Revenue Statutes that existed in the past, the new IRA contains not only the provisions pertaining to prevention of double taxation agreements but also Mutual Administrative Assistant Agreements (MAAAs). Due to an oversight, the new IRA does not contain a provision to confer force of law to the 44 existing Double Tax Agreements (DTA’s) i.e. treaties for prevention of double taxation as well the future DTA’s to be executed by the Government of Sri Lanka. This Article carries out an in depth analysis of the issue mentioned, the impact thereon and the measures for rectification to be adopted.

2. The nexus between a DTA and the Domestic Law

The relationship between a Double Tax Agreement and the domestic law has been explained by D.P Mittal, an Advocate in India in Taxman’s Indian Double Taxation Agreements & Tax Laws at page 1.53 as follows in the Indian context. The said explanation is applicable in Sri Lanka too.

“Making a treaty involves negotiation, signing, ratification and incorporation into the domestic laws of the Contracting States. A treaty is an international agreement concluded between States in written form and governed by International law. Making a treaty is an executive act, while performance of its obligations, if they entail alteration of the existing domestic law, requires legislative action. The stipulations of a treaty duly ratified, by virtue of the treaty alone, do not have the force of law – See Attorney General for Canada v Attorney General for Ontario [1937] AC 326. Adoption of a double taxation agreement requires modification to the internal tax laws of the State. In some States, legislation is needed, while in others, it is considered part of the Constitutional law, being a treaty or agreement concluded under international law. This is so done because taxpayers may be subject to the agreement and get benefit arising from its provisions. The said agreement is the interaction between its substantive rules and the national procedure rules. The Constitution of India does not render the treaties to which India is a party the law of the land. Obligations arising therefrom, therefore, are not judicially enforceable, unless backed by legislation- State of west Bengal v Jugal Kishore AIR 1969 SC 1171. No legislation is needed if its implementation is possible at the administrative level and without legislative endorsement – See State of Gujrat v Vora Fiddali AIR 1964 SC 1043. Treaties are not self-operating – Solomon v Commissioners of Customs and Excise [1967] 2 QB 116. It means that a treaty is not a part of the law unless and until it has been incorporated into the law by legislation – Pan –American World Airways Inc. v Department of Trade [1976] 1 Lloyds Rep. 257. Its enforcement and effectiveness within India could not be possible till then. A treaty does not apply internally. It requires an enabling Act of Parliament. Section 90 of the Indian Income tax Act, 1961, is such an Act. It empowers the Central Government to enter into an agreement with any country for granting relief from and avoidance of double taxation, exchange of information, recovery of tax and to make such provisions as may be necessary for implementing the agreement, by a notification in the Official Gazette. That section empowers the Central Government to enter into an agreement on behalf of the State. It also serves another purpose. The concluded agreement is incorporated in the Income–tax Act. Its enforceability and applicability have the legislative backing. Double taxation agreements have the status of treaty…” [emphasis added]

At page 1.54 - D.P Mittal, an Advocate in India in Taxman’s Indian Double Taxation Agreements & Tax Laws:

“The parties to the treaty are States, not their subjects. If it affect their private rights, it must be incorporated into the domestic laws. The manner of doing it varies from State to State. Its signing does not signify State’s consent to be bound by it, unless specifically provided in the treaty that a signature constitutes entry into force. It only signifies that the State would proceed with the ratification of the treaty. Thus, there is a distinction between the signing, the ratification, and the incorporation of the treaty in the domestic laws. Ratification of the treaty signifies State’s consent to be bound by it. The private rights are not affected unless the treaty itself is given force of law.”

“The Central Government is empowered not only to enter into an agreement with other Country, but also make such provisions, by notification in the Official Gazette, as may be necessary for implementing it.”

“Thus, once an agreement is notified in the Official Gazette it is incorporated in the Income-tax Act. On such notification, it is the law”1

The aforesaid authority also expressly stipulates at page 1.54 that, “The double tax agreement and the Income tax Act forms a single Statute.”

Therefore, once the relevant income tax statute is repealed the relevant double tax treaties would also automatically cease to have the force of law (repealed). Section 202, of the new IRA, repeals Inland Revenue Act No. 10 of 2006. Therefore, double tax treaties that were part and parcel of Inland Revenue Act of No.10 of 2006 by virtue of Section 97 (1) and Section 97 (3) would also cease to have the force of law.

Section 97 (1) of Inland Revenue

Act No.10 of 2006

“(a) Where Parliament by resolution approves any agreement entered into between the Government of Sri Lanka and the Government of any other territory or any agreement by the Government of Sri Lanka with the Governments of any other territories, for the purpose of affording relief from double taxation in relation to income tax under Sri Lanka law and any taxes of a similar character imposed by the laws of that territory, the agreement shall, notwithstanding anything in any other written law, have the force of law in Sri Lanka, in so far as it provides for–

(i) relief from income tax;

(ii) determining the profits or income to be attributed in Sri Lanka to persons not resident in Sri Lanka, or determining the profits or income to be attributed to such persons and their agencies, branches or establishments in Sri Lanka;

(iii) determining the profits or income to be attributed to persons resident in Sri Lanka who have special relationships with persons not so resident ;

(iv) exchange of information ; or

(v) assistance in the recovery of tax payable.

(b)Every agreement which is approved by a resolution under paragraph (a), shall be published in the Gazette together with a notice that it has been so approved.

(c) …………..

[emphasis added]

Section 97 (3) of Inland Revenue

Act No.10 of 2006

“Every agreement entered into between the Government of Sri Lanka and the Government of any other territory and having the force of law in Sri Lanka by virtue of the provisions of section 70 of the Inland Revenue Act, No. 4 of 1963, or section 82 of Inland Revenue Act, No. 28 of 1979, or section 92 of the Inland Revenue Act, No. 38 of 2000, shall be deemed for all purposes to be an agreement approved by Parliament by resolution under subsection (1) of this section.”

[emphasis added]

3.Monist v Dualist countries

In order to appreciate the issue addressed in the Article, a reader sans knowledge on international law may benefit from the following fundamental aspects pertaining to distinction between the monist and dualist theories. Countries could be categorised into either, “Monist” countries or “Dualist” countries, according to the way international law interacts with the national law. In countries where monist legal tradition prevails, international treaties upon ratification immediately acquire the force of law. However, in dualist countries international treaties do not acquire force of law unless they are adopted through national legislation.

United States of America, Austria, Switzerland, Germany, France, Poland, Japan, Columbia, Chile, China are some of the countries that follow monist approach. Generally civil law countries follow a monism approach whereas dualist tradition is prevalent in common law countries. It is accepted that, Sri Lanka is common law country.

Supreme Court of Sri Lanka has unequivocally pronounced that, dualist theory underpins the Constitution of Sri Lanka

In the case of Singarasa v Attorney General SC.SPL.L.A 182/99 Sarath N Silva C.J2 “When the President in terms of Customary International Law acts for the Republic and enters in to a treaty or accedes to a covenant the content of which is not inconsistent with the Constitution or the written law, the Act of the President will bind the Republic qua state - but such a treaty or a covenant has to be implemented by the exercise of legislative power by Parliament and where found to be necessary by the people at a referendum to have internal effect and attribute right and duties to individuals – This is in keeping with the dualist theory which underpins our constitution.”

Hence, it is settled law in Sri Lanka, that ours being a dualist system, international treaties by mere ratification by the Parliament do not become part of the national law of the country subject to Article 157 of the Constitution of Sri Lanka.

4.Article 157 of Constitution of the Democratic Socialist Republic of Sri Lanka 1978

Article 157 of the Constitution of Sri Lanka introduced in 1978 provides that, if the Parliament by not less than two thirds majority ratifies a treaty or agreement pertaining to “the Promotion and Protection of the Investments in Sri Lanka”, such would have the force of law in Sri Lanka.

“157. Where Parliament by resolution passed by not less than two-thirds of the whole number of Members of Parliament (including those not present) voting in its favour, approves as being essential for the development of the national economy, any Treaty or Agreement between the Government of Sri Lanka and the Government of any foreign State for the promotion and protection of the investments in Sri Lanka of such foreign State, its nationals, or of corporations, companies and other associations incorporated or constituted under its laws, such Treaty or Agreement shall have the force of law in Sri Lanka and otherwise than in the interests of national security no written law shall be enacted or made, and no executive or administrative action shall be taken, in contravention of the provisions of such Treaty or Agreement.” [emphasis added]

5.DTAs v Treaties for Promotion and Protection of Investments

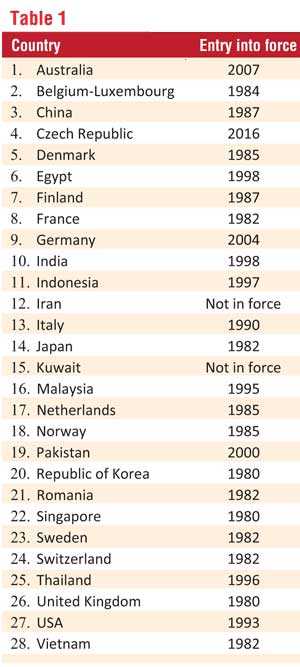

It is critical to ascertain whether DTAs would fall within a “Treaty for Promotion and Protection of Investments”. If a DTA is within the aegis of Article 157 of the Constitution, the DTA may have the force of law without the requirement for an enabling domestic legislation. Sri Lanka has concluded 28 Bi-lateral investment agreements, and in common parlance referred to as “Treaties for Promotion and Protection of Investments”. The said investment agreements and the year of entry into force is tabulated3 (see table 1).

The treaty executed with Germany prior to 1978 was abandoned in favour of a new treaty executed in 2004 presumably in order to secure the constitutional protection for investments from Germany as well. Therefore, it is manifest that it is these bilateral treaties that would fall within the ambit of Article 157 of the Constitution.

One may observe that DTAs would not fall within the ambit of the “Treaty for the Promotion and Protection of investments” referred in Article 157 for many reasons.

a)Scope of DTAs are not confined to investments.

b)Certain DTAs executed prior to the implementation of Article 157 of the Constitution.

c)Parliament may ratify DTAs by simple and not two thirds majority.

a)Scope of DTAs are not confined to investments.

“Treaties for Prevention of Double Taxation” are not confined to investment promotions, commercial and business activities. DTAs also remove impediments to desirable scientific, educational, cultural, artistic interchanges. In addition, it may also address tax treatment of Pension Plans and social security benefits, contributions to charitable organisations of scholarships and stipends for visiting scholars, researchers and students, alimony and child support.

b) Certain DTAs executed prior

to the implementation of Article

157 of the Constitution.

Sri Lanka has entered into approximately three Double Tax Treaties prior to the introduction of the 1978 Constitution.4 It is evident that the treaties executed prior to 1978 cannot derive force of law by virtue of Article 157 introduced by the Constitution, even in the unlikely case of other DTAs falling within the ambit of Article 157, introduced in 1978 constitution.

c) Parliament may ratify DTAs with simple and not two thirds majority.

In addition to the above, in order to derive force of law, “Treaties for the Promotion and Protection of Investments” by virtue of Article 157 of the Constitution, prerequisite is a resolution to be passed by the Parliament by not less than two thirds majority which is not a requirement for passing a DTA or a MAAA.

6.In new IRA “force of law” merely for Mutual Administrative Assistance Agreements (MAAAs)

It is manifest that, in order for a DTA to be part of national law of Sri Lanka, domestic legislation (new IRA) has to expressly stipulate that the treaty shall have the force of law in Sri Lanka. Such clear expressions were enacted in prior Inland Revenue Acts5 and the repealed Double Taxation (Relief Act) No. 26 of 1950 by use of the phrase “shall have the force of law”. The Section 199(2) of the new IRA unequivocally provides such force of law to a Mutual Administrative Assistance Agreement (MAAA) for which Parliament has issued an instrument of ratification.

Section 199 (2) of new IRA

“A mutual administrative assistance agreement for which Parliament has issued an instrument of ratification shall have legal effect in Sri Lanka according to its terms.”

However, there is no such similar clear provision in order to provide force of law for DTAs in the new IRA. Section 75 of new IRA refers to power of the Minister to give effect to both DTAs & MAAAs.

Section 75 (1) of new IRA

“The Minister may give effect to any double taxation agreement or mutual administrative assistance agreement with a foreign government or governments that has been approved by Parliament and published in the Gazette.”

The interpretation, in the context of the other provisions in the Act is that, above Section empowers the Minister to stipulate the commencement or the operational date of DTA or MAAA. This could be executed by issuing a Regulation, under Section 194 of new IRA.

Section 194 (1) of new IRA

“The Minister may make regulations for the purpose of carrying out or giving effect to the principles and provisions of this Act and for matters authorised to be made or prescribed under this Act.”

However, it must be noted that it is only MAAAs that have been conferred force of law under Section 199(2) of new IRA, and there is a conspicuous omission in relation to a provision in the new IRA to provide force of law for DTAs, a country with a dualist system.

The legal maxim, Expressio uni est exclusion alterius, “The express mention of one thing implies the exclusion of another”6 also tilt the scale in favour of the contention that, express mention of force of law at Section 199 (2) of the new IRA merely to MAAA that, there is a manifest lacuna with regard to treaties for the prevention of double taxation.

(To be continued)

[The writer, LLB, Attorney at Law, FCMA (UK), CGMA, is Chairman of the Tax Committee of the Bar Association of Sri Lanka.]

(Originally published in the Junior Bar Law Journal 2018 – Volume IX)

Footnotes

1 In terms of the Inland Revenue Act No. 10 of 2006, Double tax treaties are published under Section 97 (1) (b) of the said Act.

2 Singarasa Vs Attorney General SC. SPL. L.A 182/99 page 248

3 <http://investmentpolicyhub.unctad.org/IIA/CountryBits/198> accessed 28 August 2018.

4 Sri Lanka’s DTAs with the UK and Malaysia executed in 1957 and 1972 have been revised in 1979 and 1997 respectively. Treaty entered into with Japan in 1968 is still in force.

5 Inland Revenue Act No. 4 of 1963, Inland Revenue Act No. 28 of 1979, Inland Revenue Act No. 38 of 2000 and Inland Revenue Act No. 10 of 2006.

6 NS Bindra, Interpretation of Statutes 10th edn, LexisNexis 2007