Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Thursday, 16 March 2023 00:00 - - {{hitsCtrl.values.hits}}

The SLR has suddenly appreciated against the $ in the past two weeks by about 16-18%. This sudden appreciation (and vis-à-vis the depreciation of the $ against the LKR) has had a severe impact on all export earners and above all to the hotel industry. Equivalent LKR earnings have dropped drastically almost overnight, which will have a great impact on the already beleaguered hotel industry.

Sri Lanka tourism

This year Sri Lanka tourism was just recovering slowly after a triple whammy.

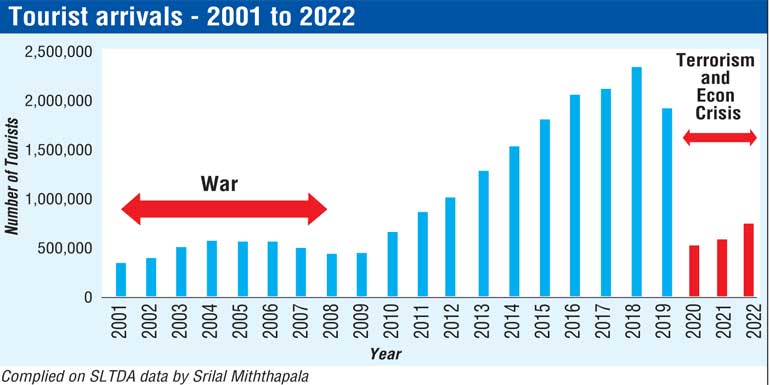

After the long drawn out war, tourism steadily improved, reaching an all-time high in 2018 when the island recorded 2.3 arrivals and $ 4.4 billion earnings. Even though 2019 started off well, all aspirations of the industry were shattered by the Easter Sunday terrorist attack and tourism nosedived. However within a few months the industry showed its resilience with arrivals increasing by December 2019 following the terrorist attack.

All this improvement was once again devastated with the outbreak of the COVID-19 pandemic. This time it was the ‘mother of all crises’ virtually bringing world tourism to a complete standstill. Sri Lanka was no exception, with almost zero arrivals during the height of the pandemic.

However once again the industry started ‘raising its head’ slowly in 2022 only to be now hit by the economic crisis in the country.

So Sri Lanka tourism has been dealt with three successive lethal blows, but it still continues to ‘keep its head above the water’ is a testimony of the resilience of the sector.

The effect of the current economic crisis

The ongoing economic crisis affected tourism in multiple ways.

The ongoing economic crisis affected tourism in multiple ways.

Rising costs

The steep increase of electricity and fuel costs, cost of food items, and almost everything else, is seeing the operating expenditure ‘skyrocket’ in hotels. Food cost which stood at about 25-30% has risen to over 50%. Energy cost now accounts to over 25% of overall costs.

Thus today, the total operating costs of a star-class hotel has climbed to more than 60% of revenue. This has resulted in the breakeven levels to rise, where even a 65-70% occupancy does not yield any operational profit.

Loan repayments

Most hotels which have been built in the past 5-6 years are still carrying substantial debt due to the initial investment. A hotel is usually normally refurbished after five years requiring large capital expense, which is often raised through bank loans. Hence even the older hotels, which do not have any initial investment costs, carry financial liabilities.

Due to the successive problems the industry faced, banks rescheduled many of these loans giving a moratorium on both capital and interest payments. Most of these relief measures came to an end in December last year, and now hotels have to start paying back these loans. But the outstanding dues (both capital and interest) have been consolidated by the banks, and the current high rates of interest applied to the out-standings. Thus effectively an ‘interest on interest’ has been applied, making the finance costs virtually unbearable for most hotels.

Of course a few of the larger hotel chains associated with conglomerates have strong negotiating power, and have obtained reasonably favourable terms from the banks. However the stand-alone star-class hotels are today feeling the impact badly.

The already high operating costs, and these new finance charges will make several hotels financially unviable. Many hotel accounts are expected to be qualified when audits are done this year.

A back-of-the-envelope calculation of the P & L of a 100 room four-star hotel, having a medium sized loan portfolio reveals that with even a 90% occupancy, at current rates, the hotel will not make enough cash to get out of this quagmire. There is no light at the end of the tunnel.

So unless there is external capital investment (very unlikely in this environment) or the banks write off some of the debts (a haircut-remote chances) many hotels will be in great financial trouble in the next few months.

Exodus of staff

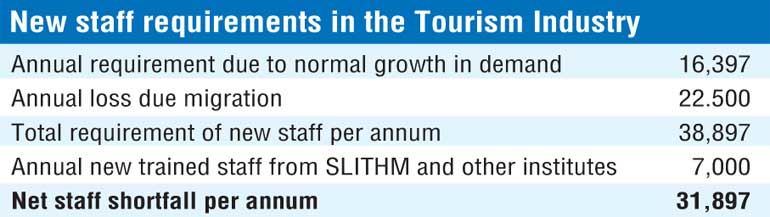

The poor showing of the industry has disillusioned the youth of the tourism industry. Many are now endeavouring to go abroad by fair or foul means. (‘Youth exodus continues, 2,000 passports daily’ – The Morning paper 2003). Most hotels are finding it difficult to fill their cadres with good young people with the correct attitude. The stragglers who do join, are often misfits who just mark the time until they move on. In a study done for the National Human Resources Development Council of Sri Lanka it was found that the industry will require 32,790 new staff by 2022. (Ref Tourism Industry Forecasts – Human Resources, Srilal Miththapala & Sunil Dissanayake, consultant Dr. Chandra Embuldeniya). Since this report was prepared before the problems, it would be prudent to de-rate this figure by 50%, arriving at the annual shortfall as 16,397.

This exodus is seen among experienced staff also, who are also leaving for greener pastures due to the prevailing economic conditions affecting their livelihoods. Maldives and the Middle East are recruiting them ‘en masse’. It is estimated that some 25,000 staff are working in the Maldivian tourism industry, while accurate figures for the Middle East are unavailable, but it is estimated to be over 100,000.

The approximate number of worker migration in Sri Lanka is about 300,000 per annum (32 Sri Lankans leaving for overseas jobs every hour – Kapila Bandara, Sunday Times). If it is assumed that 7.5% of this number (conservative) is leaving for tourism-related jobs, then the annual number of tourism staff leaving the island would be in the order of 22,500. Tourism establishments are unable to pay higher salaries to try and retain at least some of their staff due to the precarious financial situation of the industry. We cheer that worker remittances are Sri Lanka’s largest FX earners. But Dr. Sirimal Abeyratne, Professor in Economics, the University of Colombo, says migration isn’t a sign of prosperity for the country. “Sri Lanka is the only country in the world where we use taxpayers’ money and send people to other countries to build these countries. Migration is a sign of misery in the country.” Sunday Times Business Club (STBC) discussion on Migration.

The current maximum annual ‘out-put’ from the Sri Lanka Institute of Tourism and Hotel Management (SLITHM) is about 5,000. The reputed private hotel schools have an ‘out-put’ of about 2,000 per year, making a total demand of 7,000 personnel for the tourism industry.

Hence on this basis the total requirement of staff for the industry per annum would be-

The net result is that service standards (which Sri Lanka was famous for) are rapidly deteriorating in hotels, due untrained new staff. This is indeed another serious issue that the industry faces..

The silver lining

The semblance of a saving grace for the tourism industry was the deprecated LKR. Hotels usually forward contracts in $ for their room rates. Most often rates are fixed for the entire summer (May -October) and winter (November -April) periods. Even travel agents quote in advance for tours for tourists.

Hence tourism was reaping a benefit from the larger amount of LKR received for their earnings in forex currency. This was offering some sort of respite to offset the rising costs, albeit in a small manner. Last year in spite of all the problems and challenges tourism earned $ 1 billion.

The bombshell

The sudden depreciation of foreign currency, and in particular the $, has wiped off a sizable quantum of earnings of the industry almost overnight. Now hotels and travel agents will bear a loss, due to these forward contracts which were made on the earlier exchange rate. If this would have happened gradually over some period, then there would have been time for the industry to factor the change into their operations. But this sudden change has further darkened the industry, already groping around in the dark. The end result will be the earlier demise of many hotels.

Of course economists will argue that this is a price to pay to get out of this economic crisis. Be that as it may, from a tourism point of view this is very short-sighted. Tourism was the third largest FX earner to the country, behind apparels and worker remittances. On a net value added basis, tourism would be second, surpassing apparels which has a lesser value added component. At every public forum, and even in parliament the highest in the land say that tourism is the one industry that can help Sri Lanka get out of the economic crisis. How can that be achieved with an industry that is dead. (‘President pledges to make Sri Lanka a year-round tourist destination’ – https://www.presidentsoffice.gov.lk/; ‘Tourism industry is the one that could give strongest help to Sri Lankan economy’ – https://www.pmoffice.gov.lk/).

I am no economist, but experts say these measures will ‘stimulate more foreign exchange leading to additional liquidity in the banking system’ and that ‘inflation is slated to come down and improve the disposable income of people’.

There is no question that correct steps have to be taken to revive the economy. However authorities have to be cognisant of the disastrous effects that these corrective measures would have on the beleaguered tourism industry.

All the tourism industry is asking for, is for some substantial relief to tide over this difficult period.

We are ‘shooting the goose that lays the golden eggs’. The ‘Golden Moon (of Tourism) has turned into silver tears’ (Jim Reeves).

The industry that was dealt a triple whammy in the past three years, has now been dealt a fourth body blow.

The faint light at the end of the tunnel has been switched off.