Monday Mar 02, 2026

Monday Mar 02, 2026

Friday, 15 February 2019 00:00 - - {{hitsCtrl.values.hits}}

The tourism industry has been referred to as a ‘thrust industry’ and ‘engine of growth’ by the State ad nauseam, while in reality the industry is paid only lip service. The immense benefits both direct and indirect often go  unnoticed.

unnoticed.

Today the industry earns Rs. 4.3 B in foreign exchange earnings (the third largest in 2018) and provides employment to more than 300,000 persons.

It is a high value adding industry and it is a well-known fact that the trickle down and multiplier effects in the tourism sector is quite large. It is estimated that in the Asian region for every one dollar spent in the formal sector there is 2-2.5 dollars spent in the informal sector. Similarly for every direct employment there could be an equal number employed in the informal sector.

One other important factor of how the tourism industry drives the economy is the magnitude of investments in the hotel plant. Hotel construction and commissioning is quite a heavy capital investment. More importantly this investment is almost totally from the private sector, both locally and from abroad.

There is no available data or information of what the total investment in Sri Lanka’s hotel plant is. However with some careful assumptions one can get some idea of the approximate magnitude of the investment.

Assessment of the investments in hotels

The first step in this exercise would be to collate and assess the total room strength, and of what star category they are. From the SLTDA statistics it is recorded that there are 23,354 rooms in 398 hotels in the formal (registered) sector as at April 2018. It would be quite impossible to assess the large number of small unregistered units that have cropped up all over the island although this is said to be a significant number (some researchers estimate this to be as large as the formal sector).

However for this study it is proposed to deal with real verified numbers, and hence the informal accommodation sector is left out of this exercise (in any event the investment in these units is only a small fraction of the larger hotels)

From the SLTDA statistics for these 23,354, the different star class standards are also available, which range from the highest of the 5 star category down to one star, and also the boutique hotel category.

A usual benchmark used by hoteliers to very approximately assess the overall construction cost of a hotel project, is to work on a per room cost (per key costs). This is computed by dividing the total project cost for all the work, including public areas fit outs, swimming pools, landscaping, etc. (but excluding land cost) and dividing this by the room strength.

It is said that due to the high cost of construction in Sri Lanka, this index is high. However there are many new hotels that have been built recently which would give realistic figures.

The CBSL’s cost index for all forms of construction, which uses 1990 as the base, rose from 387.6 in 2007 to 677.0 in 2016, representing a 74.7% increase over the period.

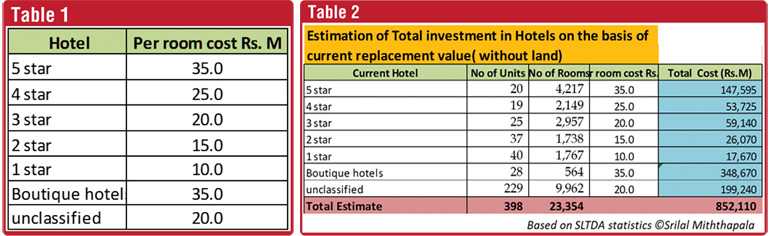

Based on current industry figures after the rapid devaluation of the Rupee vis-à-vis the USD, building costs have skyrocketed, and the conservative per key costs are assumed as per table 1.

There are a large number of ‘unclassified’ hotels under the SLTDA and it is only recently that classification has been mandated. Most of this category is found to be in the 4/3/2 star category and hence an average figure of Rs. 20 m per key has been used.

It is now a simple arithmetic calculation to arrive at an estimated replacement value for the existing hotel plant in the country (see table 2).

New hotels being built

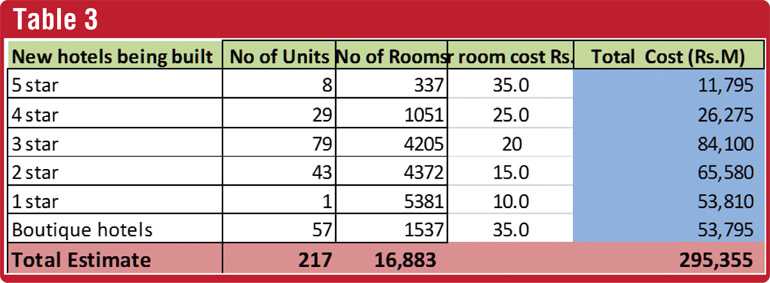

There several new hotels, for which approval has been granted by the SLTDA, that are in various stages construction/completion. Accordingly there is a total estimated 217 units in the pipeline, which will add 16,883 rooms in various star class level (as at April 2018).

It is a simple process to apply the same assumptions of per key cost to these rooms, to arrive at an aproxipmate value of these hotels that are being built (see table 3).

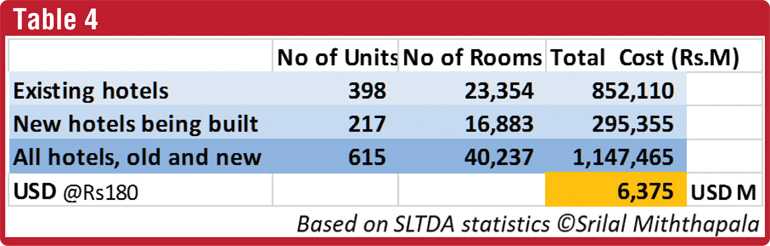

Table 4 indicates that in the next two years, once the 217 new hotels also come on stream, the total current replacement value of the hotel plant in Sri Lanka will be almost Rs. 1,147 B, which at Rs. 180 to the dollar works out to $ 6.4 b.

Conclusion

This evaluation errors on the conservative side, as most of the assumptions applied are on the low side. It should also be highlighted again that this does not take into consideration the value of the land which could be sizeable. Also the informal unregulated sector is is not included in this exercise. Hence, if any, the figures will be underestimated.

However this basic analysis and study should indicate, in no uncertain terms, how valuable the hotel industry is to the economy, with such large investment portfolio, led completely by the private sector.

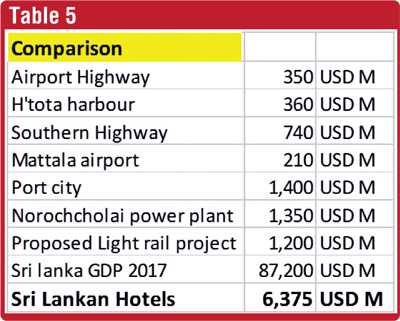

To put things in proper perspective some comparisons as per table 5.

The cost of the Katunayake Airport, Southern Highway, Hambantota Harbour, Mattala Airport, Norochcholai Power Plant and the Port City all put together cost about $ 4.4 b while the investment in hotels by the private sector is more than $ 6.3 b!

Hence this should be an eye-opener for all stakeholders and the Government to realise the true value of tourism, and that it should be given its due place as one of the most important industries in Sri Lanka.