Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 30 July 2019 00:00 - - {{hitsCtrl.values.hits}}

Government securities are issued by the governments for collecting funds to meet their budgetary requirements. Sri Lanka also largely relies on funds raised through government securities for the same purpose.

The government securities issued by the Sri Lankan Government currently are Treasury bills, Treasury bonds, Sri Lanka Development Bonds (SLDBs) and International Sovereign Bonds (ISBs).1 However, the focus of this article is on Treasury bills and Treasury bonds and the Government policy on allowing foreign investors to invest in these debt instruments.

Treasury bills are short-term instruments with the maturity periods of 91 days, 182 days and 364 days and issued under the Local Treasury Bills Ordinance No.8 of 1923 (and subsequent Amendments up to 2004). Treasury bonds have longer maturity periods of 2 years or above which are issued under the Registered Stock and Securities ordinance No.7 of 1937 (and subsequent Amendments up to 2004).

These government securities are issued through an auctioning system and therefore, yield is determined through the market mechanism. The Central Bank of Sri Lanka (CBSL), as the Government’s fiscal agent, is responsible in issuing these instruments at the least possible cost, considering the bids offered by the primary dealers2 at the auctions.

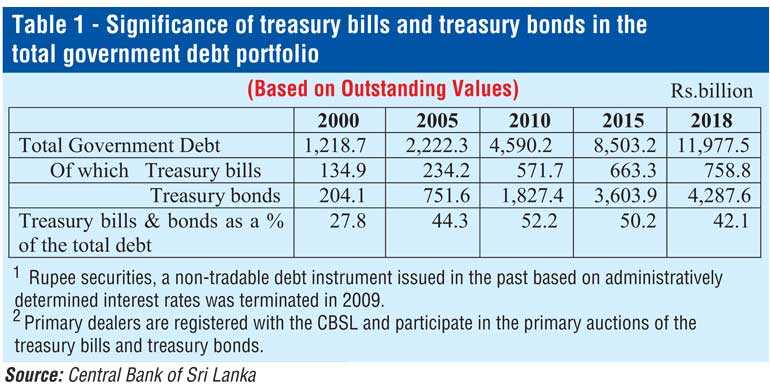

Table 1 shows that government securities hold a significant contribution to the total government debt. The outstanding values of both Treasury bills and Treasury bonds have grown over the time. However, their contribution has reduced after 2010 as international sovereign bonds, foreign syndicated loans and SLDBs have also become major components of the total government debt.

Foreign investments in short-term debt instruments

Allowing foreign investors to invest in short-term debt instruments including government securities is a widely discussed matter in the literature as short-term investments are subject to sudden reversal risks. There is a broader consensus among economists that an excessive build-up of short-term debt was a proximate cause of the crises experienced in many countries in 1990s, particularly in East Asia as well as countries such as Mexico, Russia and Brazil.

They are of the view that the large exposure to short-term debt, whether public or private and relatively scarce internationally liquid assets left those countries vulnerable to sudden change in market sentiment and reversal of capital flows. Therefore, build-up of short-term debt either by government or by private sector is a matter of concern, when external stability of a country is concerned.

Treasury bills usually get matured within a year while Treasury bonds have a longer maturity periods. However, in a panic situation due to domestic or external factors, foreign investors can withdraw their funds by selling securities in the secondary market at any time. Usually, foreign investors invest their funds in another country when the latter has sound macro-economic fundamentals and when investors are confident that their investment proceeds are secured. Also, financial market conditions such as interest rate movements as well as political or any other risks are considered when decisions are taken to invest in any country.

For example, if Sri Lanka’s market interest rates are attractive when compared to many other countries and if economic and financial conditions are relatively sound, foreign investors can choose Sri Lanka for their investments. More importantly, investors should have a flexibility to withdraw their funds at any risky situation and the beneficiary country is bound to provide the funds when investors request. In the context of Sri Lanka, usually, foreign investors invest in Treasury bills and Treasury bonds through a commercial bank. If investors decide to withdraw invested funds before maturity due to any uncertain economic situation in the country or due to better investment opportunities outside Sri Lanka, they could request respective commercial banks to return their investment proceeds.

In a situation when commercial banks do not have sufficient foreign currency liquidity or if they cannot find the required foreign exchange from the market at a reasonable price, the CBSL may have to sell foreign currency to commercial banks from its reserves for the settlement of dues to foreign investors in order to maintain excess volatility in the exchange rate arising due to large capital outflows. Therefore, such sudden withdrawal of investments would deteriorate balance of payment position of the country leading to loss in its foreign reserves. Therefore, short term foreign investments in government securities though help to find funding needs of the governments, such investments should be allowed cautiously by countries particularly with limited foreign reserves like Sri Lanka.

Foreign investments in Treasury bills and Treasury bonds market in Sri Lanka

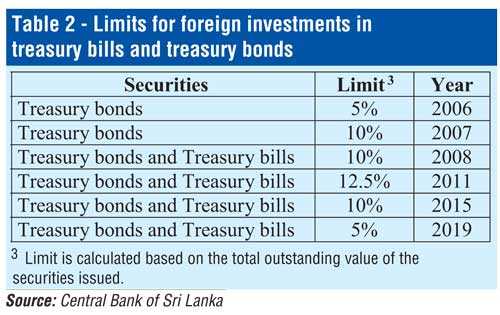

Sri Lanka opened its Treasury bonds and Treasury bills market for foreign investors in 2006 and 2008 respectively, with a limit. The intention was to minimise the interest cost of the domestic borrowing programme by maintaining an appropriate mix between domestic and foreign sources of financing. Initially, the limit for Treasury bonds was 5% and it was increased to 10% in 2007. At the same time, an entry barrier for foreign investors, i.e. minimum holding period requirement of treasury bonds was also removed enabling investors to withdraw funds whenever they decide to do so.

In 2008, when investments were opened for Treasury bills as well, the limit was set at 10% for both instruments from the total outstanding value of treasury bills and treasury bonds taken together. Since then there were several changes to the limits as shown in table 2.

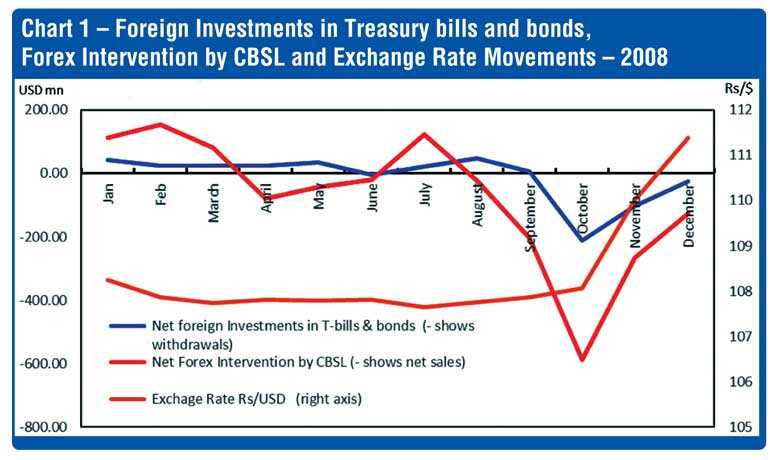

Since the opening of these government securities market for foreign investors, Sri Lanka experienced both favourable as well as unfavourable developments, with respect to such investments time to time. The first such unfavourable situation was the global financial crisis experienced in 2008 which was intensified during the latter part of the year, resulting in a net outflow of foreign investments from treasury bills and treasury bonds market in Sri Lanka.

The outstanding amount of foreign investments in these government securities was declined from $ 449 million at end of 2007 to $ 222 million at end of 2008. These outflows as well as substantial increase in the trade deficit due to increased commodity prices including crude oil, led the balance of payments difficulties. Balance of payments which recorded surpluses continuously in the preceding three years as well as during the first three quarters of the year, turned into a deficit of $ 1,225 million by end of 2008. With these developments, country’s official reserves declined by about 50% to $ 1.75 billion by end 2008 from a record level of $ 3.5 billion in July 2008. The level of reserves at end 2008 was sufficient only to finance 1.5 months of imports.

The rupee which had strengthened mainly because of increased foreign investments with the increased limit for foreign investors to invest in these government securities, started to depreciate during the latter part of 2008, reflecting significant outflows of foreign investments from this market. The rupee depreciated by 4.6% during the last quarter of the year with an overall depreciation of 3.9% during the year. These developments show that among other factors, foreign investment in short-term government securities market has been a major vulnerable factor for deterioration of the external balances causing undue volatility in the exchange rate as seen in Chart 1.

Sri Lanka had impressive macro-economic performance during several years after the end of the internal conflict in 2009. Over 8% economic growth in two consecutive years, i.e. 2010 and 2011 was recorded for the first time in Sri Lanka’s post-independence history. Low Inflation, comparatively low interest rates, stability in the exchange rate, improvement in fiscal balances and improved stability in the financial sector evident a strong macro-economic situation in the country. During this period, the intensified global financial crisis caused foreign investors to move their funds from vulnerable countries to the countries which had sound macro-economic conditions. Accordingly, foreign investors invested in large infrastructure projects and in government securities market in Sri Lanka during this period.

During the latter part of 2011, the external sector in Sri Lanka came under pressure due to worsened global economic crisis and increase in international energy and other commodity prices. This together with the significant increase in import demand for consumer durables such as motor vehicles, led higher trade and current account deficits. Number of policy measures were taken by the Central Bank to strengthen external balances. As foreign investors were interested in investing in government securities market during this time, one of the measures taken was to increase the limit on foreign investments in government securities to 12.5%. This provided more opportunities for foreign investors to invest in Sri Lanka at relatively high yield rates compared to yield rates in most other countries.

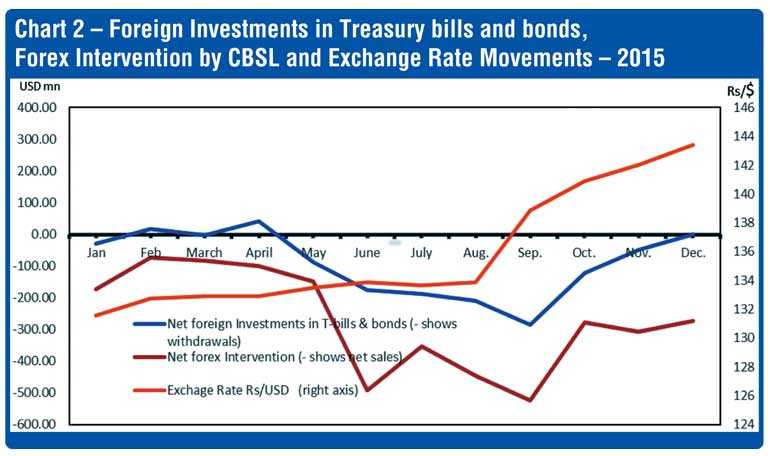

The expectation of normalisation of US monetary policy after an expansionary monetary policy adopted due to global financial crisis, and subsequent increase in US interest rates affected adversely on foreign capital inflows to many developing countries including Sri Lanka. Accordingly, substantial outflows from foreign investments in government securities were seen from mid-2014 and it intensified during 2015 and 2016. Considering increased volatility in this market and resulting vulnerabilities in external reserves and the exchange rate (as seen in Chart 2 and Chart 3), a policy of gradual reduction of limits for foreign investments in treasury bills and treasury bonds was adopted.

Accordingly, the limit was reduced from 12.5% to 10% in 2015. Foreign investment outflows from this market was seen in 2018 and early 2019 as well due to increased political uncertainty, debt repayment burden of the country and the down grading of Sri Lanka’s sovereign credit ratings by rating agencies. With these developments, policy makers decided to reduce investment limit further to 5% in early 2019, due to the fact that keeping volatile capital flows at a low level is prudent to reduce vulnerability in external balances as well as the volatility in the exchange rate which experienced in 2008, 2015 and 2018.

Sequencing of capital flows

Capital flows can have substantial benefits for countries to enhance productive investments and to improve economic growth. At the same time, capital flows, especially short-term capital flows carry risks of sudden reversals resulting reduction of external reserves, depreciation of exchange rates and instability in the financial markets affecting economic activities adversely. Therefore, prudent capital flow management policies are essential for a country.

Improved macro-economic stability through a prudent mix of monetary, fiscal and external sector policies help to attract and retain foreign capital. A country with high growth, low inflation, stable exchange rates, comfortable level of external reserves, low government budget deficit and low level of public debt provide an environment to allow as well as to attract more foreign capital. A country with such macro-economic conditions will have a capacity to face any sudden capital outflows without destabilising the economy.

In the case of Sri Lanka, high current account deficits and persistently high government budget deficits require high dependence on foreign financing to bridge the gaps of these twin deficits. Since non-debt creating capital inflows such as Foreign Direct Investment and portfolio investments to the country are very minimal, the required financing is usually met with debt creating financial flows such as bilateral and multilateral loans, syndicated foreign loans and sovereign bond issuances. Therefore, maintaining adequate foreign reserves to meet future foreign debt servicing is required. If the government depends largely on foreign investments in Treasury bills and Treasury bonds as a source of its budget financing, which is usually short term, the risks of reversal of such capital flows is high. Disruptive outflows can lead to reserve depletion, currency collapse, financial system stress and output losses. In such a situation, servicing other foreign loans would also be at risk.

Therefore, country like Sri Lanka which has twin deficits, should be careful when sequencing capital flow liberalisation. It should encourage long term capital flows before short term and should encourage non-debt creating capital flows like Foreign Direct Investments (FDIs) and equity investments. However, in Sri Lanka, FDIs are at very low level of around 2% of GDP, significantly below the expectations. To attract more FDIs, continued strong macro-economic fundamentals, political stability and a sound doing business environment are pre-requisites. It is the responsibility of the policy makers and the relevant institutions to work towards maintaining these requirements to attract more FDIs, which would support to reach high growth trajectory.

Capital flows to the treasury bills and treasury bonds market though important to lessen the pressure on domestic interest rates and hence reduce the government funding cost, such investments should be allowed prudently, enabling to avoid any threat to the external stability. Such short-term capital can be allowed when the country has a strong external reserve position and hence has a capacity to face any sudden capital outflows. More importantly, country’s future debt servicing obligations should also be taken into consideration as adequate level of foreign reserves are required for the unblemished debt repayment record the country has maintained so far. Despite India having a comfortable level of external reserves, it is very cautious when allowing investments for foreigners in government securities. In 2018, 5.5% of outstanding government securities was allowed for foreign investments. Following its policy of increasing the limit in each year by 0.5%, in 2019, the limit was increased to 6%.

The recent move of the Central Bank of Sri Lanka to reduce the limit of foreign investments in government securities to 5% of the total outstanding stock of the government securities is justifiable given country’s high debt repayment obligations and the need for maintaining external reserves at comfortable level and maintaining exchange rate stability. Allowing more foreign investments in the Treasury bills and Treasury bonds market for foreigners could expect in the future when external balances of the country improved to a more comfortable level on a sustainable basis.

(The writer is an Assistant Governor of the Central Bank.)

Footnotes

1Rupee securities, a non-tradable debt instrument issued in the past based on administratively determined interest rates was terminated in 2009.

2 Primary dealers are registered with the CBSL and participate in the primary auctions of the Treasury bills and Treasury bonds.

3 Limit is calculated based on the total outstanding value of the securities issued.